Ammonia policy in Australia

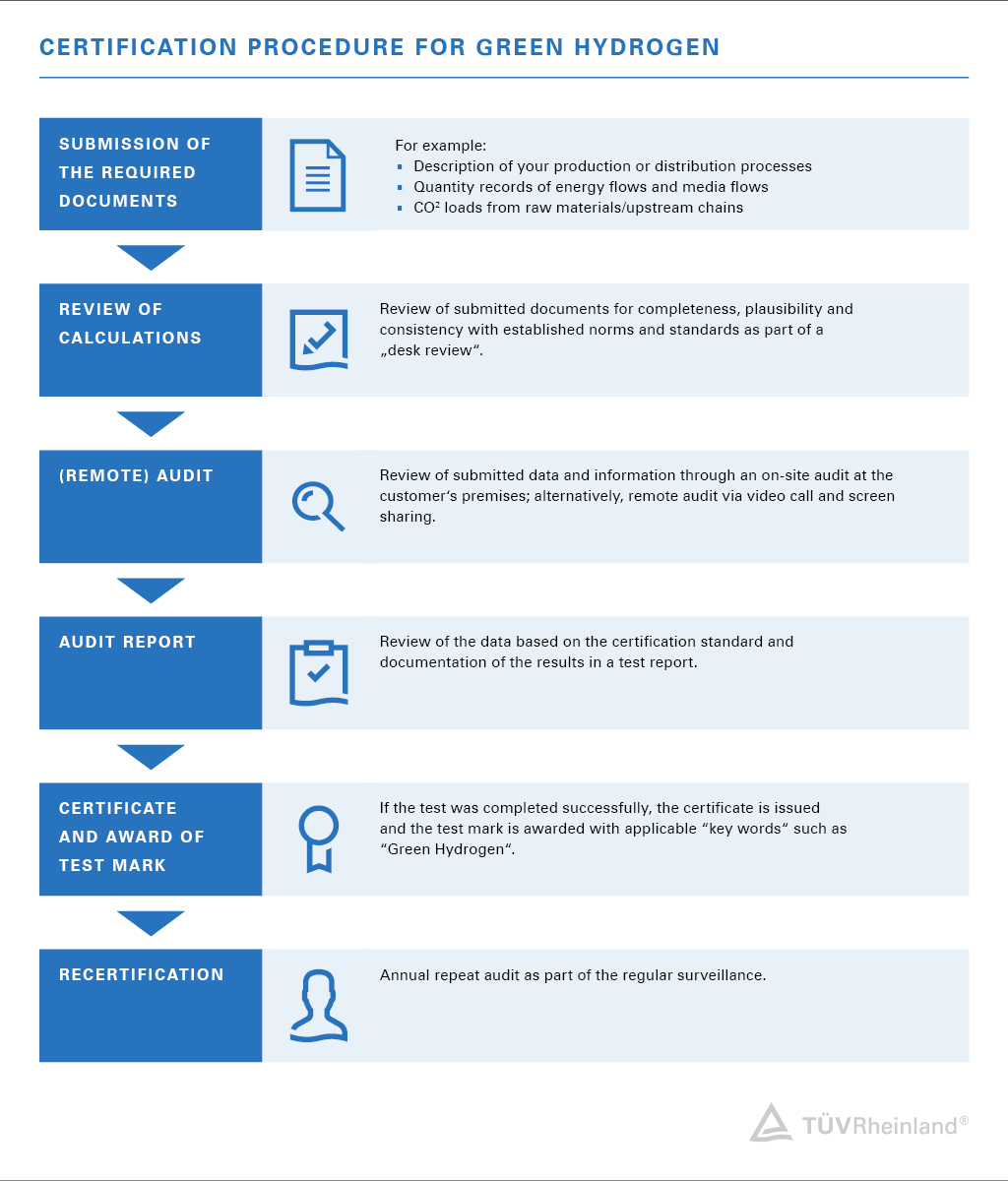

Concrete steps are being taken on ammonia and ammonia-related policy in Australia. In late 2021, the New South Wales state government launched its Hydrogen Strategy, adding to the list of state-based strategies announced around the country. There is also a high level of industry interest within NSW to develop significant hydrogen (and ammonia) hubs, and renewable energy generation. Federally, all eyes are on the Clean Energy Regulator as they develop the Guarantee of Origin certification scheme, which is soon to begin looking at low and zero-carbon ammonia production. To explore how these policy pieces are coming together, we welcome Matt Baumgurtel (Hamilton Locke), Michael Probert (NSW OECC), Cameron Mathie (CER), Dane Halstead (FFI) and panel chair Andrea Valentini (Argus Media). We also welcome Argus Media as Ruby Sponsors of this year’s conference. Join us in-person or online at 9AM on Thursday 25 August to learn more.