What drives new investments in low-carbon ammonia production? One million tons per day demand

By Trevor Brown on April 20, 2018

Last week, the International Maritime Organization (IMO) formally adopted its Initial GHG Strategy. This means that the shipping industry has committed to “reduce the total annual GHG emissions by at least 50% by 2050,” and completely “phase them out, as soon as possible in this century.”

This also means that a global industry is searching for a very large quantity of carbon-free liquid fuel, with a production and distribution infrastructure that can be scaled up within decades. The most viable option is ammonia. How much would be required? Roughly one million tons of ammonia per day.

The Paris Agreement was structured around national commitments to reduce emissions within each country’s borders and so, while it included every other industry sector, it excluded shipping, which is regulated at the international level. Now, the IMO’s commitment to reduce carbon emissions is designed to bring the international shipping sector in line with the Paris Agreement.

The IMO, part of the United Nations, has already demonstrated its ability to drive global change, with its 2020 cap on the sulphur content of fuel currently causing ripples throughout global refineries and bunker supply chains.

From the perspective of a potential new alternative fuel, it is important to recognize that the IMO is a single, global, self-regulating entity. In other alternative fuel sectors, market penetration is hampered by the splintering of codes and regulations and incentives between dozens of jurisdictions – Europe, the UK, the US, California, China – increasing the complexity of broad adoption, and increasing costs through lost economies of scale. In shipping, however, one organization sets the rules (enforcement is another question).

The IMO’s commitment to deep decarbonization is quite clear:

Levels of ambition directing the Initial Strategy are as follows …

• to reduce CO2 emissions per transport work, as an average across international shipping, by at least 40% by 2030, pursuing efforts towards 70% by 2050, compared to 2008; and

• to peak GHG emissions from international shipping as soon as possible and to reduce the total annual GHG emissions by at least 50% by 2050 compared to 2008 whilst pursuing efforts towards phasing them out as called for in the Vision as a point on a pathway of CO2 emissions reduction consistent with the Paris Agreement temperature goals.

IMO press briefing, UN body adopts climate change strategy for shipping, 04/13/2018

How much maritime fuel market share could ammonia capture?

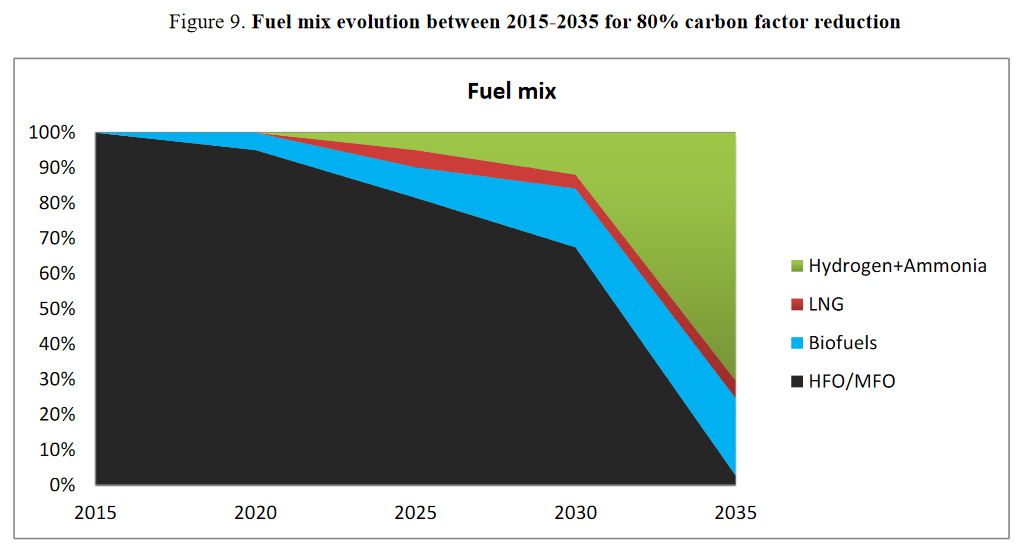

Last month, the OECD published a report demonstrating that it would be feasible to scale-up low-carbon ammonia production and deploy ammonia fuel technology swiftly enough “to almost completely decarbonise maritime shipping by 2035.”

In the OECD’s decarbonization scenario, “hydrogen and ammonia will form around 70% of the mix of ship. This, along with the increase in the uptake of biofuels (22%) and LNG (5%), could diminish the use of oil-based fossil fuels significantly to around 3% by 2035.”

As I wrote in my analysis of the OECD report last month, this scenario assumes a “high uptake of alternative fuels such as advanced biofuels, hydrogen, and ammonia,” but excludes carbon-based synthetic fuels, even though the report considers methanol in detail. Although methanol is a viable fuel and, unlike ammonia, already commercially demonstrated, its carbon content renders it inadequate to the task of decarbonization.

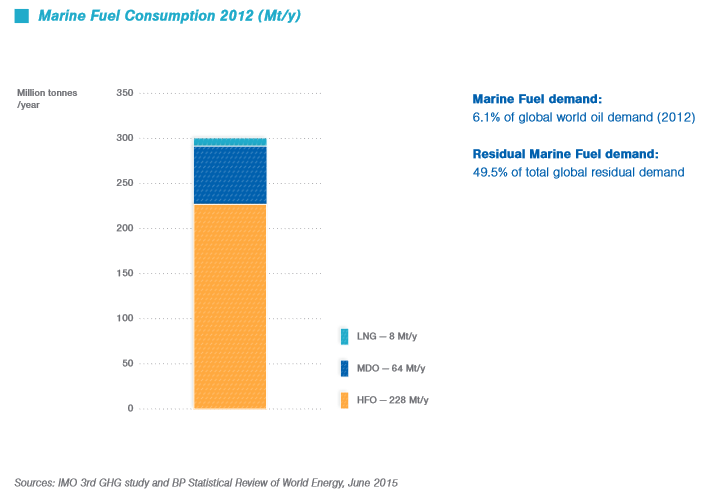

How big is this potential market?

The bunker fuel market is roughly 300 million tons per year. If ammonia were to capture a 70% mix of ship, as per the OECD decarbonization scenario, this would require global production of roughly 450 million tons of ammonia per year (assuming energy densities of 40.6 GJ and 18.6 GJ for HFO and ammonia respectively).

For simplicity, I’ll round this number down to a million tons of ammonia per day. And, of course, this is in addition to all the existing markets for ammonia, which currently consume approximately half that, or 180 million tons per year.

Is ammonia every really going to be adopted as a fuel?

This week, a new report published by IRENA (the International Renewable Energy Agency), in collaboration with the IEA (International Energy Agency) and REN21 (Renewable Energy Policy Network for the 21st Century), lays out policy advice for the 156 national governments that the organization serves.

Its “overall recommendation” for international policy support for renewable fuels is “to focus on the development of ammonia for the shipping sector.” I’ve been writing about this subject for six years and I’ve never seen such an unequivocal statement in support of broad investments in ammonia fuel research, development, and deployment.

Shipping is one of the fastest growing transport sub sectors. It is inherently the most efficient means of transporting cargo across the globe. The shipping sector mainly uses heavy fuels that contain sulphur and heavy metals, which increases the sector’s already large carbon and environmental footprint. Along with aviation, it is one of the hardest transport sub sectors to decarbonise …

Power to X, or P2X, refers to any technology that converts electricity to a gaseous or liquid energy carrier. Electrolysis converts electricity to hydrogen to use directly as a fuel or to react with either carbon (in the form of CO2 or carbon monoxide) or nitrogen to produce a range of gaseous or liquid fuels (e.g. methane, ammonia, methanol, Fischer-Tropsch diesel, formic acid and hydrocarbons) … Developing P2X is crucial because it plays a key role in decarbonising long haul road transport, aviation and shipping sectors that are difficult to decarbonize …

The overall recommendation for developing P2X is to focus on the development of ammonia for the shipping sector as well as long haul road transport, where few or no competing low carbon technologies exist and P2X is expected to be economically viable.

Renewable Energy Policies in a Time of Transition, IRENA, April 2018

What does this look like for ammonia producers?

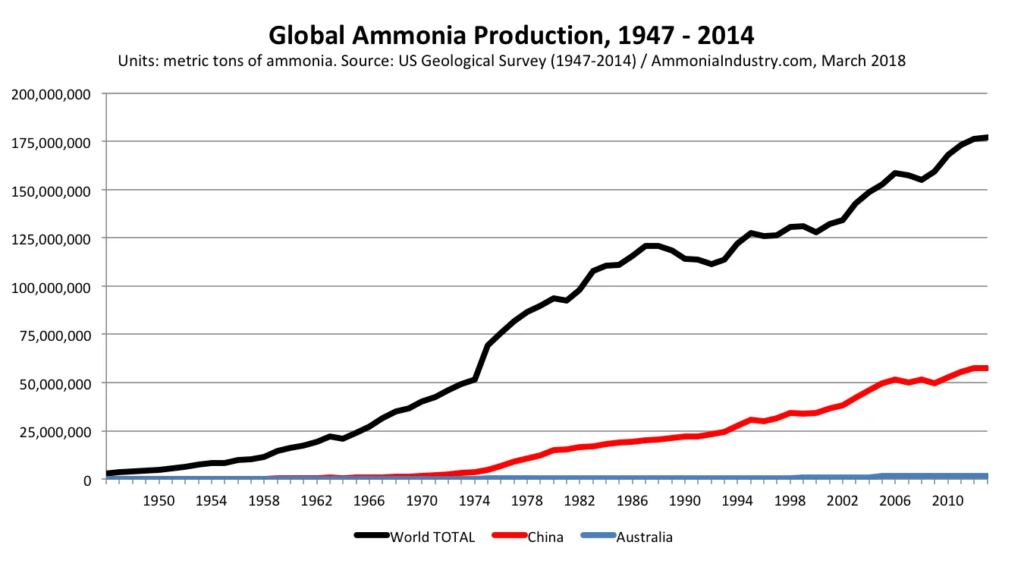

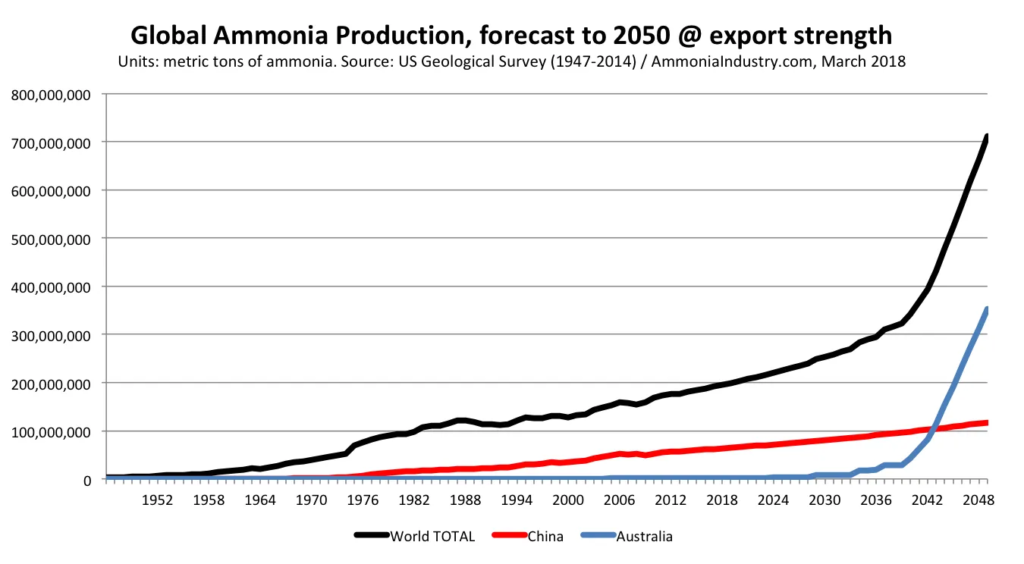

The following chart shows the US Geological Survey’s annual global ammonia production data. For perspective, I’ve included country data for China and Australia.

The Green Revolution gave the ammonia industry thirty years of steep growth, with an 8.5% compound annual growth rate from the late 1950s through the late 1980s. Over the last twenty years, growth was more subdued, ticking along at about 2% growth.

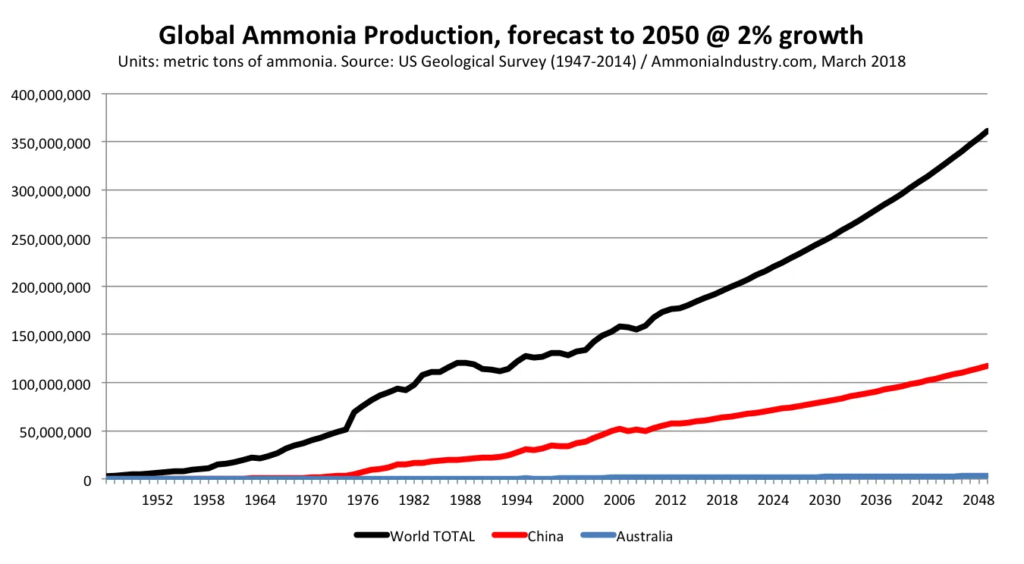

If we want to look into the future, we can make a simple projection based on that 2% growth continuing through 2050, and we’ll see that global ammonia production will almost exactly double, from 180 million tons per year in 2015 to 360 million tons per year in 2050.

But what would this chart look like if ammonia production was being expanded to meet the demand of the shipping industry with a 70% mix of ship?

A year ago, I wrote about a project in discussions by Siemens to deploy 500 GW of solar generation to produce renewable ammonia. This would be in the Pilbara, in Western Australia, and it would take up about 10,000 km2 or 20% of the desert.

With an electrolyzer system feeding Haber-Bosch ammonia synthesis plants, in total consuming approximately 12 MWh per ton ammonia, 500 GWs is all you would need to produce one million tons of ammonia per day. In the energy industry, 500 GW is not a very big deal – but in the fertilizer industry, it changes everything.

Six months ago, I wrote about another solar project, also in the Pilbara, where Yara is working on its solar ammonia pilot plant. If this project scales up, it would ultimately focus on the “integration of ammonia … in the world market of renewable fuel production.”

Yara has, in the last few weeks, publicly committed to developing energy markets for ammonia, stating in its 2017 Annual Report its intention to establish “a leading position on de-carbonized ammonia production combined with a business model of ammonia as an energy carrier.”

The IMO’s Initial GHG Strategy creates a level of regulatory certainty, and the shipping industry promises a big new market opportunity. All of a sudden, the strategy of companies like Yara and Siemens to invest in demonstration projects for carbon-free ammonia production is looking like good business.

You can also read the full article at AmmoniaIndustry.com.