Renewable ammonia demonstration plant announced in South Australia

By Trevor Brown on February 16, 2018

This week, the government of South Australia announced a “globally-significant demonstrator project,” to be built by the hydrogen infrastructure company Hydrogen Utility (H2U). The renewable hydrogen power plant will cost AUD$117.5 million ($95 million USD), and will be built by ThyssenKrupp Industrial Solutions with construction beginning in 2019.

The plant will comprise a 15 MW electrolyzer system, to produce the hydrogen, and two technologies for converting the hydrogen back into electricity: a 10MW gas turbine and 5MW fuel cell. The plant will also include a small but significant ammonia plant, making it “among the first ever commercial facilities to produce distributed ammonia from intermittent renewable resources.”

For those experiencing deja vu, let me clarify that this is a new announcement, in addition to Yara’s solar-ammonia demonstration plant, announced in August 2017, which is still destined for the Pilbara, Western Australia, roughly 3,000 km from this new project in Port Lincoln, South Australia.

According to H2U’s CEO, Attilio Pigneri:

“The facility will be an exemplar of the synergies associated with hydrogen.

It will provide balancing services to the national transmission grid, fast frequency response support to new solar plants under development in the Eyre Peninsula, supply green ammonia and other chemicals to the local farming and aquaculture sectors, and host the demonstration, at scale, of novel supply chain technologies for the export of green hydrogen from Australia to markets in the Asia-Pacific region.”

Government of South Australia news release, Green hydrogen facility to be constructed near Port Lincoln, 02/12/2018

According to the company’s website, “H2U is a specialist developer of hydrogen infrastructure solutions for sustainable mobility and renewable energy storage applications.” And, as Pigneri explained in an interview this week with local media, the true potential of using renewable hydrogen to make ammonia is not found in selling small amounts of distributed green fertilizer, but in exporting vast quantities of the hydrogen-dense chemical into low-carbon energy markets.

The focus of this demonstration is not really the technology at all, but the business model. H2U is pushing the project forwards “with the hope of opening up an industry that proponents say could eventually surpass the value of Australia’s multi-billion-dollar gas exports … an estimated $23 billion of [LNG] in 2016-17.”

One of the key issues to be tested at the site is how to get the hydrogen to growing markets in the Asia-Pacific, particularly Japan which is an established user of hydrogen for energy and transport.

“It’s really about market development,” Pigneri told InDaily.

“It’s not just to demonstrate the technology but the viability of this sort of project to the world. The end game is obviously to prove the exportability of hydrogen to markets in the Asia Pacific … It probably, in the long run, will be larger than LNG for export opportunities,” he said.

In Daily, Bigger than LNG? SA to get first “green hydrogen” plant, 02/12/2018

The AUD$117.5 demonstration project is being built with financial support from the state, in the form of a AUD$4.7 million grant and a AUD$7.5 million loan, from South Australia’s Renewable Technology Fund, a AUD$150 million pool of financing administered by the Low Carbon Economy Unit of the Department of the Premier and Cabinet.

This fund is being allocated in part to support the findings of A Hydrogen Roadmap for South Australia, published in September 2017. The Roadmap was developed “following close consultation with industry, visits to South Korea and Japan and South Australia’s Green Hydrogen Study, a comprehensive techno-economic study.” And it is this document, South Australia’s Green Hydrogen Study, that presents some of the most compelling arguments I’ve yet read in favor of exporting green ammonia as a low-carbon energy commodity.

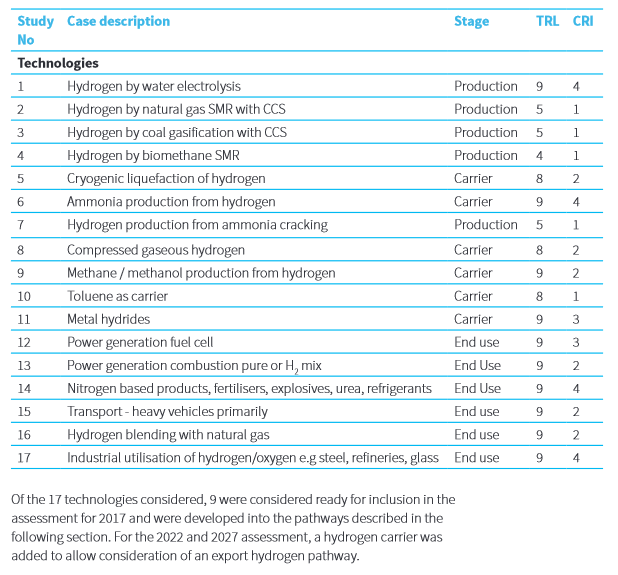

The report provides a valuable in-depth analysis of a series of technologies that could be used to build a viable green hydrogen value-chain, and assesses each option for both TRI (Technological Readiness Level, a metric established by NASA) and CRI (Commercial Readiness Index, a metric established by Australia’s renewable energy agency, ARENA).

The potential value-chains begin with low-carbon hydrogen made from various feed stocks (natural gas or coal with CCS, biomass, or water electrolysis with renewable energy), then transported short- or long-distance using a range of technologies (as liquid hydrogen, compressed hydrogen, ammonia, synthetic methane / methanol, toluene, or metal hydrides), and finally sold into existing nitrogen markets (explosives, fertilizers, etc), or used for power generation (in fuel cells or combustion turbines), or injected into the natural gas network, or used as an industrial feed stock to decarbonize steel, glass, or gasoline production.

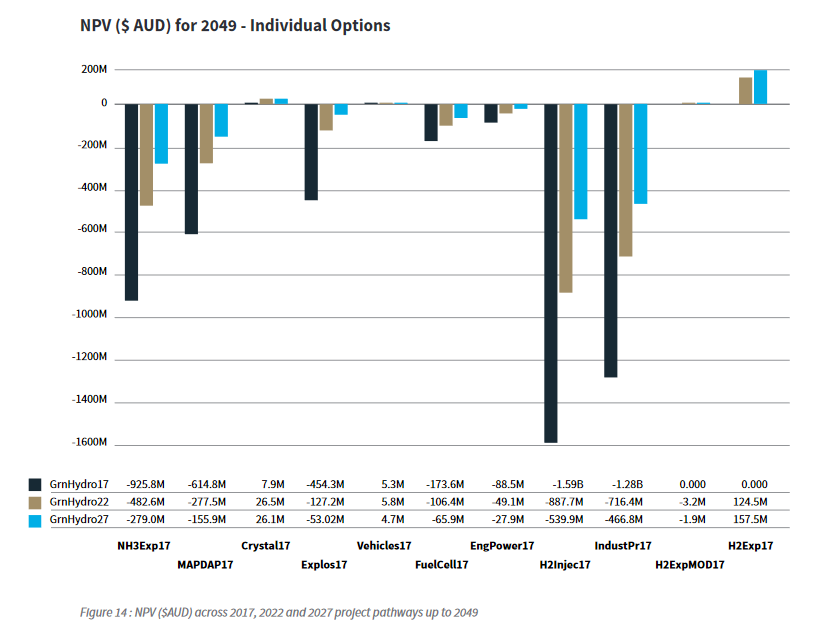

Only one value-chain makes any serious commercial sense, according to a financial analysis of each pathway’s net present value (NPV).

“Pathway A2,” which describes the use of ammonia to facilitate “Large scale hydrogen for export,” has a NPV in excess of AUD$100 million. “All other options … exhibit negative NPV” (or a very small positive NPV in two cases).

Although the study calls Pathway A2 “large scale,” we are actually looking at a fairly small-sized industrial ammonia plant: with a capacity of about 200,000 tons per year, and a CapEx (including electrolyzers, not including renewable generation) estimated at AUD$902 million ($720 million USD) in 2022 or AUD$852 million ($680 million USD) in 2027.

The study describes exactly how Pathway A2 works:

Hydrogen is produced from water and renewable electricity utilising electrolysers of 283 MW capacity operating at 80% capacity factor to allow flexibility to purchase lower priced electricity or connect directly to a high capacity renewable generator. This MW capacity was chosen to reflect current operating Ammonia plants. Hydrogen is stored in gaseous form to allow a buffer of one day of full ammonia production.

The hydrogen produced is then combined with nitrogen from the air in the Haber process with a 90% utilisation factor to produce 610 tonnes per day (tpd) of liquid ammonia. Ammonia is stored and loaded on bulk carriers for shipping to export markets.

Once the ammonia arrives at the destination, it is cracked in modular scale plants to liberate 80% of the hydrogen with the balance being used to provide heat to dissociate the ammonia into hydrogen and nitrogen. The hydrogen product is compressed and dispensed for use in public buses and light vehicles with each cracking, compression and dispensing facility sized to supply around 500 kg per day of hydrogen, enough fuel for around 10 buses.

South Australia’s Green Hydrogen Study, Section 4.6.1: Nominated Pathways: 2022 and 2027 pathways, September 2017

One other option is somewhat profitable: “Pathway J,” which is “Modular scale hydrogen for export.” Again, this uses ammonia and a hydrogen carrier, but the plant is scaled down to 18 MW of electrolysers producing 39 tons per day of ammonia, “based on the smallest, practical ammonia production unit currently available.” The ammonia is “transported to export markets in isotainers via ship. On arrival at the point of use, the same cracking, compression and dispensing processes are undertaken as pathway A2 to produce hydrogen for vehicle use.”

This “modular scale” system appears to be the pathway that H2U and ThyssenKrupp will demonstrate at Port Lincoln, starting in 2019, with their 15 MW electrolyzer system.

For those who are following with interest the growing economic viability for this business model, I note the “learning rate” assumed for electrolyzer CapEx inputs. The Green Hydrogen Study begins with the 2017 base case assumption that an electrolyzer system costs “$3.7M per t H2 per day.” Neither of these pathways, A2 or J, are technologically ready to deploy in 2017, however, so they begin in 2022 or 2027, by which time the electrolyzer CapEx has been reduced by 12.5% (2022) and 25% (2027) relative to the 2017 base case. On top of this, the electrolyzer unit’s energy consumption, which is the primary OpEx driver, drops from 55 kWh/kg of H2 in 2017 to 50 kWh/kg in 2022 and then to 45 kWh/kg in 2027.

The Green Hydrogen Study also provide some useful context, to help relate all these theoretical numbers to practical sales and investment targets:

What might the Green Hydrogen market look like in the future? …

In 2016, South Korea’s finance minister was reported to announce plans to replace the country’s 26,000 CNG powered buses with hydrogen-powered buses, representing around 475,000 tonnes of hydrogen consumption per year ..

Assuming that hydrogen is produced in South Australia from renewable energy, a hydrogen carrier, such as ammonia, is used to transport the fuel to South Korea, and based on metrics for the 2027 full scale ammonia plant involving around 28,000 tonnes of H2 per year per plant, 17 full scale 600t per day ammonia production facilities are required to meet this demand. This would be an investment of approximately [AUD]$15bn in the plant alone …

This level Green Hydrogen production would require approximately 28TWh per year in electricity input, which is more than twice the current South Australian yearly consumption. To meet this demand for renewable energy would require the installation of around 11GW of solar photovoltaic generation, or likely more than [AUD]$15B in generation investment.

South Australia’s Green Hydrogen Study, Section 6.4: Scale of industry / future renewable uptake, September 2017

Of course, this scale of renewable ammonia production is exactly what Siemens, one of the main industrial supporters of South Australia’s Green Hydrogen Study and a major supplier of electrolyzer systems, would like to see come to fruition.

As I wrote over a year ago, regarding potential future exports of Australian renewable ammonia to Germany, Siemens was talking about building 500 GW of solar in the Pilbara, which would generate enough renewable hydrogen to supply an ammonia plant with a capacity of 1 million tons. In case you aren’t following the maths here, that is 1 million tons of ammonia per day, or roughly twice the current global ammonia capacity.

Australia has abundant potential resources in solar and wind with suitable areas multiple times the entire land mass of Germany …

It currently takes about 12 MWh of electricity to produce 1 tonne of renewable ammonia (containing 176 kg of H2). Cost trends are very favourable for RNH3 (renewable ammonia) following large declines in the cost of solar energy and emerging efficiencies in electrolysis.”

Jeff Connolly, CEO at Siemens Pacific, quoted in Australian solar-ammonia exports to Germany, 01/05/2017

You can also read the full article at AmmoniaIndustry.com.