A Roadmap for The Green Hydrogen Economy in the Northern Netherlands

By Trevor Brown on June 15, 2018

A number of green ammonia projects have been announced in the Netherlands since the influential Power-to-Ammonia feasibility study was published in early 2017. Perhaps the most important publication since then, however, is the roadmap published by The Northern Netherlands Innovation Board, The Green Hydrogen Economy in the Northern Netherlands. Its scope, including sections written by consultants from ING, Rabobank, and Accenture, goes well beyond the standard techno-economic analysis and presents a cogent plan for coordinated development of “production projects, markets, infrastructure and societal issues.”

Green ammonia features heavily throughout the roadmap, which calls for the construction of 300,000 tons per year of renewable ammonia production in Delfzijl by 2024, as well as for large-scale imports of green ammonia, starting in 2021, which would provide low-cost delivery and storage of carbon-free fuel, cracked into hydrogen, for the Magnum power plant.

This vision document for a green hydrogen economy in the Northern Netherlands is the result of a collaborative process among industry, governments and organizations, initiated and led by members of the Northern Netherlands Innovation Board …

ING’s Economics Department analyzed the effect of decreases in gas production on the economy of the Northern Netherlands. Rabobank prepared an initial financial model to assess the viability of the construction and operation of electrolysis and biomass gasification for production of green hydrogen. Accenture has analyzed how the realization of a green hydrogen economy in the Northern Netherlands should be organized.

The Northern Netherlands Innovation Board: The Green Hydrogen Economy in the Northern Netherlands, October 2017

Economics of Renewable Hydrogen

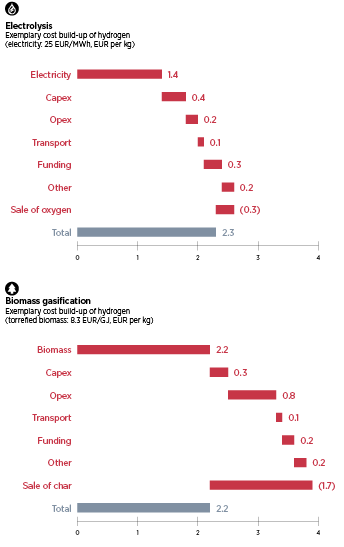

The report contains significant financial analysis on how green hydrogen can be produced at industrial scale, either from biomass gasification or water electrolysis, at a cost of EUR 2.20 to 2.30 per kg. This price would make green hydrogen competitive with traditional fossil-fueled steam methane reformation (SMR) process, and would open new markets for green chemicals, fertilizers, energy storage, and fuel.

The tremendous value of this report is its transparency: it includes two pages of financial assumptions in support of this hydrogen price model.

The numbers are certainly forward-looking, which is appropriate (the renewable electricity input price of 25 EUR/MWh cannot easily be found in Europe today), but they are painstakingly researched and referenced.

Now that prices for large-scale renewable electricity production have come down so dramatically and will continue to decrease even further in the near future, the challenge remaining is how to transport this cheap renewable energy from the places where it is produced to the centers of demand. The renewable energy has to be transported around the world, which can only be done by electrolysis of water with electricity. This hydrogen can be compressed or even turned into liquid and then shipped. With nitrogen captured from the air, the hydrogen could also be converted into ammonia. Ammonia is liquid at around 10 bar and therefore easier to transport.

The Northern Netherlands Innovation Board: The Green Hydrogen Economy in the Northern Netherlands, October 2017

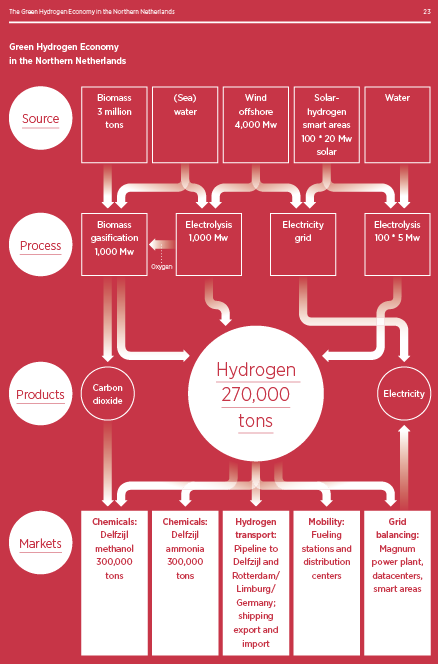

270,000 Tons of Renewable Hydrogen

The decarbonization of Western Europe calls for the development of vast quantities of offshore wind. In the Netherlands, this electricity, delivered onshore via an underwater cable, significantly exceeds the existing demand in the electricity sector, so the “surplus” (which is only “surplus” relative to today’s electricity market structure) enables the electrification and decarbonization of industry.

The roadmap calls for 4 GW of offshore wind to be developed, enabling the operation of a 1 GW electrolyzer unit, from which 60,000 tons of hydrogen will produce 300,000 tons of green ammonia per year. These numbers represent an ambitious but achievable scaling-up of renewable energy technologies in the coming years, and they rely on the chemical industry absorbing all the green hydrogen feed stock that is available in the early years of the project, producing both green ammonia and green methanol.

Large-scale hydrogen production must be achieved in order to reach competitive hydrogen prices of 2 to 3 euros per kg. A sufficient amount of hydrogen must be produced to economically justify retrofitting an existing gas pipeline into a dedicated hydrogen pipeline and infrastructure system. The first market for green hydrogen, therefore, must be the chemical industry, where hydrogen is used as a feed stock to make chemical products like ammonia and methanol. This chemical feed stock market can absorb the volume of hydrogen being produced. With green hydrogen, the chemical industry can decarbonize their chemical products and thereby contribute to the greenhouse gas emission reduction which was agreed upon in Paris …

There is already a methanol production plant at the chemical industry site in Delfzijl. In the past, natural gas was used to produce methanol, but today, there is a bio-methanol production plant: BioMCN, which is owned by OCI … Ammonia is primarily used to produce fertilizers, but it is also used in a variety of other pharmaceutical and chemical products. At Delamine in Delfzijl, ammonia is used to produce ethylene amines. At present, the ammonia is imported by train, but it can be produced from green hydrogen and nitrogen on site.

The Northern Netherlands Innovation Board: The Green Hydrogen Economy in the Northern Netherlands, October 2017

The Roadmap for Green Hydrogen and Ammonia

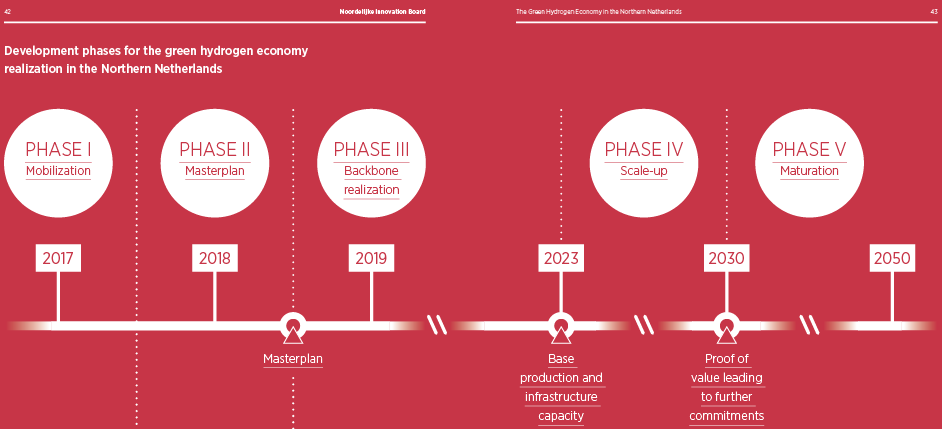

We are now in the “Masterplan” phase of the project, running through 2018, devoted to Production Development, Infrastructure Development, Market Development, Stakeholder Management, and “Alignment with initiatives connected to large-scale RES realization and regulatory framework development for hydrogen, and the development of (pilot) hydrogen projects and consortia.”

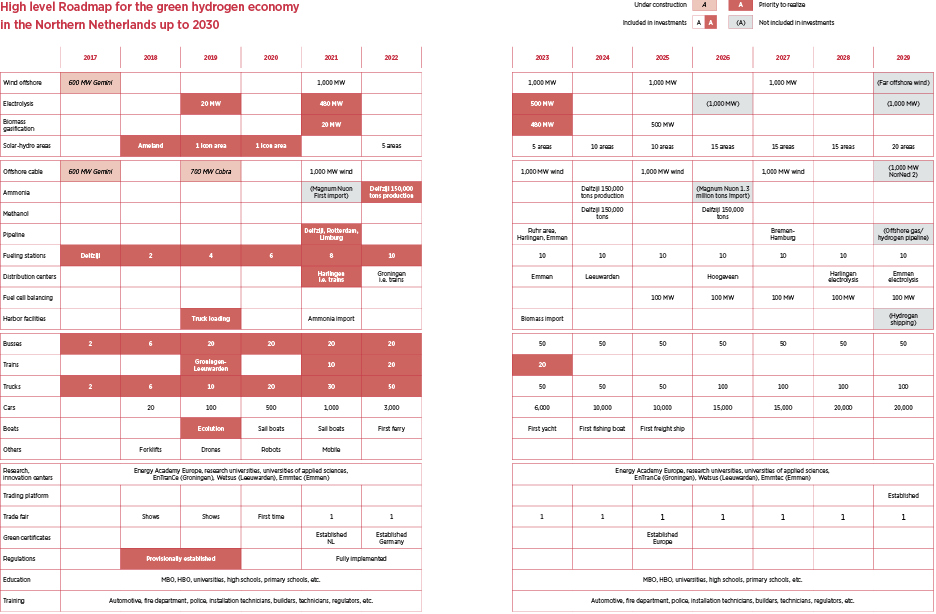

For the full specifics, by product/market and by year, the report provides a detailed two-page spread of its roadmap:

The roadmap calls for a new ammonia plant, using renewable hydrogen to produce green ammonia, to be built in two phases in Delfzijl. The first phase (150,000 tons per year) will be online by 2022 and is identified as a priority area for realization; the second phase (also 150,000 tons per year) is projected to be online by 2024, for a total estimated investment of 600 million EUR.

In addition, Dutch utility Nuon intends to begin importing green ammonia as carbon-free fuel for its Magnum power plant. Imports are expected to start in 2021, and increase significantly up to the rate of 1.3 million tons per year of green ammonia by 2026, solely for power generation at this single location.

This master plan needs to be developed from mid-2017 to mid-2018 and should be led by a Green Hydrogen Ambassador in combination with strong program coordination …

Accenture concluded that a green hydrogen economy can only be realized by a well-coordinated and tightly directed approach by companies and governments working together. Companies need to make the investments, but governments need to create the right conditions.

The Northern Netherlands Innovation Board: The Green Hydrogen Economy in the Northern Netherlands, October 2017

You can also read the full article at AmmoniaIndustry.com