Saudi Arabia to export renewable energy using green ammonia

By Trevor Brown on July 16, 2020

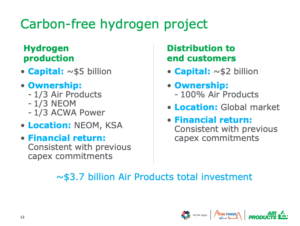

Last week, Air Products, ACWA Power, and NEOM announced a $5 billion, 4 gigawatt green ammonia plant in Saudi Arabia, to be operational by 2025.

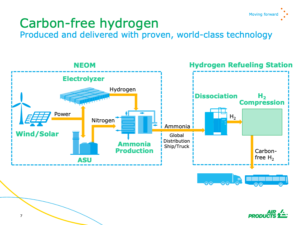

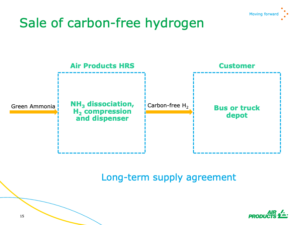

Air Products, the exclusive off-taker, intends to distribute the green ammonia globally and crack it back to “carbon-free hydrogen” at the point of use, supplying hydrogen refueling stations. According to Air Products’ presentation on the project, “our focus is fueling hydrogen fuel cell buses and trucks.”

This will be one of the first projects to be built in the industrial hub of NEOM, a futuristic “model for sustainable living.” NEOM is a key element in Vision 2030, Crown Prince Mohammed bin Salman’s plan to diversify the Saudi Arabian economy and reduce dependence on oil revenues. In other words, Saudi Arabia is establishing itself as “a global leader in green hydrogen production and green fuels.”

The joint venture project is the first partnership for NEOM with leading international and national partners in the renewable energy field and it will be a cornerstone for its strategy to become a major player in the global hydrogen market. It is based on proven, world-class technology and will include the innovative integration of over four gigawatts of renewable power from solar, wind and storage; production of 650 tons per day of hydrogen by electrolysis using thyssenkrupp technology; production of nitrogen by air separation using Air Products technology; and production of 1.2 million tons per year of green ammonia using Haldor Topsoe technology. The project is scheduled to be onstream in 2025 ...

“We are honored and proud to partner with ACWA Power and NEOM and use proven technologies to make the world’s dream of 100 percent green energy a reality,” said Seifi Ghasemi, Chairman, President and Chief Executive Officer for Air Products. “Harnessing the unique profile of NEOM’s sun and wind to convert water to hydrogen, this project will yield a totally clean source of energy on a massive scale …”

NEOM announcement, Air Products, ACWA Power and NEOM Sign Agreement for $5 Billion Production Facility in NEOM Powered by Renewable Energy for Production and Export of Green Hydrogen to Global Markets, July 7, 2020

According to NEOM’s announcement, this first green ammonia plant is a “significant milestone … the first of many developments at this scale that will put NEOM at the heart of a new future society.”

Green ammonia at oil and gas scale

The scale of this project is certainly noteworthy. With an operational date scheduled for 2025, it will probably succeed in its claim of being “the world’s largest renewable hydrogen project,” at least for a few years. Other, bigger projects are on the table, but with longer development periods, like InterContinental Energy’s Asian Renewable Energy Hub (15 GW) or Siemens’s Murchison Renewable Hydrogen Project (5 GW), both seeking to export renewable energy from Australia.

The homepage of Asian Renewable Energy Hub gets directly to the point: “Renewable energy at oil and gas scale.” Green ammonia is no longer restricted to small-scale projects; management of intermittent power inputs is no longer a techno-economic problem for the future; economies of scale matter; the chicken-and-egg problem of how to finance a plant without an established green ammonia market has been solved.

With an annual capacity of 1.2 million tons of ammonia, this is a big plant, but it is not unusually large. Most modern ammonia plants have an annual capacity of a million tons or so. It would take around 200 more of these $5 billion investments to supply enough green ammonia to decarbonize the shipping sector (see: Maritime decarbonization is a trillion dollar opportunity). Another 200 would be required to decarbonize the fertilizer sector. And many, many more would be required to satisfy renewable hydrogen demand from the fuel cell powered trucks and buses that Air Products is focused on supplying today — even more would be required as hydrogen is adopted in cars and trains and other applications. And we haven’t begun counting the opportunities in the power generation sector.

So, while we celebrate this first $5 billion investment, we should also recognize that it is a fraction of what must come. The real challenge isn’t the scale, but the speed at which we need to build all this new energy infrastructure. By this measure, 2025 is impressive.

NEOM

NEOM fills a large, coastal region in northwest Saudi Arabia. Among other things, the area boasts a combination of “perennial solar resources (20 MJ/m2)” and “ideal wind speed (an average of 10.3 m/s).”

Beyond these data, it is difficult to describe NEOM in my own words.

NEOM is being conceived on a blank slate that will introduce a new model for urbanization and sustainability. It is being designed, constructed and independently administered in a way that is unencumbered by the outdated and inefficient economic and environmental infrastructure that constrains other countries …

NEOM is the brainchild and vision of HRH Crown Prince Mohammed Bin Salman and is a centerpiece of Saudi Arabia’s Vision 2030 plan to grow and diversify the Saudi economy and position the country to play a leading role in global development …

NEOM will be backed by more than $500 billion over the coming years by the Public Investment Fund of Saudi Arabia, as well as local and international investors. NEOM’s contribution to the Kingdom’s GDP is projected to reach at least $100 billion by 2030.

NEOM Fact Sheet, accessed July 2020

Air Products, thyssenkrupp, and Haldor Topsoe

The NEOM project connects the dots between a series of announcements that have come in recent months from Air Products, which describes itself as “a global leader in industrial gases and megaproject development.”

Air Products is not known as a producer of ammonia, but it is deeply embedded in the industry as a producer of nitrogen and owner/operator of the air separation units (ASUs) that provide ammonia plants with their nitrogen feedstock. The company is also a hydrogen producer and distributor (“currently the largest supplier of hydrogen worldwide”), with high ambitions for the adoption of hydrogen as a transportation fuel.

In January 2020, Air Products combined these roles for ammonia production when it announced that it would supply both nitrogen and hydrogen to Gulf Coast Ammonia (GCA), a new ammonia plant being built in Texas City, TX. To supply GCA, Air Products is making a $500 million investment to build its largest SMR plant and a 30-mile hydrogen pipeline extension.

In May 2020, Air Products announced a “global Alliance Agreement” with ammonia technology licensor Haldor Topsoe.

The two companies will collaborate, using their extensive market network outreach for developing potential projects … on large-scale ammonia, methanol and/or dimethyl ether plants to be developed and built globally.

The Alliance Agreement provides Air Products access to Topsoe’s technology license(s) and the supply of certain engineering design, equipment, high-performance catalysts and technical services.

Haldor Topsoe press release, Air Products and Topsoe sign global alliance agreement for collaboration on large-scale ammonia, methanol, and/or dimethyl ether projects around the world, May 15, 2020

Other projects within this alliance include a coal-to-methanol plant in Indonesia and the GCA plant in Texas, which will have the same capacity as the NEOM plant. According to Haldor-Topsoe, these will boast “the world’s largest” ammonia loop (other ammonia plants might have bigger capacities, but only because they have two or more ammonia loops on one site).

Then, in early July, Air Products announced another agreement, this time with the electrolyzer arm of thyssenkrupp.

thyssenkrupp will deliver its technology and supply specific engineering, equipment and technical services for water electrolysis plants to be built, owned and operated by Air Products. The collaboration leverages thyssenkrupp’s technology supporting Air Products’ development of green hydrogen as an energy carrier for sustainable transportation, chemicals and power generation …

Matching the need for low-CAPEX, low-OPEX, reliable technology and solid project execution to make world-scale green hydrogen projects feasible, Air Products and thyssenkrupp are committed to deploying economic green hydrogen plants in the gigawatt size.

thyssenkrupp press release, Air Products and thyssenkrupp sign exclusive strategic cooperation agreement for world-scale electrolysis plants to generate green hydrogen, July 6, 2020

The size of the investment that Air Products is making, both in NEOM and in its sales and distribution network to deliver the NEOM product, is impressive. Beyond the $5 billion plant cost, it expects to invest an additional $2 billion in “distribution to end customers.”

But, as discussed above, these numbers are for the first plant, and they are only really relevant to that first plant. The impact that building this plant will have on the cost of electrolyzers, at one end of the value chain, and on the cost of ammonia crackers, at the other end, will be significant. The cost of building the initial infrastructure to deliver this volume of ammonia might be significant, but those volumes can later be expanded at far lower incremental delivery cost.

The second and third big green ammonia plants will have a lower capex; the second and third hundredth plants will have economics that we’ve yet to quantify.