Monash team publishes Ammonia Economy Roadmap

By Trevor Brown on May 28, 2020

Earlier this month, Doug MacFarlane and his team of researchers at Monash University published A Roadmap to the Ammonia Economy in the journal Joule. The paper charts an evolution of ammonia synthesis “through multiple generations of technology development and scale-up.” It provides a clear assessment of “the increasingly diverse range of applications of ammonia as a fuel that is emerging,” and concludes with perspectives on the “broader scale sustainability of an ammonia economy,” with emphasis on the Nitrogen Cycle.

The Roadmap is brilliant in its simple distillation of complex and competing technology developments across decades. It assesses the sustainability and scalability of three generations of ammonia synthesis technologies. Put simply, Gen1 is blue ammonia, Gen2 is green ammonia, and Gen3 is electrochemical ammonia. It also outlines the amount of research and development required before each could be broadly adopted (“commercial readiness”). The paper thus provides vital clarity on the role that each generation of technology could play in the energy transition, and the timing at which it could make its impact.

(Exponential) Scaling up ammonia synthesis

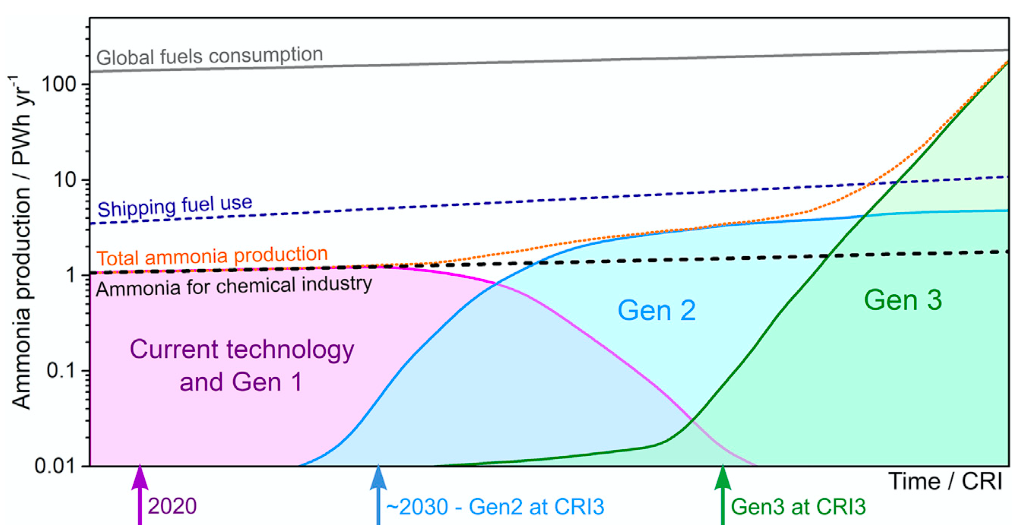

Note that Figure 5, which shows ammonia production volumes, has a logarithmic scale. The gently rising orange slope does not indicate gradual growth, but swift doubling of global production with Gen1 and Gen2 technologies (blue and green Haber-Bosch plants). In this Roadmap, once Gen3 (electrochemical) reaches commercial readiness, true exponential growth is unleashed and ammonia is adopted in vast new markets demanding production volumes one hundred times greater than today’s market.

The units are petawatt hours (one PWh is a million GWh), based on ammonia’s lower heating value of 5.18 kWh per kg. For those who, like me, are unfamiliar with the PWh as a metric for ammonia volumes, the current annual global ammonia production of 180 million tons is about 1 PWh.

In its analysis of potential markets for ammonia as a fuel, and the various technologies that would enable each market, the Roadmap assumes an ammonia price of US$ 300 per ton (this is based on a range of prices for conventional ammonia in recent years). At this price:

It becomes clear that ammonia can be competitive with current fossil fuel prices to the user, if the end-use technologies are at least equivalently energy efficient.

A price on carbon would have material impact on this comparison.

MacFarlane et al., A Roadmap to the Ammonia Economy, Joule, May 2020

Next Generation(s) of Ammonia Synthesis Technology

Using existing pricing makes sense at the start of this Roadmap because Gen1 technology is the existing installed fleet of ammonia plants — no capital investment is required, with the relatively minor addition of “carbon sequestration or offsets to bring the net carbon impact of the ammonia production to zero.” In this context, “offsets” could refer to planting trees rather than capturing any of the actual emissions from an ammonia plant. The price of this ammonia is closely tied to the price of the fossil feedstock.

Gen2 ammonia production, employing electrolyzers to produce hydrogen from water using renewable electricity, might still use the Haber-Bosch plant, but the product will have a completely different cost structure. This will be driven by renewable electricity prices, the capital costs of electrolyzers, and the operational capacity factor (% uptime).

Gen 2 technology … is likely to reach a commercial readiness index of 3 (CRI3) and emerge as a significant contributor of liquid fuels around 2030. Gen 2 ammonia production would then rapidly increase, eventually replacing current and Gen 1 processes. Given the very significant existing H-B infrastructure, it is likely that Gen 2 will continue to grow in the future and remain the baseline ammonia production in many parts of the world.

MacFarlane et al., A Roadmap to the Ammonia Economy, Joule, May 2020

MacFarlane and his team at Monash have their own stake in the success of Gen3 technologies. We wrote about their electrochemical ammonia synthesis technology in late 2017, and again in 2018 when Science magazine reviewed its prospects in an article with the headline “Liquid sunshine: Ammonia made from sun, air, and water could turn Australia into a renewable energy superpower.”

Ammonia clearly has the potential to become the dominant form of transportable renewable energy in the future, displacing fossil fuels from all but the most demanding of applications. It will sit alongside other forms of chemical energy storage, including hydrogen and renewable carbon-derived fuels, as well as battery storage for grid and local electrical energy storage, as one of the core components of renewable energy technology …

Entirely electrochemical, renewable-powered Gen 3 ammonia synthesis technology is expected to enter the market at scale as soon as it achieves CRI1; we anticipate this occurring toward the end of decade and to start significantly contributing to global ammonia production thereafter, as plant size and capacity increases. However, there is little doubt that Gen 3 will rapidly become the preferred technology as soon as it reaches CRI3 and becomes an efficient industrial process. Possibly the first major market for ammonia as a fuel will be for maritime transportation, as discussed above. We envisage that Gen 3 technology will then enable production of renewable ammonia for other transportable energy storage applications that will begin to significantly replace fossil fuels in the 2040s.

MacFarlane et al., A Roadmap to the Ammonia Economy, Joule, May 2020

The Nitrogen Cycle

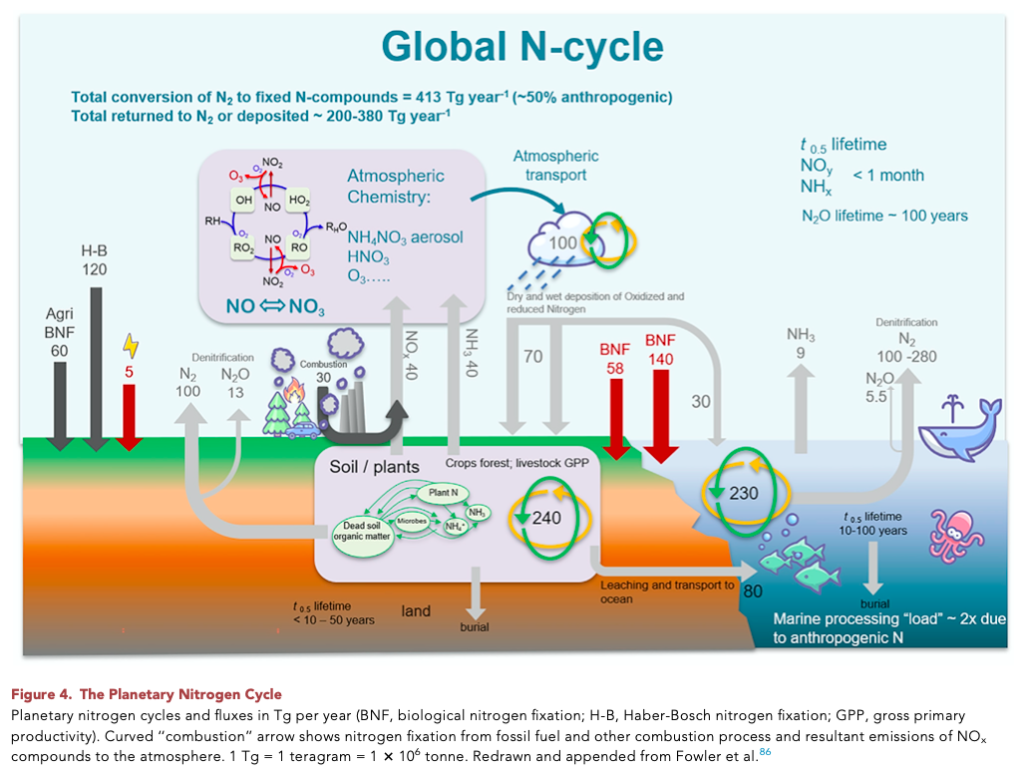

The Roadmap concludes with some important “perspectives” on the Nitrogen Cycle, which is too often overlooked.

The Nitrogen Cycle is one of the key focus areas of the Stockholm Resilience Centre’s work on Planetary Boundaries. Anthropogenic emissions of reactive nitrogen (N, as opposed to inert atmospheric N2) have far exceeded “safe” levels on this planet, even more so than the carbon emissions that drive climate change. Only biodiversity loss ranks as “high risk” (catastrophic might be a better phrase) as reactive nitrogen in the Planetary Boundaries schema — both directly caused by expanding food production to meet population growth.

There is a profound conceptual difference, however, between ammonia fertilizer and ammonia energy: one is spread into the environment with tremendous losses to air and water; the other is stored without loss until it can be used as completely as possible. For ammonia energy technologies to be adopted, this means strict management and, preferably, elimination of NOx, N2O, and NHx emissions.

It is vital that the roadmap always considers the broader, global environmental impacts of large-scale ammonia use as a fuel. It is clear that our understanding of the mechanisms of the global nitrogen cycle is incomplete, in particular in regard to the slow turnover in marine cycling of N-compounds. Hence, investment in technology development should also include investment in further basic science research on the environmental impacts of increased quantities of fixed nitrogen, and policy makers must mandate strong emissions standards and controls at an early stage.

MacFarlane et al., A Roadmap to the Ammonia Economy, Joule, May 2020