Yara’s green ammonia project YURI gets further boosts

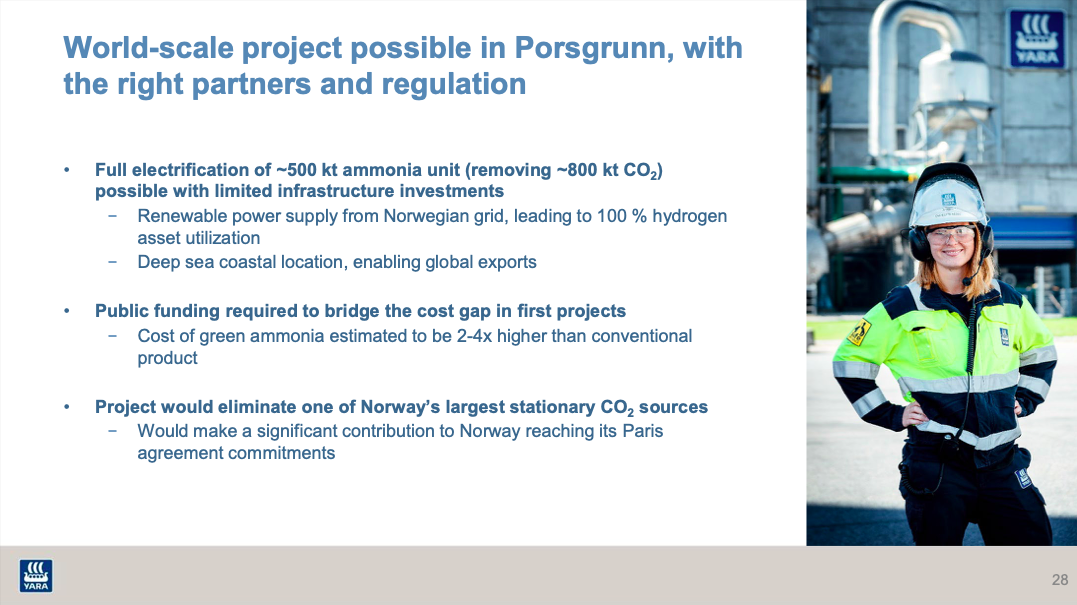

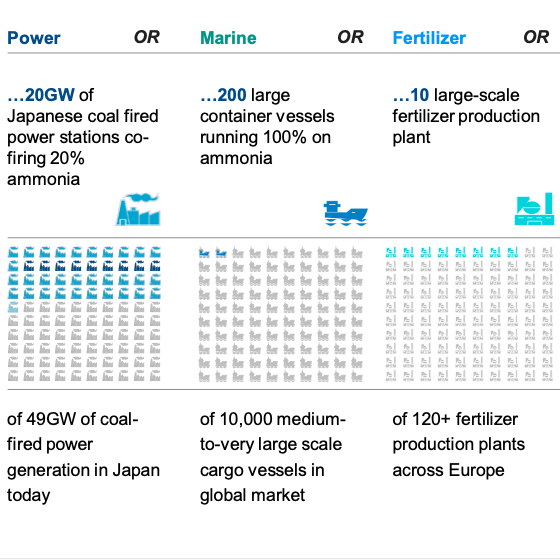

There were two new funding announcements last week concerning Yara’s YURI renewable ammonia project, to be built next to their Pilbara fertiliser plant in Western Australia. The Pilbara ammonia plant is an ideal demonstration site for green hydrogen and green ammonia at an industrial scale. This export-oriented plant has an annual capacity of 850,000 tons per year of ammonia, representing about 5% of the world’s merchant ammonia supply, and while the current site uses natural gas as fuel and feedstock it is situated adjacent to rich solar and wind energy resources. These announcements show that interest in YURI is strong from Australian local, state, and federal governments, with more funding opportunities in the pipeline.