Trinidad & Tobago launches roadmap to decarbonise hydrogen & ammonia production

By Julian Atchison on December 18, 2022

Offshore wind to power transition

Trinidad & Tobago’s National Energy Corporation, the Inter-American Development Bank and KBR have released their findings on how to establish a market for renewable hydrogen in the Caribbean country. Currently, the oil & gas sector accounts for 40% of GDP and 80% of exports from T&T, and there is demand for 1.5 million tonnes per year of fossil-based hydrogen. Combining this “heritage” and expertise with extensive petrochemical infrastructure puts the country in “pole position” to become a key hydrogen exporter, not just regionally but globally. The new report sets out a roadmap for T&T to decarbonise hydrogen production via offshore wind power:

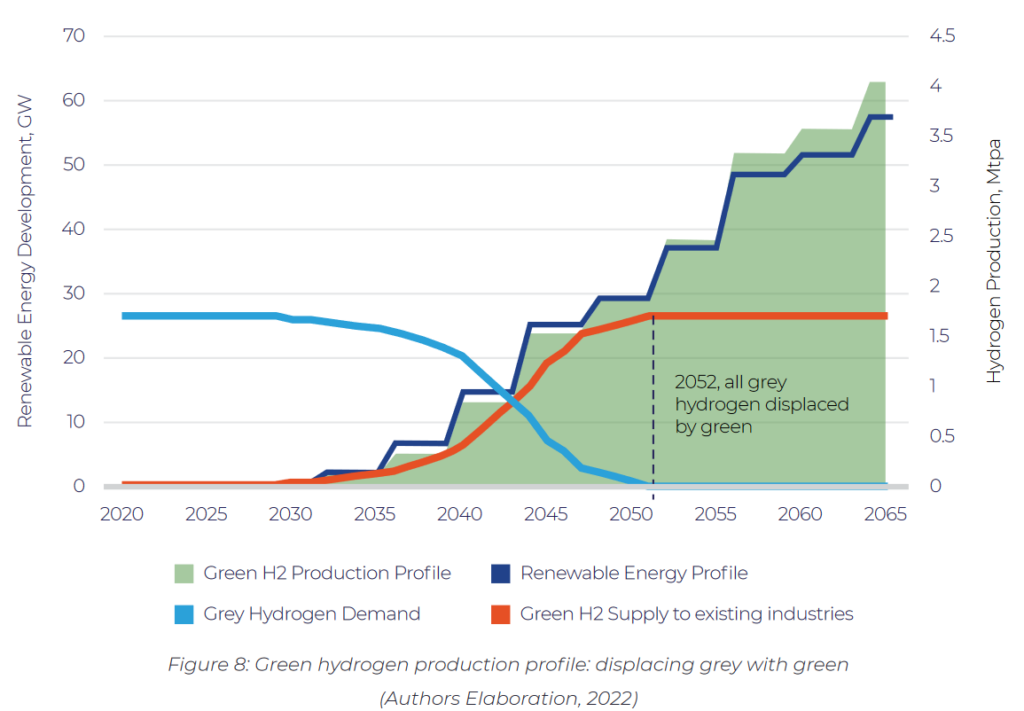

By 2065, Trinidad and Tobago could aim to install 57 GW of offshore wind nameplate capacity, translating to 25 GW of power that feeds electrolysers, producing 4 Mtpa of green hydrogen. Through this programme, Trinidad and Tobago will generate net benefits in the billions creating thousands of jobs in the construction, operation and maintenance sectors. This ensures sustainable economic growth for Trinidad and Tobago, and also enables Trinidad and Tobago to maintain its leadership in the petrochemicals sector and in the Caribbean region.

Executive Summary from The roadmap for a green hydrogen economy in Trinidad and Tobago, Nov 2022

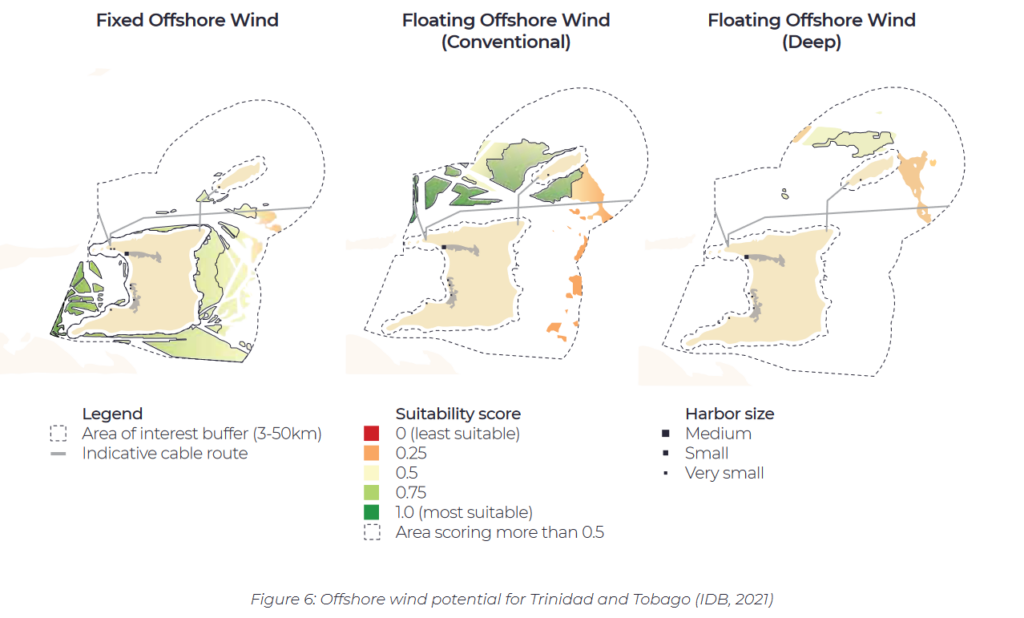

The authors note that extensive investment in upstream industries for hydrogen production (eg. electrolyser, wind turbines) would be necessary to realise this vision. Huge, untapped offshore wind resources underpin this whole transformation, including fixed and floating turbines connected to an undersea transmission cable running north of Trinidad island.

By 2030, a long-term, stepwise development program for offshore wind and renewable hydrogen production will commence, stepping the Caribbean nation up from zero capacity currently to 57 GW of installed offshore wind turbines and 4 million tonnes of hydrogen production per year in 2065. Although the remainder of this decade is critical to get the policy & regulatory frameworks, people power, investments and demonstration projects (like this one in Point Lisas) in place, the authors see 2052 as the key milestone for the program. At this point, all fossil-based hydrogen production will be replaced with renewable hydrogen.

Role for CCS hydrogen?

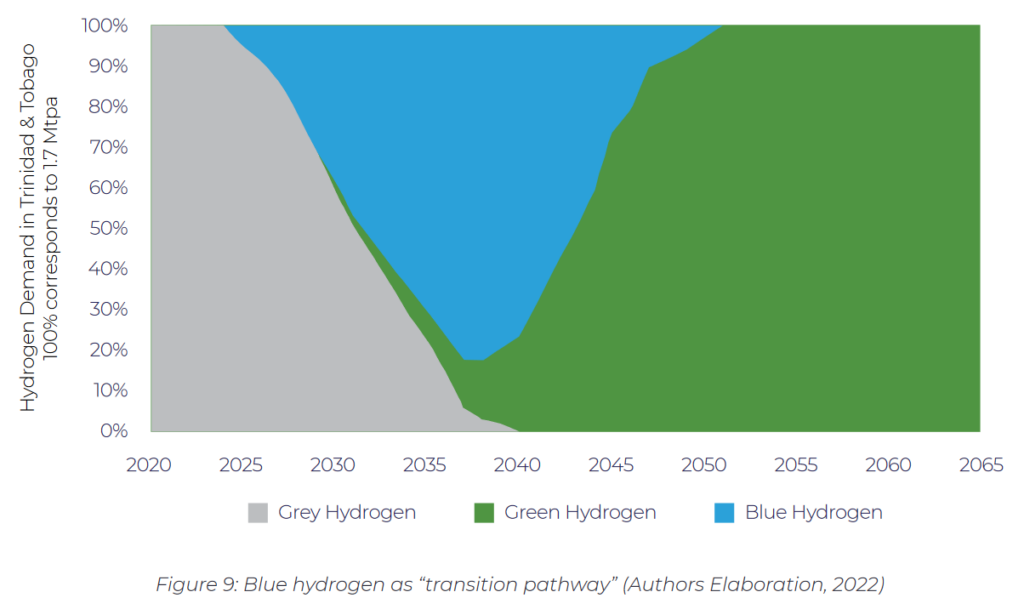

In the short-term, the authors see a role for CCS hydrogen to almost completely displace current production. Retrofitting of existing plants could see CCS hydrogen peak at 80% of total demand around 2040, before quickly tailing off to zero in 2050 when electrolysis becomes the key production pathway.

The authors also make a comparison to Singapore: an island nation with no oil reserves which has established itself as arguably the key hydrocarbon hub globally. Given Trinidad & Tobago’s excellent resource “headstart”, there is no reason why T&T couldn’t transform itself into a key global hub for renewable hydrogen markets:

Trinidad and Tobago can adopt a similar transformational journey of another island nation, Singapore, which started as an oil trading hub.Singapore had no crude oil reserves but imported crude oil primarily from the Middle East and provided storage, bunkering and later refining and blending facilities and exported the oil products into Asia. This was enabled by its geographical location, intervention by the government in economic activity and planning as well as Singapore’s history as an entrepot, which provided them with the competitive advantage to store and distribute oil and oil products. Whilst Trinidad and Tobago is starting from a different position to Singapore, there is a parallel comparison between these two island nations that can be explored to enable the future positioning of Trinidad and Tobago in the regional market as well as global market.

Comparison of T&T with Singapore for green hydrogen competitiveness, from The roadmap for a green hydrogen economy in Trinidad and Tobago, Nov 2022

*this article has been updated to reflect the role of KBR in the roadmap study