Brazil’s first electrolysis-based ammonia plant takes shape

By Julian Atchison on August 01, 2022

Unigel to retrofit plant in Camaçari

Brazil’s largest fertiliser producer Unigel (Portuguese language) has launched the country’s first industrial-scale electrolytic hydrogen & ammonia project. The initial phase of the project entails $120 million of investment and 60 MW of thyssenkrupp nucera electrolysers, to be installed in three 20 MW units. Operational by 2023, the plant (located within the existing Camaçari Industrial Complex in Bahia province) will produce 60,000 tonnes per year of ammonia, with production to “quadruple” in the second phase, which is due in 2025.

Historically an acrylics manufacturer, Unigel expanded into the agricultural space in 2021, when they leased multiple, fossil-based fertiliser production plants from Brazil’s national petroleum company Petrobras. One of these production units is in Camaçari, and (as flagged back in 2021), will provide the foundation for the new electrolysis project and green ammonia plant.

Grid-connected electrolysis

It appears the source of electricity for this plant will initially be Brazil’s grid, which already has a high share of renewable electricity (IRENA estimates the share was 83% of total generation capacity in 2020). Thyssenkrupp’s press release states that “around three quarters of the energy used in electrolysis of the project comes from renewable sources”. Unigel’s press release notes their $1 billion partnership with renewable developer Casa dos Ventos, which has a 43 GW pipeline of solar, onshore wind and hydropower projects under development or completed in Brazil. This perhaps hints that dedicated, new build renewable generation for the Camaçari plant could eventuate, or in any case that the share of renewable electricity generation in Brazil’s national grid will continue to increase.

Uruguay’s national hydrogen strategy gets more detail

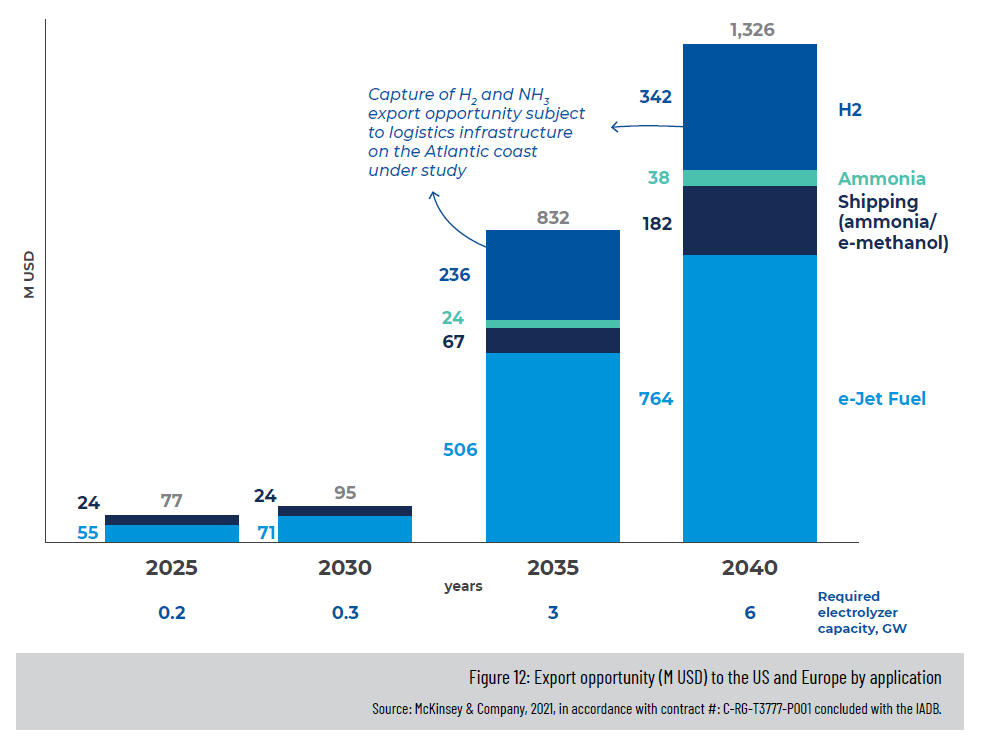

In other South American news, Uruguay’s officially-released Green Hydrogen Roadmap sets out ambitious decarbonisation goals – and a role for ammonia. By 2040, a domestic market of around $300 million is forecast for green ammonia and e-methanol, with two-thirds of that demand coming from maritime transport. 4 GW of electrolysis will be required for domestic markets.

On the export side, exports of shipping fuel (green ammonia and e-methanol), and green ammonia itself represent a $220 million opportunity by 2040, with another $340 million in generic green hydrogen exports dependent on the logistics, costs and feasibility to Atlantic ports in the US and Europe (ie. potential for more ammonia). Exports will require another 6 GW of installed electrolysers, bringing the total amount required to around 10 GW. You can access a pdf of the full roadmap here.