In our recent episode of Project Features, we explored the outcomes from a recent ammonia bunkering demonstration at the Port of Rotterdam. With thirteen ammonia transfer and bunkering demonstrations occurring in nine global locations since 2024, where does the Port Readiness Level for ammonia bunkering stand in Rotterdam and elsewhere, what are the key technical learnings, and what gaps remain?

Content Related to Global Maritime Forum

Webinar

Deploying safe ammonia bunkering in the Port of Rotterdam and beyond

Learn more about a recently-completed ammonia bunker pilot facilitated by the Port of Rotterdam, and the global landscape of maritime ammonia activities being tracked by the Global Maritime Forum.

Article

Ammonia marine fuel cheapest option from late 2030s, dual-fuel vessels lowest-risk

Julian Atchison May 30, 2025

Based on their analysis, UMAS and the University College of London conclude that scalable e-fuels have the highest potential to meet shipping’s new decarbonization targets, but that the next decade is critical to ensure supply chains are ready to supply these fuels. Ammonia-LNG dual-fuel vessels represent the lowest-risk, cheapest decarbonization option to the mid 2030s.

Article

Order book for alternative-fueled vessels grows in 2023

Julian Atchison January 16, 2024

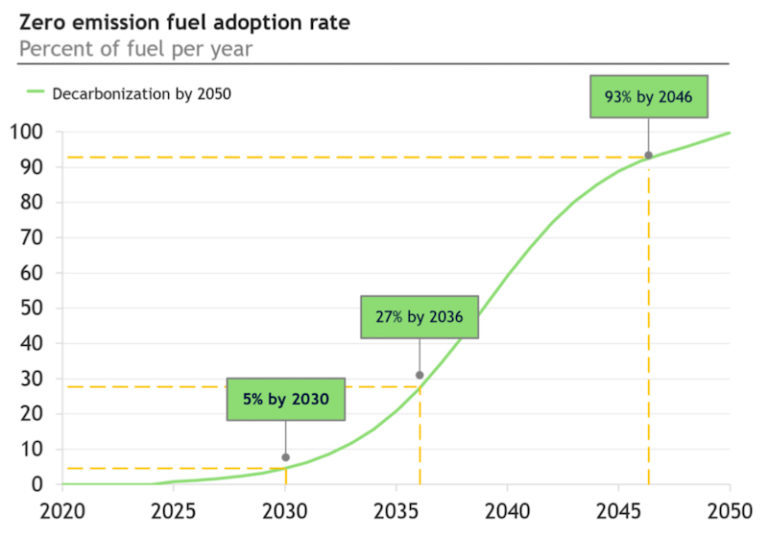

Clarksons Research and DNV have provided their analysis of global ship orders for 2023. Last year saw the first orders for ammonia-fueled vessels, with container ships & car carriers dominating the order book for alternative fuel propulsion ships. But UMAS & the Global Maritime Forum warn that the current order book trajectory may only be a fifth of what is needed to achieve the IMO’s 2030 target for alternative fuel uptake.

Article

All hands to the pump: every stakeholder needed to support marine ammonia fuel

Julian Atchison December 21, 2023

For our final episode of Maritime Ammonia Insights, we asked our resident experts Sofia and Conor Fürstenberg Stott to provide their insights on the pathway forward for marine ammonia fuel. Discussion topics included challenges for overlaying alternative fuels onto the existing bunker industry, the importance of seafarers to the transition, and why we need to move beyond talking about competition between alternative fuel candidates.

Article

Successful finance pathways for the NoGAPS vessel

Julian Atchison September 05, 2023

New analysis from the Global Maritime Forum has found that the cost gap between ammonia fuel and conventional fuel could be closed as early as 2026 for their new NoGAPS vessel. A series of levers need to be pulled to fully finance NoGAPS and similar vessels (such as long-term charters), but the authors report favorable deals should be readily available. The authors also map out three commercial pathways for NoGAPS to operate, the easiest being exclusive bunkering on the US Gulf Coast.

Article

Major maritime companies align behind book-and-claim approach to certification

Julian Atchison July 10, 2023

Nine key shipping stakeholders have joined the Global Maritime Forum to issue a joint statement, committing to develop and implement “robust book and claim chain of custody systems” that will accelerate the uptake of new maritime fuels like ammonia.

Article

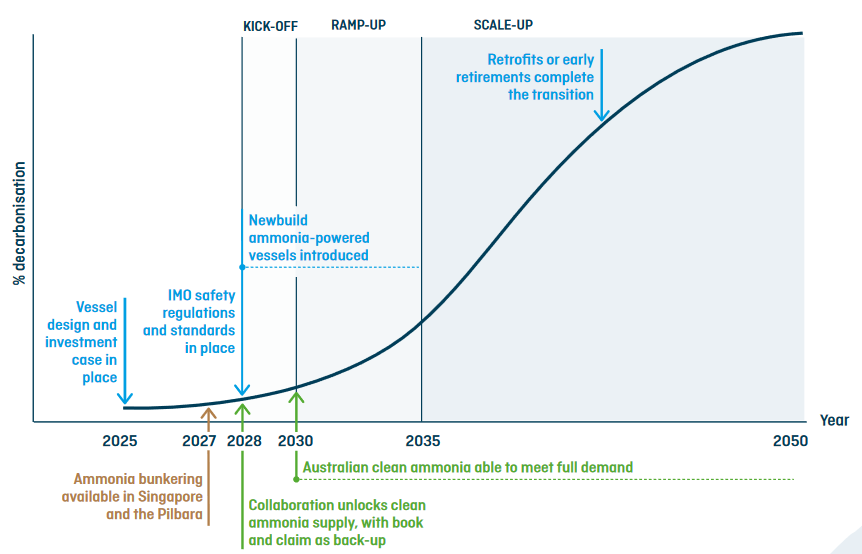

Ammonia fuel could begin powering Australia - Asia green maritime corridor from 2028

Julian Atchison May 22, 2023

Ammonia-powered vessels could be deployed on the iron ore trade routes between West Australia and East Asia from 2028, a new consortium study suggests. More than 20 vessels could be deployed on these routes by 2030, and over 360 by 2050. While ammonia fuel supply from Australia is unlikely to be a concern, validating the safety case for ammonia fuel, policy support to close the cost gap & industry-wide collaboration must all be established in time for deployment.

Article

Key shipping stakeholders see a multi-fuel future: new survey results

Julian Atchison May 08, 2023

A recent survey reveals how shipping industry leaders see the maritime fuel transition progressing. With conventional ship engines set to remain the preferred technology until at least 2050, almost all the survey respondents saw their fleets running on a mix of fuels by that date. Although methanol & ammonia are likely to be adopted at scale, respondents do not currently see any of the new fuels emerging as an industry standard, with key choices ahead for shipping companies, fuel producers, bunker providers and industry regulators.

Article

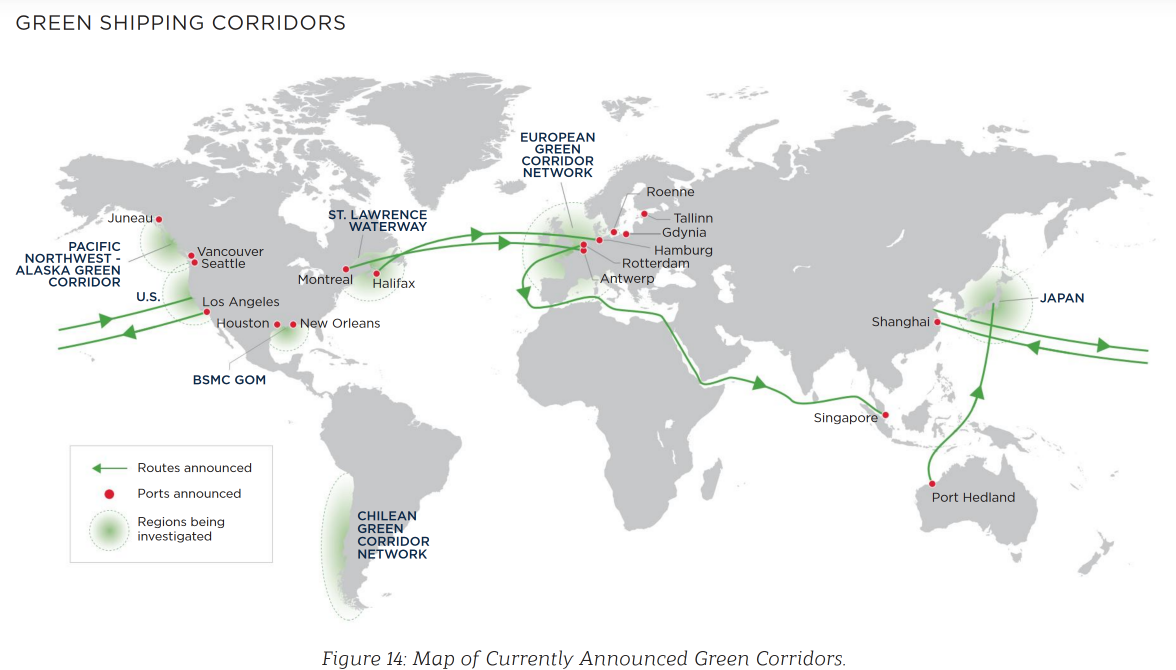

COP27: the Green Shipping Challenge

Julian Atchison November 25, 2022

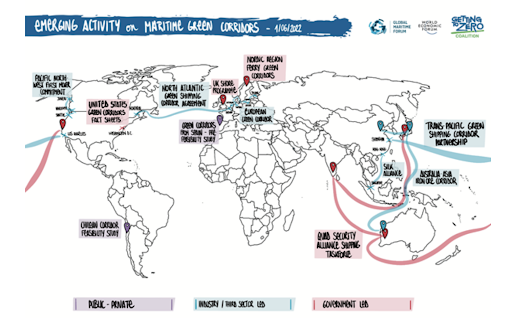

The US and Norway launched the Green Shipping Challenge in Sharm el-Sheikh this month. The Challenge encompasses more than forty different announcements & initiatives, including ammonia fuel production in Namibia, ammonia-powered cargo shipping in Finland, ammonia-powered pilot vessels in Norway's Green Shipping Programme, and a host of new green corridor projects. A trio of new reports have also provided an assessment of progress to date in green corridor development, and suggested key next steps.

Article

Ammonia Green Corridors - The Opportunity Is Now

Conor Furstenberg StottSofia Furstenberg Stott September 02, 2022

Since the Clydebank Declaration was signed last December, the prospect of ammonia-fueled, green maritime corridors has been steadily rising. The Global Maritime Forum has just released a valuable discussion paper on potential definitions and approaches for green corridors. Recent announcements in Europe, Singapore, Australia and the Nordic countries demonstrate growing momentum. For maritime stakeholders to capture early learnings and best manage the complex task of alternative maritime fuel scale-up, the opportune time is right now.

Article

Maritime green corridors in Chile, Australia and the US

Julian Atchison April 19, 2022

In three green maritime corridor announcements this week:

- Chile’s Ministry of Energy and the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping will develop a network of transport corridors in and out of the country.

- The Global Maritime Forum will lead an Australian consortium seeking to establish ammonia-powered iron ore transport routes between Australia and southeast Asia.

- and the US State Department has outlined its official approach to green corridors, describing them as a “key means of spurring the early adoption of zero-emission fuels” like ammonia.

Article

Closing the Gap for Zero-Emission Fuels

Sofia Furstenberg Stott March 27, 2022

In January 2022, UMAS and the Getting To Zero Coalition (GtZC) released a report with policy options for closing the competitiveness gap between conventional & future maritime fuels. Such measures will be necessary to enable an equitable transition to zero-emissions shipping. So how might these potential policy routes may impact and enable the scaling of maritime ammonia?

Article

Global Centre for Maritime Decarbonisation and Mærsk Mc-Kinney Møller Center join forces

Julian Atchison March 02, 2022

Two maritime ammonia heavyweights - the Global Centre for Maritime Decarbonisation and the Mærsk Mc-Kinney Møller Center - have signed a long-term agreement to accelerate the maritime industry’s decarbonisation efforts. The Global Centre for Maritime Decarbonisation is currently overseeing a comprehensive ammonia bunkering study that will enable ammonia bunkering trials to proceed at two Singapore locations to start in 2023.

Article

Green Maritime Corridors - A catalyst for transition to green shipping fuels

Conor Furstenberg Stott March 01, 2022

The ports of Los Angeles and Shanghai have announced the intention to create a green shipping corridor across the Pacific Ocean. The ambition is for ships trading between these ports to run on alternative low greenhouse gas emission fuels. Ammonia stands among the options as such an alternative.

There is a clear willingness from key players at the LA end of this trans-Pacific shipping corridor to embrace alternative fuel solutions and work together to unlock a suite of zero emissions technologies, albeit limited to an onshore focus for now. Shifting focus onto the water - where ammonia maritime fuel will undoubtedly play a critical role - is the logical next step.

Article

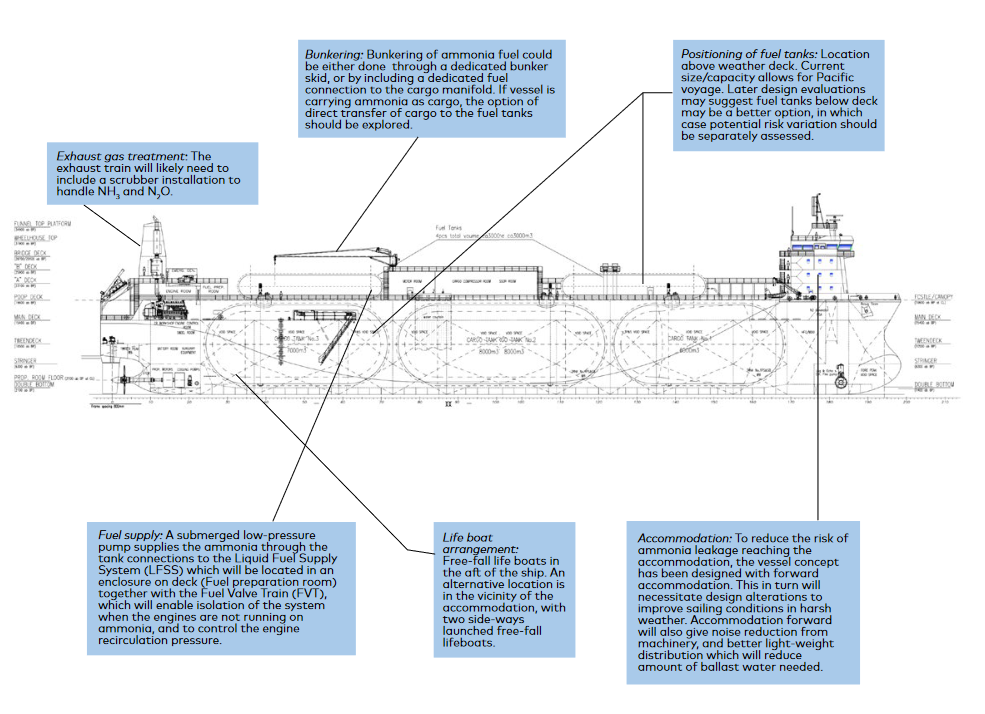

The Ammonia Wrap: no major obstacles for NoGAPS success and more

Julian Atchison June 08, 2021

Welcome to the Ammonia Wrap: a summary of all the latest announcements, news items and publications about ammonia energy. This week: latest report from NoGAPS, Viking Energy project takes another step, more collaborations for Yara, thyssenkrupp to invest in cracking R&D, investment in clean hydrogen technology in the USA, world-first visualisation of ammonia combustion in a spark-ignition engine and our numbers of the week.

Article

The Ammonia Wrap: OCI to charter ammonia-fueled vessels, Japanese CCGT units await ammonia, more green ammonia for Chile, new South Korea and Uruguay updates

Julian Atchison March 10, 2021

Welcome to the Ammonia Wrap: a summary of all the latest announcements, news items and publications about ammonia energy. This week: OCI to charter ammonia-fueled vessels, new carbon-free maritime fuels forecast, Hokkaido Electric postpones CCGT deployment, awaits ammonia, more green ammonia for Chile, Net-zero Teesside to include CF Industries ammonia production, South Korea and Uruguay.

Article

Maritime Ammonia: ready for demonstration

Trevor Brown May 07, 2020

At least four major maritime ammonia projects have been announced in the last few weeks, each of which aims to demonstrate an ammonia-fueled vessel operating at sea. In Norway, Color Fantasy, the world's largest RORO cruise liner, will pilot ammonia fuel. Across the broader Nordic region, the Global Maritime Forum has launched NoGAPS, a major consortium that aims to deploy "the world's first ammonia powered deep sea vessel" by 2025. In Japan, a new industry consortium has launched that goes beyond on-board ship technology to include "owning and operating the ships, supplying ammonia fuel and developing ammonia supply facilities." And the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), which published its roadmap last month, aims to demonstrate ammonia fuel on "an actual ship from 2028" — specifically, a 80,000 dwt ammonia-fueled bulk carrier.

Article

Maritime decarbonization is a trillion dollar opportunity

Trevor Brown February 06, 2020

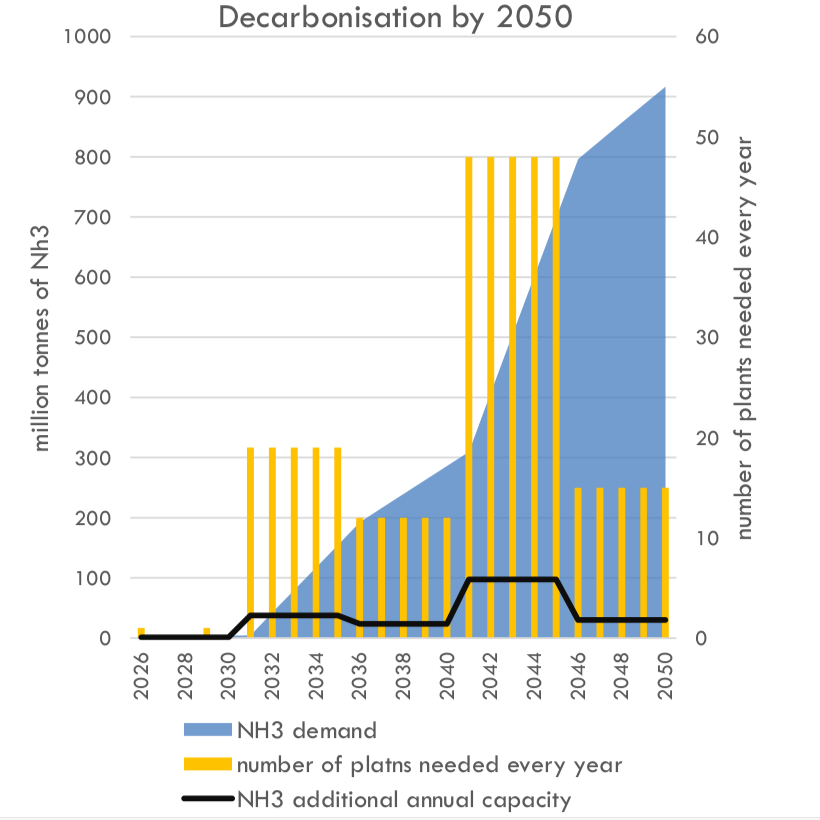

In January 2020, the Global Maritime Forum published new analysis that calculates "the capital investment needed to achieve decarbonization" in line with the International Maritime Organization's Initial GHG Strategy. The result of this analysis, which assumes that ammonia will be "the primary zero carbon fuel choice adopted by the shipping industry," is an aggregate investment of between $1 trillion and $1.4 trillion dollars, from 2030 to 2050, or roughly $50 to $70 billion per year across two decades. Ship-side costs are only 13% of this number. The bulk of the investment will be directed towards green ammonia plants for maritime fuel synthesis. By 2050, this global fuel demand is estimated to be more than 900 million tons per year of green ammonia, more than five time today's total global output of conventional ammonia.