McKinsey report on industrial decarbonization examines pathways to green ammonia

By Trevor Brown on August 10, 2018

McKinsey & Company, the global consulting firm, recently published a report that analyzes the “Decarbonization of industrial sectors,” with a focus on the four heaviest emitters: cement, steel, ammonia, and ethylene production.

“We conclude that decarbonizing industry is technically possible … We also identify the drivers of costs associated with decarbonization and the impact it will have on the broader energy system.” Of course, “technical and economical hurdles arise,” but the report provides valuable analysis of the economic levers that will be required.

According to McKinsey, carbon-free ammonia will come at a “~5 to 35 percent increase in price,” depending on the future price of renewable electricity. And, because of this economic hurdle, “decarbonization would require technological breakthroughs, a further lowering of zero-carbon energy prices, changing customer preferences (willingness to pay) and/or a regulatory push.” These four market drivers are already evolving to make green ammonia increasingly competitive.

The challenge of industrial decarbonization

McKinsey views the industrial sector as “the next frontier” because, while techno-economic pathways to deep decarbonization have become proven at scale across most of the global economy, the industrial sector has yet to develop viable plans to meet its fair share of GHG emission reductions: “Over the last decades, the outlines of energy transition pathways have emerged in the buildings, power and transport sectors. These have been driven by technological breakthroughs and cost reduction. For industrial processes, such pathways are less well-defined.”

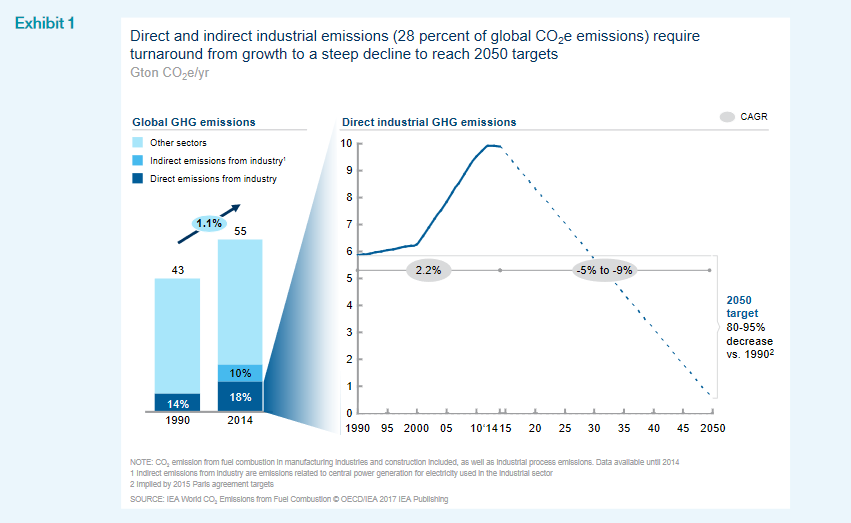

Today, industry is responsible for “about 28 percent of global greenhouse gas (GHG) emissions, of which 90 percent are carbon dioxide (CO2) emissions.” Moreover, the industrial sector’s direct emissions have been increasing at 2.2% compound annual growth rate (CAGR) in the last few decades, twice the rate of total global GHG emissions, which grew at 1.1% CAGR.

The industrial sector’s decarbonization target for 2050, as implied by the Paris Agreement, is an 80-95% decrease in emissions relative to 1990 levels. To achieve this, industry will need to turn around fast, from steady growth to sharp decline, going forward with an average -5 to -9% CAGR through 2050.

This report provides a global perspective on the energy transition in industry, with a focus on reducing CO2 emissions … It shows that decarbonization of industry is technically possible through a combination of technical solutions, the optimum mix of which will vary widely between sectors and regions. It also shows that in many cases decarbonized production processes are currently not cost competitive with conventional production technology. In cases such as these, where there is currently an absence of an economic driver, decarbonization would require technological breakthroughs, a further lowering of zero-carbon energy prices, changing customer preferences (willingness to pay) and/or a regulatory push.

This should not be seen as a ground to delay action. We believe that starting now with the decarbonization of industry would lead to better outcomes for individual companies. The long time horizons involved in building or retrofitting industrial sites mean that significant emission reductions can be achieved more efficiently through investment and plans initiated now, with an eye on capitalizing on future developments.

This report offers industrial executives, policy makers, and others a menu of options for decarbonization, along with ideas for how to prioritize and pursue them.

McKinsey & Company, Decarbonization of industrial sectors: the next frontier, June 2018

The costs and benefits of decarbonization pathways

An interesting part of the analysis looks at the absolute impact and relative cost effectiveness of different decarbonization pathways.

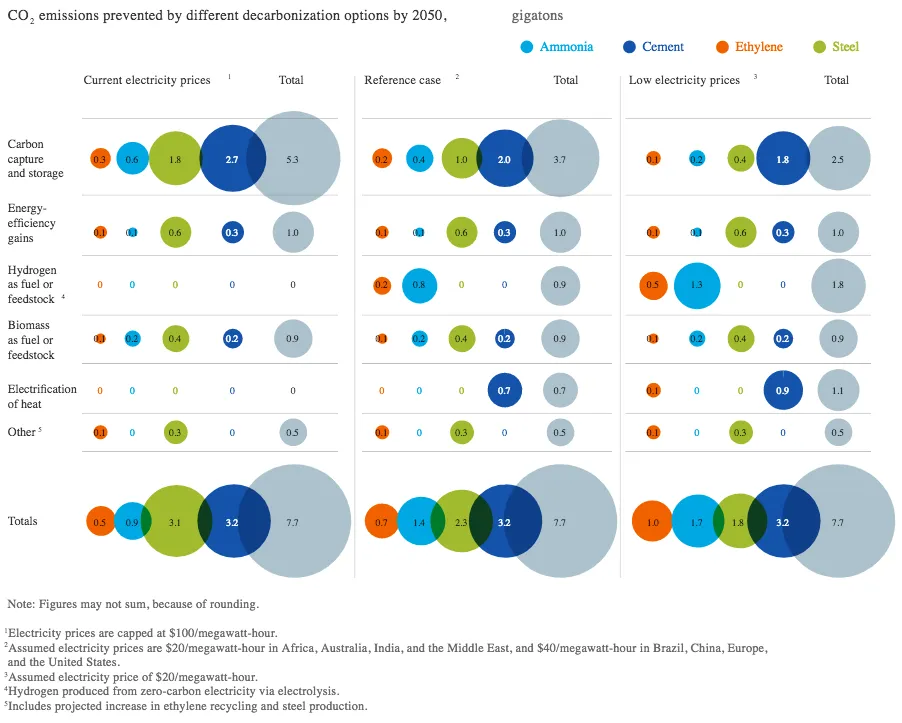

First, how much carbon can be avoided by each pathway? Today, global CO2 emissions from ammonia production total 0.5 gigatons but by 2050 this will have more than tripled to 1.7 gigatons of CO2. By far the biggest decarbonization opportunity is to replace fossil feed stocks with carbon-free hydrogen, produced by electrolysis using carbon-free electricity. By 2050, this could reduce annual emissions from ammonia production by as much as 1.3 gigatons. By contrast, CCS could reduce CO2 emissions by no more than 0.6 gigatons in the most favorable scenario for carbon capture.

Second, at what electricity price does it become cheaper to use electrolytic hydrogen than carbon capture technology?

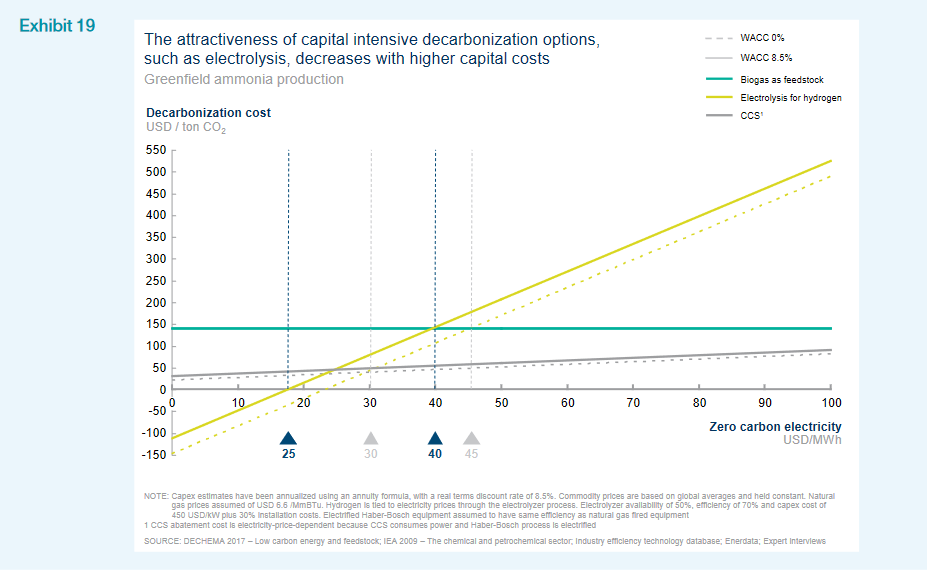

At electricity prices below ~USD 35/MWh, hydrogen [from electrolysis using renewable power] use for greenfield ammonia and steel production sites is more cost-competitive than applying CCS to conventional production processes …

Below an electricity price of ~USD 15/MWh, usage of hydrogen for brownfield ammonia production and electrification of heat for ethylene production are more cost-competitive than applying CCS to conventional production processes. This means that electric heat production and usage of electricity to make hydrogen are more economical approaches to decarbonization than CCS in all four focus sectors at this electricity price level.

McKinsey & Company, Decarbonization of industrial sectors: the next frontier, June 2018

The McKinsey report also examines the capital intensity of decarbonization pathways. For example, there is almost no capital cost incurred in a switch from natural gas inputs to biogas inputs (this assumes that enough biogas is available to operate existing production assets). However, there is a significant capital cost incurred in a switch from an existing SMR plant, producing hydrogen from natural gas, to a new electrolysis plant, producing hydrogen from renewable electricity. Adding carbon capture equipment to an existing SMR plant is less capital intensive.

For this reason, the cost of capital becomes an important input that the report analyzes in some detail, using a range of weighted average costs of capital (WACCs), from 0% to 8.5%. The implication is that, as different technology pathways for decarbonization become available, distinct financing models must follow.

You can also read the full article at AmmoniaIndustry.com.