Australian Company Advances Low-Carbon Hydrogen from Methane

By Stephen H. Crolius on January 16, 2020

Hazer Group, an Australian company with technology in development for the production of low-carbon hydrogen from methane, had a busy 2019. In April the company announced that it had received its first Australian patent. In September, the Australian Renewable Energy Agency (ARENA) announced the approval of “up to [AUD] $9.41 million in funding to Hazer … for the construction and operation of a groundbreaking hydrogen production facility in Munster, Western Australia.” In December Hazer announced that it was negotiating an agreement with BOC, the industrial gas distributor, related to its Munster project. Last week the company announced that it had secured up to AUD $250,000 in grant funding from the Government of Western Australia for “a feasibility study on the creation of a renewable hydrogen transport hub” in the City of Mandurah.

Hazer was founded in 2010 for the purpose of commercializing technology developed at the University of Western Australia. The company went public on the Australian Securities Exchange in 2015. It has a market capitalization of AUD$45 million at its current share price.

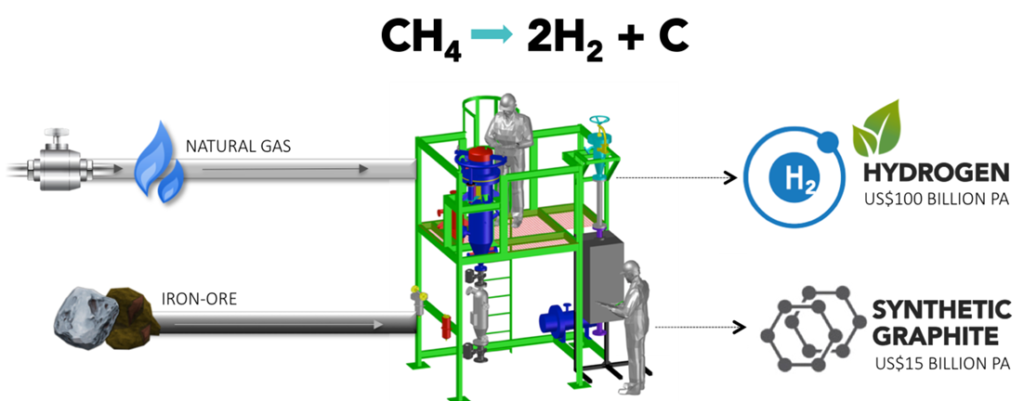

Hazer’s technology occupies an emergent branch on the family tree of low-carbon hydrogen production technologies. On the ‘blue hydrogen’ side of the tree (i.e., hydrogen derived from methane without the uncontrolled release of carbon dioxide, as opposed to ‘green hydrogen,’ produced from renewables), much of the attention goes to capturing the carbon dioxide (CO2) from steam methane reforming (SMR, the current source of most of the world’s hydrogen). On Hazer’s branch of technologies, carbon issues from the methane reforming process not as CO2 but as C, in a pure “graphitic” form of the element.

At the heart of the company’s proprietary technology is the use of “iron ore as a process catalyst.” According to one of Hazer’s international patent applications, in the generic version of the process,

… the solid carbon material deposits onto the surface of the catalyst and hydrogen gas evolves. There are a wide number of known catalysts for the process, including precious metals, transition metals and carbon-based catalysts. Whilst the above process is known, it has not been exploited commercially for a number of economic reasons, primarily relating to the underlying catalyst costs, both in the initial supply, as well as costs in recycling and regenerating the catalyst. The particular catalyst used also heavily impacts the morphology of the solid carbon produced …

“A Process of Controlling the Morphology of Graphite,” International Patent Application WO 2017/031529 Al, submitted March 2, 2017.

The patent application suggests that the company has found “new and improved processes and catalysts … which are stable and commercially valuable, whilst allowing for the morphology of the produced carbon to be controlled.”

The strength of Hazer’s technology will be tested over time, but there is no doubt that the company finds itself in a robust competitive field. Numerous players are working on the SMR branch of the low-carbon hydrogen tree. An example is global catalyst powerhouse Johnson Matthey which is promoting its Low Carbon Hydrogen solution under which “the vast majority of CO2 produced during the various [SMR] reactions is contained within the process and can be captured at more than 95%.” Occupying a newer niche on the blue hydrogen branch is Net Power, lead developer of the Allam cycle. As Ammonia Energy reported in February 2019, Net Power and its partners view the Allam cycle as “the only technology that will enable the world to meet all of its climate targets without having to pay more for electricity.” And Hazer even has company on its solid-carbon branch. One business working in this area, Monolith Materials, reported on the construction of their first commercial-scale pyrolysis plant at the 2019 Ammonia Energy Conference. Another example is TNO, in the Netherlands, with its EMBER methane pyrolysis process.

Complicating the categorization of Hazer’s place in the blue-green hydrogen spectrum is the source of its methane. Unlike Monolith or EMBER, both of which consume natural gas feedstock, the Hazer process is geared toward hydrogen production using biogas produced from waste management.

Hazer’s success in raising capital from both public and private sources has presumably been furthered by its decision to focus on this specific niche. In an October 2019 interview with the Australian investment newsletter Eureka Report, Hazer’s Chief Executive Officer Geoff Ward spoke about the company’s intention to “work with customers to produce hydrogen from waste biogas close to where they use it, so taking gas from tips and wastewater treatment plants, converting it to hydrogen to fuel bus and truck fleets which are often located close to those large waste municipal facilities.”

Ward believes that production on this basis will create a cost advantage for the company relative to producers on another trunk of the low-carbon hydrogen tree: those using renewable electricity to power electrolyzers. “We think we’ll be very cost competitive with [electrolytic hydrogen] because we use less energy and we take away feed stock and we produce graphite as an additional byproduct,” he said. Nor does he feel that Hazer’s chosen niche will be limited in growth potential. “The scale is actually very large,” he said, mentioning the worldwide ubiquity of waste management facilities. “We think we could extend to many hundreds of plants globally.”

The downstream parts of Hazer’s value chain appear to have a more speculative quality. Ward sees fuel cell vehicles as an important end use application for his product. He did not have occasion during the Eureka Report interview to lay out his vision for the steps associated with moving the hydrogen from production site to FCV fuel tank. He did include “transport modules and tube trailers” on a list of items “in the hydrogen supply system” whose costs would go down as volumes go up. It is not clear if the company has examined the cost of transporting gaseous hydrogen by tube trailer, but doing so over even a short distance could sabotage a carefully cultivated production cost position. The company has yet to publicly identify ammonia as a potential carrier for its hydrogen, but that could change in the fullness of time.

Hazer’s announcement, that it is working with BOC on an arrangement under which the latter would be the offtaker of the hydrogen produced in the former’s demonstration project, is significant. According to Hazer’s press release, BOC “will supply storage, logistics and refuelling services to deliver hydrogen to end users.” BOC, currently an operating brand of global industrial gas company Linde, is well versed in hydrogen logistics. Critically, BOC provided support to Australia’s Commonwealth Scientific and Industrial Research Organisation (CSIRO) for the demonstration of its high-purity ammonia-to-hydrogen conversion technology that could be deployed at hydrogen fueling stations. (Ammonia Energy reported on this in September 2017.) We can be sure, therefore, that BOC is well aware of the role ammonia can play in a transportation-oriented hydrogen value chain.