Hydrogen in Australia: investments and jobs

By Trevor Brown on June 11, 2020

There is so much hydrogen news coming out of Australia that it is hard to keep up.

At the state level, Tasmania has released its draft plan to increase renewables to 200% of its electricity use by 2040. This marks a serious start to establishing a renewable energy export economy, and includes funding and policy support to ramp up green hydrogen and ammonia production and begin exports by 2027.

At the federal level, ARENA announced that its AU$ 70 million funding round for large-scale, “shovel-ready,” renewable hydrogen projects received applications representing over $3 billion of commercial investments. Australia’s renewable hydrogen industry has appetite and momentum, “and we’re seeing a lot of projects ready to be built.”

As if to prove the point, two developers in two weeks have each announced hydrogen projects that could produce a million tons per year of ammonia. These are at opposite ends of the low-carbon spectrum: Leigh Creek Energy’s in-situ gasification (ISG) coal-to-ammonia plant; and Austom Hydrogen’s 3.6 GW green hydrogen export project.

In Australia, progress for hydrogen is progress for ammonia. As I wrote in April, based on analysis by Rystad Energy, Green Ammonia Dominates Hydrogen Demonstrations in Australia, with “more than 400 MW of electrolyzer installations planned for green ammonia production, from a nationwide total of 700 MW.” Rystad evidently isn’t including any of the multi-GW projects in its analysis, yet.

Tasmania — Battery of the Nation

The island state of Tasmania announced a “world-leading” target earlier this year, to produce 200% of its electricity from renewables. The state is already on track to hit 100% clean energy generation by 2022 and, simultaneously, “the lowest-cost regulated electricity in Australia for residential and small business customers.”

In May, Tasmania released its draft Renewable Energy Action Plan, which identifies how to achieve this 200% target.

We have set a target to double our renewable generation with a target of 200 per cent of our current needs by 2040 … the opportunity to double our already significant renewable energy production, injecting billions into our economy and creating thousands of local jobs, will largely be realised through our nationally significant Project Marinus and Battery of the Nation projects.

Our $50 million hydrogen industry development support package, the biggest in the nation, will kick-start the renewable hydrogen industry in Tasmania, creating hundreds of additional jobs and injecting further billions into our economy.

Tasmanian Government, The Draft Tasmanian Renewable Energy Action Plan 2020, May 2020

Project Marinus is a 1.5 GW capacity undersea cable from Tasmania to Victoria, which offers one obvious opportunity for energy exports. Hydrogen production, however, opens up the much larger international export opportunity.

A few months ago, in March 2020, Tasmania published its Renewable Hydrogen Action Plan. This has become a key component of the broader Renewable Energy Action Plan.

The hydrogen timeline is summarized as follows:

By 2022 to 2024:

— Tasmania has commenced production of renewable hydrogen.

— Locally produced renewable hydrogen is being used in Tasmania.

— Export based renewable hydrogen production projects are well advanced.By 2025 to 2027:

— Tasmania has commenced export of renewable hydrogen.From 2030:

Tasmanian Government, The Draft Tasmanian Renewable Energy Action Plan 2020, May 2020

— Tasmania is a significant global producer and exporter of renewable hydrogen.

— Locally produced hydrogen is a significant form of energy used in Tasmania.

To deliver this vision, Tasmania has committed to a $50 million package over 10 years, including a $20 million Renewable Hydrogen Fund, $20 million of “concessional loans,” and $10 million of “support services including competitive electricity supply arrangements and payroll tax relief.” In addition, it will provide “assistance for developing offtakes for hydrogen end-use, and facilitating land and infrastructure access.”

The plan estimates Tasmania’s competitive advantage against other Australian states — due, to a large extent, to the availability of baseload hydropower — and the impact of green hydrogen on local employment.

Tasmania is in a unique position where a large-scale renewable hydrogen production and distribution industry could be developed now …

The cost of production of renewable hydrogen in Tasmania could be 10 to 15 per cent lower than from other Australian power grids and 20 to 30 per cent lower than from dedicated off-grid variable renewables.

A 100 megawatt renewable hydrogen production facility could contribute an estimated 100 to 150 jobs, while a 1,000 megawatt facility, which could be feasible by 2030, could support around 2,000 megawatts of renewable energy investment and contribute an estimated 1,000 to 1,200 jobs.

Tasmanian Government, Tasmanian Renewable Hydrogen Action Plan, March 2020

ARENA assesses $3 billion of shovel-ready green hydrogen plants

At the end of May, ARENA closed its Renewable Hydrogen Deployment Funding Round, which is looking to spend AU$70 million to support large-scale “shovel-ready hydrogen electrolysis projects.” This week, ARENA announced that interest in this program far exceeded expectations, attracting over AU$1 billion of grant requests, representing over “$3 billion in combined project value, when accounting for private sector investment.”

The end goal of the program is clear: “to bring the cost of renewable hydrogen production below $2 per kilogram to be cost competitive with hydrogen generated from fossil fuels.”

Applicants are required to deploy electrolysers powered by electricity from renewable sources, with a minimum capacity of 5 MW and preference for 10 MW or more.

Collectively the 36 applications received have more than 500 MW of electrolysis capacity. Projects range in size from 5 MW to approximately 80 MW and will seek to produce hydrogen for a wide range of end uses across a number of industries.

Applications have been received from every Australian state and territory.

ARENA article, More than $3 billion of hydrogen projects bid for ARENA funding, June 5, 2020

ARENA hopes to assess the applications swiftly and announce awards before the end of 2020. “Successful projects will aim to reach financial close and begin construction in 2021.”

Two things are clear from this: first, the industry believes that green hydrogen and ammonia is feasible at large scale; second, this isn’t a future scenario: these projects are “shovel-ready.” Projects that begin construction in 2021 should start production in the first half of this decade.

The projects are showing that it is technically feasible to produce hydrogen with renewable energy, but attention is now shifting to large scale demonstrations to help renewable hydrogen compete on cost with hydrogen produced from fossil fuels.

ARENA CEO Darren Miller [said …] “The fact that we’ve received expressions of interest for projects totalling over $3 billion in cost and 500 MW in size shows that we’re beginning to see companies embrace making hydrogen through renewable means and we’re seeing a lot of projects ready to be built.”

ARENA article, More than $3 billion of hydrogen projects bid for ARENA funding, June 5, 2020

ARENA’s AU$70 million will be augmented by another source of finance, the Clean Energy Finance Corporation’s (CEFC) AU$300 million Advancing Hydrogen Fund. This fund was announced in May, “to support the growth of a clean, innovative, safe and competitive Australian hydrogen industry,” with explicit coordination and support for ARENA’s renewable projects.

An early priority will see the CEFC seek to invest in projects included in the ARENA Renewable Hydrogen Deployment Funding Round …

CEFC CEO Ian Learmonth said … “CEFC finance remains central to filling market gaps, whether driven by technology, development or commercial challenges. We are confident we can use our capital to help build investor confidence in the emerging hydrogen sector, which is an exciting extension of our investment focus” …

Through the Advancing Hydrogen Fund, the CEFC expects to provide either debt or equity finance to eligible larger-scale commercial and industrial projects, typically requiring $10 million or more of CEFC capital. CEFC investments typically include co-financiers and/or equity partners where possible.

CEFC announcement, CEFC welcomes launch of new $300 million Advancing Hydrogen Fund, May 4, 2020

All these announcements talk about jobs — thousands of jobs, and billions in sustainable economic impact. The government numbers are conservative, however, compared to others looking to transform Australia’s economy.

Beyond Zero Emissions: Million Jobs Plan

Beyond Zero Emissions, a “climate change think tank,” has just published the first Briefing Paper of its Million Jobs Plan, “a post-COVID economic recovery … that will pave the way for Australia to become an International economic powerhouse and a renewable energy superpower in the decades to come.”

While many of these new jobs are in other sectors of the energy economy, like buildings, the plan quantifies the benefits of “new industries, such as renewable hydrogen, energy-intensive manufacturing, zero-emissions steel and electricity exports.”

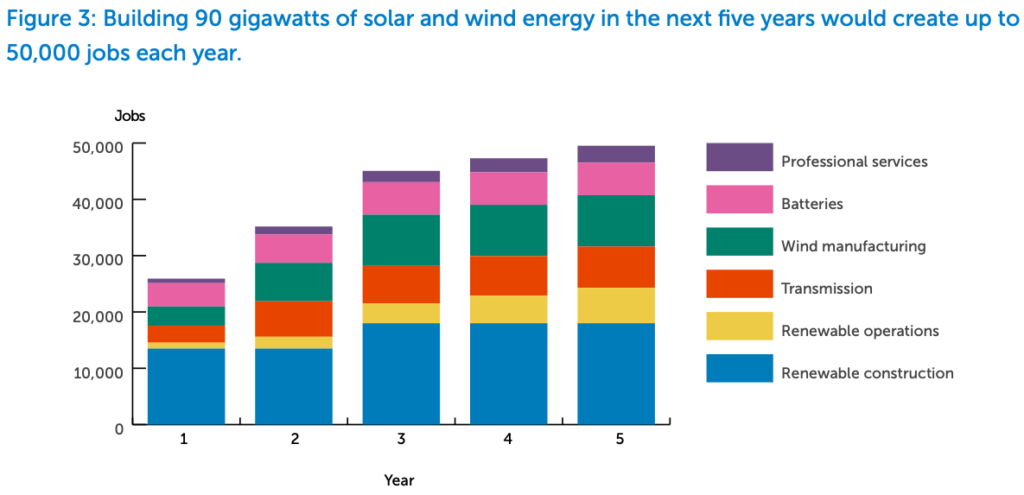

Australia’s renewable energy sector is a major employer, with 26,850 full-time workers in 2019, several times more than the coal-fired power industry. This skilled workforce of engineers, technicians, construction workers and consultants is the foundation for a far larger industry. Unleashing the full potential of Australia renewables would create many thousands more jobs (Figure 3).

Investors have already identified a vast pipeline of clean energy projects in Australia. Unblocking barriers in this pipeline will accelerate construction of many of these projects.

Beyond Zero Emissions, Million Jobs Plan Briefing Paper 1: Renewable Energy, May 2020

And the vast pipeline of projects continues to grow.

Leigh Creek’s million tons of ammonia

Underneath a disused coalfield in the middle of South Australia, 500 km north of Adelaide, Leigh Creek Energy proposes to begin “in-situ gasification” of underground coal deposits (ISG, as opposed to “coal seam gasification” or CSG), producing syngas at the surface that can be upgraded to ammonia and turned into urea fertilizer. The project has been in development for some years, with permitting underway for a demonstration project leading to a commercial project.

Last week, Leigh Creek Energy announced its intention to address the hydrogen market directly, and to seek financing from the CEFC’s Advancing Hydrogen Fund.

LCK’s main aim is to produce hydrogen and then ammonia for urea manufacture. Ultimately this will mean we could produce 2 million tonnes of urea from 200 million kg of hydrogen at <$1 per kg. However, if the market exists in Australia or an export market exists for hydrogen, we can divert excess hydrogen for sale as a standalone product.

Leigh Creek Energy ASX announcement, The Option for Hydrogen, June 3, 2020

Of course, this is fossil-based hydrogen with no carbon sequestration, and so it goes against ARENA’s ultimate goal of bringing renewable hydrogen into a cost-competitive position. (We might also ask why a project that produces hydrogen at <$1 per kg needs government support.) Nonetheless, this is the range of hydrogen projects under development in Australia.

Austrom’s million tons of ammonia

This week, Austrom Hydrogen announced a new multi-GW renewable hydrogen project, in Callide, Queensland. This 3.6 GW solar farm would produce 200,000 tons per year of hydrogen, for export from Gladstone Port (the same port that Hydrogen Utility hopes to use for its 3 GW renewable ammonia export plant) .

Austrom Hydrogen has enough land acquired and ready for the development of a solar farm and battery facility. With a capacity of up to 3,600 MW and located in Callide, Queensland the area is ideally suited to solar energy production with proximity to existing power infrastructure. Environmental impact studies and irradiance monitoring have been initiated on site in line with the next step of the development process. This area was selected due to its proximity to Gladstone Port and robust existing grid offering low line losses.

Austrom Hydrogen website, accessed June 2020

Austrom sees “3 main options to prepare hydrogen for export,” namely liquefaction, ammonia production, or toluene / MCH. In its comparison of these options it states that ammonia is easier to transport but at a “great cost in energy.”

Whether Austrom ultimately selects ammonia as its hydrogen carrier or not, progress for hydrogen is progress for ammonia. Renewable hydrogen projects are multiplying, and increasing their capacities by orders of magnitude. And they are shovel-ready.