Picking bunker winners: the mono-fuel / dual-fuel duel

By Trevor Brown on September 24, 2020

This week, DNV GL published its annual Energy Transition Outlook — Maritime Forecast to 2050, concluding that “e-ammonia, blue ammonia and bio-methanol are the most promising carbon-neutral fuels in the long run.” (“The big takeaway being the prediction that hydrogen will not be among the leading fuels of the future for shipping,” according to maritime media outlet Splash 247.)

DNV GL’s assumptions that determine this long run, however, suggest a significant mid-term reliance on fossil LNG. This risks locking the industry into a long-term emissions trajectory incompatible with the IMO’s 2050 GHG targets, in part because of significant fuel supply and infrastructure investments. These investments could become more ‘sticky’ than expected.

A host of alternative opinions have been published in the days before and after DNV GL published its report. These suggest that, for ammonia, the long run could begin this decade. Among others, MAN ES has announced that its ammonia engine will be available for retrofits by 2025.

Known Unknowns

The Maritime Forecast has evolved over the last few years, from a fairly straightforward prediction to a complex web of simulations and scenarios.

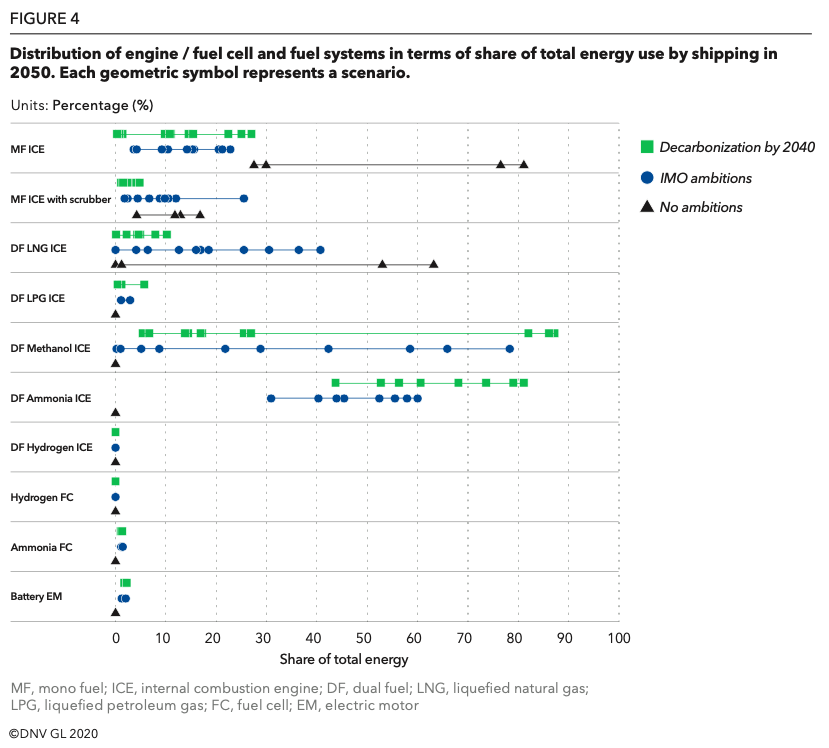

In scenarios compatible with the “IMO ambitions,” ammonia in dual-fuel internal combustion engines takes a share ranging from 30% to 60% of the total 2050 maritime fuel mix. In scenarios with more ambitious climate targets (“Decarbonization by 2040”), ammonia could capture over 80% of the 2050 maritime fuel mix.

Complexity or certainty

Depending on your outlook, the decision-making process is becoming either simpler or more complicated.

The biggest factor in decarbonization is the fuels that we use – and the fuel picture for shipping is becoming ever more complicated.

Knut Ørbeck-Nillsen, CEO DNV GL – Maritime, Foreword to Energy Transition Outlook — Maritime Forecast to 2050, September 2020

Some in the industry say that there is increasing certainty that these future fuels have already been chosen.

“The winners have already been decided and that is going to be either hydrogen or ammonia,” [shipping company Euronav’s CEO Huge] De Stoop told S&P Global Platts in an interview on Sept. 7.

S&P Global Platts, Inteview: Hydrogen, ammonia likely to win cleaner shipping fuel race – Euronav CEO, September 18, 2020

But — and perhaps this is when DNV GL forms its notion of complexity — the remaining questions become much more detailed: when, where, how much?

“The only problem that we have that we don’t know when it’s going to be ready and available,” he added.

“I’m speaking about an engine that is really capable of burning efficiently ammonia in a safe way because ammonia is a very toxic gas,” the tanker leader said, noting that infrastructure is crucial too.

S&P Global Platts, Inteview: Hydrogen, ammonia likely to win cleaner shipping fuel race – Euronav CEO, September 18, 2020

Ammonia engines ready by 2024

One day before S&P published that interview with Euronav (“the largest NYSE listed independent crude oil tanker company in the world”), MAN ES announced that it expects to deliver its first ammonia engine in 2024 (for newbuilds) and make a retrofit option commercially available the next year.

Retrofit is the crucial word here: the challenge isn’t just how to build new carbon-neutral ships in the future, but how to convert the big fleet that exists in 2030 or 2040 off of whatever ‘bridge’ fuels its relies upon at that time.

The sooner retrofits to truly carbon-neutral fuels become available, the fewer years the sector spends emitting unnecessary GHGs by burning transition fuels.

“We are working to have a package ready for retrofits by early 2025, approximately one year after the first ammonia engine is delivered to the yard,” Brian Østergaard Sørensen, Vice President, Head of R&D 2-Stroke Business, at MAN Energy Solutions announced …

The introduction of a retrofit solution that offers full fuel flexibility would offer shipowners peace of mind, eliminating the risk that assets may become stranded in the future.

The Motorship, MAN ES Unveils 2025 Ammonia Retrofit Target, September 17, 2020

MAN ES already promotes its methanol and (especially) LPG dual-fuel engines as being compatible with ammonia via retrofit. The insight here is that ships with ‘monofuel’ engines can also be retrofitted with dual-fuel ammonia engines. (This will not surprise attendees of the Ammonia Energy Conference who, in Pittsburgh in October 2018, heard MAN ES quantify the retrofit opportunity as 3,000 vessels.)

MAN ES is not alone. The day after I last wrote about Wärtsilä’s maritime ammonia engine, in July 2020, the engine-maker published another announcement, to stress that “Successful tests pave the way for ammonia as a future marine fuel.”

DNV GL’s Maritime Forecast to 2050

In the highlights of its Maritime Forecast to 2050, DNV says:

— It is hard to identify clear winners among the many different fuel options across all scenarios, but e-ammonia, blue ammonia and bio-methanol are the most promising carbon-neutral fuels in the long run in a decarbonization trajectory.

— Fossil LNG gains a significant share until regulations tighten in 2030 or 2040 depending on the decarbonization pathway, when we see bio-MGO, e-MGO, bio-LNG and e-LNG used as drop-in fuels for existing ships, and bio-methanol, blue ammonia or e-ammonia for newbuilds and some retrofits.

— Although ammonia and methanol dominate the fuel mix in 2050, we also see that bio-LNG, e-LNG, bio-MGO and e-MGO have a limited but stable share for newbuilds, indicating that these fuels are not only transitional fuels but a viable alternative for some ships.

DNV GL, Energy Transition Outlook — Maritime Forecast to 2050, September 2020

(Query: if bio-LNG, bio-MGO, and bio-methanol are plausible options, why is bio-ammonia excluded from this outlook? Perhaps next year.)

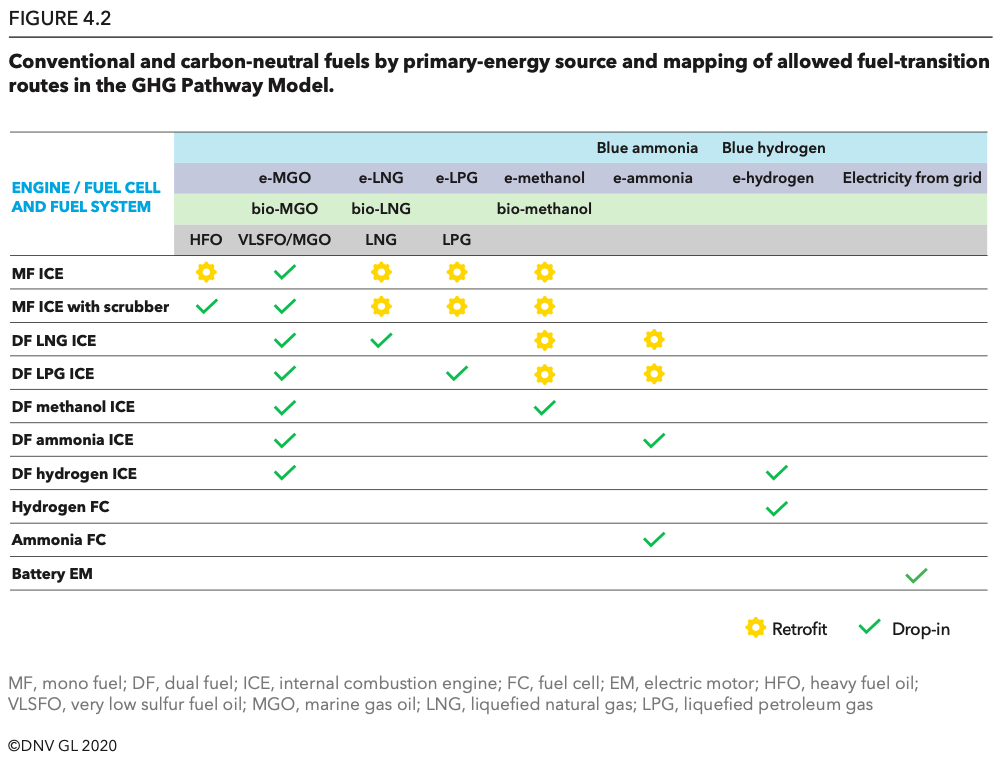

The very interesting question to come from this report and the commentary around it is: can monofuel engines be retrofitted to use ammonia, or will ammonia only be available for vessels that originally used dual fuels?

The modelled fuel and technology mix for ships in 2050 will be a result of a development path where a ship is built to run on one fuel and later switch to a drop-in fuel or retrofit to another engine and fuel system. For instance, a significant share of ships expected to use methanol and ammonia in 2050 have in many scenarios been through a retrofit from dual-fuel LNG solutions. The pace of decarbonization plays a significant role. In the Decarbonization by 2040 pathway, all fuels used must be carbon-neutral by 2040, and the transition must start almost immediately and accelerate from 2030. Instead of a transition via LNG, the fleet shifts directly to methanol or ammonia, with bio-MGO and e-MGO as drop-in fuels for existing ships.”

DNV GL, Energy Transition Outlook — Maritime Forecast to 2050, September 2020

A frequent observation from maritime media and analysts is that DNV GL is “more heavily invested in LNG as a future fuel than all other class societies,” (this quote from the Splash 247 article, linked above). Within the industry, there is skepticism that this forecast might be a wolf in sheep’s clothing. The assumption that ammonia could only be retrofitted onto LNG-powered and other dual-fueled ships might be false.

DNV assume that conventional (mono fuel) engines (HFO/LSHFO/MDO) would not be able to retrofit to ammonia, but that DF [dual fuel] LNG would be able to. So in the many scenarios for which ammonia is a dominant fuel in the long-run, starting with DF LNG in 2020 is given rather a strong advantage…

Directly challenging DNV’s assumption, MAN ES have come out stating intention to have an ammonia retrofit for several engines (including conventional mono fuel) available from 2025.

Who is right DNV GL or MAN ES? And would DNV’s analysis give the same ‘pro LNG today’ result if they had adopted an assumption inline with MAN’s announcement?

Tristan Smith, UCL Energy Institute, LinkedIn post, September 24, 2020

The velocity of change

Whether we believe in a monofuel future, a polyfuel future, or a future maritime sector reliant solely upon efficiency and wind, our assumptions are evolving at a dizzying speed. This is the third year I’ve reported on DNV GL‘s Maritime Forecast to 2050, and the third year that the forecast has been materially different. (What will they say next year? How will I report it?)

The clock is ticking. The land is burning. The ice is melting.

New ships purchased this decade will probably still be in service in 2050 and so, to meet the IMO’s 2050 goal for 50% emission reduction, carbon-neutral vessels must be launched before 2030. Luckily, they will be.

Baltic shipping company DFDS has just announced its intention to decarbonize by 2050, which, to them, means phasing out fossil fuels completely and swiftly. (Among others, DFDS is a partner in the ZEEDS consortium, a project developing large-scale offshore green ammonia fuel production.)

“Changing the type of fuel on which a ship runs on is not a decision to be taken lightly. It has a massive impact on all aspects of our industry. Conclusions and choices are difficult to make as climate neutral fuels and technologies are still in their infancy. Some are more sophisticated and market-ready than others, but on a whole, there is very little out there that you can buy off the shelf, put it into your business and voilà – you reduce emissions …

“Some industry actors seem to be jumping to conclusions and placing their bets on one kind of fuel. It’s human nature to want to stick with what we understand. And if we see that a ship can run on methanol, some people may say ‘done! That’s what we’re choosing’. But the choice of fuel is not a choice we are ready to make just yet. There are too many unknowns. What if the aviation industry goes for methanol, too? How can we know that there’s enough to go around for everyone and that the price of it doesn’t skyrocket? We don’t want to end up in a situation where the shortage of some of the elements we need for our fuel trigger a ‘who is willing to pay most’ competition between aviation and shipping, for instance. We need to keep investigating …

“We do already know a few things … We know which fuels have the biggest potential to work in shipping: ammonia, hydrogen, methanol. So far so good. And we know that we have until 2026/2027 to make a qualified choice of which fuels and vessels to go for.

DFDS’s Head of Innovation and Partnerships, Jakob Steffensen, quoted in DFDS announcement, DFDS to phase out fossil fuels , September 15, 2020.