Australian, Canadian producers to supply ammonia for power generation to South Korea

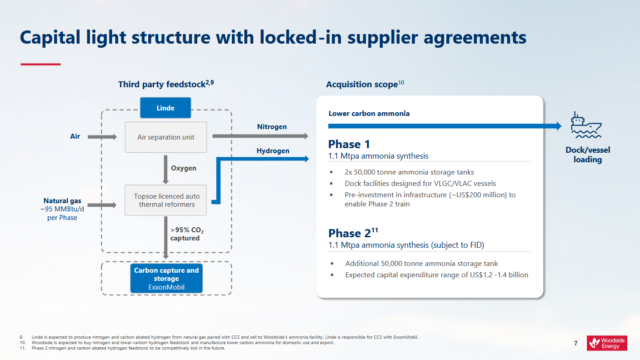

Australia-based Pilot Energy has been approved as a potential low-emission ammonia fuel supplier under the newly-implemented Clean Hydrogen Production Standard (CHPS) scheme in Korea. In Alberta, Korea Southern Power will work with Hydrogen Canada Corporation to jointly develop a 1 million tons per year ammonia production facility.