Renewable ammonia & fertilizers in Sub-Saharan Africa

By Kevin Rouwenhorst on December 06, 2022

The latest webinar in our series Ammonia Project Features focused on renewable ammonia production in Sub-Saharan Africa. Ralph Koekkoek (MET Development), Marcel Jacobs (African Hydrogen Partnership), and Allan Manhanga (Sable Chemicals) discussed renewable ammonia and fertilizer projects in Kenya and Zimbabwe, as well as green hydrogen and fertilizer corridors. The recording is publicly available via our Vimeo channel (you can also download the speaker presentations).

The story of renewable ammonia in Zimbabwe

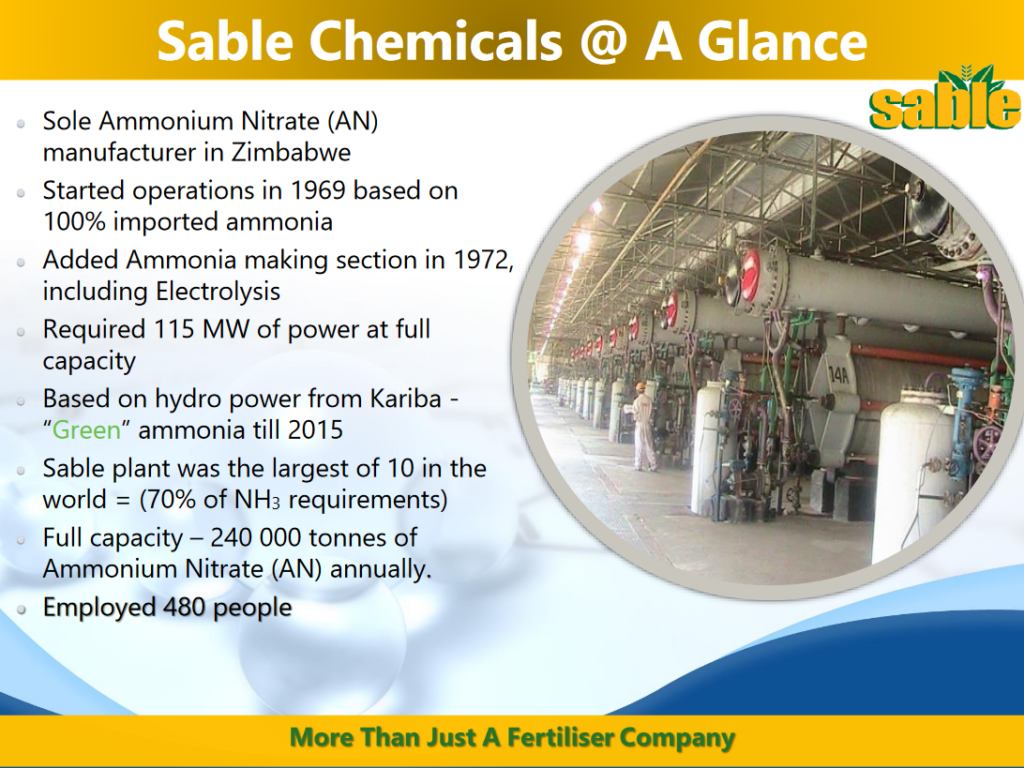

Sable Chemicals is one of the few companies with operational experience in renewable ammonia production. The company produced renewable ammonia from 1972 until 2015, based on alkaline electrolysis powered by Zimbabwe’s hydroelectric-dominated grid. About 240,000 of ammonium nitrate was produced annually at their Kariba plant in northern Zimbabwe.

The hydroelectric power for the renewable ammonia plant was supplied from the Kariba Dam, which has an installed capacity of 1.6 GW. The renewable ammonia plant requires at least 12.5 MWh per tonne ammonia. At an annual capacity of 115,000 ammonia, this plant required at least 10% of the hydroelectric power generation from the Kariba Dam to operate.

Unfortunately, the renewable ammonia plant was decommissioned in 2015. Due to a higher demand for electricity in other sectors, power availability became an issue, increasing the cost of electricity from about 30 USD per MWh to about 56 USD per MWh. This year, the electricity price in Zimbabwe is about 90 USD MWh. For reference, a renewable ammonia plant can only compete with imported ammonia when electricity prices are about 30 USD per MWh. Next to an increase in demand for electricity over time, the Kariba Dam faced sustained droughts in 2015, decreasing the hydroelectric power production.

Currently, all the ammonia Sable Chemicals uses is imported from neighbouring South Africa. Sable Chemical’s nitric acid and ammonium nitrate plants are still operational. The alkaline electrolyzers of the renewable ammonia plants have been sold, but the nitrogen purification plant (ASU) and the ammonia synthesis loop (Haber-Bosch) are still onsite. Sable Chemicals is evaluating a restart of renewable ammonia production once again, based on solar PV electricity. To this end, Sable Chemicals’ sister company Katanga Solar Energy aims to develop a 400 MW solar PV farm.

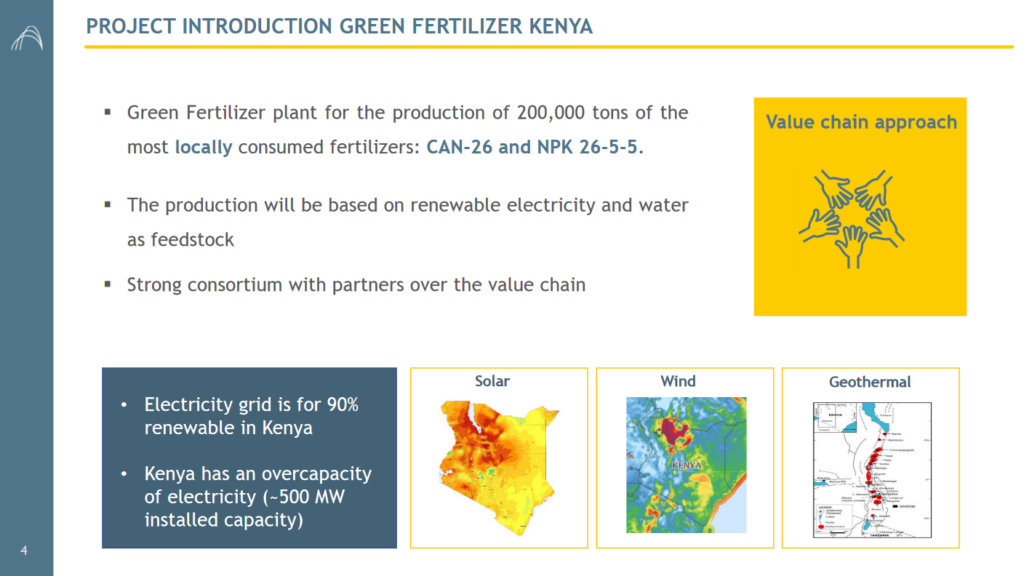

Renewable fertilizers in Kenya

Looking further north on the African continent, MET Development is developing a renewable ammonia & fertilizer plant in Kenya. The inland facility will be located in the Oserian Industrial Park, next to Lake Naivasha. The 200,000 per annum of fertilizers produced will be mostly used by local farmers. The grid in Kenya has a high renewables penetration, with about 90% of the energy derived from solar PV, wind, hydro and geothermal. Kenya has an “overcapacity” of electricity, with about 500 MW of installed capacity currently considered surplus to requirements.

The ammonia plant will be based on Stamicarbon’s green ammonia technology, which focuses on modularized, small-scale plants in the range of hundreds of tonnes of ammonia per day, rather than thousands of tonnes per day.

A value chain approach is required to make such a local fertilizer production facility a success, ranging from developers and investors to the actual offtake by farmer collectives. The focus has historically been on transitioning from imported fossil fertilizer to reliably produced renewable fertilizers. Spot market prices in excess of 1000 USD per tonne ammonia (and similar trends for urea, etc.) in early 2022 means that imported fertilizers are even more difficult to acquire. Therefore, local production of ammonia and fertilizer aids national food security.

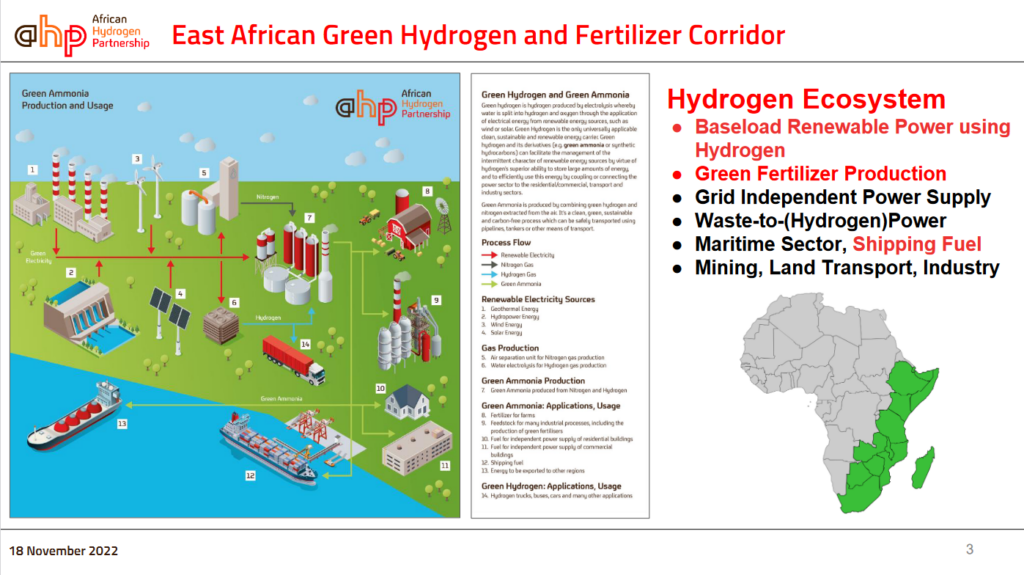

The role of organizations – raising awareness, de-risking investment

Associations such as the African Hydrogen Partnership (AHP) and the Ammonia Energy Association (AEA) have a role to play in accelerating and realizing renewable hydrogen and ammonia projects. Raising awareness is key. Technology readiness can be demonstrated by showing what is already happening, de-risking future projects for investors (for example, in September’s webinar we explored an operational green hydrogen project in Spain).

Next to this, education and training is needed, especially in locations with limited operational experience in chemical operations. No ammonia plant has ever been operated in Kenya, unlike Zimbabwe with existing operational experience.

Financial institutions play a significant role in developing renewable ammonia plants, especially when renewable power also must be installed. There is plenty of interest from equity investors and lenders in some locations, but capital investment may be a bottleneck in other locations. In any case, a renewables developer is typically required when new build solar or wind power is required.

Renewable ammonia plants are capital intensive, while the operational expenses are minor. Hence, the high cost of capital in Sub-Saharan Africa (compared to Europe for example) is definitely an issue. The investment risk can be minimized by collaborations across countries (eg. players in a green hydrogen or green fertilizer corridor securing international offtake). Unlike Canada, the EU, and the US, Sub-Saharan African projects cannot rely significantly on subsidies or tax deductions. The business case has to stand by itself.

Monetising certification

“Valorization” of low carbon products with a cost premium can help the finances of renewable projects. Direct valorization seems to be difficult, as farmers are not likely to pay a premium for a low carbon product, unless this is mandated by downstream product requirements.

However, indirect valorization may be possible via certification. In the case that certification is based on a book & claim system, the product can be sold independently from low carbon certificates. This means that local fertilizers can be sold independently from a low carbon ammonia certificate – a possibility in places like Kenya and Zimbabwe.

Ammonia certification is likely to become relevant for energy applications, such as ammonia as maritime fuel. By 2026, the maritime sector will be fully included in the EU ETS (Emission Trading System). In a book & claim system, the low carbon certificate from renewable ammonia plants in Kenya and Zimbabwe can be monetized by selling the certificates to ammonia applications in Europe. The current CO2 prices in the EU of about 75-80 EUR per tonne CO2 are likely already sufficient.

Currently, locally produced renewable ammonia and fertilizer can compete with imported fossil ammonia and fertilizer in various Sub-Saharan countries. This is not only true in terms of cost, but also in terms of national food security. As electrolyzer manufacturing scales up, the cost of capital in Sub-Saharan Africa decreases, and as certification becomes a monetary incentive, multiple renewable ammonia projects are expected to be realized in the coming decade.