Ammonia Flash Cracking and Energy Development in Southern Africa

By Stephen H. Crolius on March 09, 2018

In July 2017 Yara International, the world’s largest ammonia producer, and the Mozambican Ministry of Mineral Resources and Energy “signed a memorandum of understanding for the production of fertilizers from the natural gas extracted in the Rovuma basin in the northern province of Cabo Delgado,” according to an official statement. This announcement from southern Africa’s Indian Ocean coast mirrored one six years earlier from a Japanese group on plans to build an ammonia plant on Angola’s Atlantic coast.

Expansion of ammonia production in sub-Saharan Africa is enabled by the development of heretofore unexploited natural gas resources. The main impetus is the opportunity to secure foreign exchange via export of LNG to Northern Hemisphere markets, but local production of ammonia serves a widely recognized imperative to increase regional agricultural productivity. Fertilizer use has been constrained by the high price of nitrogenous commodities in southern Africa relative to global norms. Expanding regional production could lead to a virtuous cycle of investment in distribution assets, decreasing costs and prices, and increasing uptake by farmers.

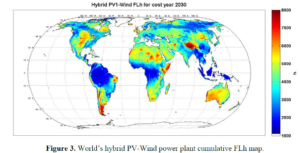

This raises an interesting possibility: what if less-developed parts of southern Africa were to substantially skip the construction of a fossil-based energy infrastructure and leapfrog to an infrastructure based on renewable energy resources? Certainly southern Africa is on the list of the world’s special places that have strong endowments of both solar and wind resources. As reported previously in Ammonia Energy, the locales on this list could become the powerhouse energy producers of the future. So if southern Africa has that potential, why not start building out the regional economy in a way that positions ammonia as a universal energy commodity?

This idea may or may not be under consideration in relevant quarters, but Tower Power Ltd., a British start-up company, is working to develop a beachhead use case for ammonia energy. Tower Power’s idea is to deploy ammonia-fueled systems to power cell phone towers in locations that lack reliable – or any – grid-based electrical service. The company is the successor to Diverse Energy Ltd., which went out of business in 2012. Prior to its demise, Diverse Energy had developed a free-standing distributed generation system based on proton-exchange membrane (PEM) fuel cells. The system employed an integrated ammonia cracker to supply the hydrogen.

In an interview this week with Ammonia Energy, Ron Hodkinson, a founder of both Diverse Energy and Tower Power, said that he got the idea for the cell tower power station from a former colleague who had gone on to launch a variety of mobile-phone service providers in Africa. “He mentioned he was having problems obtaining energy in remote places,” Hodkinson said. As recorded in a later Diverse Energy report to a funding agency, “The benchmark [for powering off-grid cell towers] is the polluting diesel generator technology which is unreliable and requires high maintenance . . .” At the same time, Africa “shares a similar high taxation policy on diesel with the EU, [while] theft and adulteration of diesel fuel [are] widespread.”

Diverse Energy, which previously had conducted fuel-cell related research, decided to accept the challenge. The company was able to raise capital from a British investment firm and a grant from the European Commission’s Joint Technology Initiative on Hydrogen and Fuel Cells. By the end of 2011, the company had completed system development and had made arrangements with the cellular telephone providers MTC and LEO for a full-scale, on-the-ground trial in Namibia. By the end of March 2012, the product, dubbed the “PowerCube,” was installed at four sites. Ammonia was supplied by the industrial gas distributor Linde Afrox. The trial was judged a technical and economic success. LEO’s successor company continued to use the PowerCubes through 2013 and only stopped because of the termination of the ammonia supply arrangement.

Unfortunately, while Diverse Energy was at work on the development of the PowerCube, Hodkinson said, the cell phone industry was transitioning to a new generation of cell towers whose power requirements were approximately an order of magnitude greater than those of the previous generation. Diverse Energy thus found itself in 2012 with a technically successful system that did not meet its targeted customers’ updated requirements. The company’s subsequent scramble for the capital needed to develop a next-generation PowerCube stretched into 2013 but did not ultimately bear fruit.

In 2014, Hodkinson said, he “collected the wreckage of the old company” and brought it under the umbrella of a company he had formed in 2011: Tower Power Ltd. In the years since, Tower Power picked up where Diverse Energy left off in the development of ammonia-fueled cell tower power systems. In its current incarnation, known as the ToWER/CuBE, the product consists of a fuel cell module, an ammonia cracker and gas separator module, and a control module, all arranged inside a ten-foot shipping container. Also included is an ammonia storage tank that extends 12 meters into the air and doubles as the mast for the telecommunications antennae.

Although Hodkinson has a deep background in fuel cell technology, the fuel cell module is purchased from an outside vendor. Tower Power’s main area of proprietary expertise is ammonia cracking. Many groups have developed functional ammonia crackers. Hodkinson says Tower Power’s technology is distinctive in its compact size and quick ramp-up/ramp-down capabilities. He refers to the company’s approach as “flash cracking.” It employs a specially designed assembly of catalyst-coated metal tubes that can be quickly brought up to functional temperature with an induction heating system.

The company’s website says that “successful prototypes of the ToWER/CuBE™ have been built and tested in the field and we can already achieve a 37.5% lower cost of ownership and 60% lower operational cost (based on 2.5kW Customer Output Power over a 5 yr period) than currently deployed Diesel equivalent.”

Hodkinson says that the company is close to securing the capital it will need to return to the African market with its ToWER/CuBE system. The first phase of the reentry will involve placing the new system at Diverse Energy’s four original Namibian sites. This will be followed by expansion to other sites in Namibia and then to sites in other African countries. The target for the continent is 1,300 systems. Thereafter, the company intends to expand into other parts of the developing world such as India.

Tower Power’s vision does not end there, however. Hodkinson believes the company’s ammonia cracking system, with its rapid cold-start capability, could compete in the fuel cell vehicle market as an alternative to fueling with high-pressure hydrogen. He says that the company is well-positioned to enter this market arena too, based on the years devoted to advanced powerplant technologies by Hodkinson and his Tower Power co-founders. The company already has a profile with certain European automotive manufacturers, Hodkinson said. “We know the industry intimately.”