USDoE Issues H2@Scale Funding Opportunity Announcement

By Stephen H. Crolius on February 13, 2020

Last month the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy (EERE) issued a USD$64 million funding opportunity announcement (FOA) on behalf of the H2@Scale program. H2@Scale was launched in 2016 by representatives of several U.S. national laboratories with the goal of moving hydrogen energy technologies toward practical implementation. It is certainly one of the United States’ main vehicles for advancing the hydrogen economy. Given this, the program’s investments will do much to determine whether the U.S. is a leader or follower in ammonia energy. In June 2017, Ammonia Energy reported that “ammonia energy had started to move from the extreme periphery of the H2@Scale conceptual map toward its more trafficked precincts.” The EERE FOA shows that while progress is being made, the journey is not yet complete.

The current FOA is the second funding round that EERE (with intellectual leadership from the Fuel Cell Technologies Office) has conducted on behalf of H2@Scale. The first, issued in December 2018, made USD$40 million available for R&D aimed at “innovations that will build new markets for H2@Scale.” The ammonia energy concept did not figure in any of the 29 projects ultimately selected for funding. Given this, it is certainly good news that the current FOA opens the door to ammonia-oriented concepts in its Topic 5a, “H2@Scale New Markets Maritime Demonstrations.” (The FOA contains six topics in total.)

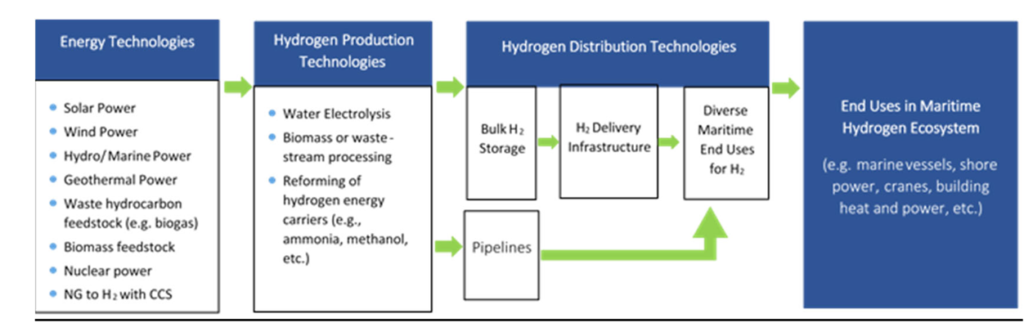

The maritime demonstrations are intended to “serve as real world laboratories with multi‐sector industry‐led validation of innovative technologies …” and to “jumpstart a new market.” Maritime demand for low-carbon fuels is seen as a beachhead opportunity that could initiate a virtuous cycle of growth in market appetite, investment in production and infrastructure, and improvement in cost position. This will create a context within which the most promising hydrogen carriers can move to the head of the pack:

Enormous volumes of alternative low‐sulfur fuels are needed, which could include large‐scale, low‐cost clean hydrogen or various synthetic fuels enabled by hydrogen. As one example, a preliminary assessment conducted by Oak Ridge National Laboratory suggests that replacing HFO with biofuels in maritime applications could significantly reduce sulfur and criteria emissions in the near term. Hydrogen carriers, including synthetic ammonia and methanol, among others could be even more promising in the long term.

U.S. Department of Energy Office of Energy Efficiency and Renewable Energy, H2@Scale New Markets FOA, January 23, 2020

EERE notes that it is well aligned with hydrogen-oriented maritime initiatives in other parts of the world. Its international alignment is less clear within other FOA topics where one might expect to see a role for ammonia: fuel cells for heavy-duty transportation applications (Topic 3) and for “primary and/or backup power applications” for data centers (Topic 5b). Topic 3 asserts that “for heavy‐duty fuel cell vehicles to be market competitive, it is necessary to improve the performance and durability of polymer electrolyte membrane fuel cells (PEMFCs) currently employed in automotive applications.” And indeed everything that follows in the discussion is explicitly oriented to PEM technology. The same is true for Topic 5b, even though data centers would appear to represent a use case that differs significantly from heavy-duty transportation. For the unobservant and obstinate, both Topics conclude with the same admonishment: “Proposals for electrolyte materials for solid oxide fuel cells, molten carbonate fuel cells, phosphoric acid, polybenzimidazole‐type phosphoric‐acid fuel cells, and alkaline anion exchange membranes, will not be considered.” Ammonia-capable fuel cells, in others words, are not welcome here.

For public-sector entities engaged in funding the energy transition, the tension is perennial between supporting the full scope of promising technologies and focusing on the most promising technologies. Perhaps this is EERE’s rationale for excluding ammonia-oriented fuel cell technologies. But if so, the calculus overlooks the scenario in which ammonia proves to be the “new petroleum,” i.e., the commodity used to move gigajoules from regions with advantaged energy production to regions with large energy appetites. In that scenario, energy conversion technologies that run directly on ammonia will likely dominate the end-use asset base.