APA Group and WesCEF: Renewable ammonia production in Western Australia via over the fence hydrogen

By Kevin Rouwenhorst on December 17, 2024

Following a partnership established in May 2022, APA Group and WesCEF have partnered in a feasibility study to decarbonize an existing ammonia plant in the Kwinana Industrial Area in Western Australia via over-the-fence renewable hydrogen, transported via the existing Parmelia Gas Pipeline. Wesfarmers Chemicals, Energy & Fertilisers (WesCEF) is an Australian conglomerate, producing ammonia and ammonium nitrate among other products. The ammonia plant in Kwinana has an annual capacity of around 300,000 tons of ammonia, based on hydrogen production via steam methane reforming. Wesfarmers is investigating a doubling of production capacity at Kwinana, with a second 300,000 tons of ammonia per year plant to replace ammonia imports.

APA Group owns and operates a portfolio of gas, electricity, solar, and wind assets across Australia. The company delivers about half of the nation’s domestic gas through 15,000 km of existing gas pipelines, including the Parmelia Gas Pipeline. APA Group also connects various states in eastern Australia via its electricity transmission assets.

Renewable hydrogen production near Pinjarra

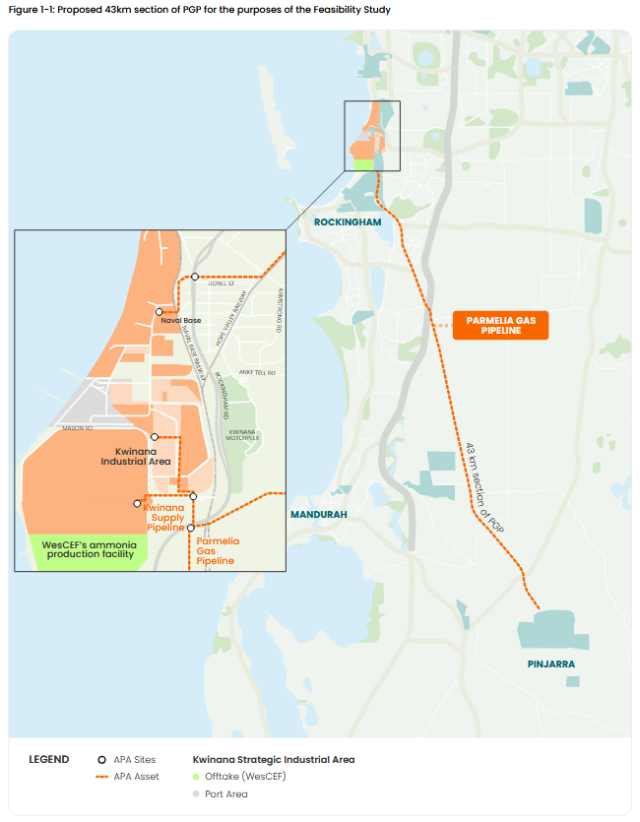

Click to enlarge. Geographic overview of the feasibility study of APA Group and WesFarmers. Fig 1 from Parmelia Green Hydrogen Project: Feasibility Study Summary Report (APA Group & WesCEF, Oct 2024).

The preferred site for the electrolysis plant was identified near Pinjarra, around 80 km south of Perth, with minimal environmental and cultural impacts, favourable site conditions, and proximity to key infrastructure such as transmission lines, water pipelines, and (critically) the Parmelia Gas Pipeline.

The feasibility study has a multi-phase approach and assumes alkaline electrolysis, with phase 1 comprising 200 MW electrolysis capacity to produce 71.2 tons of hydrogen per day (equivalent to 140,000 tons of ammonia per year), followed by 400 MW electrolyser capacity in phase 2 to produce 143.5 tons of hydrogen per day (equivalent to 280,000 tons of ammonia per year), and then 900 MW electrolyser capacity in phase 3 to produce 312 tons of hydrogen per day (equivalent to 610,000 tons of ammonia per year). By the third phase, enough renewable hydrogen feedstock is produced to cover full annual requirements for WesCEF’s Kwinana plant, including the planned expansion.

About two-third of the power comes from wind and solar, with about one third from “grid firming”. Electricity from wind will be sourced from a grid-connected wind project at about 28 km from Pinjarra, while local solar farms will operate behind the meter for a lower levelized cost of electricity. The produced hydrogen will be then transported across 43 km via a repurposed section of the Parmelia Gas Pipeline to the Kwinana plant.

Researchers from Oxford University previously showed that grid firming could reduce the levelized cost of ammonia by up to 11%, compared to no grid connection. It should be noted that the researchers assumed a grid firming of less than 15%, much lower than the 35% assumed in the feasibility study of APA Group and Wesfarmers. The required grid firming strongly depends on the assumed electrolyser flexibility, the assumed cost of the electrolyser plant, and the assumed cost of battery energy storage systems (BESS) to buffer solar and wind electricity.

The feasibility study estimates the electrolyser plant to cost as much as AU$4016-4865/kW, substantially higher than studies seen in recent years (for example, the similarly-sized 1 GW electrolyser study of ISPT in 2020, coming in at €1400/kW for alkaline electrolysis). APA Group and Wesfarmers notes that costs have significantly increased over the last 12 months, while Australia is already an expensive location for construction. The high electrolyser plant cost explains the requirement for up to 35% of grid firming requirement, as an expensive asset must be operating as much as possible.

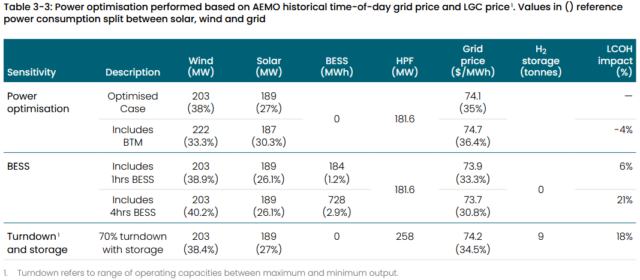

Click to enlarge. Electricity sourcing scenarios for the renewable hydrogen plant. Table 3 from Parmelia Green Hydrogen Project: Feasibility Study Summary Report (APA Group & WesCEF, Oct 2024).

A sensitivity was performed on the renewable hydrogen plant for various scenarios, namely (1) wind and solar combined with grid electricity without BESS, (2) wind and solar combined with grid electricity with 1-4 hours BESS, and (3) wind and solar combined with grid electricity and up to 70% turndown of electrolysers, compensated with hydrogen storage (9 tons total). For baseload hydrogen supply to the pipeline, wind and solar combined with grid electricity without BESS (scenario 1) is found to yield the lowest levelised cost of hydrogen production.

It should be noted that flexible operation of the ammonia plant is not considered in the study, which can significantly reduce the demand for hydrogen storage in scenario 3, as well as reduce the requirement for grid banking, possibly resulting in a lower levelized cost of hydrogen. It is possible WesCEF’s existing ammonia plant (and plans for an additional production train) has little turndown flexibility. Decoupling ammonia production from steam methane reforming also comes with a few challenges.

Next steps

In May 2023, APA Group announced testing had shown that it is technically feasible for the 43 km section of the Parmelia Gas Pipeline to transport pure or blended hydrogen, without reducing the operating pressure. APA is currently engaged in safety studies and retrofit plans for the section of steel pipeline, ahead of a delivery phase. The feasibility study also revealed that nearly half of APA’s existing 15,000 km pipeline network could carry pure or blended hydrogen, with little to no changes in operating profile needed. To connect the Pinjarra renewable hydrogen plant to the Parmelia Gas Pipeline, a short section of 14″ pipeline will be required, with a similar diameter and wall thickness.

A timeline for development of the Pinjarra hydrogen plant is provided, with FID targeted 5.5 years after the start date, and operations 8 years after. No start date has been set. Regulatory approvals, third-party coordination (wind and solar farm developers, electrolysis technology provider etc.) and two key external dependencies (upgrades at the ammonia plant, grid connections) are highlighted as three key considerations for the project timeline.