BOC/Linde Embraces Ammonia-Based Hydrogen Fueling Technology

By Stephen H. Crolius on September 07, 2017

Dateline: Sydney, August 22, 2017. Industrial gas vendor Linde Group (under its BOC brand) confirms its participation in a previously announced Australian ammonia-energy project. With the Commonwealth Scientific and Industrial Research Organization (CSIRO) in the lead, the project partners will build and operate a pilot-scale “ammonia-to-hydrogen cracking” facility that showcases CSIRO’s hydrogen purification membrane technology. BOC/Linde will contribute goods and services valued at AUD$100,000 (USD$80,000) to the AUD$3.4 million project.

This is good news for ammonia energy proponents but news of even greater significance is buried in paragraph nine of the press release: “[BOC General Manager Hydrogen Alex] Dronoff adds the CSIRO project is a vital technology breakthrough that complements much of the pioneering work that The Linde Group has been driving for decades. [Emphasis added.] ‘With more than 150 fueling stations built worldwide and over 1.5 million refueling operations completed, Linde is continuously working on the expansion of hydrogen infrastructure.’”

A good way to build the case for this quote’s significance is to go back to the launch of the Hydrogen Council in January 2017 (covered by a contemporaneous Ammonia Energy post). According to its website, the Hydrogen Council is “a global initiative of leading energy, transport and industry companies with a united vision and ambition for hydrogen to foster the energy transition.” The organization’s three stated missions are “to provide long-term and stable policy frameworks to guide the energy transition in all sectors (energy, transport, industry, and residential)”; “develop coordination and incentive policies to encourage early deployment of hydrogen solutions and sufficient private-sector investments”; and “to facilitate harmonization of industry standards.”

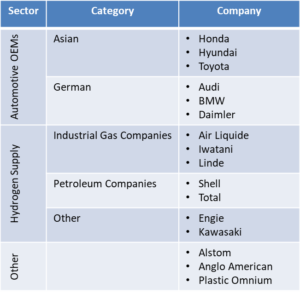

But obscured behind this wonky language is the reality that six of the Hydrogen Council’s 16 members are car companies that are either selling fuel-cell vehicles (FCVs) today or plan to within the next five years (although one of the companies, Daimler, announced in April 2017 that “hydrogen fuel cells are no longer a major part of [its] plans for the future”); and seven of the remaining ten have a current or emerging interest in supplying hydrogen fuel for these vehicles.

It would thus appear that the “mission behind the missions” is to break the “chicken and egg” impasse faced by most aspiring transportation fuels: why would anyone buy a car that runs on an alternative fuel that isn’t readily available? why make the alternative fuel available when no cars run on it? Since the car companies have spent many years — and no doubt many billions of dollars – to develop FCVs, it’s not surprising to see them in a forum that permits active communication and coordination with hydrogen supply companies.

Three of the seven hydrogen supply companies are industrial gas companies: Linde, Air Liquide, and Iwatani. Linde (based in Germany) and Air Liquide (based in France) are two of the “big four” global players in the industrial gas industry. The other two are both based in the U.S.: Air Products and Praxair. The big four will become the big three when Praxair and Linde complete their pending merger.

The industrial gas companies bring a unique and indispensable set of qualifications to the challenge of fueling FCVs. They are the repository of knowledge on how to profitably manage gaseous commodities from the point of production, through intermediate transportation and storage, to the point of dispensing and/or use. While the corporate heft of the Hydrogen Council’s petroleum companies Shell and Total is a critical part of the formula, it complements, rather than substitutes for, the know-how of the industrial gas companies.

So the opinions of the industrial gas companies about the best way to move hydrogen from the point of production to the point of dispensing are consequential. And while industry opinion has not been unanimous, until recently it seemed to center on elemental hydrogen – as distinct from ammonia or liquid organic hydrides. This is understandable since elemental hydrogen has been an important offering of the industrial gas industry for decades – in both gaseous form, and, thanks to deep expertise in cryogenics, liquid form. The problem is that managing elemental hydrogen in either of these forms has a cost footprint that is out of line with the current economics of transportation fuels. The chicken and egg impasse becomes truly impassable when the alternative fuel costs twice as much as the incumbent petroleum fuel.

The industrial gas companies have been working hard to reduce costs for the elemental hydrogen technologies. Linde, for example, has been innovating in the area of on-site conversion of liquid to gaseous hydrogen, with the goal of meeting the “economic needs . . . of fueling station operators.” Iwatani, on the other hand, is addressing practical aspects that can add cost – including via a consortium whose focuses include “maintenance and operation support for hydrogen stations, reduc[ing] deployment cost including regulatory review, and increas[ing] efficiency of operation.”

Ammonia, by contrast, has historically been outside the scope of both the production and distribution activities of the industrial gas companies. Eighty percent of ammonia production is delivered to agricultural customers via a supply chain that is entirely distinct from that of industrial gases, while yet another supply chain is in place for the 20% of ammonia production that goes into refrigeration and other industrial applications. At least that was the case until the U.S. company Airgas upset that status quo in the mid-aughts.

Airgas was launched in 1982 with an exclusive focus on the distribution end of the industry and grew by rapid-fire acquisition of regional distributors (more than 200 in its first ten years). It didn’t own any production assets until the 2000s. Given the company’s distribution mindset and well-worn acquisition playbook, the only surprise in the purchase of its first industrial ammonia distributor in 2006 was that it took so long to materialize. Other ammonia acquisitions followed. By 2015, when Air Liquide started to woo the company as an acquisition target, Airgas was the largest industrial ammonia distributor in the U.S. The Air Liquide acquisition was consummated in 2016, with the upshot that one of the big four companies now has as much interest in selling ammonia as hydrogen.

It is in this context that the statement by BOC’s Dronoff acquires its significance. Dronoff’s remarks include mention of Energiepark Mainz, a demonstration project that appears to be centered exclusively on hydrogen. “In this project,” according to its website, “environmentally friendly electricity from wind energy will soon help to produce green hydrogen. Hydrogen is a diverse source of energy that can easily be stored. It is predestined, for example, as clean fuel for cars, for gas heating as well as for power generation in modern power plants.”

But Dronoff concludes his thoughts with the following statement, “With this CSIRO technology, it will be easier and faster to replicate this success [of Energiepark Mainz] on an even larger scale.” It might be reasonable to infer from this that one of the major players in hydrogen fueling has anointed ammonia as a key enabler of an affordable hydrogen fuel supply chain.

A detailed discussion of the CSIRO hydrogen purification membrane technology was posted recently on FuelCellWorks.com.