South America

The mining industry: a driving force behind green ammonia

ANNUAL REVIEW 2019: Ammonia is too often assumed to be only a fertilizer. This assumption overlooks other important uses for the chemical, large and small, in every corner of our economy. Some of the recent green ammonia announcements suggest that these other industries might, in fact, present better economic fundamentals for green ammonia investments than the fertilizer industry. Alternatively, these companies might have set their sights on becoming first movers in developing the commodities of the future. Time will tell but, if the last 12 months is any guide, the mining industry could be a force for change in the ammonia industry.

Green Ammonia Plants in Chile, Australia, New Zealand

Green ammonia plants are being announced quicker than I can report. Here is a summary of four new projects that propose to use electrolyzers, fed by renewable power, to produce hydrogen for ammonia production. These are big companies, operating in regions with excellent renewable resources, making significant investments in their future. In Chile, it is Enaex, a major ammonium nitrate manufacturer, supplying explosives to the mining industry. In Australia, it is Incitec Pivot, "the second largest supplier of explosives products and services in the world," and Wesfarmers, "the largest Australian company by revenue," according to Wikipedia. In New Zealand, it is Ballance-Agri Nutrients, a big farmers' co-operative and the country's sole fertilizer producer. Each aims to make its business "future-proof." The transition from fossil ammonia to renewable ammonia is underway.

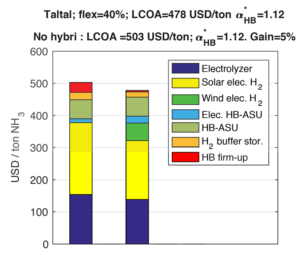

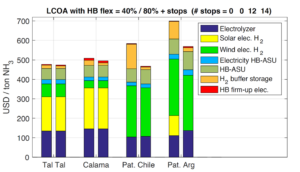

Study Models NH3 Economics from Variable Energy Resources

Last week IEA Consultant Julien Armijo and IEA Senior Analyst Cédric Philibert submitted their study Flexible Production of Green Hydrogen and Ammonia from Variable Solar and Wind Energy: Case Study of Chile and Argentina to the International Journal of Hydrogen Energy and concurrently posted it on ResearchGate. The study addresses one of the key questions of the energy transition: what are the economics of producing hydrogen, or a hydrogen carrier such as ammonia, at sites with excellent renewable energy resources? The answer, framed in terms of the cost-competitiveness in local markets of green ammonia vs. conventionally produced brown ammonia, casts an encouraging light on the eventual prospects for international trade in green ammonia as an energy commodity.

IEA Completes Two Power-to-Ammonia Reports

The International Energy Agency has completed two reports that examine the economics of hydrogen and ammonia production based on wind and solar electricity generation. Both reports were written by IEA Consultant Julien Armijo under the supervision of IEA Senior Analyst Cédric Philibert. One focuses on China and formalizes the findings and conclusions that were the subject of a February 2019 Ammonia Energy post. The other focuses on Chile and Argentina. Both reports cast an encouraging light on the near-term cost-competitiveness of green ammonia vs. conventionally produced brown ammonia in specific national markets.

The Hydrogen Consensus

Let’s say there is such a thing as the “hydrogen consensus.” Most fundamentally, the consensus holds that hydrogen will be at the center of the sustainable energy economy of the future. By definition, hydrogen from fossil fuels will be off the table. Hydrogen from biomass will be on the table but the amount that can be derived sustainably will be limited by finite resources like land and water. This will leave a yawning gap (in the U.S., 60-70% of total energy consumption) that will be filled with the major renewables -- wind, solar, and geothermal -- and nuclear energy. This may be as far as the consensus goes today, but more detail is now emerging on the global system of production and use that could animate a hydrogen economy.