Ammonia Figures Prominently in IEA Hydrogen Report

By Stephen H. Crolius on June 27, 2019

Two weeks ago the International Energy Agency released The Future of Hydrogen, a 203-page report that “provides an extensive and independent assessment of hydrogen that lays out where things stand now; the ways in which hydrogen can help to achieve a clean, secure and affordable energy future; and how we can go about realising its potential.” The report devotes considerable attention to the role ammonia could play as a hydrogen carrier. The IEA is an autonomous intergovernmental organization whose mission is to advocate “policies that will enhance the reliability, affordability and sustainability of energy in its 30 member countries and beyond.” The organization’s membership includes most of the world’s largest economies, so its statements about ammonia will receive widespread attention.

Most of the report’s ammonia-related content is framed by the molecule’s potential as a medium for storing and transporting renewably generated electricity.

With declining costs for renewable power (in particular solar PV and wind), interest is now growing in water electrolysis for hydrogen production and in the scope for further conversion of that hydrogen into hydrogen-based fuels or feedstocks, such as synthetic hydrocarbons and ammonia, which are more compatible than hydrogen with existing infrastructure.

The Future of Hydrogen, International Energy Agency, June 2019.

The report’s Hydrogen Storage, Transmission, and Distribution chapter dives deeply into technical and economic comparisons of hydrogen, ammonia, and liquid organic hydrogen carriers (LOHCs) such as methyl cyclohexane. Pipelines take center stage in the discussion because of the allure of giving a new lease on life to almost three million kilometers of existing infrastructure. The report makes the point that it is a simple matter to inject hydrogen into the existing natural gas supply, at least up to a stipulated maximum blending rate. Although in most jurisdictions the maximums are single-digit percentages, such low-level blending “could provide a major boost to the development of hydrogen.”

For example, a blend of 3% hydrogen in natural gas demand globally (around 3 900 bcm in 2018) would require close to 12 MtH2. If the majority of this hydrogen came from electrolysers, then this by itself would require around 100 gigawatts (GW) of installed electrolyser capacity (at a 50% load factor), a level that could deliver around a 50% reduction in the capital cost of electrolysers.

The Future of Hydrogen, International Energy Agency, June 2019.

Galvanizing the green hydrogen market in this way could be an important early step, but clearly, deep decarbonization will require measures whose impacts are one to two orders of magnitude larger. Contemplating hydrogen in these quantities brings to the fore the need for global supply chains that start in locales with high-quality renewable energy resources and end in major economic centers, spanning, potentially, thousands of kilometers. In this frame of reference, the report draws several conclusions:

Transport and storage costs will play a significant role in the competitiveness of hydrogen . . . if the hydrogen has to travel a long way before it can be used, the costs of transmission and distribution could be three times as large as the cost of hydrogen production . . .

Long-distance transmission and local distribution of hydrogen is difficult given its low energy density. Compression, liquefaction or incorporation of the hydrogen into larger molecules are possible options to overcome this hurdle. Each option has advantages and disadvantages, and the cheapest choice will vary according to geography, distance, scale and the required end use . . .

If hydrogen needs to be shipped overseas, it generally has to be liquefied or transported as ammonia or in liquid organic hydrogen carriers (LOHCs).

The Future of Hydrogen, International Energy Agency, June 2019.

The report considers “the full cost of hydrogen delivery to end users [across] all possible stages of the supply chain.” This holistic approach is essential since “the different hydrogen carriers and modes of transport have very different conversion, transmission, distribution, storage and reconversion costs.” At the end:

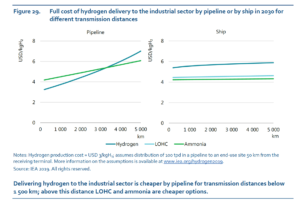

. . . despite the many uncertainties around most of these cost components, IEA analysis suggests that for inland transmission and distribution, hydrogen gas is the cheaper option for distances below around 3 500 km. Above this distance, ammonia pipelines would be the cheaper option. Comparing transport using pipelines and ships, transmission and distribution of hydrogen gas by pipeline is cheaper for distances below around 1 500 km. Above this distance, LOHC and ammonia transport by ship, which are broadly similar in terms of their full costs, become the cheaper delivery options.

The Future of Hydrogen, International Energy Agency, June 2019.

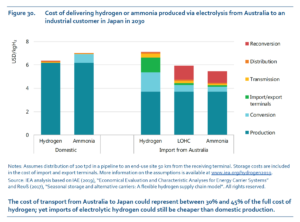

A critical factor in this outcome is the cost of reconversion, i.e., extracting at the end of the value chain a hydrogen stream of sufficient purity for a designated end use. Among other points, the report raises the obvious alternative to reconversion: “Ammonia would be even more attractive if it could be used directly by the end consumer, thereby avoiding the additional costs of reconverting it back into hydrogen.” In fact, if the cost of reconversion shown in the report’s Figure 30 were to be subtracted from the “full cost of hydrogen delivery” shown in Figure 29, ammonia would appear to be the hands-down cost champion across virtually all transport modes and distances.

One hopes that developers of ammonia-fueled gas turbines, boilers, burners, fuel cells, and internal combustion engines are taking note.