September 10–14 gave us five remarkable events both evidencing and advancing the rise of hydrogen in transportation and energy. Any one of them would have made it a significant week; together they make a sea change.

Content Related to Toyota

Article

Toyota, 7-Eleven to Cooperate on Low-Carbon Convenience Stores

Stephen H. Crolius June 28, 2018

Last month, one Ammonia Energy post discussed Toyota’s participation in a Low-Carbon Hydrogen Project in its home prefecture -- including implicit support for ammonia as a hydrogen carrier. Another post discussed Japanese manufacturer IHI’s plans to commercialize a small-scale combined heat and power system (micro CHP) based on direct ammonia solid oxide fuel cell technology. Now, according to a June 6 Toyota Motor Corporation press release, Toyota and micro CHP have converged. The announcement served as the unveiling of a “joint project” by Toyota and the convenience store chain 7-Eleven to develop “next-generation convenience stores aiming to considerably reduce CO2 emissions.” The two companies initially agreed to cooperate in August 2017 on "considerations toward energy conservation and carbon dioxide emission reduction in store distribution and operation.”

Article

Toyota Supports H2 Society Roll-Out on Its Home Turf; Sees Role for NH3

Stephen H. Crolius May 03, 2018

Toyota Motor Corporation announced on April 25 the launch of an effort called the Chita City and Toyota City Renewable Energy-Use Low-Carbon Hydrogen Project. According to the company’s press release, the project is intended as a step toward “the realization of a hydrogen-based society spanning the entire region through mutual coordination and all-inclusive efforts.” For ammonia energy advocates, the announcement had two elements of particular significance. First is the clear indication that Toyota Motor Corporation is embracing ammonia as a hydrogen carrier – although not as a motor fuel. Second is the project’s stated intention to establish a “system in which Aichi Prefecture certifies low-carbon hydrogen objectively and fairly.”

Article

H2@Scale in California: A Role for Ammonia?

Stephen H. Crolius January 25, 2018

The U.S. Department of Energy H2@Scale program’s November 2017 workshop in California included mention of ammonia as a constituent of a future hydrogen economy. It also highlighted the relevance ammonia energy could have in California. California stands out globally as a large economy that is strongly committed to development of a hydrogen economy. The state’s strategy for hydrogen-powered transportation involves reducing the production cost of renewable hydrogen and the capital and operating costs of hydrogen fueling stations. It does not explicitly address the cost of intermediate hydrogen logistics. The question of cost is of utmost importance because California has so far put $120 million of public funds into hydrogen fueling stations and intends to invest an additional $20 million per year through 2022. The state’s aspiration is to move to a point where hydrogen that is used as a motor fuel is free of public subsidy. So it clearly behooves the state to investigate how ammonia could be used as a cost-reducing energy carrier. Toyota is active in California’s hydrogen movement and has announced plans to build a renewable hydrogen plant that will use cow manure as a feedstock. A project with a different conception, one that draws upon the solar and wind resources of the Mojave Desert to produce renewable hydrogen and logistically advantaged ammonia, would align better with the state’s sustainability objectives.

Article

On the Ground in Japan: FCV Uptake and Hydrogen Fueling Stations

Stephen H. Crolius June 01, 2017

Module four of the ten-module research and development agenda for Japan’s Cross-Ministerial Strategic Innovation Promotion Program -- Energy Carriers is entitled “Basic Technology for Hydrogen Station Utilizing Ammonia.” The rationale for including this technology is that “high purity H2 supply system with low cost hydrogen transportation is a key issue to spread fuel cell vehicles (FCVs).” A story published last week in the Tokyo Shimbun says that to date FCVs have not spread very far. Among the factors seen as constraints is the cost of hydrogen fueling stations (HFS). The Tokyo Shimbun story states that “according to industry officials, each station that supplies hydrogen to fuel cell vehicles runs about ¥400 million ($3.6 million) in construction costs. In order to achieve profitability, about 1,000 fuel cell vehicles are required as customers per location. Construction is not proceeding.” So far, the players focused on FCVs do not seem to be looking to ammonia as an expedient that will help reduce the cost of HFS and thereby encourage their construction and by extension the uptake of FCVs. This appears to be a missed opportunity whose benefits may become too compelling to ignore.

Article

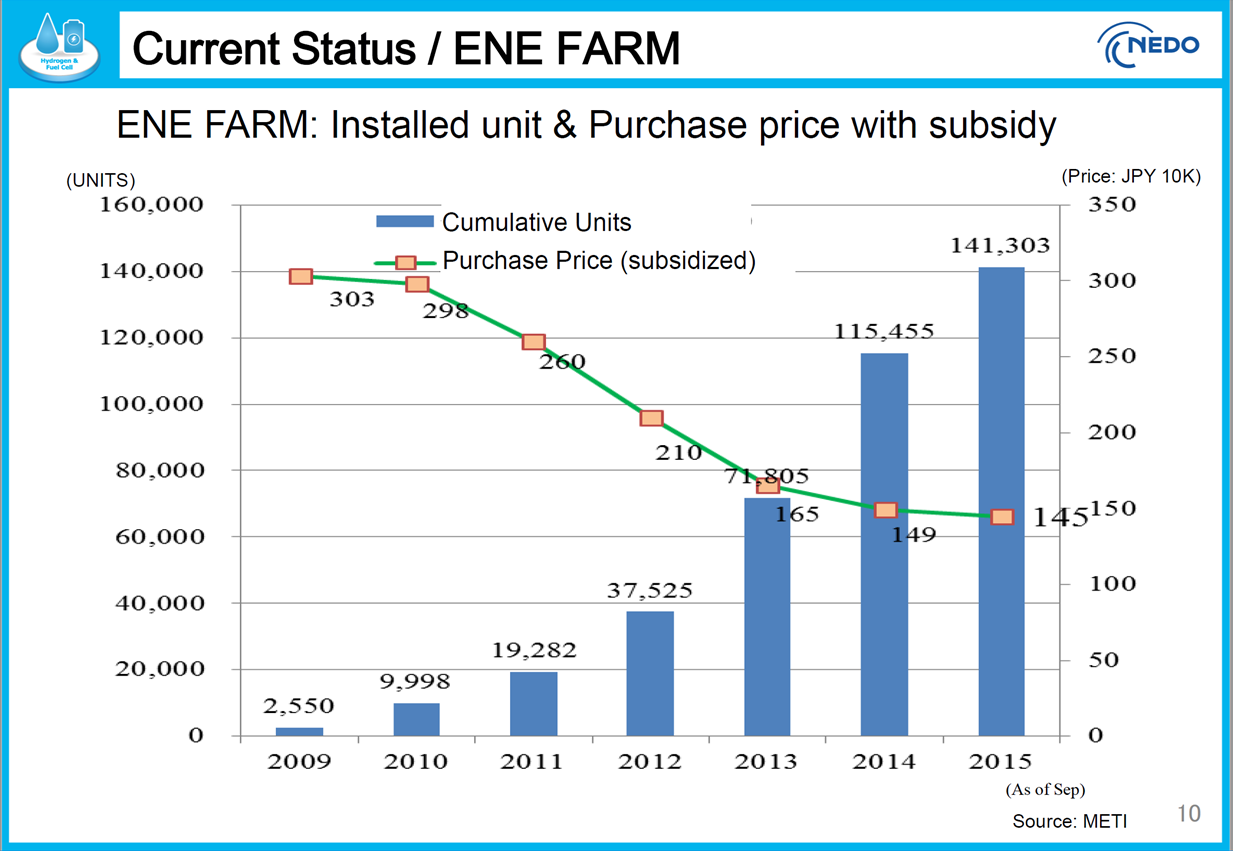

On the Ground in Japan: Residential Fuel Cells

Stephen H. Crolius May 18, 2017

Last week Kaden Watch, a Japanese Web site for appliance news, reported that Tokyo Gas had delivered its 80,000th Ene Farm residential fuel cell system. This small news item, delivered by a niche media outlet, lifts a critical corner of the decidedly “big-tent” story of Japan’s strategy to develop a hydrogen-based energy economy. How the Ene Farm topic develops is likely to be a major factor in Japan’s ability to sustain its hydrogen vision -- and possibly a determinant of the role ammonia could play within it.

Article

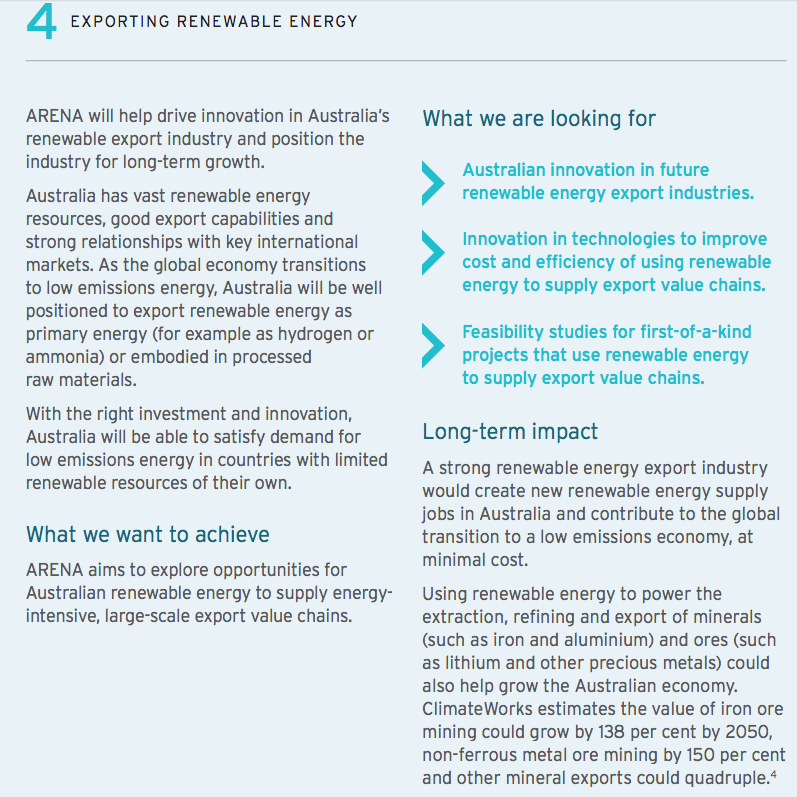

CSIRO Membrane: Ammonia to High-Purity Hydrogen

Trevor Brown May 05, 2017

In Australia this week, CSIRO announced funding for the "final stages of development" of its metal membrane technology to produce high-purity hydrogen from ammonia. The two year research project aims to get the technology "ready for commercial deployment," with industrial partners including Toyota and Hyundai.