The Allam Cycle’s Nexus with Ammonia

By Stephen H. Crolius on February 01, 2019

8 Rivers Capital, the developer of “the Allam Cycle, the only technology that will enable the world to meet all of its climate targets without having to pay more for electricity,” unveiled plans in November 2018 for a “billion-dollar clean energy production site” in New Zealand whose outputs are slated to include low-carbon ammonia. That is a sentence with a lot of angles, and unpacking it will take some effort.

So let’s start with the Allam Cycle.

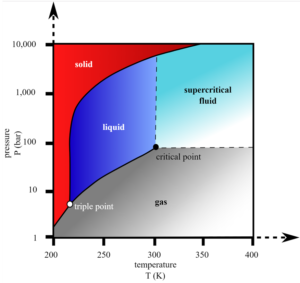

The Allam Cycle is a specialized version of the Brayton Cycle, which is the nineteenth century invention that embodies the particular set of thermodynamic processes that make the gas turbine an effective converter of fuel to power. The most notable feature of the Allam Cycle is that it employs carbon dioxide as its “working fluid,” i.e., the substance whose flow over the blades of a turbine makes the rotor spin. The CO2 comes from an upstream combustor in which a combination of pure oxygen and methane or syngas is burnt at high pressure. Both temperature and pressure are maintained at levels sufficiently elevated that the CO2 exiting the combustor is in “supercritical” state, meaning that, while it is neither a liquid nor a gas, it has properties characteristic of each. A key insight underpinning the Allam Cycle is that supercritical CO2 is a more effective turbine working fluid than air or steam.

The Allam Cycle was invented by Rodney Allam, a chemical engineer who has worked in industry throughout his career. According to an account in the on-line journal Only Natural Energy, “Allam came up with his eponymous power cycle following a meeting with Bill Brown – a disillusioned Wall Street banker in search of a technology which could change the world.” Another on-line journal, Quartz, picks up the story:

In 2008, as the stock markets were melting, Bill Brown decided to quit his Wall Street job [he had worked at the investment banks Goldman Sachs and Morgan Stanley and the insurance company AIG] and ‘make something good for a change.’ He founded 8 Rivers, an investment firm focused on new technologies, with Miles Palmer, a friend from his undergraduate years at the Massachusetts Institute of Technology. They thought the energy industry seemed ripe for disruption. The risk of failure was high, but so was the reward for success.

After their first few ideas failed to take off, Brown and Palmer realized they needed someone with process-engineering knowledge on the team. Through friends of friends, they were introduced to Rodney Allam, a retired chemical engineer whose last job was as the head of research and development for a specialty gas supplier in Europe. After just a few months with 8 Rivers, Allam presented them with a radically new design for a natural-gas power plant.

A radical startup has invented the world’s first zero-emissions fossil-fuel power plant, Quartz, 05/12/2017.

According to a contemporaneous press release, in 2012 8 Rivers launched a subsidiary, NET Power, and formed a team to pursue development of the technology:

Toshiba will develop the innovative system’s high temperature and high pressure turbine and combustor, the key equipment in thermal power plants, by making best use of its material, combustion and cooling technology. NET Power and [global engineering services firm] Shaw will work on overall plant engineering and [U.S. utility] Exelon will support development and operation of the 25MW plant, such as selecting the site, obtaining permits and commissioning the facility.

Toshiba Signs Agreement to Develop Next Generation Thermal Power System with NET Power, Shaw and Exelon, Toshiba Corporation, 06/15/2012.

In the ensuing years, the NET Power team spent $150 million as it built a demonstration plant in Laporte, Texas; and in May 2018 conducted the first firing test of the plant’s combustor.

Next let’s tackle the Allam Cycle’s potential for “enabling the world to meet all of its climate targets.”

(The quote is from the 8 Rivers home page.) After “cold-end” (post-turbine) removal of water and impurities such as sulfur that were borne in the fuel, the Allam process produces a nearly pure stream of CO2, which is suitable for sequestration without any further ado. This circumstance contributes to Allam’s claim in a 2017 paper in the journal Energy Procedia that the cost of electricity produced in his process will be “highly competitive with the best available energy production systems that do not employ CO2 capture.” Another contributing factor is the strong energy efficiency of the process, which attains “59% LHV [lower heating value] efficiency (comparable to best-in-class NGCC power plants not capturing CO2).” And yet another factor is “low capital costs due to the simplicity and high-pressure of the cycle; low ambient cooling requirements, depending on cooling configurations used; and virtually no air emissions.” Since the paper does not contain a cost itemization (or any dollar figures at all), it is not clear if Allam’s assertion of cost competitiveness takes into account the costs of CO2 transportation to a sequestration site, injection, and the capital invested in the site itself. Published cost estimates for these activities range from $15 to $50 per MWh of electricity. (The high estimate is from a story in the on-line journal Clean Technica.) Costs in this range are certainly non-trivial when the costs of variable renewable energy are now reported consistently in the sub-$50-per-MWh range.

And now let’s take on the hydrogen angle.

Allam’s Energy Procedia paper mentions that “technology developments are underway to use the Allam Cycle for low-cost hydrogen production.” This is not surprising, given hydrogen’s value as a marketable commodity, and the presumptively greater value that low-carbon hydrogen will have in the sustainable energy economy of the future. It would also appear to have a high degree of technical feasibility, given that current industrial processes for producing hydrogen involve reforming of methane via controlled conditions at elevated temperatures. (One such process, autothermal reforming, involves the use of pure oxygen as a key step in the reaction sequence.)

And this is where we can pick up the New Zealand strand of the story.

On November 25, the Taranaki (New Zealand) Daily News reported that “Pouakai NZ, a wholly-owned subsidiary of US company 8 Rivers Capital, is eyeing up the region for a clean hydrogen power plant that would also produce fertiliser for domestic use and export.” The story quoted a statement from Pouakai NZ as follows: “When the Allam Cycle is paired with highly efficient hydrogen production, as proposed in this project, the overall system will unlock the tremendous economic and environmental benefits of an affordable, truly clean hydrogen economy.”

Outside of local reporting, 8 Rivers’ New Zealand initiative has a very low profile. Pouakai NZ lacks a searchable Web presence, and does not appear to be mentioned on either 8 Rivers’ or NET Power’s Web sites. This may be because the proposed project has attracted a measure of controversy. In April 2018, the New Zealand government announced that henceforth it would “grant no new offshore oil exploration permits.” This provides the context for Greenpeace New Zealand’s sharp denunciation of Pouakai NZ’s planned venture as a “’Trojan horse’” whose effect will be “to keep the oil and gas sector alive.” In the subsequent weeks, politicians at various levels of government staked out positions, with the weight of opinion favoring the promised economic development benefits. However, the Taxpayers Union, a national lobbying group, is focusing on the company’s request for public funding – quoted by one source as NZD$20 million (USD$13.7 million) — for a feasibility study.

In another twist, a subsequent Taranaki Daily News story noted that Andrew Clennett, CEO of New Zealand hydrogen energy developer Hiringa Energy, had observed that “there [is] no guarantee there [is] enough natural gas reserves in Taranaki for the likes of such a project . . . ‘Certainly the natural reserves are not particularly robust; that’s one of the concerns.’”

Pouakai NZ does not seem to have made any public statements about possible sequestration sites for the CO2 that it will be produce. NET Power has articulated a vision for CO2 disposition, but it may not sit well with green energy advocates in New Zealand:

In the United States alone, 85 billion barrels of oil are recoverable using EOR [enhanced oil recovery]. Most industrial CO2 capture technologies cannot produce cost-effective, EOR-ready CO2, despite the fact that the industry is tremendously CO2-starved. NET Power will have both the capacity and economics to enable the EOR industry to unlock this vast resource while simultaneously sequestering CO2 from thousands of power plants below ground.

Pipeline-Ready Carbon Dioxide Byproduct, NET Power Web site, January 2019.

A 2015 International Energy Agency report on EOR includes an analysis of its impact on CO2 emissions, which varies considerably from case to case but typically has a beneficial result:

. . . understanding the net CO2 emissions benefit of EOR on both project level and globally is a complex task. It requires thorough analysis and clear decisions regarding the included elements (‘project boundaries’). However, the above results clearly show that EOR+ [EOR with CO2 storage] can generate an emissions reduction benefit.

Storing CO2 through Enhanced Oil Recovery, IEA, 2015.

How large might this benefit be? In its “illustrative” scenario for “conventional” EOR with CO2 storage, the analysis shows that for every tonne of CO2 injected underground, “net emissions” of 0.8 tonnes of CO2 result when “downstream emissions from oil use” are considered. The magnitude of this effect is directionally similar to that of switching from diesel fuel to natural gas in transportation applications.

The carbon footprint of EOR is one issue. The carbon footprint of the potential fertilizer product is another, given that the envisioned fertilizer is urea. It does makes economic sense to devote a portion of the plant’s CO2 output to turn the ammonia into a fertilizer staple. But, as Steve Abel a “campaigner” for Greenpeace in New Zealand, observed in a story in on-line journal Scoop Business, “the Pouakai plan to produce urea for agricultural fertiliser [is] unacceptable because the urea [would emit] greenhouse gases when used.”

But surely, we ask, doesn’t the latter point, at least, have a clear path to resolution?

Instead of turning the ammonia into fossil-carbon-laden urea fertilizer, Pouakai NZ could try to market it internationally as a green energy commodity. Such an approach could provide an early test of how green is green enough.

A factual correction to this post was made on February 5, 2019. The parent company of Pouakai NZ is 8 Rivers Capital, not NET Power as had been originally stated.