In our latest technology landscape analysis, AEA Technology Manager Kevin Rouwenhorst explores four broad categories for novel ammonia production technologies: improved catalysts, sorbent enhancement, electrochemical ammonia synthesis, and other technology pathways (including geological, single-step and looping synthesis).

Content Related to KBR

Article

2025: an ammonia energy rollercoaster

Julian Atchison December 17, 2025

Despite the successes and progress made in 2025, the year remains a missed opportunity for ammonia energy. The first complete supply chains for renewable ammonia are emerging, and some 600,000 tons of annual production capacity is set to be online in northeast China early next year. Maritime engines, cracking, and power & heat technology solutions also made their mark, moving from feasibility into deployment. But disappointing outcomes at the IMO and government support that failed to spark market development remains an issue, with plenty of critical, detail-heavy work ahead of us in 2026.

Article

Status of renewable ammonia projects and technology licensors

Kevin Rouwenhorst November 18, 2025

One of the key steps in project development remains the selection of the licensor for the renewable ammonia synthesis loop. We explore different technology offerings from leading licensors – including KBR, Topsoe, Thyssenkrupp Uhde, Casale, Stamicarbon, and GoodChina – as well as the growing list of projects where they are being deployed.

Presentation

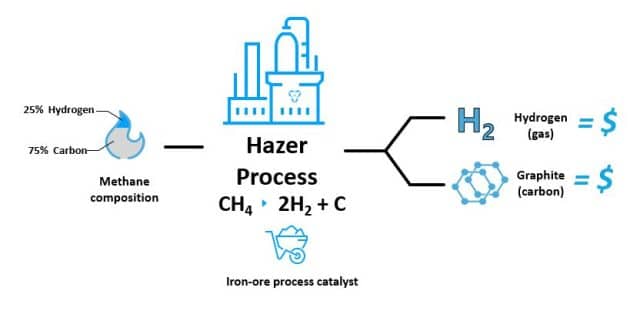

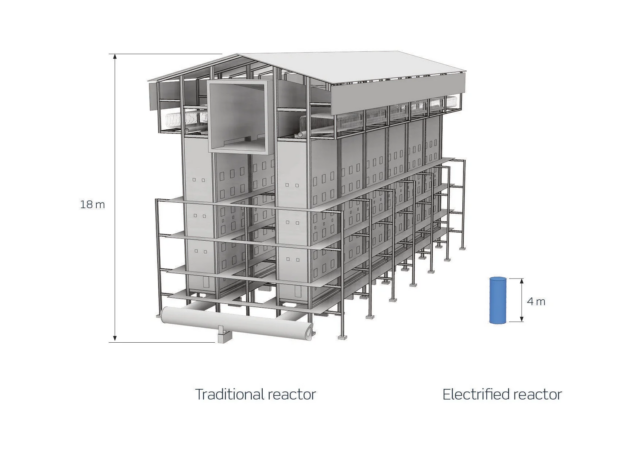

Methane Pyrolysis for Turquoise Hydrogen

KBR & Hazer Cooperation: Demonstrate a scalable catalytic methane pyrolysis pathway for low-carbon hydrogen and graphite co-production. Explore value proposition & technical developments.

Presentation

Innovative Integration of Ammonia Cracking and Power Generation: Hanwha Impact’s H2ACT-HRSG Project

The Hanwha Impact H2ACT-HRSG project introduces a novel and highly efficient flow-scheme that integrates ammonia cracking with heat recovery steam generation (HRSG), tailored for small-to-medium scale clean power applications. Developed in collaboration with KBR, this configuration leverages high-grade heat from gas turbine exhaust and duct firing to drive a series of adiabatic reactors, enabling efficient hydrogen production from ammonia while simultaneously generating steam for power. This innovative integration—termed H2ACT-HRSG—offers performance advantages over conventional stand-alone ammonia cracking systems in combined cycle power generation settings. Key benefits include enhanced hydrogen yield, improved net power generation, and reduced specific ammonia consumption, all contributing…

Article

Floating ammonia energy: new AiPs and partnerships

Julian Atchison September 16, 2025

At the recent GasTech event in Italy, new agreements were signed for the development and execution of floating ammonia cracking (MOL and KBR), gas-based ammonia production (SBM Offshore), and renewable electricity-based ammonia production (H2Carrier).

Article

Gas-based reforming for low-emission ammonia production: ATR, POX, and two-step reforming

Kevin Rouwenhorst August 06, 2025

Current global ammonia production is mostly based on gas-fed, two-stage reforming processs. Decarbonization of this existing production capacity – as well as new newbuild low-emission capacity also based on gas – can utilize an industrially-proven suite of alternative technologies and processes, including autothermal reforming, and partial oxidation combined with CCS. This article discusses some of the technologies available from various tech providers, and reference projects in operation.

Article

Hazer & KBR: commercial deployment of biomethane-based hydrogen production technology

Geofrey Njovu June 04, 2025

The new strategic agreement between the two parties will see KBR act as exclusive licensing and marketing partner of Hazer Group’s proprietary methane pyrolysis technology, which can produce low-carbon hydrogen and high quality graphite from biomethane.

Article

Industrial demonstration of ammonia cracking: exploring global progress

Kevin Rouwenhorst April 16, 2025

Here, we explore the current demonstration landscape for large-scale cracking. To produce pipeline-quality hydrogen at future energy import hubs, industrial-scale ammonia cracking is still to be derisked and demonstrated, although certain parts of the overall process have been proven at scale. What are the technology elements to be considered, and who are the first-movers deploying the technology in a variety of global locations?

Article

New green maritime corridor to link Portugal with northern Europe

Julian Atchison January 23, 2025

Madoqua and Mitsui O.S.K. Lines will lead development of the corridor. Industry partners in the consortium include financiers, terminal operators, Port authorities, alternative fuel producers and offtakers. The transportation of liquified CO2 along the corridor will help establish a supply chain for sequestration of carbon emissions in Norway at Horisont Energi’s Gismarvik CO2 hub.

Presentation

H2ACT: Empowering Energy Mobility through Large Scale Ammonia Cracking

Ammonia cracking technology overview – Exploring the process and diverse industrial demand for hydrogen from ammonia cracking. Achieving scalability and operational efficiency through strategic & inherently safe design, proven technology elements and streamlined processes.

Article

Technology options for low-emission ammonia production from gas

Kevin Rouwenhorst October 16, 2024

In this Technology Insights article, we explore the different technology options for low-emission ammonia production from gas feedstock. What are the different energy, carbon capture, scale and maturity trade-offs that need to be considered? What technology choices are project developers currently making?

Article

Licensor selection picking up for renewable ammonia synthesis loops

Kevin Rouwenhorst August 20, 2024

One of the key steps in project development is the selection of the licensor for the renewable ammonia synthesis loop. For renewable ammonia projects, licensors including KBR, Topsoe, Thyssenkrupp Uhde, Casale, and Stamicarbon offer a range of technologies and services covering small to large-scale ammonia production. We explore these different technology offerings, as well as the growing list of projects where they are being deployed.

Article

Blue Horizons: CCS-based ammonia production in Oman

Julian Atchison July 29, 2024

KBR will provide its licensed ammonia synthesis loop technology for a new million ton-per-year ammonia plant in Duqm, Oman. Shell will produce CCS-based hydrogen feedstock at its adjacent Blue Horizons plant, a project launched last year with support from Oman’s Ministry of Energy and Minerals.

Article

Copenhagen Infrastructure Partners, Lotte plan offtake from mega-projects

Julian Atchison April 07, 2024

Discussions will commence for the supply, purchase, and sale of ammonia from two of CIP’s ongoing mega-projects - St. Charles in Louisiana and Murchison in Western Australia - to Lotte in South Korea. Meanwhile, Lotte has selected KBR’s synthesis technology for its hydro-ammonia production project in Malaysia.

Article

Decarbonizing existing, SMR-based ammonia plants: workshop recap

Kevin Rouwenhorst November 26, 2023

Decarbonization of existing steam methane reforming-based ammonia plants is possible, and changes in gas and heat flows can be recovered via alternative technologies. Recap our workshop in Atlanta, where we discussed the use of upstream methane monitoring equipment, electrolysers, carbon capture, hydrogen burners, energy storage and electric heating to achieve decarbonization of conventional ammonia plants.

Article

Harmonised certification – opportunities and challenges across different markets

Geofrey Njovu November 26, 2023

In this session at our 2023 annual conference, panelists explored the challenges and opportunities for designing certification schemes for different markets. Moderated by Madhav Acharya, the discussion featured Emily Wolf from Ambient Fuel, Claire Behar from Hy Stor Energy, Domagoj Baresic from the UCL Energy Institute and Patrick Hastwell from KBR.

Compliance with EU standards offers flexibility for producers and will facilitate the immediate scale-up of export markets, but progress towards an umbrella-style certification scheme remains in focus for the AEA. Broad-based certification schemes will help create new voluntary demand markets and avoid a sector-by-sector approach to developing certification.

Article

KBR, SolydEra to deploy solid oxide electrolysis for ammonia production

Julian Atchison October 11, 2023

KBR will integrate SolydEra’s solid oxide electrolysis technology into its proprietary K-GreeN® ammonia synthesis process thanks to a new MoU. K-GreeN® is the technology of choice for several significant ammonia mega-projects, including Avina Clean Hydrogen (Texas), and ACME Group (Oman).

Article

KBR to provide cracking tech for new South Korean project

Julian Atchison October 11, 2023

KBR will deploy its new H2ACTSM ammonia cracking technology in Daesan, South Korea, delivering 200 tonnes of hydrogen per day as fuel for power generation. The new project is part of Hanwha Corporation’s decarbonisation push which includes co- and 100% firing of hydrogen fuel in gas turbines, ammonia production & export, and ammonia-powered vessels.

Article

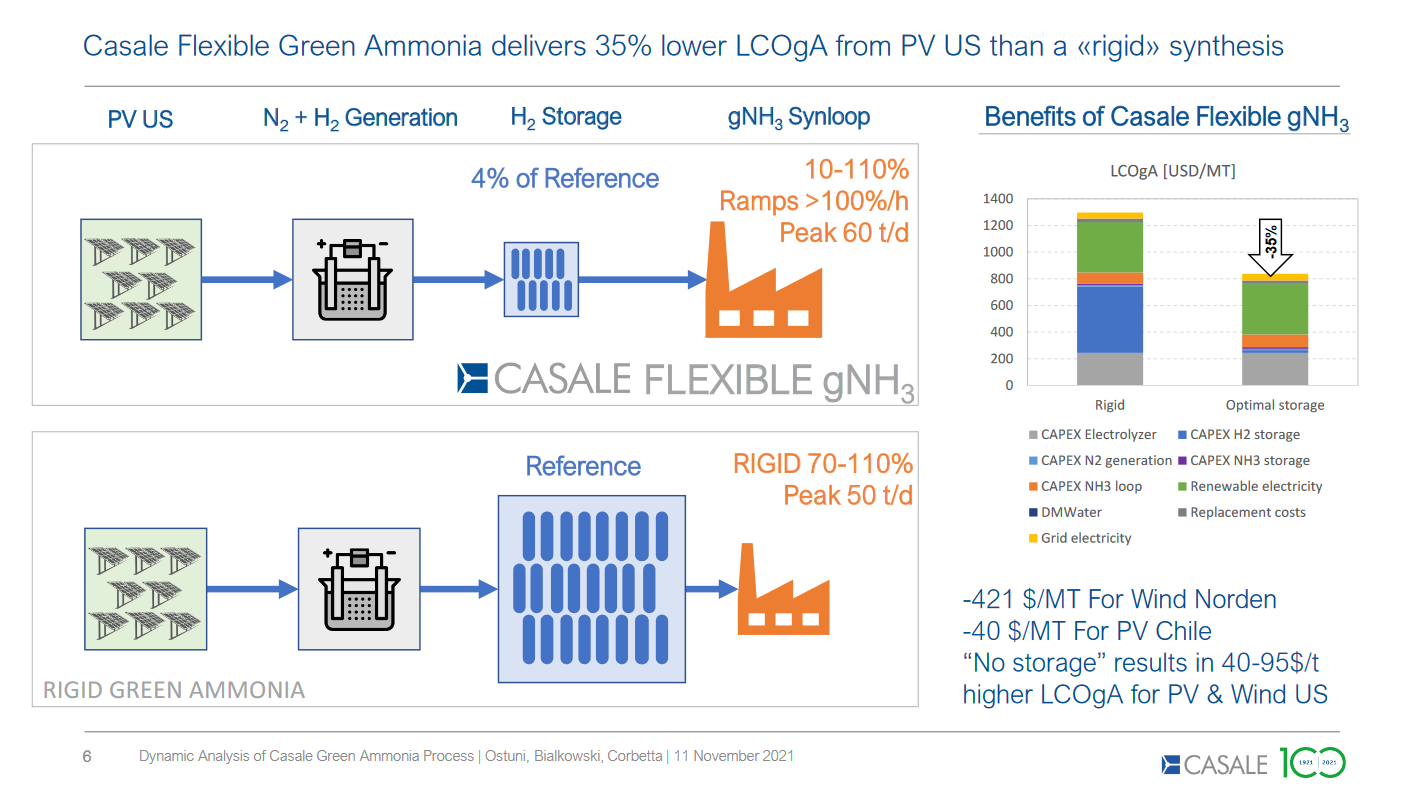

Flexible ammonia synthesis: shifting the narrative around hydrogen storage

Kevin Rouwenhorst April 27, 2023

Flexible ammonia production technology is currently scaling up to meet the challenges of fluctuating electricity feedstock. The ability to ramp down plants to 5 - 10% of their nominal load will minimize the requirement for hydrogen storage buffers and reduce the overall cost of renewable ammonia production. The first demonstration-sized flexible ammonia plants are due to begin operations later this year.

Article

Electrolysis-based projects progress in USA & Canada

Julian Atchison April 17, 2023

KBR has been selected as technology provider for two future production projects in Texas and Washington state. At the Port of Galveston, Texas Green Fuels has begun pre-FEED work and sourcing renewable electricity for its fuels export complex. And in Nova Scotia, Bear Head Energy has received environmental approval to proceed with its 2 million tonnes per year production project near Point Tupper.

Article

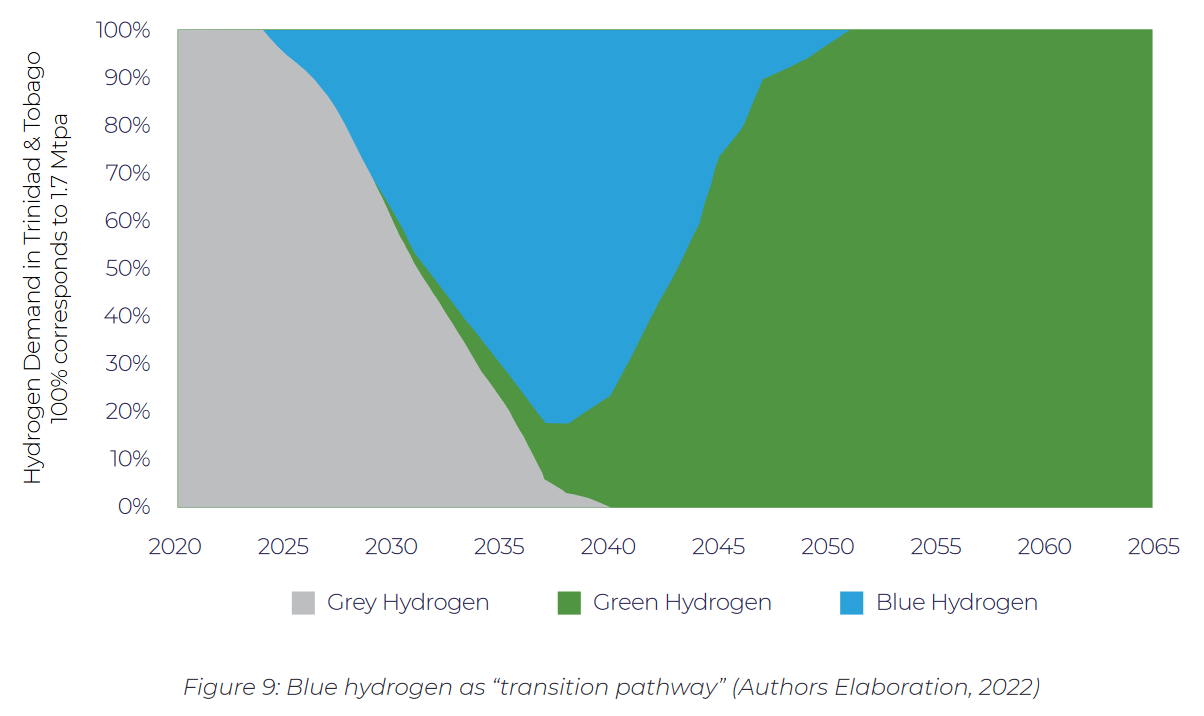

Trinidad & Tobago launches roadmap to decarbonise hydrogen & ammonia production

Julian Atchison December 18, 2022

Trinidad & Tobago’s National Energy Corporation, the Inter-American Development Bank and KBR have released their findings on how to establish a market for renewable hydrogen in the Caribbean country. Underpinned by a stepwise development of 57 GW of offshore wind power potential, the country could completely displace fossil-based hydrogen with renewable hydrogen in 2052. The 4 million tonnes-per-year production potential would meet industrial demands and lay the foundation for a significant export industry, potentially transforming Trinidad & Tobago into a global energy hub.

Article

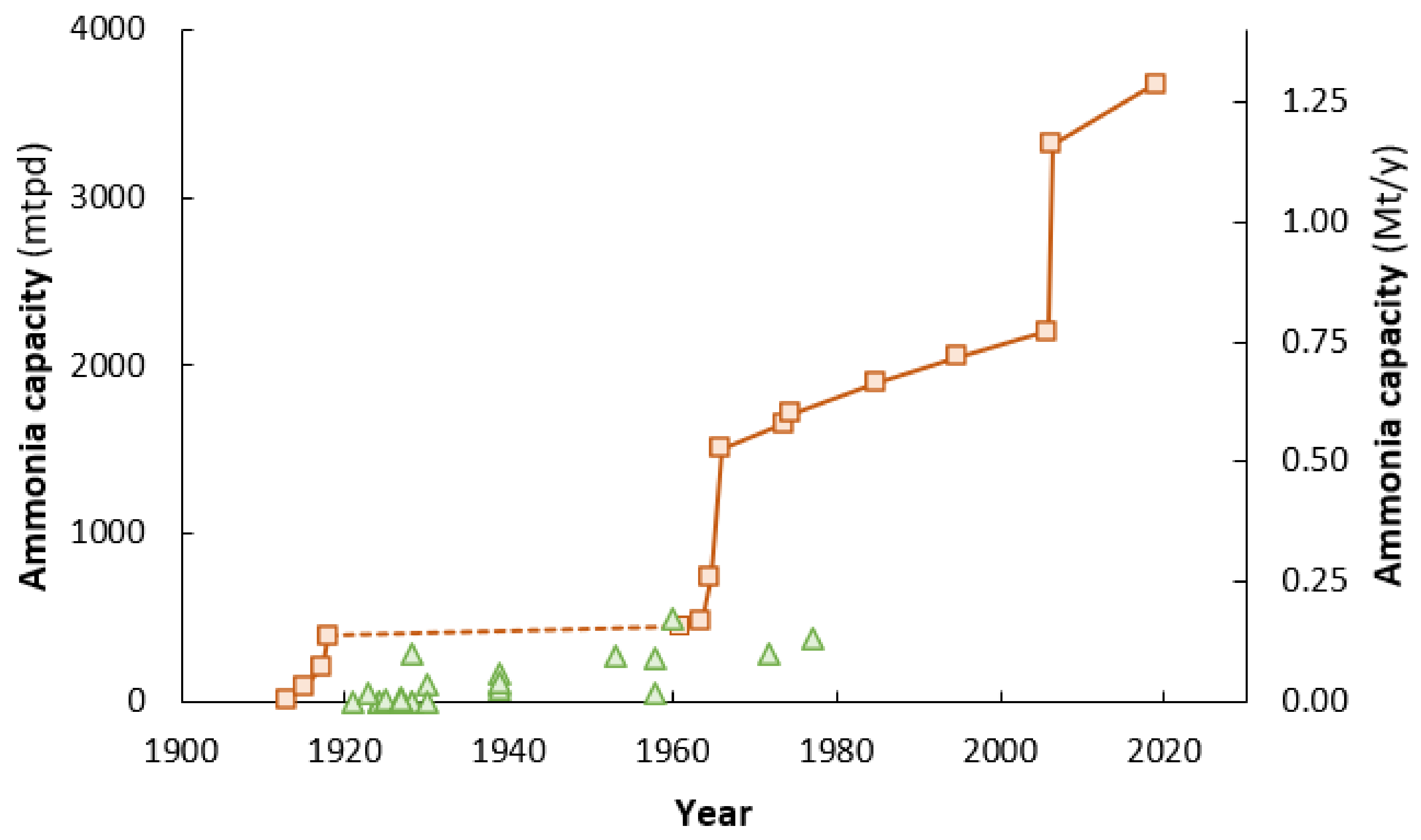

Production technology updates: from mega-scale to distributed ammonia

Kevin Rouwenhorst November 11, 2022

Recently, KBR launched its Ammonia 10,000 technology for newbuild ammonia plants, tripling the largest available single train capacity to 10,000 metric tonnes per day. In our latest Technology Insights article, we explore the other pieces of the puzzle required for mega-scale ammonia, as well as some updates from the other end of the spectrum, with three distributed, small-scale ammonia synthesis systems under development in North America.

Article

KBR: ammonia-powered offshore drilling

Julian Atchison September 21, 2022

KBR, Odfjell, Equinor and Wärtsilä will all collaborate to study conversion of diesel generators on board semi-submersible, offshore drilling vessels to ammonia-fueled generators. On-board power for equipment and heavy machinery on these vessels is typically provided by fossil-fed generators. As fuel costs increase, operators are looking to new energy solutions including offshore wind and alternative fuels like hydrogen & ammonia.

Article

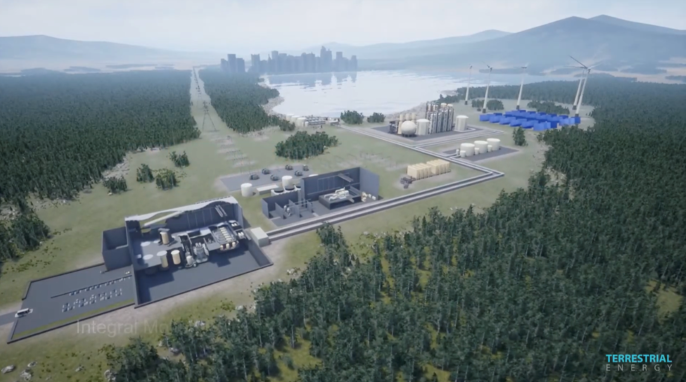

Nuclear-powered ammonia production

Kevin Rouwenhorst July 12, 2022

The potential for nuclear-powered ammonia production is developing fast. Two seperate industrial consortia (Copenhagen Atomics, Alfa Larval & Topsoe, and KBR & Terrestrial Energy) have formed to develop thorium-fueled reactors, and hydrogen & ammonia production is a key part of their plans. Given nuclear electricity dominates France’s energy mix, a grid-connected electrolyser project at Borealis’ fertiliser production plant in Ottmarsheim, France will be one of the first examples of commercial-scale, nuclear-powered ammonia production. And, while capital costs & lead times remain significant, mass production of new technologies and research into flexible power production capabilities are emerging as key to unlocking nuclear-powered ammonia production.

Article

New ammonia partnerships in Japan, Indonesia

Julian Atchison June 09, 2022

JGC Corporation has entered into a series of new ammonia partnerships. As part of a wider agreement to license KBR’s patented ammonia production technology, a new renewable ammonia pilot plant will be developed near Fukushima. JGC will team up in an “alliance agreement” with TOYO Corporation to develop fuel ammonia production projects and import terminals in Japan. And in Indonesia - where TOYO is currently assessing the feasibility of retrofitting an existing ammonia plant to run entirely on renewable energy - JGC and Indonesia’s national energy organisation Pertamina will collaborate on key decarbonisation projects.

Article

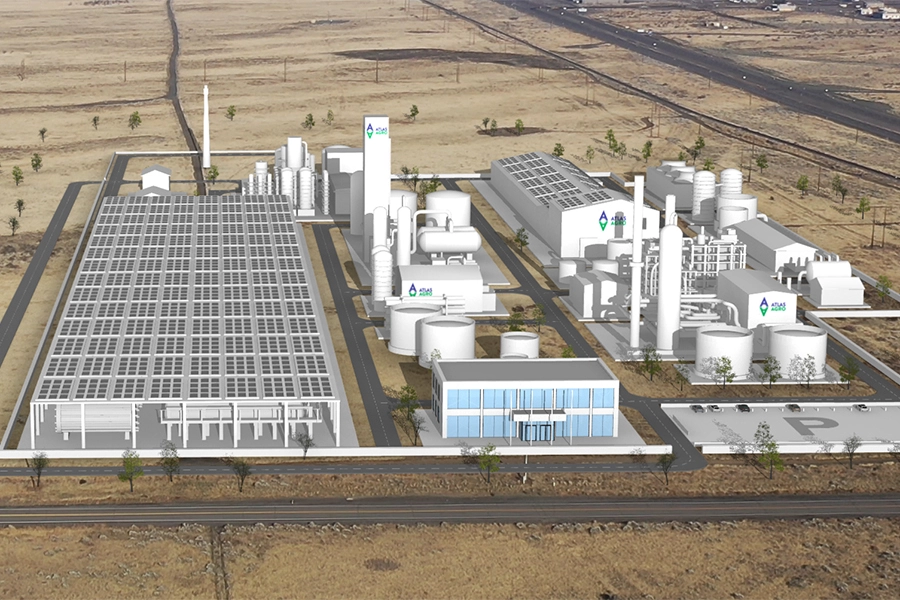

Scatec joins ACME’s Oman green ammonia project

Julian Atchison March 08, 2022

Scatec will enter into a 50:50 joint venture with ACME to design, develop, build, own and operate a planned large-scale, green ammonia facility in the Duqm Special Economic Zone of Oman. At full capacity the facility will produce 1.2 million tonnes of green ammonia per year, and the partners aspire to be “one of the first” commercial green ammonia facilities operating in the world. Advanced discussions for long-term off-take are already in progress. The project was launched last March by ACME and Oman government authority Tatweer, and added KBR as technology partner last October.

Article

Green ammonia in Trinidad & Tobago

Julian Atchison January 27, 2022

KBR has been awarded a study to help establish a green hydrogen economy in the dual-island nation. Repurposing of Trinidad & Tobago's existing industrial infrastructure - particularly grey hydrogen & ammonia production facilities - will be a key focus. Trinidad & Tobago occupies a crucial role in the global ammonia supply chain, but its reliance on grey hydrogen means that declining gas reserves and spiraling gas import prices have created shortfalls, with some ammonia production suspended and plants closed. A green ammonia project led by NewGen Energy will develop a 130 MW, solar-powered electrolyser facility in Point Lisas, and feed the state-owned Tringen I & II ammonia production plants 27,200 tonnes per year of green hydrogen feedstock.

Article

KBR selected as technology partner for Oman green ammonia project

Julian Atchison October 25, 2021

ACME has selected KBR to provide ammonia synthesis technology for its new green hydrogen & ammonia production facility to be built in Duqm, Oman. The project was first announced in March 2021, and has now grown to $3.5 billion in investment size, with energy to be provided by 3 GW of solar panels and 0.5 GW onshore wind power. The 2,400 tonnes per day (or 0.9 million tonnes per year) renewable ammonia facility is planned to be operational in 2022.

Article

The Ammonia Wrap: ICE announces its new green ammonia "SuperGiant", Cummins and KBR team up on integrated solutions, a new green ammonia pilot in Minnesota and decarbonisation of existing plants in Russia

Julian Atchison May 19, 2021

Welcome to the Ammonia Wrap: a summary of all the latest announcements, news items and publications about ammonia energy. There's so much news this edition that we're bringing you two, special Wrap articles. Our first focuses on ammonia production - both existing and new build plants. This week: InterContinental Energy to build 25 GW of green ammonia production in Oman, Cummins and KBR to collaborate on integrated green ammonia solutions, New green ammonia pilot plant for Minnesota, Stamicarbon launches new technology for sustainable fertilizer production in Kenya, Haldor Topsoe and Shchekinoazot to explore ammonia plant decarbonisation in Russia, 1 million tonne blue ammonia per year in Norway and Trammo announces off-take MoU for 2GW AustriaEnergy plant in Chile.

Article

Ammonia infrastructure: panel wrap-up from the 2020 Ammonia Energy Conference

Julian Atchison January 22, 2021

Infrastructure is key to realising the full potential of ammonia energy, enabling new markets and expanding the existing ones. By 2050 the hydrogen (and by extension, ammonia) market could be 20 times larger than it is today. What future possibilities are there to expand global ammonia production (currently 180 million tonnes per year) or trade volumes across the world’s oceans (currently 18 million tonnes per year)? On November 18, 2020, the Ammonia Energy Association (AEA) hosted a panel discussion moderated by Daniel Morris from KBR, as well as panel members Anthony Teo from DNV GL, Oliver Hatfield from Argus Media, and Michael Goff from Black & Veatch as part of the recent Ammonia Energy Conference. The panel’s insights from a number of different perspectives - market analytics, ship building and operating, as well as pipeline engineering - demonstrated ammonia's potential to become a low- or zero-carbon fuel of choice for the future. Current infrastructure can be adapted, new infrastructure can be built and operated cheaply, and lessons from previous fuel transitions can be taken on board to make the uptake of ammonia energy as smooth as possible.

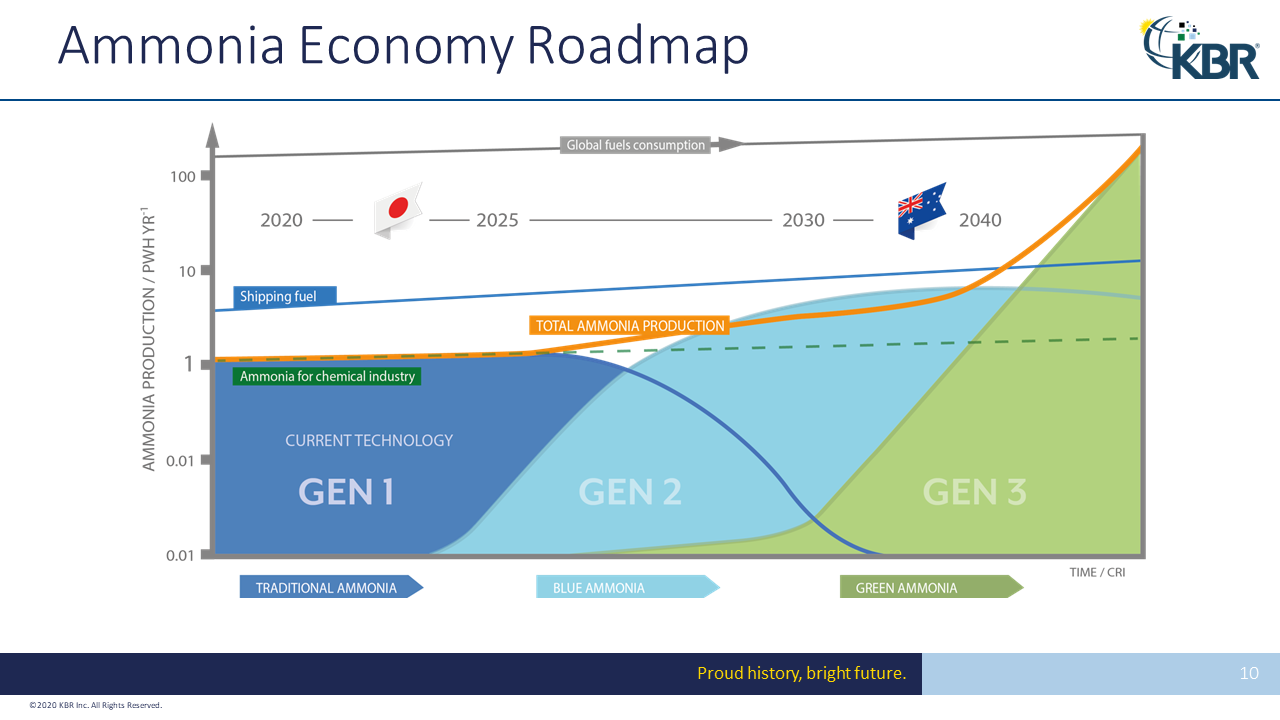

Presentation

Ammonia Asset Transition for New Markets

With over $900 billion worth of assets at risk of being stranded by the energy transition, operators must act now in order to compete in the future. Ammonia, as an already widely traded commodity, may prove to be the vehicle to deliver decarbonised gas resources ahead of a completed transition. Reimagining how we deliver energy is essential to people, planet and economy. Blue ammonia offers a step to realise national gas monetization objectives with the utopia of green ammonia. This presentation with showcase the challenges and opportunities that await and how well we are prepared.

Article

All together now: every major ammonia technology licensor is working on renewable ammonia

Trevor Brown June 01, 2018

The second annual Power to Ammonia conference, which took place earlier this month in Rotterdam, was a tremendous success. It was again hosted by Proton Ventures, the Dutch engineering firm and mini-ammonia-plant pioneer, and had roughly twice as many attendees as last year with the same extremely high quality of presentations (it is always an honor for me to speak alongside the technical wizards and economic innovators who represent the world of ammonia energy). However, for me, the most exciting part of this year's event was the fact that, for the first time at an ammonia energy conference, all four of the major ammonia technology licensors were represented. With Casale, Haldor Topsoe, ThyssenKrupp, and KBR all developing designs for integration of their ammonia synthesis technologies with renewable powered electrolyzers, green ammonia is now clearly established as a commercial prospect.