Ammonia Featured in Hydrogen Europe Roadmaps Report

By Stephen H. Crolius on December 21, 2018

By definition, members of the ammonia energy community see ammonia as the preferred form of hydrogen in many applications. Until recently, this view was not shared by most members of the hydrogen energy community. Where there was awareness at all, ammonia was often seen as dangerous or irrelevant. However, since the middle years of this decade a transition has been occurring. Lack of awareness and wariness (let’s call this stage 1) are giving way to interest in and exploration of ammonia’s potential role in discrete applications (stage 2). At some point, we may arrive at a third stage. This will be characterized by the design of sustainable energy systems that have been cost-optimized with ammonia as a staple energy commodity. In this scenario, elemental hydrogen will be the supporting player that appears only in discrete contexts.

Hydrogen, Enabling a Zero Emission Europe, Technology Roadmaps, a report released in September 2018 by the advocacy group Hydrogen Europe, perfectly exemplifies the stage 2 mindset. Ammonia energy is discussed in a handful of instances as a narrow-scope expedient. To be sure, the report implies, ammonia could be a part of the solution. But it also might not pan out at all.

Founded in 2008 as the New Energy World Industry Grouping, Hydrogen Europe describes itself as “an umbrella association representing . . . European Industry [111 companies, including Ammonia Energy Association member ITM Power], Research [69 institutions], and National and Regional Associations [13 entities] in the Hydrogen and Fuel Cell sector.” The group’s current scope of activity, per its Web site, includes 229 active projects.

Most critically, Hydrogen Europe is an equal partner with the European Commission in the Fuel Cell and Hydrogen Joint Undertaking (FCH JU). The FCH JU was brought under the European Union’s Horizon 2020 R&D framework in 2014. Its budget in the 2014-2020 period was €1.3 billion (USD$1.5 billion), provided “on a matched basis.”

Hydrogen Europe’s Hydrogen, Enabling a Zero Emission Europe report is oriented toward a new phase of effort that will commence in 2021. It calls for funding of €8.7 billion (USD$9.9 billion) through 2027 that can mobilize an additional €43.3 billion (USD$49.2 billion) of industry investment through 2030. This spending is to be allocated across 22 roadmaps, with the goal of showing “the key steps to achieve the vision, and the role for EU budget support” in each one.

The dynamic for ammonia within the report is illustrated in the juxtaposition of roadmaps 6, 7, and 8. Roadmap 6 focuses on “Transport of H2 by road, etc.,” with “H2” meaning elemental hydrogen exclusively. The set-up statement is clear about the challenges posed by elemental hydrogen:

Centralised hydrogen production may achieve lower production costs but delivering H2 poses unique challenges due to its low volumetric density. A mature market has already been established in the road transport of compressed gaseous H2. However, H2 transport remains limited by high costs and geographical distance.

Hydrogen Europe, Hydrogen, Enabling a Zero Emission Europe: Technology Roadmaps, September 2018

Therefore, “to improve large-scale H2 distribution, key focus areas for development are high pressure tube trailers, liquid H2 storage and H2 distribution via pipelines” — which focus areas are to be addressed via an extensive research program. But then, in spite of the apparent ambition of the effort, a mere €37 million (USD$42 million) – 0.4% of the investment budget – is designated for spending on this roadmap.

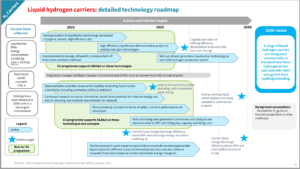

Roadmap 7 continues with the theme of transporting hydrogen, but now the focus is on liquid hydrogen carriers (including still more coverage of liquid hydrogen itself). This roadmap’s set-up statement presents the rationale for looking beyond elemental hydrogen:

Current methods of transporting hydrogen include liquefaction (at -253°C) in large scale plants or compression to high pressures. There are alternative liquid carriers which are safer to transport, and can use existing fuel distribution infrastructures. There is interest in a range of chemistries which could provide an energy efficient, safe and practicable solution to transporting hydrogen. Liquid organic hydrogen carriers are a promising area, with potential for low energy losses. Ammonia is also an area of interest, both as a hydrogen carrier and also as an energy carrier in its own right, with potential to use ammonia directly in high temperature fuel cells, gas turbines and other applications.

Hydrogen Europe, Hydrogen, Enabling a Zero Emission Europe: Technology Roadmaps, September 2018

Roadmap 7, too, culminates in a detailed research program, but it too is earmarked for a relatively modest funding amount: €66 million (USD$75 million) – 0.8% of the investment budget.

By contrast, target funding for Roadmap 8 – “hydrogen refueling stations” is €1.1 billion (USD$1.3 billion), almost 13% of the total budget. €1.0 billion (USD$1.1 billion) will flow to “market deployment,” i.e., construction of 900 hydrogen fueling stations between 2020 and 2025, and yet another 3,500 between 2025 and 2030. While Roadmap 8 enunciates the goal of a greater-than-50% reduction in fueling station cost, and assumes a dispensed price of €5.00 (USD$5.68) per kg of hydrogen (vs. prices in excess of €10.00 (USD$11.36) per kg that are prevalent today), highlighted technology development measures all focus on elemental hydrogen. The high-purity ammonia-to-hydrogen conversion technology that is headed toward commercialization in 2020 in Australia, Japan, and possibly other countries, is not mentioned, much less the possibility of vehicles powered with direct ammonia fuel cells.

The view of ammonia presented in the Hydrogen Europe report is not negative. It is, simply, “very stage 2.” Ammonia energy is not ignored or belittled. It is taken seriously as a technological expedient that could be part of the solution. But, clearly, the report’s authors are not ready for stage 3 conceptualization and the deep integration of ammonia within the envisioned energy system that this would imply. This is not a circumstance that should inspire pessimism, though. With ammonia energy momentum now gathering on the continent, it is reasonable to believe that stage 3 will come.