Ammonia-fueled gas turbines: a technology and deployment update

By Kevin Rouwenhorst on December 11, 2024

In 2023, about 22.5% of global electricity was produced from gas turbines, including traditional, baseload power generation and “peaker” plants used in high demand periods. In a decarbonized electricity grid with a high penetration of fluctuating renewables, peaker plants will be one option to stabilize the grid during periods of high demand. Such peaker plants will have near daily start-ups and variable running times (and loads), meaning that decarbonization of such plants via CCS (carbon capture and storage) is not practical.

This is where low-emission fuel options come in. Ammonia can be used as a fuel for new build gas turbines, or as a fuel in retrofitted gas turbines. In fact, gas turbines are often retrofitted throughout their operational lifetime to improve efficiency and to allow for different fuels, and the relocation of gas turbine units to new locations is common practice. Retrofits offer a lower-cost alternative to new build gas turbines, and make more efficient use of existing assets.

The development of ammonia fuel capabilities for gas turbines has come in the context of decades of R&D, deployment and extensive operational hours for hydrogen-fired gas turbines. Although not widely used, the technical and logistical aspects of hydrogen fuel in gas turbines are well understood, particularly the minimization and abatement of NOX emissions. These successes inform the new work on ammonia fuel, and provide OEMs (original equipment manufacturers) with different fuel strategy options, as we will explore below. During the recent AEA Annual Conference 2024, the status of ammonia as fuel for gas turbines was discussed, featuring a panel of OEMs and gas turbine experts.

Technology description of gas turbines

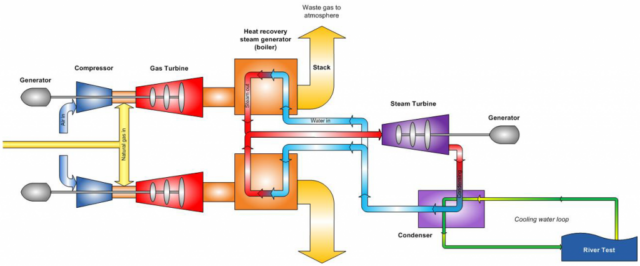

Click to expand. Overview of a combined cycle gas turbine, with two gas turbines and one steam turbine. Source: Marchwood Power.

Gas turbines can be operated in a simple cycle mode, achieving around 35-40% (LHV) efficiency from fuel to electricity. When the gas turbine is combined with a steam turbine in a combined cycle mode, the overall efficiency is increased to the range 55-60% (LHV). This relatively high fuel conversion to electricity gives gas turbines an efficiency advantage over coal-fired thermal power plants (35-45% (LHV) efficiency range). Although the vast majority of existing gas turbines run on conventional, carbon-intensive fuels, the potential to retrofit these units to run on lower or zero-emission fuels presents a huge opportunity to decarbonize existing, high-efficiency power generation assets.

Ammonia combustion: two stage

Ammonia fuel can be combusted in a stable manner. However, ammonia ignition is not easy. Therefore, hydrocarbons are typically used as start-up or pilot fuel for ammonia-fed gas turbines. Gas turbines with liquid ammonia feed use oil (and potentially bio-fuels) as a start-up fuel, while gas turbines with gaseous ammonia feed use methane (natural gas or biogas) as a start-up fuel.

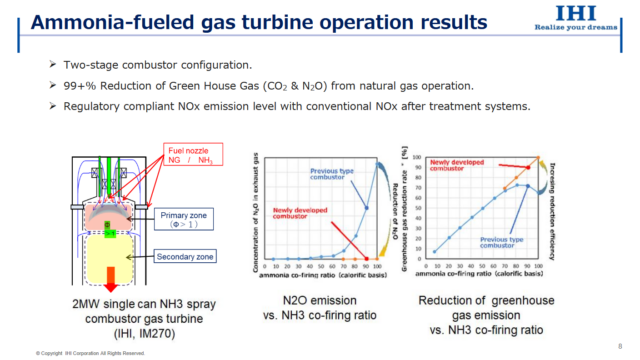

Click to expand. IHI’s two-stage ammonia combustor. From Toshihiro Fujimori, Gas turbine technology development for fuel ammonia (Nov 2024).

Although different fuel strategies might be chosen (see below), the widely agreed-on configuration for ammonia-fueled gas turbines is known as two-staged combustion. The first zone is a “rich” fuel mixture with a surplus of ammonia fuel versus air / oxygen, which prevents excessive nitrogen oxides (NOX) formation, and results in ammonia conversion to hydrogen and nitrogen within the gas turbine. This is followed by a second “lean” zone with a surplus of air / oxygen to ensure full conversion of the fuel. In 2022, this technology was demonstrated by IHI in a 2 MW ammonia spray combustor gas turbine (IM270). Scale-up continues for two-stage combustors to be applied in larger turbine models.

Fuel strategies for ammonia

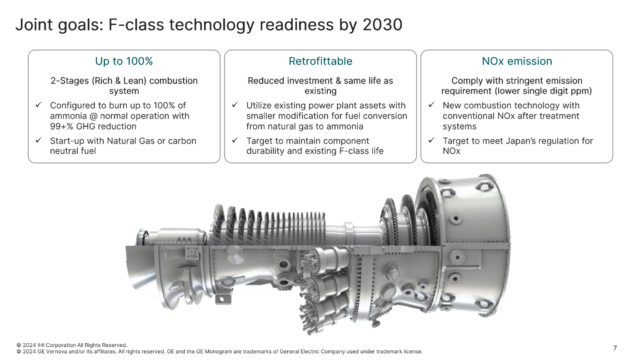

Click to expand. Overview of GE Vernova’s technology development for ammonia-fueled gas turbines. From Jeff Goldmeer, Ammonia Gas Turbine Update (Nov 2024).

Ammonia can be fed as a pressurized liquid into the gas turbine, which is a strategy proposed by GE Vernova in collaboration with IHI Engineering. Various of GE Vernova’s existing gas turbine models will be able to retrofitted to use liquid ammonia as fuel by 2030, including the 6F.03 (88 MW), 7F (201-239 MW), and 9F (288 MW) models. Liquid ammonia feedstock can also be evaporated before the gas turbine, sending gaseous ammonia fuel into the turbine. This is the strategy elected by Mitsubishi Power. The use of liquid or gaseous fuel impacts a range of operational aspects, including pilot fuel selection.

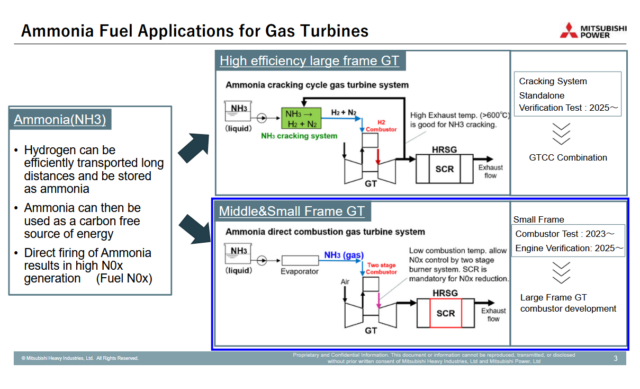

Click to expand. Overview of Mitsubishi Power’s ammonia-fired gas turbine configurations. From Jeanfils Saint-Cyr, Ammonia Fuel Firing Technology Development Update (Nov 2024).

Given the experience OEMs have with hydrogen-fueled turbines (and the increased combustibility of hydrogen), there is also the option of cracking ammonia into hydrogen fuel, or a more easily-combustible ammonia-hydrogen fuel blend. Small ammonia-fueled gas turbines of Mitsubishi Power will utilize ammonia gas directly as a fuel, whereas large ammonia-fueled gas turbines will feature ammonia cracking integrated with waste heat from the exhaust of the gas turbine. Heat integration is the key feature here, as waste heat from the gas turbine is used to crack the ammonia, which increases the overall energy efficiency. A standalone ammonia cracker without heat integration will actually result in a lower overall efficiency for electricity generation, and thus be a more costly way of producing power.

The fuel strategy chosen depends on several factors, including:

- NOX emissions from combustion, which increase as the % of ammonia fuel increases (or conversely, decrease as the % of hydrogen fuel increases). Two-staged combustion helps minimize NOX formation, but after-treatment may still be required to bring emissions within regulatory limits

- Turbine size, load applied to turbine and its operational profile

- Selection, availability and/or emissions impact of pilot fuel

- Potential for heat integration with ammonia cracking (or other processes)

Announced projects for ammonia-fueled gas turbines

Click to expand. Ammonia-fueled gas turbines for maritime propulsion, as announced by Hanwha Power Systems. From Jeff Benoit, Ammonia Gas Turbine Panel Session (Nov 2024.

During the panel, the first few projects for ammonia-fueled gas turbines were highlighted:

- A 60 MW ammonia-fueled gas turbine project was already announced by Jurong Port, Singapore, with the winning bidder announced in early 2025. The project is a pilot, which also includes ammonia bunkering. Consortia of Keppel and Sembcorp are the two remaining bidders.

- Sembcorp, IHI and GE Vernova are exploring ammonia retrofits at the Sakra power plant in Singapore. The plant has a total power generation capacity of 815 MW.

- Mitsubishi Heavy Industries performed a feasibility study for 2x 40 MW ammonia-fueled gas turbines in Keramassan (Indonesia).

- Centrica Energy, Bord Gáis Energy and Mitsubishi Power are investigating a retrofit of a 2x 288 MW power plant to use ammonia fuel in the Republic of Ireland. The plant features two GE Vernova 9F type gas turbines.

- And Hanwha Power Systems and GasLog, who are exploring the retrofit of existing LNG carriers to be powered by ammonia gas turbines.

The pathway forward

As with hydrogen-fueled turbines, deployment and operational hours will help the OEMs optimize ammonia-fueled gas turbines and work through initial difficulties. Similar to ammonia-powered marine engines, the next few years will be critical as demonstration projects begin and concepts move out of the laboratory, into commercial settings. In fact, ammonia-fueled gas turbines may even benefit from the technology toolkit developed for ammonia-powered marine engines. The use of ammonia-fueled gas turbines is likely to be situation-dependent and cost-effective only in certain locations and market segments. But early signs are promising, and the required technology set is fast approaching commercialisation.