Ammonia technology portfolio: optimize for energy efficiency and carbon efficiency

By Trevor Brown on March 23, 2018

Earlier this month, I had the pleasure of speaking at the International Fertilizer Association’s (IFA) conference on the subject of Innovations in Ammonia. A key point was the benefit of technology diversification: as with any portfolio, whether an investment account or a global industry’s range of available technologies, concentration in any area represents risk, and diversification represents resiliency. Unfortunately, the ammonia industry has grown highly concentrated, and its dependency upon one technology and one feed stock represents significant risk in tomorrow’s markets.

This article features five charts that aim to demonstrate why energy efficiency is insufficient as the only measure of technology improvement, why it is better to optimize instead of maximize, and why market evolution is necessary to support investment decisions in sustainable ammonia synthesis technologies.

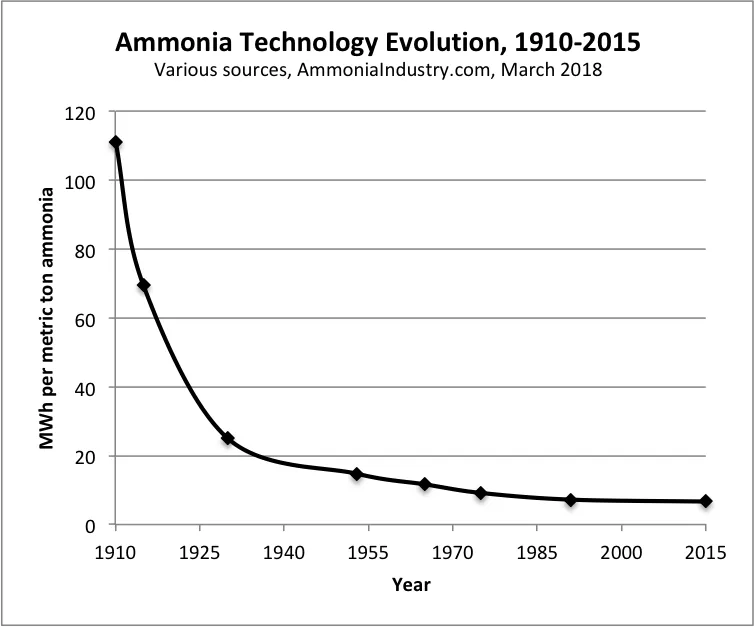

The Evolution of Ammonia Synthesis Technology: a triumph of efficiency

This chart might be familiar. It describes one of the greatest accomplishments in human history. It measures the improvements in energy efficiency of ammonia synthesis technologies during the last century. It tells the story of Nobel Prizes and World Wars and Green Revolutions, and it illustrates the driving force behind a discovery that has saved more lives on this planet than any other.

It begins with the Birkeland-Eyde Process (electric arc) and the Cyanamid Process in the early Twentieth Century, and reaches the Haber-Bosch Process in 1930 (although this was first invented in 1914, 1930 seems like a good time to measure it as a mature commercial technology). Haber-Bosch made those older, more energy intensive processes obsolete, but the drive for efficiency didn’t stop there. Although the basic process of Haber-Bosch might appear relatively unchanged since then, constant incremental innovations in engineering, catalysis, and optimization have delivered previously unimaginable improvements. The amount of energy required to produce one ton of ammonia today is only about one quarter of what it took in 1930.

This is, truly, a story of great human achievement, and yet the story remains unfinished. If there is one aspect of this chart that will be unfamiliar, it is the energy units on the Y-axis. Instead of gigajoules (GJ) or millions of British thermal units (MMBtu) or any other traditional unit of measurement that describes how much energy we get from burning fossil fuels, this chart uses a unit of measurement that describes electrical energy, the megawatt-hour (MWh). This unit is useful for looking to the future.

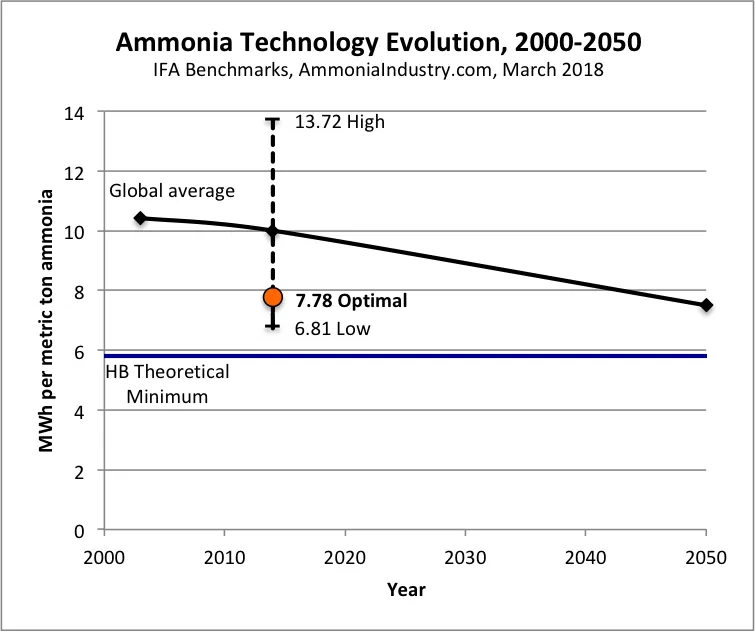

Haber-Bosch efficiency improvements: diminishing returns

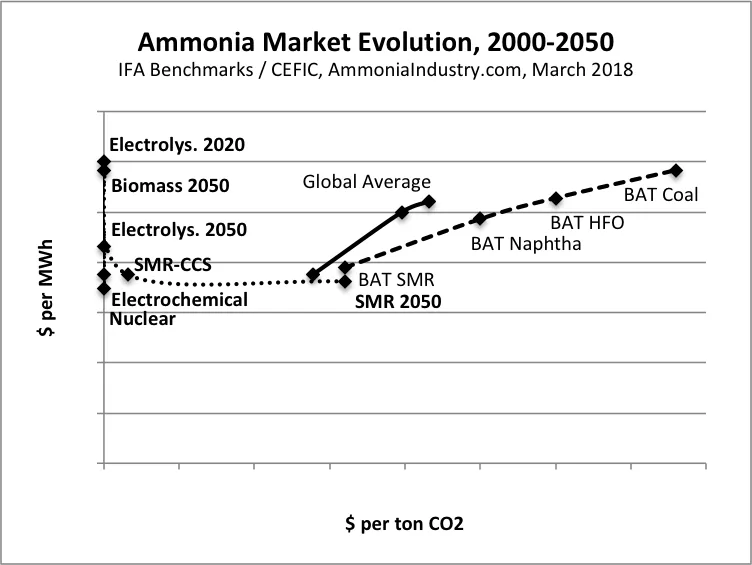

This second chart ‘zooms in’ on recent technology improvements, looking back at the last twenty years, and forward to 2050. The units on the Y-axis are still MWh, but the scale is an order of magnitude smaller than the previous historical chart.

The “Global average” data is from the IFA’s ongoing bench marking project, which collects efficiency metrics from active ammonia plants worldwide. Between the first benchmark (2003) and the latest one (2014), the energy consumption of the global fleet of ammonia plants dropped from 10.42 MWh to 10.00 MWh (37.5 GJ to 36 GJ) per ton ammonia. Impressive as this is, it illustrates how the future evolution of Haber-Bosch will deliver diminishing returns on investment and invention.

The dashed vertical line illustrates the high-low range of plant efficiencies captured in the 2014 average. While the data are anonymous, the high figure most likely represents an old coal-fed plant, while the low figure is, in fact, too low! It perhaps represents a plant that bypasses normal measurements of efficiency by using, for example, byproduct hydrogen without the need for any fossil fuel reformation. The “Optimal” figure of 7.78 MWh (28-29 GJ) per ton describes a new natural gas-fed world-scale ammonia plant built today using best available technology (BAT).

The problem becomes clear as we look toward the future.

The IFA identifies potential future improvements in the global average: a further 25% reduction in energy consumption is possible. This can be achieved by replacing old, inefficient plants with new, efficient ones and by replacing heavy hydrocarbon feed stocks, like coal or heavy fuel oil, with natural gas. These changes would require huge investments across decades. And the end result would be that the global fleet of ammonia plants in 2050 would be, on average, about as efficient as a new plant is today.

There is no longer any significant potential for energy efficiency improvements in the Haber-Bosch process itself (see my appendix below). According to the IFA, the vast majority of the future efficiency improvements in the “Global average” for ammonia production will be achieved simply by replacing old plants with new ones. The technical limits of Haber-Bosch are insurmountable. Haber-Bosch is already highly optimized for energy efficiency.

But I believe in the industry’s unique history – and future! – of ground-breaking innovation, so I have to ask: is efficient sufficient? Our habit of measuring ammonia production in terms of energy intensity is missing the point. It might have been useful in the age of fossil fuels but, by itself, the energy efficiency metric is no longer enough to describe future improvements in the technology portfolio.

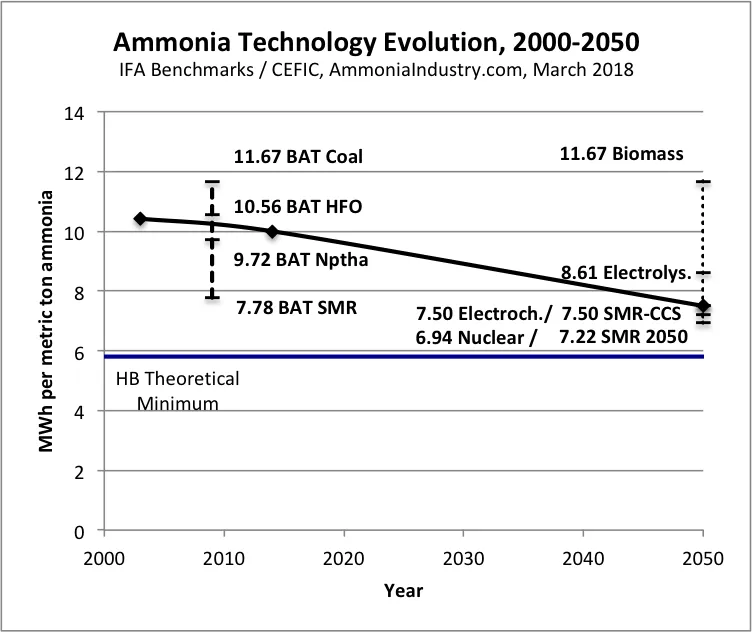

Future Technologies: More sustainable, not necessarily more energy efficient

This chart repeats the “Global average” data, but features a new dashed line that shows the energy efficiency of the best available technologies (BAT) by feed stock, according to the IFA’s 2009 benchmark. Coal-based ammonia production consumes more energy than natural gas-based ammonia production, heavy fuel oil and naphtha are in between. To reach the 2050 goal of a 25% energy efficiency improvement, all those energy intensive feed stocks must be replaced by natural gas (SMR).

However, for comparison, I’ve included another set of technologies: future processes that might be available in 2050. The dotted line for 2050 shows data from the 2013 Energy Roadmap published by Cefic (“the voice of the chemical industry in Europe”). These technologies might well be more sustainable, but they are not obviously more energy efficient. Ammonia from biomass gasification in 2050 will be as energy intensive as today’s coal-based production, but it will be carbon neutral. The other technologies included in Cefic’s 2050 projections are electrolysis with Haber-Bosch, electrochemical processes, nuclear high temperature steam electrolysis, and natural gas-fed Haber-Bosch with carbon capture and sequestration (SMR CCS). Of all these, only the yet-to-be-invented nuclear process is more energy efficient than the future of natural gas-based ammonia production (SMR 2050).

The difference between the technology pathway described by the IFA and the future technologies imagined by Cefic is simple: diversification. The energy efficiency route, in which we successfully reduce global average energy consumption per ton by 25%, requires a global fleet of ammonia plants that is concentrated on one technology and one feedstock: Haber-Bosch with natural gas. If this were an investment portfolio (which it is), this concentration would be described as risk. Without diversification, the ammonia industry – and thus the global food supply chain – faces risks that it cannot adequately measure, nor combat, through energy efficiency alone.

The next chart is my favorite.

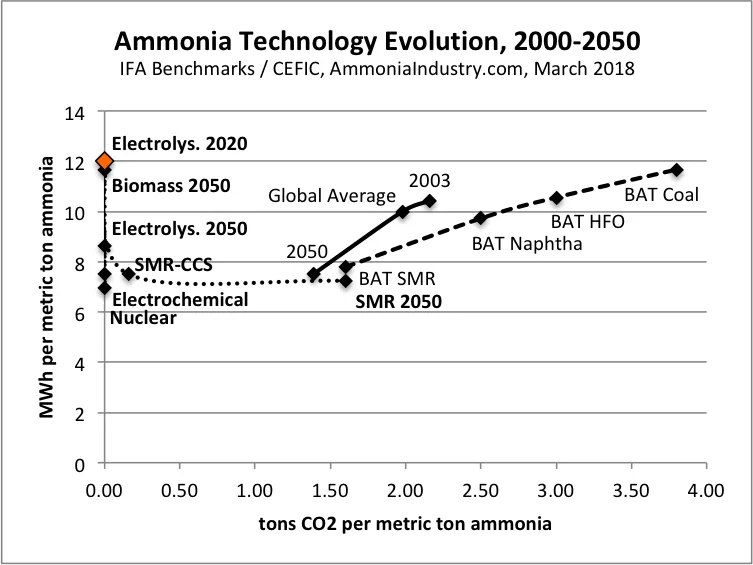

Ammonia Technology Evolution: diversified across feed stocks and processes

This chart shows exactly the same data as the last one. The difference is that the X-axis shows carbon intensity for each technology instead of years. In this chart, a process that might have looked “inefficient” when we considered only energy now looks “efficient” when we consider both energy and carbon.

In investment terms, this chart describes an opportunity to optimize the ammonia synthesis technology portfolio. Instead of simply maximizing for energy efficiency, as we’ve done for the last hundred years, we can begin optimizing for both energy and carbon efficiency at the same time. The most carbon efficient process might be too energy intensive; at the same time, the most energy efficient process might be too carbon intensive.

As with any diversification strategy, this process will be driven according to the industry’s appetite for risk. And, as with any innovation program, there will be first-mover advantages and disadvantages.

The first movers are already moving: there are no less than four different green ammonia demonstration plants currently in development, each proposing to use renewable energy to run electrolyzers to produce hydrogen for a traditional Haber-Bosch synthesis loop. Although the energy efficiency of these projects is not yet defined, I’ve added an extra data point to the chart for electrolytic Haber-Bosch in 2020, allowing us to compare the rule-of-thumb estimate of 12 MWh per ton today against Cefic’s figure of 8.61 MWh per ton in 2050.

Ammonia Market Evolution: rewarding both carbon and energy efficiency

The essential point, of course, is that there will be a cost of carbon. While ammonia technology evolves towards carbon-energy optimization, the ammonia market must evolve to reward carbon efficiency.

To illustrate, here is the identical chart of technologies but with dollar signs in front of the units: $ per MWh consumed, and $ per ton CO2 emitted.

The values are unknown today, the scale could be be skewed, and different prices will exist in every region for each commodity. Nonetheless, if both energy and carbon are valued in the market, technologies in the upper right will be less competitive while technologies in the lower left will be more competitive.

This is not to say that the cost of carbon will be an economic negative (eg, a carbon tax). On the contrary, we are far more likely to see a positive market evolution that rewards carbon efficiency by putting a premium price on green ammonia.

APPENDIX:

The charts in this article draw heavily on two sources, the IFA Benchmark and Cefic.

IFA: The Year of the Benchmark

The IFA is currently collecting data for its 2018 benchmark, and I would strongly encourage any ammonia plant operators not currently participating to get involved. As its promotional video says, “the moment has come to commit to excellence.” The IFA provides full details on how to participate in the 2018 Benchmark.

Cefic: Energy Roadmap – European chemistry for growth

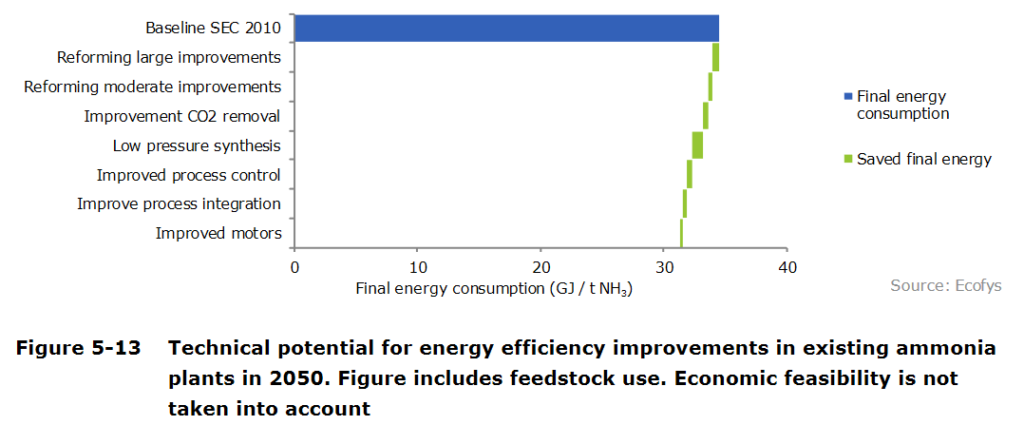

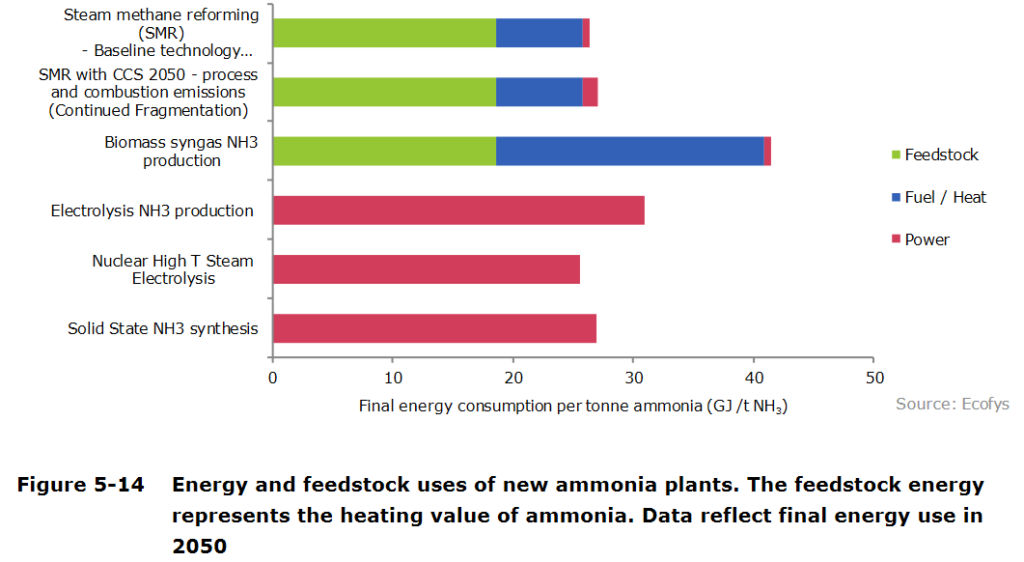

The Cefic report is all about “Unlocking a competitive, low carbon and energy efficient future,” for the European chemical industries. It contains two charts in particular that informed this article.

The first chart identifies the future energy savings possible from improvements on existing ammonia synthesis technology. It stresses the point that, while these improvements on natural gas-fed Haber-Bosch are technically possible, “economic feasibility is not taken into account.”

The second chart illustrates the energy consumption profile of the 2050 technology set, starting with the improved natural gas-fed Haber-Bosch process as a baseline. The differentiation between the three energy inputs (feed stock, fuel, and power) illustrates the benefit of measuring future technologies in MWh: these processes require no feed stock or fuel.

The full 186-page report is available at the Cefic website.

You can also read the full article at AmmoniaIndustry.com.