Renewable ammonia opportunities in Egypt

By Kevin Rouwenhorst on December 18, 2022

Our December episode of Ammonia Project Features focused on Egypt. Alzbeta Klein (International Fertilizer Association) presented a pathway for Egypt’s fertilizer industry to decarbonize, while Tarek Hosny (Fertiglobe) discussed the newly-commissioned Egypt Green Hydrogen project. The recording is publicly available via our Vimeo channel, and you can also download the speaker presentations.

Egypt: a unique location

Egypt is an important location when discussing decarbonizing ammonia production. It boasts a combined ammonia production capacity of 6 million tonnes per annum, all based on natural gas. Globally, Egypt is the 6th largest urea fertilizer producer, and the 5th largest urea exporter. Furthermore, Egypt had one of the last operational electrolysis-based ammonia plants in the world: this one fed with hydropower. The KIMA plant operated with alkaline electrolyzers and hydroelectricity from the Aswan Dam, and was closed down in 2019.

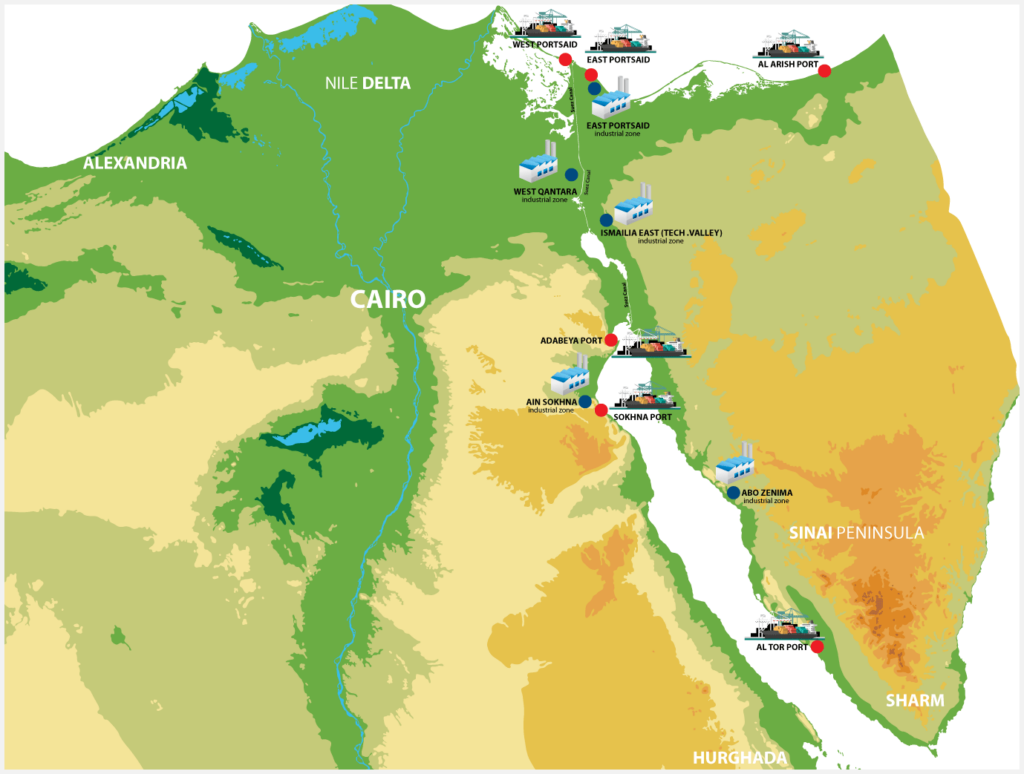

Recently, COP 27 was held in Sharm El Sheikh, making Egypt the center of decarbonization discussions. Various new projects in the SCZONE (Suez Canal Economic Zone) were highlighted during COP 27, adding to a long list of proposed projects. Existing ammonia production assets and new-build projects are also concentrated in certain locations (eg. Ain Sokhna in the SCZONE), which will allow companies to learn from each other’s development experiences.

In addition to this, Egypt benefits from access to both good solar and good wind resources, allowing for high utilization rates of electrolyzers. Renewable projects have been developed in Egypt at the GW scale, such as the Benban Solar Park with a capacity of 1650 MW in the Aswan Governorate, which was commissioned in 2019. Egypt’s newest electrolyzer facility – the first phase of Egypt Green Hydrogen – started operations in November this year.

A pathway forward for Egypt

Fertilizers sit at the crossroads between energy applications and food production, as energy feedstock such as natural gas is converted into fertilizers, which are critical for enhancing global food production. Thus, energy and food should be looked at in an integrated value chain approach.

Last year IFA (International Fertilizer Association) teamed up with the IEA (International Energy Agency) to publish the Ammonia Technology Roadmap, presented during COP 26 in Glasgow, Scotland. The aim was to identify the potential technology pathways for decarbonizing ammonia production. Roles and actions of stakeholders were identified, as well as investment opportunities and policies that governments need to implement. A key conclusion from the report is that we have the technologies to decarbonize the ammonia sector, and decarbonization is rather a question of cost and time. Permitting & offtake uncertainty are two of the key issues slowing down projects, even if the technology and the economics work.

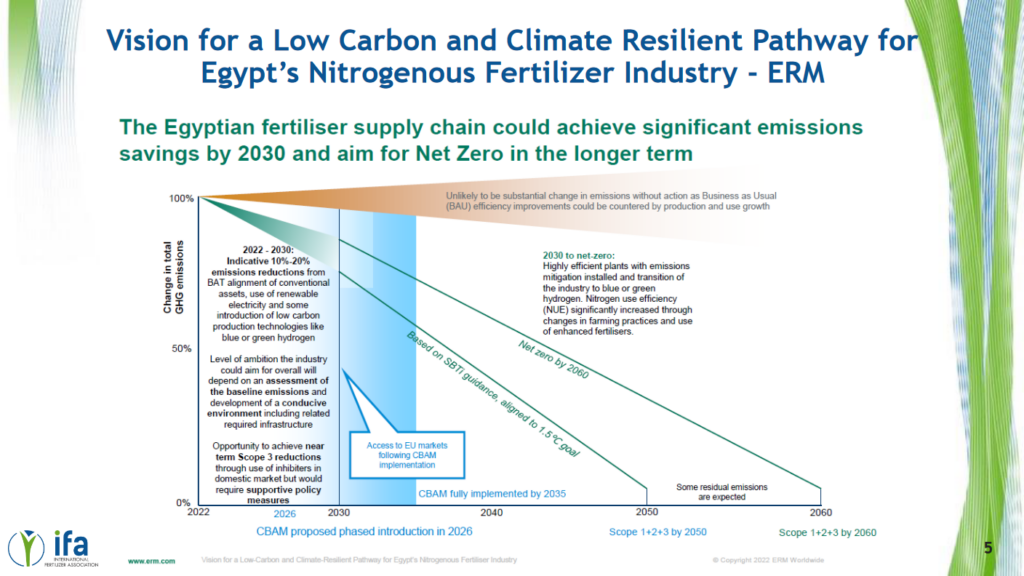

IFA is currently working on country-specific roadmaps, among them a roadmap focused on Egypt, which is set to be published in 2023. Decarbonizing the fertilizer industry is key in Egypt, as the sector accounts for about 8% of the national CO2 equivalent emissions. In Egypt, it’s estimated that nitrogen fertilizers emit about 13 million tonnes CO2 equivalents from production processes (scope 1 & 2), and 8 million tonnes CO2 equivalents are emitted during fertilizer use (scope 3).

Implementing BAT (best available technology) for current fossil-based ammonia plants, introducing renewable electricity for processes, and introduction of low carbon technologies can reduce the CO2 emissions from the fertilizer sector in Egypt by 10-20% in 2030. Fertilizer use emissions (scope 3) can be reduced through the use of inhibitors and other new technologies, and these could be further accelerated by supportive policy measures.

The introduction of policies in the EU are also expected to play a role in the short term and long term, as Europe is a key export destination for Egyptian ammonia and fertilizers. The EU ETS (Emission Trading System) and CBAM (Carbon Border Adjustment Mechanism) may spur decarbonization of Egyptian ammonia assets to remain competitive.

Egypt Green Hydrogen: the first of many

Fertiglobe was established in 2019 as a partnership between OCI and ADNOC. It is one of the largest nitrogen fertilizer producers in the Middle East and North Africa, with a combined production capacity of 6.5 million tons of urea and merchant ammonia. Fertiglobe boasts a gross ammonia production capacity of 4.4 million tonnes per annum.

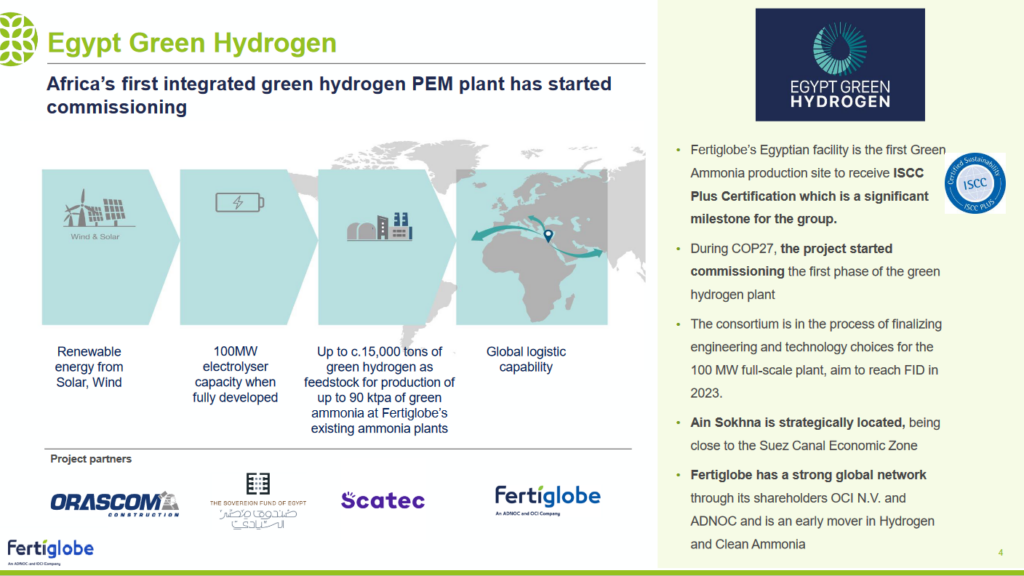

During COP 27, Fertiglobe commissioned the first phase of Egypt Green Hydrogen in Ain Sokhna. Egypt Green is a consortium partnership including Orascom construction, The Sovereign Fund of Egypt, Scatec, as well as Fertiglobe. The electrolyzer plant produces hydrogen using renewable electricity from solar and wind, utilizing PEM electrolyzers manufactured by Plug Power. Fertiglobe’s subsidiary and ammonia producer EBIC offtakes the hydrogen to produce renewable ammonia at an adjacent plant.

At full scale, the project is expected to have 100 MW electrolyzer capacity, producing 90,000 tonnes per annum of renewable ammonia. This decarbonizes the existing ammonia plant of EBIC by about 14%, given its stated production capacity of 660,000 tonnes per annum. The FID for the full-scale plant is expected in 2023.

PEM electrolyzers were selected instead of alkaline electrolyzers for the first phase of Egypt Green Hydrogen. A main reason is the higher output pressure of PEM electrolyzers, at about 40 bar. Recent supply chain disruptions have substantially increased the lead time for compressors, delaying projects requiring both electrolyzers and compressors. The plant footprint of PEM electrolyzers is also smaller than for alkaline electrolyzers. Furthermore, manufacturers of PEM electrolyzers frequently claim to have a faster response to renewable electricity fluctuations (although this benefit is less relevant for grid-connected systems, which it appears will account for the bulk of Egypt’s renewable hydrogen projects).

Egypt’s future potential

There is substantial interest in renewable ammonia production in Egypt, as follows from the numerous announced projects in the SCZONE, as well as the availability of suitable financing in the country. However, long-term offtake security & clarity on certification rules is still required before these projects can reach FID.

With regards to clarity, it is evident that rules regarding what is considered “green” are far from settled. Once aspects such as temporality, additionality and grid-connected hydrogen production have been figured out, certification must be implemented to allow for differentiating between carbon intensities of ammonia end-product. Clarity is also required with regards to which type of certification is allowed, e.g. can the low carbon ammonia certificate be traded separately from the ammonia product?

Once these hurdles have been overcome, Egypt will be in a strong position to serve low carbon ammonia markets for energy applications, in particular in Europe. By 2026, the shipping sector will be fully part of the EU ETS and CBAM, providing more opportunities in the maritime fuel market. Renewable ammonia production is capital intensive, implying long term commitments (20 years) from offtakers are required to de-risk investment for producers. But, with a wealth of potential projects to choose from in the SCZONE (including large-scale methanol production), and in such a critical location for global shipping, it’s not hard to envisage customers showing a willingness to commit to long-term offtake from Egyptian projects.