Ammonia Energy Live April: low-carbon innovation at Hazer Group

By Julian Atchison on May 31, 2021

This April we presented a new episode in our monthly webinar series: Ammonia Energy Live. Every month we’ll explore the wonderful world of ammonia energy and the role it will play in global decarbonisation – with an Australian twist.

For this episode we welcomed Geoff Ward, CEO of the Hazer Group. Hazer has been steadily developing their novel methane pyrolysis technique in Western Australia with a new low-carbon hydrogen production facility to begin construction later this year. Geoff joined us to reflect on Hazer’s journey so far, familiarise our audience with their processes and give his thoughts on what needs to be put in place for similar decarbonisation projects to succeed. And – of course – we asked Geoff where ammonia fits into Hazer’s future plans! Geoff was interviewed by Andrew Dickson (Development Manager of the Asian Renewable Energy Hub at CWP Global), and Darren Jarvis (Vice President of Strategic Project Development at Incitec Pivot).

Hazer?

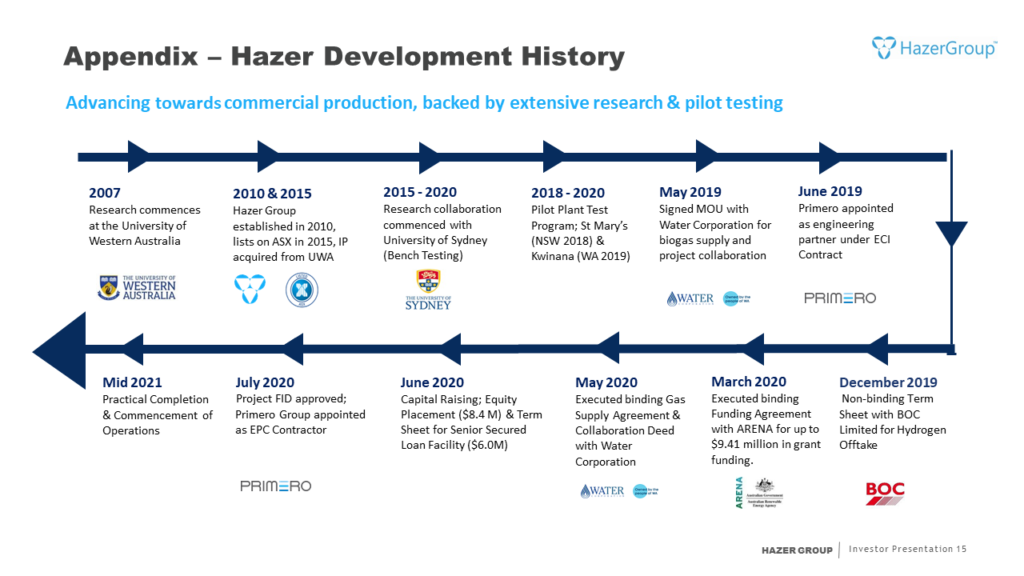

Hazer Group is a clean technology development company, with a primary focus on commercialising the Hazer process – a low-emission method of manufacturing hydrogen from methane. The process has its genesis in PhD research at the University of Western Australia (UWA). Through research collaborations with the University of Sydney, the Innovative Manufacturing CRC and now with the support of ARENA, Hazer has kept developing its process and is now implementing its first demonstration project after a successful couple of years of pilot trials. And in case you’re wondering, there’s no brilliant, mad scientist named Mr or Mrs Hazer behind this – Hazer is an acronym for hydrogen and zero emission research.

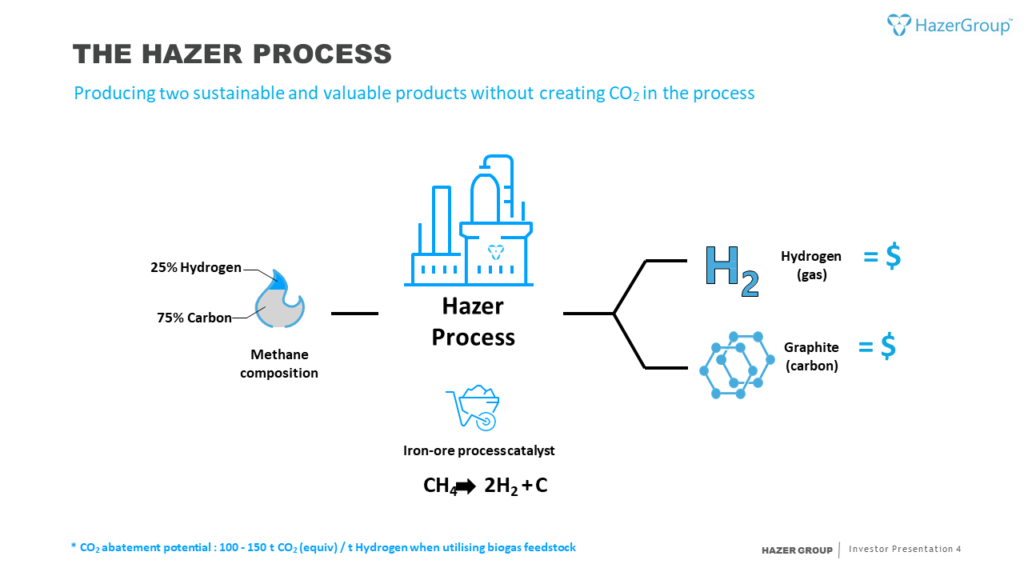

Geoff explained Hazer’s methane pyrolysis process and exactly what a Hazer plant looks like to us in detail, and also gave us an insight into what first attracted him to the technology – Hazer’s innovative choice of catalyst. From the very beginning research was focused on a low-cost, sacrificial catalyst that was abundant locally: iron ore. Historically, catalysts involved in methane pyrolysis were usually precious metals – and carbon is a poison to these! So they needed constant regenerating, and researchers were stuck in an awkward development cycle of trying to improve reaction rates while also defeating carbon growth/production at the catalytic surface. The carbon produced in the pyrolysis reaction has to go somewhere!

Enter Hazer’s research: in their reactor powdered iron ore (200-500 microns) disintegrates further into nano-sized shards of metallic iron, which becomes the site of methane decomposition. Once hydrogen is released graphite then forms around these iron nano-shards. The graphite by-product needs further refining (and the catalyst is spent), but a problem was turned into a solution. Suddenly, Hazer had a usable, potentially saleable by-product. Fast forward a few years, and now Hazer’s 90% carbon graphite by-product has commercial uses and new R&D is focused on the further refinement of it for sale in the battery materials market. Plus, the graphite essentially works as a solid state form of carbon capture and storage.

Where does Hazer fit?

Where does Geoff see the emerging market opportunities for Hazer’s technology and products? Anywhere hydrogen can play in decarbonisation: transport, heavy industry and other hard to decarbonise sectors. It’s a very broad scope but eminently possible – and the hydrogen landscape is changing so quickly! Geoff sees Hazer as the perfect fit for a multi-technology future. There won’t be a one-size-fits-all solution to decarbonisation, and Hazer is a collaborator with large-scale decarbonisation projects like the Asian Renewable Energy Hub – certainly not an out-and-out competitor. Geoff is cheering for the large-scale export of green hydrogen from Australia, but local-scale technologies like Hazer will have a role, especially where methane emissions need to be captured and utilised. One of Hazer’s key business models is operating small to medium-sized Hazer plants based on landfill gas or biogas, creating an “intentionally sustainable”, localised industry producing hydrogen for vehicle fueling. Hazer plants could also be embedded into steel, cement or petrochemical manufacturing complexes and use waste heat and gases to produce low-emissions hydrogen – an exciting prospect.

The journey

Hazer’s commercialisation journey has been rigorous but standard. UWA took the initial IP from PhD research and put it into a special-purpose company – something that’s now best practice amongst universities. Seed capital raising then funded some pre-commercial research, and after that an IPO supported more desktop research and Hazer’s pilot program. Primary research, pre-commercial & desktop research and piloting – that’s a fairly standard pathway.

Hazer is now in the process of designing, procuring and fabricating their first commercial demonstration plant: a 100 tonne per annum hydrogen production facility that co-produces about 370 tonnes per year of graphite. Working in collaboration with the Water Corporation WA (a government-owned service that provides drinking water and sewage services to Perth and surrounds), the demonstration plant will be co-located at the Woodman Point wastewater treatment facility, where biogas produced at Woodman Point’s solids handling facility (and which is currently going to flare) will become the methane feed for the demonstration plant.

In terms of funding, the initial research was supported by the university sector, then some seed capital, and now through shareholder equity and a listing on the Australian stock exchange. Government funding has been significant. Hazer is the recipient of an ARENA grant that has been a major contributor to the demonstration project. There’s an ongoing R&D program driven by four researchers at the University of Sydney, partly funded by the government-run Innovative Manufacturing CRC program. And West Australian state government contributions have also been crucial.

Geoff’s advice for others? One – build that diversity of funding. Two – make sure the venture is based on deep science. Hazer’s success is built off strong university research which continues to evolve.

What can be done to encourage more Hazers?

When asked what were the key things he wanted to see done to encourage more Hazers to succeed, Geoff’s answer was simple. Australia punches above its weight in bringing forward innovation, and we have the engineering and operations expertise to bring projects like this to life. But at some point we have to “mention the unmentionable” and talk about government policy – something not always forthcoming in Australia.

Geoff believes Australia has to “bite the bullet” and start creating frameworks to incentivise customers. He reflects on the incredible success of the Australian renewable energy industry: what started as a 1% national renewable energy target became 3% that became 20% – which Australia reached in 2019, a full year ahead of schedule! And, the industry achieved cost savings “no one had ever dreamed” of by building scale and experience into the supply chains.

At some point a price on carbon needs to be put in place. This will actually crystallise the demand for clean technology everyone that everyone knows is out there. Australia is “tiptoeing” around this at the moment. It’s all well and good to have 2050 targets, but the mechanisms need to be in place to encourage the first customers, or Australia runs the risk of “stalling at the starting gate” – not to mention missing a great economic opportunity!

Ammonia

And of course we had to ask about the potential role of ammonia in Hazer’s plans! Geoff says the potential is there (anything that diversifies the supply of low-carbon hydrogen is important), but it’s important to remember Hazer (100 tonnes per annum clean hydrogen producer) is at the very low end of what the big, established ammonia producers need in terms of hydrogen supply. But, Geoff reflects that all processes started this way. Hazer is on the same journey of risk-out, scale-up that’s been followed by the refining, LNG and ammonia industries – they’re just at a much earlier stage. At some point in the future, Geoff is confident their paths will intersect.

To finish Geoff answered some audience questions – one on the similarity (& differences) between Hazer and Monolith Materials’ pyrolysis processes, and one asking whether there’s a “magic number” for renewable energy costs that made methane pyrolysis cheaper than steam methane reforming (short answer: it’s more complicated than that!). You can check out the answers via the episode recording on our YouTube channel. You can read more about Hazer from our Ammonia Energy reporting archives, and Geoff provided us with a recent presentation given at an investment conference.

Thanks again to Geoff, Andrew and Darren for the session. You can register for our upcoming June episode featuring the Hydrogen Utility (H2U) here. All episodes of Ammonia Energy Live can be found at AEA Australia’s YouTube channel – make sure to hit subscribe while you’re there. Thanks for tuning into Ammonia Energy Live, and see you next month!