Ammonia from Offshore Wind: a techno-economic review on the US East Coast

By Trevor Brown on January 26, 2018

A new study examines the technologies needed to produce renewable ammonia from offshore wind in the US, and analyzes the lifetime economics of such an operation.

This is the latest in a years-long series of papers by a team of researchers from the University of Massachusetts, Amherst, and Massachusetts Institute of Technology (MIT). And it is by far the closest they have come to establishing sustainable ammonia as being cost-competitive with fossil ammonia.

Ammonia production with offshore wind power has the potential to transform energy and fertilizer markets within the United States … This work reviews the technologies required for all-electric, wind-powered ammonia production and offers a general design of such a system … A case study for a utility-connected, all-electric ammonia plant in the Gulf of Maine is used to assess the lifetime economics of such a system.

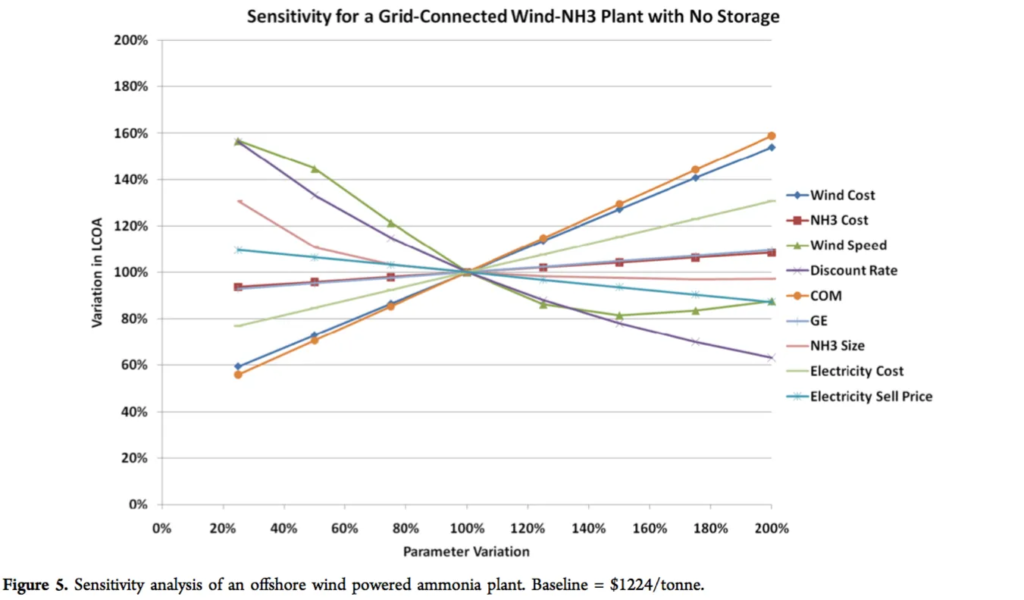

The results show that significant utility grid backup is required for an all-electric ammonia plant built with present-day technologies. A sensitivity analysis showed that the total levelized cost of ammonia is driven in large part by the cost of producing electricity with offshore wind.

McGowan et al, Sustainable Ammonia Production from U.S. Offshore Wind Farms: A Techno-Economic Review, 10/19/2017

System design

Although the study acknowledges that “there are many possibilities where wind power could assist ammonia production,” it examines only one potential model: an onshore ammonia plant powered by offshore wind. (For contrast, I recently published information about ammonia from offshore wind and tidal power in the UK, and from wind and tidal power in the Netherlands, not to mention the wind-to-ammonia demonstration plant at the University of Minnesota.)

The “baseline” plant size that the team analyzes is 300 (metric) tons per day, “nearly the smallest practical size with conventional equipment.” To produce this amount of ammonia, the site would need to be connected to a 370 MW wind farm (net 150 MW, assuming a 40% capacity factor).

The ammonia synthesis loop features standard technology but, instead of the traditional natural gas-fed steam methane reformation unit, electrolyzers produce renewable hydrogen from water. For back-up, a grid connection is necessary so that the whole system can “achieve the same results as a conventional fossil fuel ammonia plant.” The grid connection goes both ways: it supplies the ammonia plant with back-up power, but also allows the project to sell excess power back to the utility.

A 300 ton per day (tpd) ammonia plant would require the following inputs:

- 246.7 tpd of nitrogen …

- from an air separation unit (ASU) rated at 214,500 m3/day or 8,940 m3/h.

- 53.3 tpd of hydrogen (2,220 kg/h or 26,820 m3/h) …

- from an electrolysis unit rated at 145 MW, consuming 476 tpd of desalinated water.

The power consumption of the all-electric ammonia loop:

The power in the synthesis loop is required almost exclusively by the compression train and the recycle compressor. To a much lesser extent, pumping power is also required, but it is almost negligible. A 300 tonne per day ammonia synthesis plant that operates at 150 bar and 450 °C requires 7.9 MW of electrical power, and the pumping power is related to the cooling water requirements which equals 9.5 tons per minute. The total pumping power required is 0.1 MW, bringing the total power required in the synthesis loop to 8.0 MW.

McGowan et al, Sustainable Ammonia Production from U.S. Offshore Wind Farms: A Techno-Economic Review, 10/19/2017

The electrolyzers chosen for this system are made by Nel. “The specific power for Norsk Hydro Atmospheric Type 5040 electrolyzers is listed as 4.8 kWh/Nm3 of hydrogen, of which 4.3 kWh/Nm3 is for electrolysis and the remaining 0.5 kWh/Nm3 is for the balance of plant.” The study estimates the ammonia plant’s electrolyzer power requirement would therefore be 128.65 MW (DC) or, “assuming a rectifier efficiency of 95%,” 135.4 MW (AC).

Therefore, in terms of the total energy consumption, “the power requirements are almost entirely for the electrolysis of water.”

For a 300 ton per day plant, the power requirements are 145 MW total with 135 MW being required for the electrolysis – 93% of the total. The synthesis loop requires 8 MW of power, or about 5.5% of the total power requirements. The ASU and the MVC are not power intensive processes and together make up only 1% of the total power required – the ASU [air separation unit, for nitrogen production] requires 1.0 MW while the MVC [mechanical vapor compression, for seawater desalination] requires 0.5 MW.

McGowan et al, Sustainable Ammonia Production from U.S. Offshore Wind Farms: A Techno-Economic Review, 10/19/2017

Carbon emission reduction

Even with a significant grid back-up, which the study assumes has the carbon-intensity of the average US electricity mix, the wind-powered ammonia plant would offer “at least a 5-fold decrease in carbon dioxide emissions.” According to the report, “conventional ammonia production releases 2322 kg of CO2 per metric ton of ammonia,” whereas with a (fossil fueled) grid back-up “the electrolytic process would release about 478 kg of CO2 for every metric ton of ammonia.”

If they went off-grid, of course, a “remote, variable production electrolytic ammonia plant would have essentially no carbon emissions.”

Levelized Cost of Ammonia

The paper does an excellent job of defining a “levelized cost of ammonia” (LCOA), which is “a chemical analogue to the levelized cost of energy (LCOE),” a common pricing metric for electricity systems. The LCOA formula “represents the present value of all costs associated with producing ammonia over the lifetime of a plant divided by the total lifetime production.”

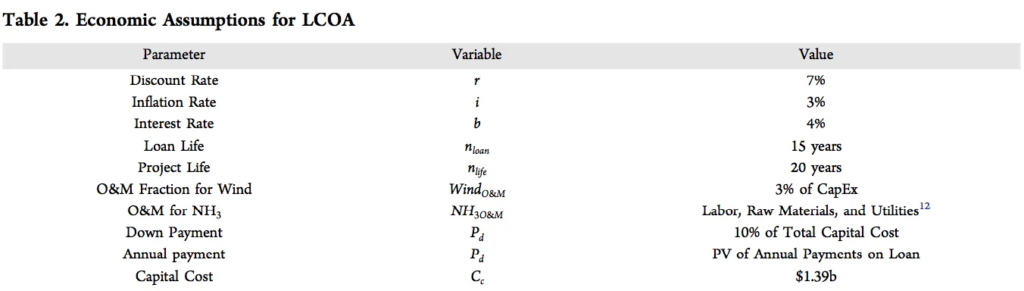

The researchers use the following LCOA variables in their calculation:

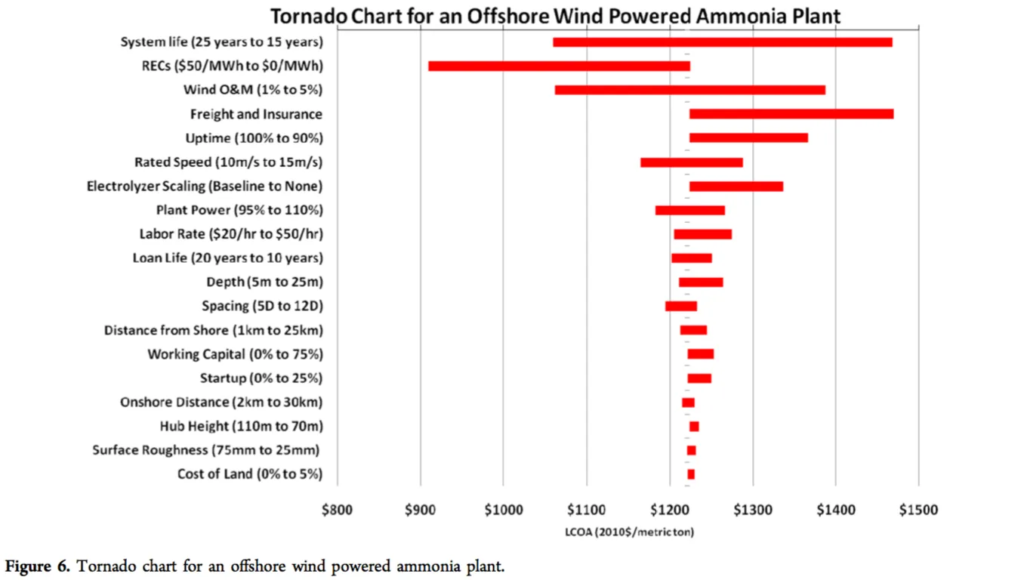

For the study’s baseline ammonia plant specifications, “the LCOA was found to be $1224 per ton of ammonia produced.”

This may sound too high, and it certainly isn’t competitive today, but there are a few keys to understanding this number.

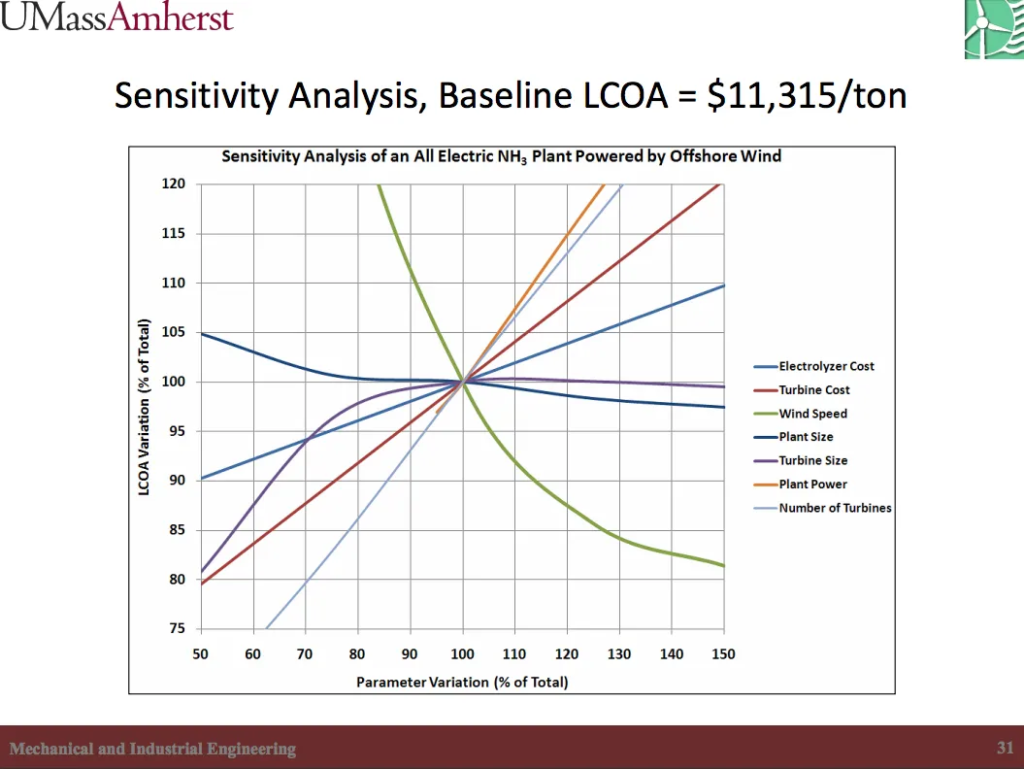

First, this LCOA is an order of magnitude closer to a competitive price than the same team’s analysis in 2011. According to their presentation at the NH3 Fuel Conference that year, the LCOA for offshore wind to ammonia was $11,315 per ton.

Of course, many of the design elements and assumptions have changed between 2011 and 2017 – but that’s precisely the point: they will keep changing, as wind power and electrolyzer cost curves come down, and as renewable ammonia business models are developed and de-risked.

(Interestingly, the Power-to-Ammonia feasibility study produced a very similar set of LCOA numbers, in its business case for OCI Nitrogen at Geleen. In that case, however, the analysis was based less on academic assumptions and more on engineering know-how and market data.)

Second, understanding the cost drivers is crucial for reducing the LCOA in the future.

The sensitivity analyses presented in both 2011 and 2017 give excellent insight into the potential for further improvement, and areas of greatest potential.

Third, the study doesn’t address one major disconnect between the LCOA generated under these assumptions and the cost of ammonia in the marketplace: almost no commercial ammonia plant finances its own feedstock supply.

(One might argue exceptions in the US for CVR Partners or Dakota Gas, perhaps, but they’re oddities: pet coke and coal gasification).

The LCOA for this offshore wind ammonia plant assumes the full financing and debt coverage of the wind farm. This leads to a capex / opex mismatch, where a 300 tpd ammonia plant that costs $1.39 billion (almost all of which, of course, is the wind farm) is trying to compete with a 2,000 tpd ammonia plant that cost less than $1 billion.

An alternative model might examine the economics of an all-electric ammonia plant with a long-term renewable power purchase agreement, as this would perhaps enable a more competitive economic comparison with traditional fossil ammonia plants.

On the other hand, the value of owning your own feedstock supply is quantifiable. The benefit of establishing relevant comparisons between renewable and fossil ammonia plants was captured, ironically, in today’s news: a world-scale ammonia plant in Trinidad has closed, after only 15 years of operation, because the natural gas it was built to exploit is no longer available. Those kinds of market risks are not captured in this economic analysis, but they don’t apply to a plant that owns its own wind farm.

Potential for expansion

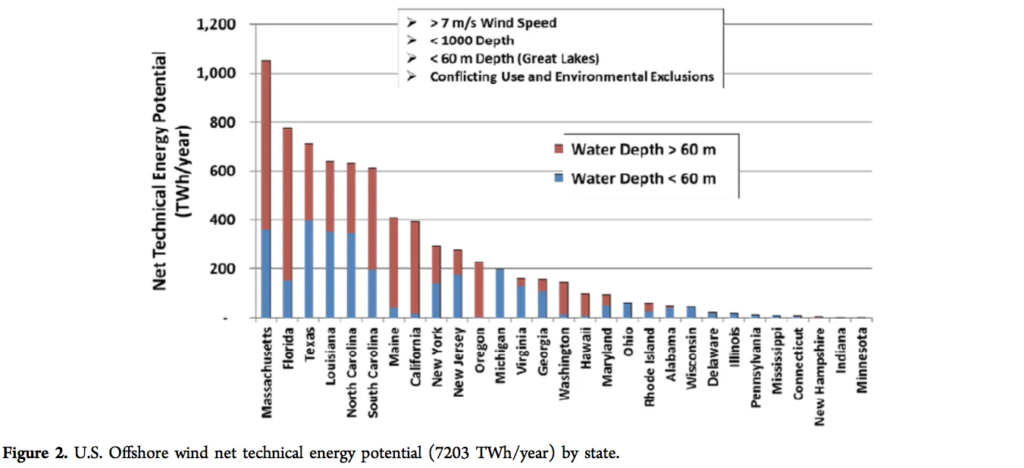

Finally, with more offshore wind potential than any other US state, it seems logical that these two academic institutions in Massachusetts are looking at how to exploit its resources.

A 300 ton per day ammonia plant might appear to be a small system, but it can be expanded: the state has enough offshore wind potential to power a thousand of them. That many plants would produce over 100 million tons of ammonia per year, in Massachusetts alone, offshore, from a resource that is currently wasted.

I imagine that economies of scale could also improve the LCOA.

You can also read the full article at AmmoniaIndustry.com.