AMON Maritime: Ammonia-fueled ships and networks

By Conor Furstenberg Stott on June 30, 2022

In our latest episode of Maritime Ammonia Insights we hosted Amon Maritime from Norway. Amon is a role model for the increasingly evident trend, where actors from across the maritime ammonia fuel value chain join forces to better enable business cases. This notion of collaboration being a “secret sauce” for success was explained by Amon Maritime CEO André Risholm and CCO Karl Arthur Bræin.

With its vision of a flexible, short-sea bulk shipping and bunkering network up-and-down the Scandinavian peninsula; Amon Maritime aims to create the world’s first carbon-free shipping company. Amon’s ambition is no less than being a green game changer for short-sea bulk shipping.

Amon Maritime “at the centre”

Acting as a hub for other organizations in the value chain, Amon presents itself as a pure play ammonia powered shipping and technology company. With no fleet to consider, Amon is focused only on pioneering ammonia as a maritime fuel, and is progressing in-house development of ammonia bunkering technology. Financially, Amon is backed by Glastad Holding, a large private investor, and has raised NOK 160 million in soft funding during 2021.

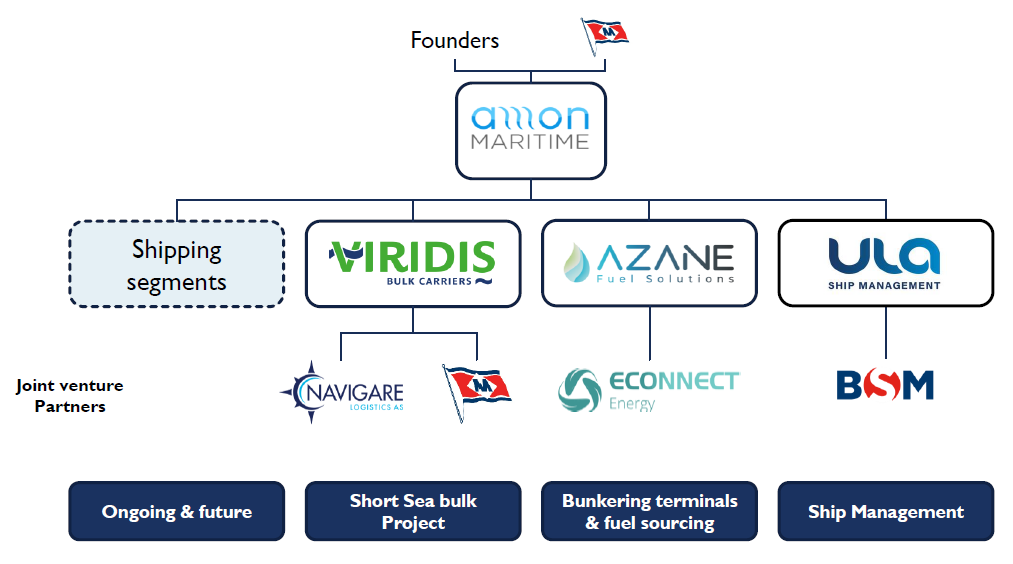

As André and Karl Arthur explained their greater framework, we understood how the partnership structure (see right) for Amon Maritime connects deep into a matrix value chain. Perhaps unusually at this stage, Amon Maritime is already partnering with a ship management entity (Bernhard Schulte Management) thus covering all requirements for putting the complete maritime picture together.

Digging a little deeper into this partnership structure Amon sits at the center of, André and Karl Arthur then outlined the key partner organisations and initiatives Amon is connected to.

Viridis Bulk Carriers

Formed as a new joint venture in 2020, Viridis Bulk Carriers connects technology providers with seven Flex Bulk clients (see below), and is supported by the Pilot-E grant from the Government of Norway. This project intends to be part of the next generation of short sea bulk with five initial vessels planned, and capacity for further growth. These vessels optimize technology and network utilization, incorporating versatility of deployment at their design stage.

Flex Bulk Project

As mentioned, Viridis connects the seven-member Flex Bulk consortium with maritime technology providers. Flex Bulk is also a key part of the process for securing ENOVA investment. At the outset, Flex Bulk is about optimized commercial utilization and ammonia fuel for flexibility and tradability. The partners as detailed to the left identified early the need for ESG funding and government grants to provide low cost capital as an alleviator of technical cost increase. They expect to see ships ordered in 2023 for delivery by 2025.

Azane Fuel Solutions

So that covers the vessels themselves, but what about bunker fuel? Karl Arthur described Azane Fuel Solutions as a pure play ammonia fuel technology company for turn key bunkering solutions. Their key partner ECONNECT Energy holds proprietary iQuay and other specialized technology which have been honed through the development of bunkering solutions for LNG and other fluids. Azane cooperates closely with the rest of the bunker fuel value chain contained in the Ammonia Fuel Bunkering Network (see below). Azane has also received a pre-order for fifteen terminals from Yara and expect to start construction H2 2023.

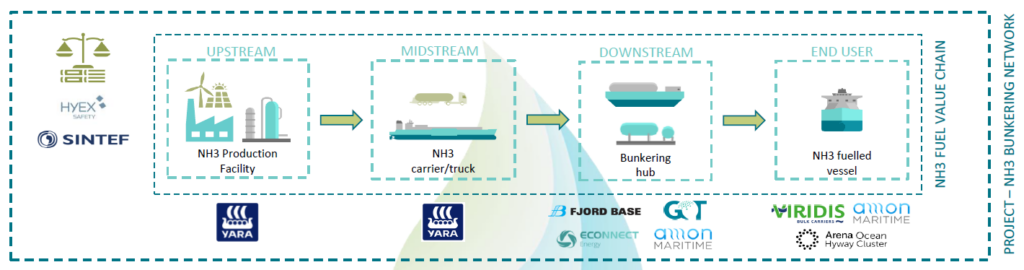

The Ammonia Fuel Bunkering Network

This larger network typifies the concept Amon was founded on, signaling a commitment for a long-term connection between value chain partners. In doing so, the Network draws in actors traditionally more external to maritime consortia such as the cargo owners in the Flex Bulk project. The partners interconnect across all other projects, and their various roles are laid out as shown:

As a Scandinavian-focused network, the vessels will be designed to cover the whole geographic area with a fuel range up to 3000 km. Amon is undertaking feasibility studies encompassing engineering, operations, supply chain, logistics and environmental impact. As part of this fuel element, the turnkey bunkering solution is seen as a fundamental part of the puzzle to be developed, holding both flexibility and scalability as paramount.

Why Norway?

Amon is leveraging the “springboard factors” already present in Norway, such as its long seafaring tradition, urgent drive to decarbonise the industry, and relative cost advantage for production and transport of maritime ammonia fuel. Looking further ahead, Amon indeed sees a potential worldwide market to be available following successful implementation at home. Amon is not concerned about negative market forces from other sectors and sees a good path for supply and demand once shipping is technologically ready for ammonia.

The way forward: zero-carbon ammonia

In discussion, André pointed out that we currently do not price fossil fuels properly, given the additional costs of emitting carbon dioxide into the atmosphere. His expectation is that – once we do adjust this pricing approach – the required large-scale expansion of renewable power that follows will support a new energy trading structure with ammonia as the hydrogen carrier of choice.

Reflecting upon the growth of some other maritime fuel alternatives, André also raised an opinion that “history will not be kind to carbon neutral fuels”. For Amon, zero-carbon ammonia fuel represents the way forward for alternative maritime fuels, and enabling its use across Scandinavian waters presents a huge opportunity. You can re-watch the webinar below, and speaker slides are available to download here.