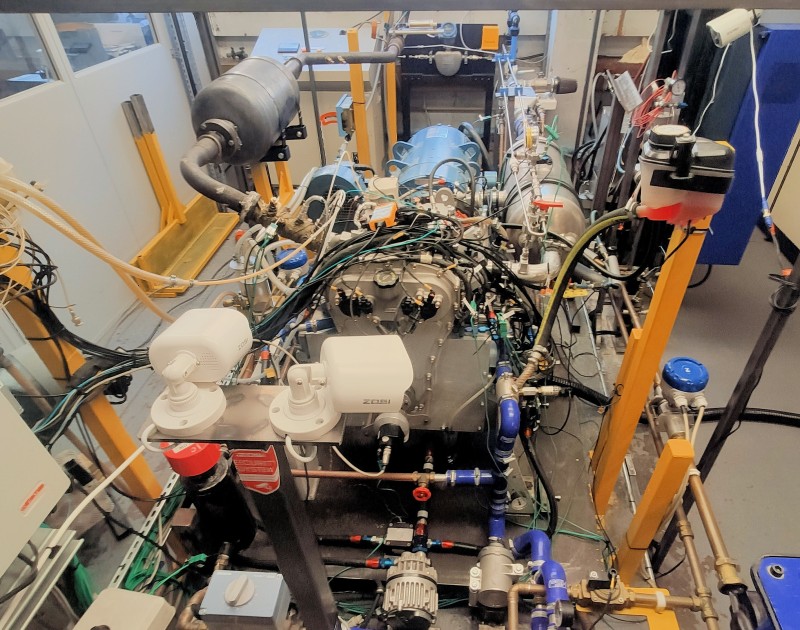

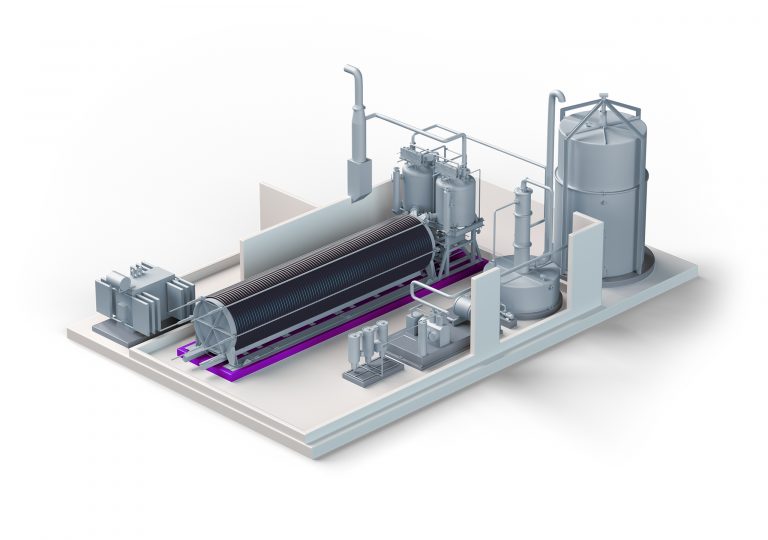

The UK government will fund a new red diesel replacement project from engine developers MAHLE Powertrain and partners Clean Air Power and the University of Nottingham. The trio will demonstrate decarbonisation of heavy duty engines using ammonia and hydrogen fuel, or a blend of the two. Fortescue Future Industries and Liebherr are also involved in the decarbonisation of the UK construction sector, with agreements on hydrogen fuel supply & engine development signed last October. Fuel cells also enter this mix, with AFC Energy currently rolling out off-grid, ammonia-powered gensets on construction sites in London and Madrid.

Europe

Skovgaard renewable ammonia project orders electrolysers from Nel

The consortium developing the Skovgaard ammonia project has ordered an alkaline electrolyser system from Nel, bringing the 10 MW plant a step closer to reality. Skovgaard will be an important test case for hydrogen production directly from renewable energy, with no battery storage or firming to be used.

In other electrolyser news, German-based Sunfire and US-based Electric Hydrogen have received new funding to develop their technologies. Also in Germany, Siemens and Air Liquide will join forces to develop a GW-sized factory in Berlin, with 3 GW of PEM electrolyser units to be manufactured annually by 2025.

AmmoniaDrive

The University of Amsterdam and TU Delft will lead an academic-industry consortium that will determine the feasibility of combining ammonia-fed solid-oxide fuel cells with internal combustion engines for maritime propulsion. The AmmoniaDrive project just received over €2 million in support from the Dutch government, and is the latest in a series of hybrid and fuel cell-based propulsion projects using ammonia as an onboard fuel.

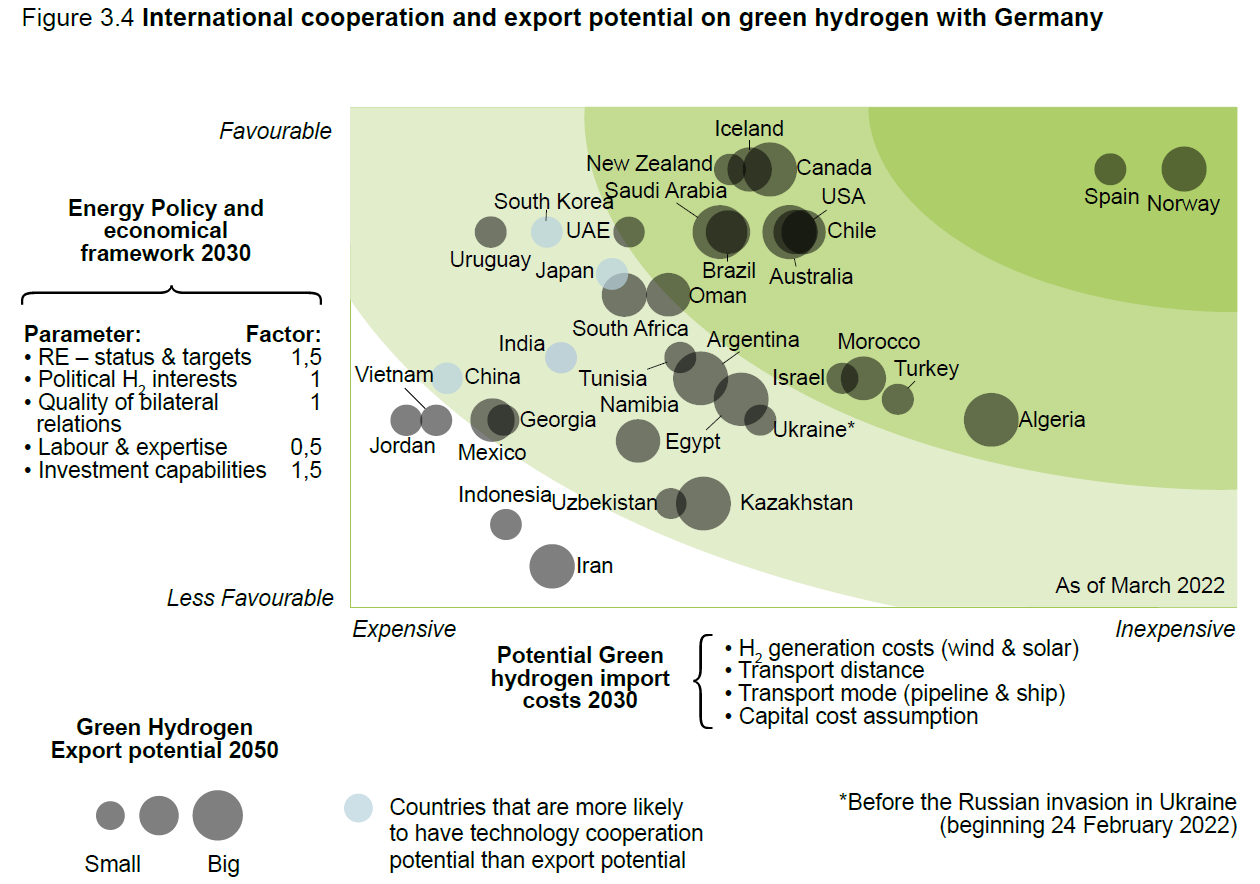

New roadmap for ammonia imports into Germany

A Fortescue-led Australian-German business coalition has released a roadmap and ten-point action plan to meet ambitious ammonia import targets for Germany. Policy recommendations on the EU and Australian side of the emerging supply chain include financial support to address the first-mover disadvantage. Guidehouse have laid out recommendations of their own in a new report, which finds maritime shipping of ammonia over long distance is the best import option, and that - ideally - hydrogen derivatives should be shipped into Germany in the form required by end users, saving on reconversion costs.

Meanwhile in Copenhagen, EU Commission Executive Vice-President Frans Timmermans has backed the shipping industry to make the transition faster than expected, with ammonia to be the “future fuel”.

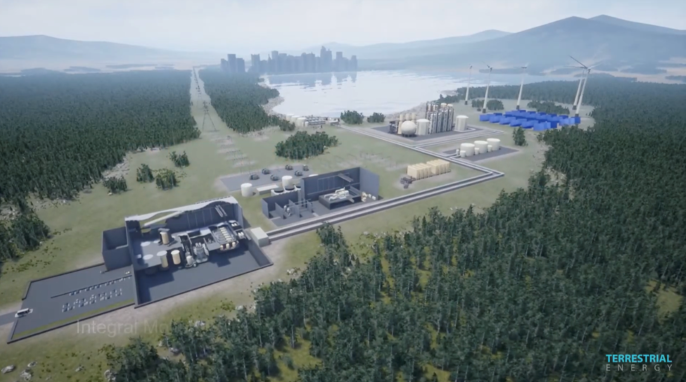

Nuclear-powered ammonia production

The potential for nuclear-powered ammonia production is developing fast. Two seperate industrial consortia (Copenhagen Atomics, Alfa Larval & Topsoe, and KBR & Terrestrial Energy) have formed to develop thorium-fueled reactors, and hydrogen & ammonia production is a key part of their plans. Given nuclear electricity dominates France’s energy mix, a grid-connected electrolyser project at Borealis’ fertiliser production plant in Ottmarsheim, France will be one of the first examples of commercial-scale, nuclear-powered ammonia production. And, while capital costs & lead times remain significant, mass production of new technologies and research into flexible power production capabilities are emerging as key to unlocking nuclear-powered ammonia production.

Ammonia energy funding & acquisitions

SK Innovation has led a successful $46 million capital funding round for New York-based Amogy. The new funds will go towards two ammonia-powered, heavy vehicle demonstration projects: an eighteen-wheel tractor trailer, and an ocean-going cargo ship. H2SITE has closed a successful €12.5 million Series A funding round led by Breakthrough Energy Ventures to expand manufacturing capacity in Spain, and Sweden-based organisation Alfa Laval will acquire RenCat’s patented ammonia reforming technology.