Carbon Capture Set to Advance in the U.S.

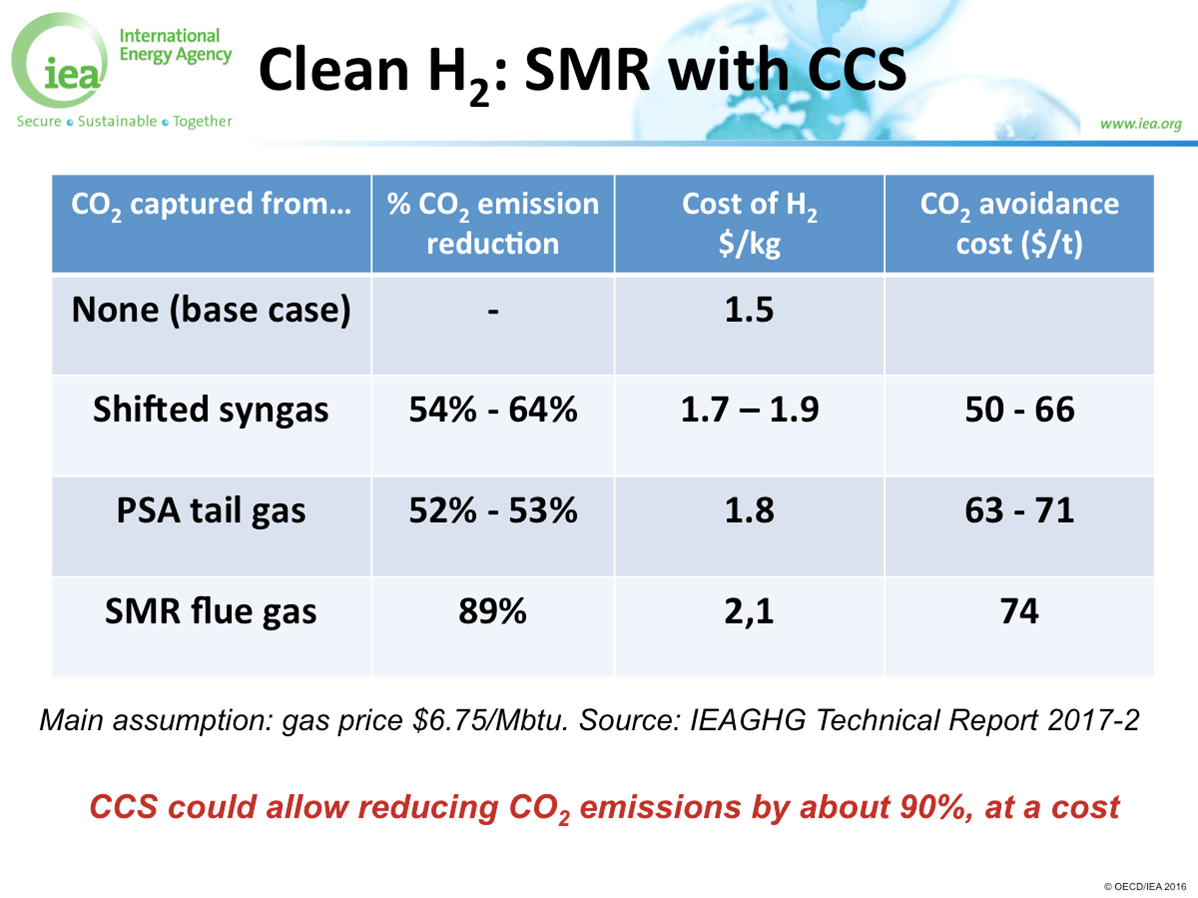

The United States Congress passed a measure on February 9 that could galvanize the production of low-carbon ammonia in the U.S. The measure, included within the Bipartisan Budget Act of 2018, amends Section 45Q of the Internal Revenue Code, titled “Credit for Carbon Dioxide Sequestration”. That section, originally adopted in 2008, created a framework of tax credits for carbon capture and sequestration. 45Q’s impact in the intervening years has been minimal, an outcome attributed by experts to the relatively low prices assigned to CO2 sequestration and the fact that tax credits would be allowed only for the first 75 million tonnes of sequestered CO2. The new legislation increases the tax credit per tonne of CO2 placed in secure geological storage from $20 to $50, and for CO2 used for enhanced oil recovery from $10 to $35. It eliminates the credits cap altogether. With these changes, it now seems possible that low-carbon ammonia could find itself on an equal economic footing with “fossil” ammonia – and this could have consequences well beyond American agricultural markets.