Small-scale ammonia production is the next big thing

By Trevor Brown on May 11, 2018

Over the last few years, world-scale ammonia plants have been built, restarted, and relocated across the US. The last of these mega-projects began operations at Freeport in Texas last month. No more new ammonia plants are currently under construction in the US, and the received industry wisdom is that no more will begin construction.

However, project developers and ammonia start-ups did not get this memo. With low natural gas prices persisting, they have not stopped announcing plans to build new plants. The difference is that the next tranche of new ammonia plants breaking ground will not be world-scale but regional-scale, with production capacities of perhaps only one tenth the industry standard. Despite using fossil feed stocks, these plants will set new efficiency and emissions standards for small-scale ammonia plants, and demonstrate novel business models that will profoundly alter the future industry landscape for sustainable ammonia technologies.

Ammonia plant capacity trends in the US

The newest natural gas-fed world-scale ammonia plant began operations about a year ago at Wever, Iowa. Unfortunately, many aspects of this project went wrong – primarily, it was two years behind schedule and at least $1 billion over budget. Similar, if lesser, problems plagued the other new ammonia plants, with cost over-runs and delays tarnishing new plants at Waggaman, Donaldsonville, and Port Neal, and almost bankrupting LSB Industries at El Dorado. The outcome of all this industry expansion? Additional new world-scale plants are now, to a great extent, no longer financeable in the US: lenders have no reason to trust the industry to stay on budget or on schedule.

For some decades, the trend in ammonia plant design has been toward bigger and ever-bigger plants, to maximise the theoretical efficiencies of scale. Unfortunately, the most efficient ammonia plant might be cheap in relative terms, but it has become so big and expensive in absolute terms that it is now too big to build.

Now, therefore, a new trend is developing toward smaller plants. These may not be the most efficient but they are big enough to serve a regional market and they represent a viable business model. Crucially, smaller plants cost less and may actually be fundable.

Small-scale ammonia: proven technology, profitable business model

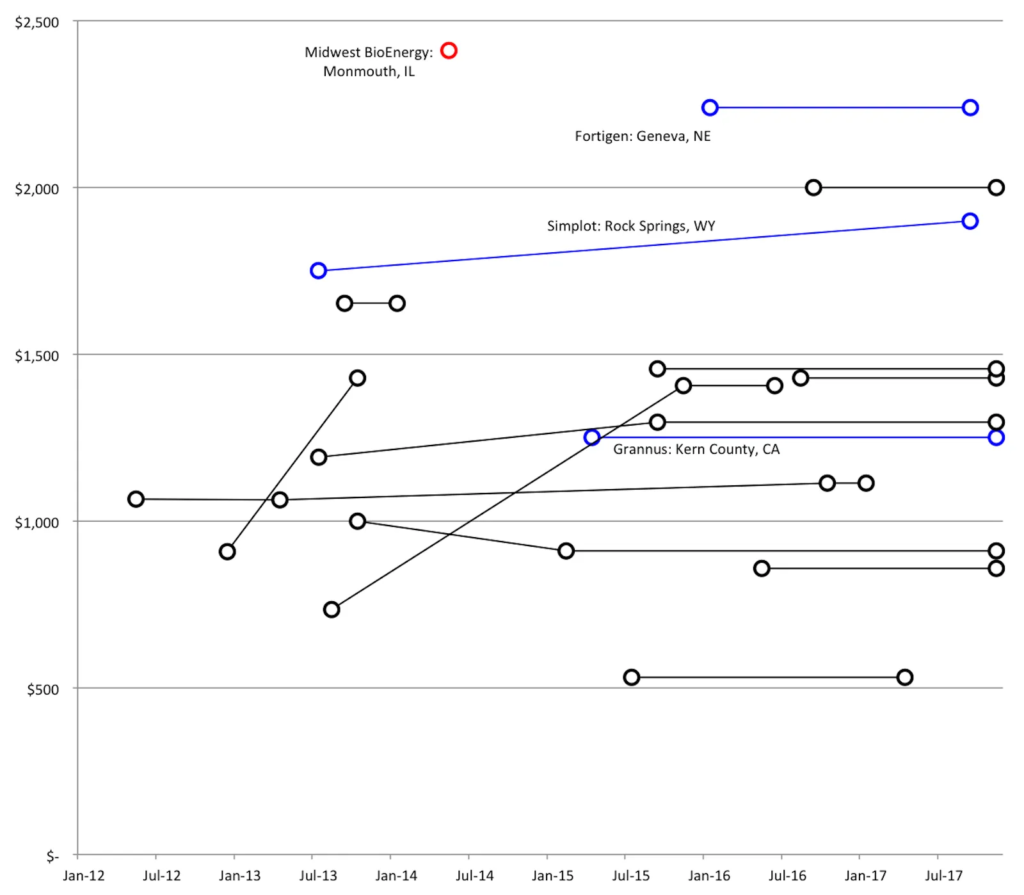

I wrote a few months ago about the Capital Intensity of Small-scale Ammonia Plants, with a focus on how two newly-constructed ammonia plants succeed as viable commercial projects despite their “expensive” small-scale production economics. These were Simplot’s 200,000 ton per year plant at Rock Springs, WY, and Fortigen’s 30,000 ton per year plant at Geneva, NE.

To support the economics of the projects, both of these small, regional-scale plants, have pre-sold all of their product. In Simplot’s case, the demand is captive, upgrading Simplot’s own phosphates to MAP fertilizer, and no longer purchasing that quantity of ammonia in the market. In Fortigen’s case, all the product is contracted to be purchased by a local farmers’ co-operative. Both projects demonstrate the regional business model: they succeed in a captive market, competing with a more expensive product by avoiding the costs of transportation from cheaper production regions.

Within the last few months, three additional regional-scale ammonia projects have made announcements. Each of these projects has already raised millions of dollars in funding, either through seed equity or venture capital, and each puts forward a strong business case for regional-scale ammonia.

Greenfield Nitrogen (Garner, Iowa)

Greenfield Nitrogen‘s proposed 120,000 ton per year ammonia plant “will serve the agricultural community within a 100-mile radius and produce enough ammonia to meet one third of the expected [regional] shortfall and approximately 1-2% of overall [national] nitrogen imports.”

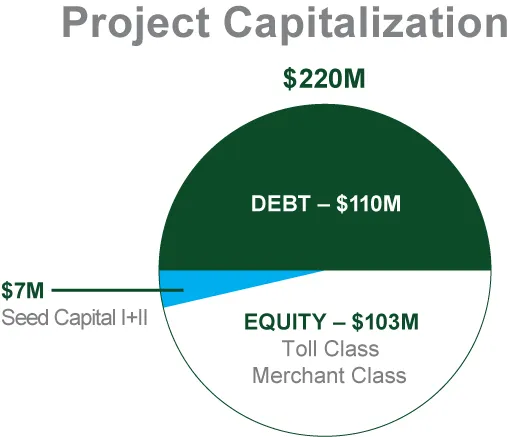

The project recently launched an equity drive, aiming for participation from farmers and agricultural retailers. With a total cost of $220 million, the capital intensity of this new ammonia capacity would be under $1,900 per ton, less than both the Simplot and Fortigen plants.

This would be the first US plant to use the Linde Ammonia Concept, which packages Linde’s fossil feed stock preparation technologies with Casale’s ammonia synthesis technology. The great benefit of this is that it allows for modular, off-site construction – avoiding the need for construction to take place in the Iowa winter, and derisking the project for investors.

BayoTech (no demonstration plant announced yet)

Last month, BayoTech announced that it had closed its $12.5 million Series B round of financing, allowing it “to expand the company’s infrastructure and complete the commercialization of its technology.” Importantly, it also announced that one of the participants in the funding round was “one of the world’s largest fertilizer companies … BayoTech’s new strategic partner, a significant player in the global fertilizer marketplace.”

The Nested-flow reactors offer improved temperature management, energy efficiency and production scalability for both Steam Methane Reforming (SMR) and Water Shift Reaction (WSR), the two primary processes used for industrial production of hydrogen. The Nested-flow technology will improve the energy efficiency of natural gas production of hydrogen from today’s energy conversion of 63% and 73% (for 20 ton/day and 100 ton/day respectively) to an energy efficiency of nearly 90%, while maintaining this efficiency to production levels of less than 0.1 ton/day …

The natural gas required to produce a ton of ammonia is reduced by 25%. The capital cost on a per ton basis is reduced by 30% and the physical footprint on a per ton basis is reduced by 70%. CO2 Green House Gas emissions are reduced by 25% and when distribution emissions are factored in the savings jumps to 80%.

Bayotech website, accessed 05/10/2018

BayoTech hasn’t yet announced a demonstration plant. However, its business model appears to be more focused on engineering and technology licensing, rather than making and selling ammonia.

Grannus (Kern County, California)

Grannus is also developing a modular, scalable engineering package for regional-scale ammonia plants. However, its business model has two further twists.

First, these will be “polygeneration plants,” which simply means that they will sell multiple products, in this instance, ammonia, CO2, and electricity. Second, the EPA recently designated Grannus’s technology as BACT (Best Available Control Technology) for both hydrogen production and ammonia production. [To be granted a construction permit, a new plant generally must demonstrate that it uses the best technology for emitting the least pollutants; BACT provides the methodology for defining this highest acceptable emission limit.] The Grannus BACT designation means that any other new ammonia plant proposed in the US must meet or exceed Grannus’s emission limits. Given that this is a zero-emission ammonia plant, the Grannus BACT sets a high bar for any other project.

Grannus’ revolutionary natural gas to syngas technology and manufacturing plant design produces nitrogen fertilizer and generates power while emitting virtually no criteria pollutants … Combining partial oxidation (POX) combustion, power generation and zero emissions (100% carbon utilization), these next generation plants reduce natural gas consumption by up to 30% allowing for reduced operational costs. Built locally through our network of Tier 1 engineering, procurement and construction partners, Grannus designed plants are sized to fulfill regional fertilizer demand thereby eliminating the cost and risk of long-distance sourcing.

Grannus website, accessed 05/10/2018

Grannus is a venture capital-backed start-up, and it intends to build “the first ever, zero emissions combined fertilizer & thermal power plant,” with a commercial-scale demonstration in Kern County, California. The Grannus technology package includes hydrogen technology from Air Liquide (the Lurgi partial oxidation process), ammonia technology from Haldor Topsoe, and its own patent (US 9,957,161 awarded this month) to link these systems and produce electricity.

From small-scale fossil ammonia, to small-scale green ammonia

While each of these projects relies on natural gas usage, each will demonstrate the viability of small-scale ammonia synthesis technologies. One benefit of reducing the ammonia plant size is that it better matches the scale of renewable power generation. As these technologies move forward and become proven, investment in green ammonia production will equally become derisked.

You can also read the full article at AmmoniaIndustry.com