Carbon Capture Set to Advance in the U.S.

By Stephen H. Crolius on May 11, 2018

The United States Congress passed a measure on February 9 that could galvanize the production of low-carbon ammonia in the U.S. The measure, included within the Bipartisan Budget Act of 2018, amends Section 45Q of the Internal Revenue Code, titled “Credit for Carbon Dioxide Sequestration”. That section, originally adopted in 2008, created a framework of tax credits for carbon capture and sequestration (CCS). 45Q’s impact in the intervening years has been minimal, an outcome attributed to the relatively low tax credits allowed for CO2 sequestration and the fact that credits would be allowed only for the first 75 million tonnes of sequestered CO2. The new legislation increases the tax credit per tonne of CO2 placed in secure geological storage from $20 to $50, and for CO2 used for enhanced oil recovery from $10 to $35. It eliminates the credits cap altogether. With these changes, it now seems possible that low-carbon ammonia could find itself on an equal economic footing with “fossil” ammonia – and this could have consequences well beyond American agricultural markets.

Contemporaneous news reports sound a chorus of optimism about the salutary impact the legislation could have on the field of CCS. In a recent blog post, the non-governmental organization Center for Carbon Removal described the years of futility that preceded the 45Q upgrade: “Advocates for the technology have repelled waves of naysayers, all while holding out for a big break. For wind and solar, that break came in the form of federal tax credits in the 1990s that helped incentivize their use. Those investment and production credits also helped shift public perceptions, and adoption has since taken off.” Now, the 45Q upgrade provides similar “hope for carbon capture.” Indeed according to Matt Lucas, the Center’s Associate Director of Carbon Capture, Utilization and Storage Technology, the measure is “pretty revolutionary.”

The ammonia industry is especially well suited for CCS since much of its CO2 output takes the form of a concentrated flue stream. But to bring the CCS opportunity into focus, it is necessary to delve into two industry realities. The first is that conventional ammonia plants use natural gas in two distinct parts of the process. In one it is “fuel.” In the other, it is “feed stock.” The consumption of fuel produces heat. The consumption of feed stock produces hydrogen. The combustion of fuel yields a dilute flue stream of CO2 whose concentration (by volume) is 15% or less. The chemical reaction of feed stock yields a flue stream whose 90% level of purity draws the attention of CCS advocates. The approximate ratio of fuel to feed stock is 1:3, meaning that a quarter of emitted CO2 is not inherently advantaged for carbon capture.

The second industry reality is that some of the advantaged feed stock flue stream is already spoken for. A portion is brought to high purity and sold for industrial use. Some is used in enhanced oil recovery. By far the most prevalent use, however, is as a feed stock in the production of urea, usually by the ammonia producer itself. According to the U.S. Geological Survey’s Minerals Handbook, 11.7 million tonnes of ammonia were produced in the U.S. in 2015. Using the estimated North American ratio of 2.1 tonnes of CO2 per tonne of ammonia, the yield of byproduct CO2 was 24.6 million tonnes. Of that, approximately 18.5 million tonnes exited the process in the concentrated flue stream. Per the Minerals Handbook, U.S. urea production in 2015 was 5.5 million tonnes, which means that 4.0 million tonnes of CO2 were consumed for that purpose. Even with the other end uses of ammonia industry CO2 taken into account, this calculation confirms that a large proportion of the industry’s CO2 output is highly relevant to the implementation of CCS technology.

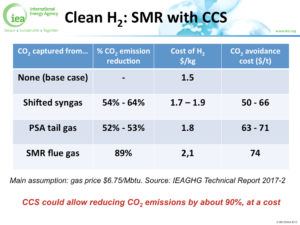

This is a favorable conclusion but there is another question that must be addressed: that of economic attractiveness. In 2017, the International Energy Agency performed a “techno-economic analysis” of CCS in the context of hydrogen production from natural gas feed stock. The end point of the exercise was a comparison of the levelized cost of hydrogen with and without CCS. Depending on the technology employed, the CCS projections ranged from $50 to $74 of added cost per tonne of captured and sequestered CO2. The numbers could differ for ammonia production even though the natural-gas-to-hydrogen chemical process is the same for both industries (so that both have concentrated flue streams of CO2). Nonetheless, a reasonable expectation is that while a $50-per-tonne tax credit will get the industry’s attention, it is unlikely to set off a near-term stampede.

What could in due course drive ammonia industry embrace of the CCS concept is market demand for low-carbon ammonia. Low-carbon ammonia is not yet a commodity in the agricultural market, but it could become one if a jurisdiction like California starts to include the carbon footprint of applied fertilizer as a parameter that could be progressively reduced under its Cap and Trade Program. The price of a tonne of CO2 under the California program is currently $15.

Alternatively, low-carbon ammonia could enter existing markets governed by renewable energy standards. For example, in California low-carbon ammonia could conceivably compete with other renewable energy sources as the state adopts ever more stringent goals under its Renewables Portfolio Standard. On an even bigger stage, production of low-carbon ammonia could position the U.S. as an early player in the prospective international market for climate-friendly energy. It is worth noting that Saudi Arabia and Australia, both already in discussions with Japan about the supply of low-carbon hydrogen (for pertinent Ammonia Energy posts, click here and here), are looking to CCS as an expedient that can convert their carbon-intensive fossil energy resources to more climate-friendly status.

It may not have been anticipated by 45Q’s Congressional sponsors, but their legislative tinkering with an obscure section of the U.S. Internal Revenue Code may play an important role in furthering ammonia’s prospects in the sustainable global energy system of the future.

Featured image photo by by Mark Wilson/Getty Images.