Flattening the climate risks curve

By Lars-Erik Gaertner on April 22, 2020

The CCUS & Clean Hydrogen Economy for a post COVID-19 era

A guest post by Lars-Erik Gärtner, Head of Transformational R&D — Americas at Linde, originally published on LinkedIn Pulse, April 8, 2020.

Stimulating the economy while mitigating climate change

You never let a serious crisis go to waste. And what I mean by that it’s an opportunity to do things you think you could not do before.

Rahm Emanuel – US Congressman & White House Chief of Staff

The COVID-19 pandemic is a human tragedy of epic proportions. It directly affects the life and livelihoods of people all around the world as an unprecedented healthcare and economic crisis. It is clear by now that COVID-19 marks an inflection point or “black swan” event in history that will have a shaping influence on society and the economy for many years to come; a post COVID-19 era will begin. This article is written in the spirit of Rahm Emanuel to make the case for an opportunity to “hit two birds with one stone” in the midst of a negative economic outlook: creating significant stimulus to restart the economy after containment of COVID-19 while also addressing long-term risks – above all climate change.

In the same way that the developing renewable energy industry significantly benefited from the economic stimulus packages to address the financial crisis of 2008/2009, we now have the opportunity to kick-start the next important phase of global CO2 emissions reduction through support of the developing CO2 Capture, Utilization and Storage (CCUS) & Clean Hydrogen Economy. Many of these clean technologies have been proven at industrial scale and implementation has started. Still, commercial projects will continue to need financial incentives for broad deployment that will enable accelerated technology maturation and reductions in project risk and cost. With the support from COVID-19 stimulus packages, the private sector will be able to execute CCUS & Clean Hydrogen projects in the near-term, secure and create jobs, grow the economy and mitigate the risk of “green swan” climate change events through significant CO2 emissions reduction.

Putting climate change risk into perspective

In 2019, climate change and the role of CO2 emissions as a greenhouse effect propagator rose to unparalleled public and corporate attention when natural events like the Australian forest fires exemplified what we must expect as we progress into the 3rd decade of the 21st century. The socioeconomic impact of climate change in all facets is estimated to be nonlinear and have knock-on effects into other domains. Supplemental to the Global Risk Report published by the World Economic Forum (WEF), the WEF presented a recap of a Likelihood vs Impact Global Risk Assessment which was first started in 2007. Notably, environmental risks have risen to the top 5 risks ranked during the 14-year analysis timeframe and are perceived as the major risk to global society above all others in the beginning of 2020. Although the COVID-19 pandemic will undoubtedly have an impact on the 2021 global risk landscape, it is to be expected that the previously top ranked global environmental risks like failure of climate change mitigation and adaption will not degrade in relevance. If anything, the world has now learned that risks like infectious disease, which by relative comparison were previously regarded as less likely and less impactful, can severely upset societies and financial markets. The general public realization that there are more likely and more impactful “green swan” events looming, will create an even stronger sense of urgency to act against climate change than we have seen in the recent past.

“Flattening the curve” through social distancing has been the mantra of the COVID-19 response, a reference to the necessity to slow down the growth of the number of infected individuals. The goal of this campaign is to prevent an overburdening of the healthcare systems that in turn mitigates the risk of additional suffering and fatalities. The same is true for climate change risk mitigation on an even broader scale since there will be a threshold beyond which humans will not be able to endure suffering when it comes to the impact on health & livelihood. Not exceeding this threshold limit means slowing down the growth rate of climate change risks today.

The 2008/2009 precedence for climate change mitigation stimulus

Looking back to 2008/2009 when the world had to respond to the global financial crisis at that time, China spent 12.7%, the US spent 5.6%, Germany spent 4% and Japan spent 2.4% of their 2008 GDP for economic stimulus packages. The global stimulus response time to the crisis happened within 5 months in 90% of countries that acted and additional stimulus packages were introduced over the next years. All stimulus packages were designed based on the same principles of being timely, temporary, targeted and coordinated.

In the US, a total of 5 stimulus packages were implemented including the tax relief stimulus package from February of 2008. The flagship American Recovery and Reinvestment Act (ARRA) enacted in February of 2009 was the largest single US stimulus package in the size of 787 billion US dollars, of which 90 billion US dollars where appropriated “to lay the foundation for a clean energy economy of the future”. This included 35 billion US dollars of direct clean energy investments through the US Department of Energy Program Office and 37 billion US dollars of tax credit investments through the US Department of Treasury. China released a 4 trillion RMB (585 billion US dollar) stimulus package of which 210 billion RMB (31 billion US dollar) were dedicated to “energy conservation and emissions reduction”. The EU, in addition to substantial stimulus packages from member states, enacted the European Economic Recovery Plan in the amount of 200 billion euros which included a “strategy for limiting climate change and promoting energy security”.

Comparing the 2008/2009 efforts to the situation in 2020, the US for example just released a 2 trillion US dollar stimulus package called the Coronavirus Aid, Relief, and Economic Security Act (CARES) that is double the size of the inflation adjusted 2009 ARRA. The CARES Act is comprised of measures to manage the initial crisis and create immediate economic impact and it is expected that additional stimulus packages with a longer-term economic stabilization focus will be introduced in the coming months and years. Germany released a 750 billion euro (814 billion US dollar) coronavirus stimulus package, which is more than 12 times the inflation adjusted 50 billion euro stimulus package of 2009. Again, follow-up stimulus packages are expected after the immediate threats to public health and the economy have been addressed. The number of countries creating such stimulus packages continuous to increase.

Kick-starting the CCUS & Clean Hydrogen Economy

Concluding from the above, it is very likely that substantial funding will be available for the mitigation of climate change as part of the global COVID-19 economic stimulus effort, either directly or indirectly. At the moment, multi-stakeholder interest groups are rallying to provide language to the quickly developing economic stimulus bills in various countries. Developing the CCUS & Clean Hydrogen Economy is one highly impactful mission at the top of their agenda, and here’s why:

Analysis by the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA) has consistently shown that CCUS is an essential part of the lowest cost path towards meeting climate targets. The IPCC’s Fifth Annual Assessment Report (AR5) showed that excluding CCUS from the portfolio of technologies used to reduce emissions would lead to a doubling in cost – the largest cost increase from the exclusion of any technology.

CO2 capture technology can be applied to high-volume, concentrated industrial CO2 point sources like those from hydrogen, power, cement and iron & steel production industries, or it can be applied to capture highly dilute CO2 directly from air. The cost of industrial CO2 capture by means of conventional solvent, sorbent or membrane technology is today on the order of 60-80 US dollar per tonne of CO2, while new projects demonstrating more advanced technologies estimate costs closer to 40 US dollar per tonne of CO2. Direct Air Capture (DAC) cost is in the range of 500 – 700 US dollar per tonne of CO2 today, with a long-term target to decrease the cost below 100 US dollar per tonne of CO2. The cost of CO2 transport is dependent on the distance as well as on the mode of transport (e.g. pipeline, truck). Excluding the CO2 merchant market, the cost of large-scale CO2 pipeline transport is usually less than 30% of total cost.

Once CO2 is captured it needs to be used in such a way that it will not be emitted to the atmosphere again (the utilization (U) part of CCUS) or it needs to be safely stored in subsurface formations (the storage (S) part of CCUS). While the former can create value to offset the cost of CO2 capture and is therefore always the preferred option of CCUS, the existing commercial market for CO2 utilization is limited in total CO2 volume and thus climate change mitigation potential. Storing CO2 in the subsurface does not create additional value, however much larger volumes of CO2 can be processed. Hence, CO2 storage is inevitable but the cost of CO2 capture, transportation and subsurface storage must be offset by either a price for CO2, which can be in the form of an Emissions Trading Scheme (ETS), a CO2 tax for consumers or a CO2 tax credit for industry, or direct government funding.

The use of hydrogen to decarbonize sectors that are otherwise impossible or hard to abate – such as logistics, industrial heating and industry feedstock, and hydrogen as a means to increase energy security – have led to broad governmental recognition that hydrogen is a powerful energy carrier and feedstock of the future. Hydrogen has a market today, but it is set out to grow 10x by 2050. This developing Clean Hydrogen Economy will in turn contribute significantly to the realization of more and more ambitious global decarbonization targets (see the Hydrogen Roadmap Europe or the Road Map to a US Hydrogen Economy). Analysis shows that 8% of global energy demand can be met by hydrogen at a production cost of 2.50 US dollar per kg and as much as 15% at 1.80 US dollar per kg.

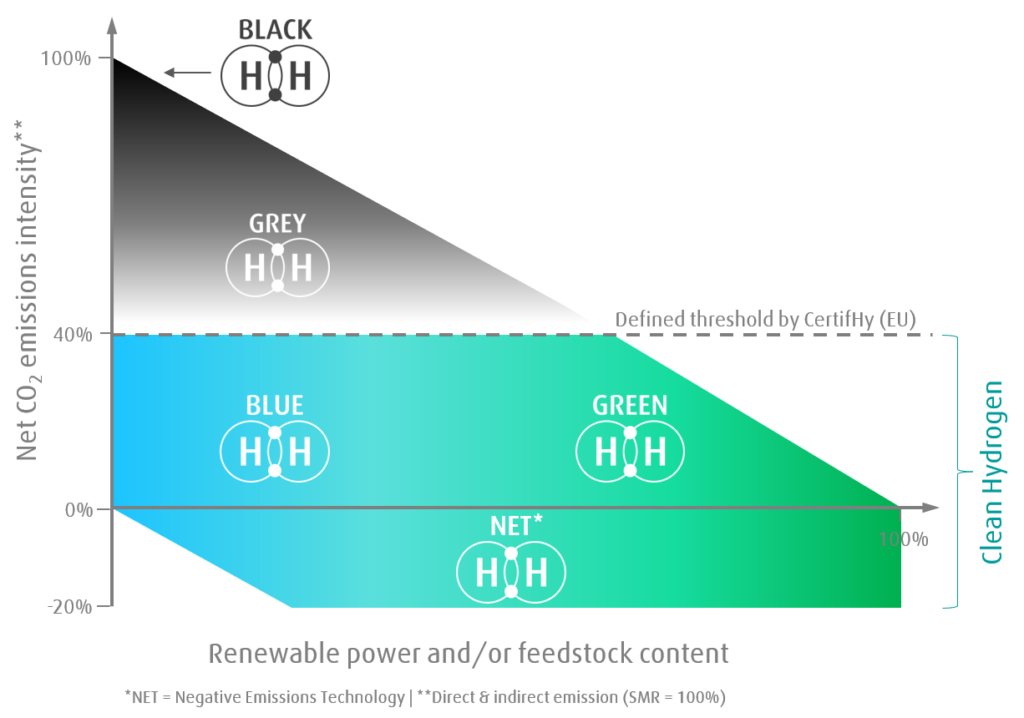

Clean Hydrogen can be differentiated in 2 major categories, Blue Hydrogen and Green Hydrogen (see Figure 2). Blue Hydrogen is produced from fossil feedstock by means of technologies such as steam methane reforming (SMR) and coal gasification in combination with CCUS technology. The cost of Blue Hydrogen is projected to decrease and can drop below 1.50 US dollar per kg in most preferred regions in the near-term and is set out to decline further to as low as 1.20 US dollar per kg by 2025. A price of 50 US dollar per tonne of CO2 would allow Blue Hydrogen at a production cost of 1.50 US dollar per kg to reach cost parity with Black and Grey Hydrogen.

Green Hydrogen is produced from renewable power or renewable feedstock by means of technologies such as water electrolysis and biomass gasification. The average cost of Green Hydrogen has declined from 10-15 US dollar per kg in 2010 to 4-6 US dollar per kg today and is set out to decrease to as low as 2.50 US dollar per kg by 2030. In most preferred regions such as Chile and Australia it is possible to generate Green Hydrogen at a cost of 2.50 US dollar today, declining to 1.90 US dollar per kg in 2025, and 1.20 US dollar per kg in 2030.

98% of today’s hydrogen production is from fossil feedstocks such as methane or coal, which makes it essential to deploy readily available CCUS technology for large-scale Blue Hydrogen production in the near-term. At the same time, it is important to grow the market share of Green Hydrogen, which will become the major Clean Hydrogen technology in a renewable power-driven future.

The incremental cost of CCUS & Clean Hydrogen technology compared to conventional technology has been, and still is, constantly declining, while regional CO2 prices or CO2 taxes have steadily increased. However, business cases are generally not attractive enough for private industry to pursue large-scale commercial projects today. Moreover, it can be expected that ETS-governed CO2 prices will temporarily decrease due to reduced industry activity and resulting lower CO2 emissions. This will temporarily reduce industry pressure to act on climate change. COVID-19 stimulus packages can make the necessary difference and drive enough projects over the remaining commercial risk hurdle to create an eventually self-sustaining CCUS & Clean Hydrogen economy. The more projects are realized, the more technology cost will decline, project risk will be mitigated and today’s high cost of debt financing for such projects will decrease and enable future private sector investments.

Stimulus packages are designed based on the principles of being timely, temporary, targeted and coordinated. This narrows down appropriate policy measures for climate change mitigation. Most effective to create timely and temporary impact are direct grant programs for the private sector enabling immediate project realization. Other options are loan guarantees that de-risk the debt financing of capital-intensive projects, resulting in lower cost of debt and higher economic attractiveness. The difference between loan guarantees and direct grants is that government funds are only spent when the projects fail and the loans default. Yet another measure are investment tax credits like the already existing 45Q legislation for CCUS projects in the US. This requires that the tax appetite of recipient companies remains high in a time of economic downturn. Adversely, tax credits may not be considered timely and also not temporary as they are more likely to be a continuous longer-term measure. In fact, one critically acclaimed policy tweak of the 2009 ARRA in the US was to change existing legislation converting investment and production tax credits for the renewable energy industry to a direct grant policy.

Industry behavior & private sector investments during and after the COVID-19 pandemic

Due to the high degree of uncertainty regarding the duration of the COVID-19 pandemic, it is not possible to define clear timelines as of now. It is possible, however, to describe the industry transition to a new “post COVID-19 business normal” in stages, namely Resolve, Resilience, Return, Reimagination, and Reform.

In the first stage Resolve, the focus is to deal with the immediate threat to employees and to continue business operations during a time of acute transactional slowdown. Due to decreased market activity, the uncertainty on the duration of the pandemic, and the consequential economic downturn, businesses are cutting discretionary costs and holding off on planned investments. First economic stimulus packages are being released in this period to address the immediate needs of industries that experienced severe impact, e.g. the airline industry and the hotel industry. This is most likely not the optimal time to start new CCUS & Clean Hydrogen projects. However, targeted early economic stimulus efforts can help realize current projects that have not yet passed a final investment decision, and which otherwise may be delayed or stopped entirely due to increased uncertainty risk.

The next stage is Resilience, when the global health crisis transforms into a global economic and financial crisis. Cash management to maintain liquidity and solvency are of highest importance to businesses and new investments at this stage are under high scrutiny. General investment appetite will be lowest then of all the proposed stages. On the positive side, economic stimulus packages may enable some highly resilient industries, such as the power industry, to deal with the increased risk and continue investments in Clean Energy that could help realize CCUS & Clean Hydrogen projects.

Moving into the Return phase, industries will focus on reactivating their globally disrupted supply chains, returning their businesses to effective production at pace and scale. The resurgence uncertainty of a second or even multiple COVID-19 waves will keep investment appetite from growing rapidly since businesses will fear reversion to the Resolve stage. This is the period when economic stimulus packages can have the biggest impact to deliver short and midterm economic benefits by promoting CCUS & Clean Hydrogen projects through significant project de-risking.

After Return comes Reimagination, a phase when industries will collect lessons learned from the crisis up to this point and build a framework for successful business continuation into the future. This will include long-term strategies on how to be more resilient and productive during economic downturns. Multiple economic stimulus packages will have been issued for months and years by this point and due to their temporary nature will start to fade out soon. Many industries will return to focusing more on their sustainability roadmaps because this will be the time to use available stimulus funding for longer-term strategic climate change risk mitigation investments, such as those for CCUS & Clean Hydrogen.

The last stage of this transition process is Reform, when Governments will be emboldened to pass comprehensive legislation to prevent similar “black swan” or future “green swan” events from reoccurring or significantly lessen their impact if they do occur. Businesses will adapt to the “new normal” and leverage healthcare reform and climate change mitigation policy to their benefit, transforming products, services and work practices according to sustainable principles. Short-term economic stimulus packages will not play an active role anymore, but by this time will have propelled industry transition such as the CCUS & Clean Hydrogen Economy to grow out of its early stages into a more mature and self-sustaining industry.

* * *

The steps that are taken now to implement a global CCUS & Clean Hydrogen Economy will have significant impact on whether we can avoid runaway climate change, as the global economy will likely not be able to cope with risks created by an average global temperature rise above 1.5 °C. Therefore, reducing global CO2 emissions and not exceeding the carbon emissions budget are key. In essence, we must resolve the acute health and financial COVID-19 crisis with all available measures and restart the economy with a plan to fully recover with a much higher degree of economic and environmental resiliency.

A guest post by Lars-Erik Gärtner, Head of Transformational R&D — Americas at Linde, originally published on LinkedIn Pulse, April 8, 2020. For glossary and full references, please refer to the original article. Also refer to the original article for the author’s disclaimer, incorporated here by reference. Reproduced at Ammonia Energy with the author’s permission.