Closing the Gap for Zero-Emission Fuels

By Sofia Furstenberg Stott on March 27, 2022

Scaling maritime ammonia

In January 2022, UMAS and the Getting To Zero Coalition (GtZC) released a report with policy options for closing the competitiveness gap between conventional & future maritime fuels. Such measures will be necessary to enable an equitable transition to zero-emissions shipping. So how might these potential policy routes impact and enable the scaling of maritime ammonia?

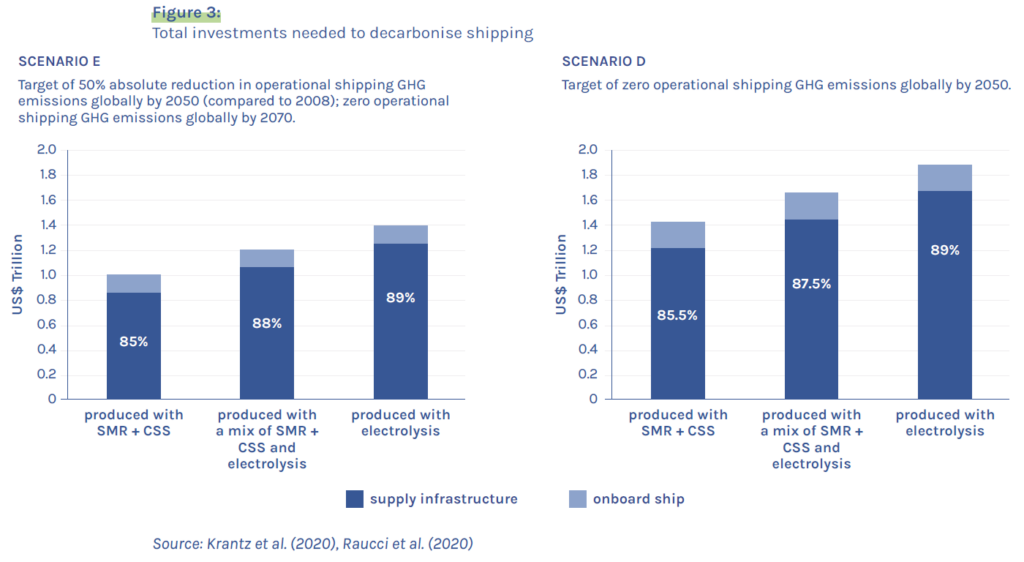

In their comprehensive report, UMAS and GtZC estimate what carbon costs are needed to successfully decarbonize global shipping by 2050. To reach 50% decarbonization by 2050, a carbon cost of USD 173/tonne CO2 is needed, and USD 191/tonne CO2 for 100% decarbonization of global fleet by the same year. The report emphasizes that without policy intervention, low- or zero-emission maritime fuels will struggle to become competitive. The authors also forecast that USD 1-1.4 trillion of investments are needed over the period of 2030-2050 to reach that 50% goal.

Urgent intervention required

The report suggests that, without policy intervention, renewable ammonia would be at least 3 times the cost of conventional maritime fuel. The authors argue that closing this competitiveness gap between zero-emission fuels and fossil fuels is perhaps the essential step to decarbonising shipping. The report warns that market failures and barriers currently exist in the global shipping industry, which will slow the transition to zero-emission shipping and worsen the competitiveness gap. These roadblocks will need to be understood and addressed by policymakers, urgently:

Shipping is an essential global industry which is currently on an emissions trajectory that is dramatically out of line with the Paris Agreement temperature goal. As such, there is an urgent need for the development of policies which guide and support this sector through an equitable transition towards zero emissions.

UMAS & GtZC, Closing the Gap report, Jan 2022

Policy routes going forward

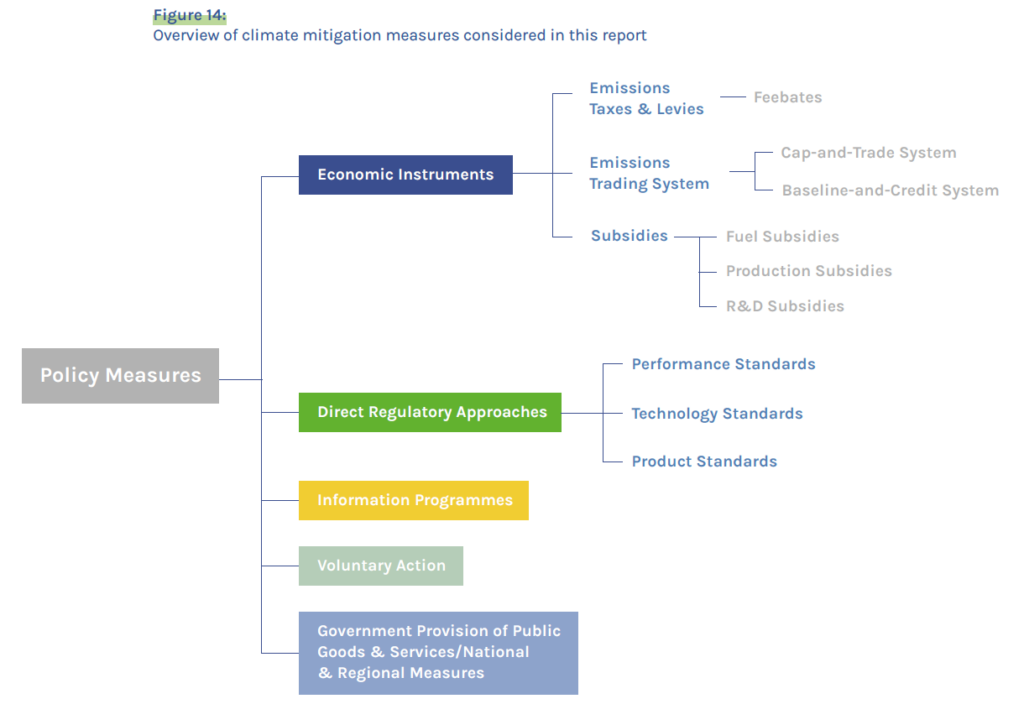

The report outlines five potential policy routes going forward:

in this report. From UMAS & GtZC, Closing the Gap report, Jan 2022.

- Adopt a global MBM (market-based measure) capable of generating significant revenue. This mechanism needs to create a carbon price that incentivises emissions reductions and investments into readily available GHG mitigation options in the near term, and fuel switching once alternative zero- emission fuels are widely available.

- Combine an MBM with an effective and fair use of revenue recycling and other revenue use options to drive both demand and supply of zero-emission fuels whilst also supporting an equitable transition and addressing disproportionately negative impacts on States.

- Use a direct command-and-control measure such as a fuel mandate in the long term to send an unequivocable signal to the market that a fuel transition will take place.

- Develop national and regional policy that can ensure the transition of domestic fleets at least at the same rate or sooner than international fleets and that work in synergy with global IMO-driven policy.

- Promote voluntary initiatives and information programmes to stimulate supply-side investments in RD&D and infrastructure, encourage knowledge sharing and support capacity development.

National & regional levels

We have previously addressed some of the major regional and national policy initiatives which are included in this report: the Clydebank Declaration, FuelEU Maritime Initiative and the ETS, and Germany’s new Hydrogen Strategy. National and regional initiatives are expected to have significant impact to the speed at which the global maritime sector can decarbonize.

Investing in the supply side

To speed up the production of renewable fuels for maritime use, the report proposes policy plans to invest in the production and supply of zero-emission marine fuels (including the associated production of renewable energy) and bunkering infrastructure. This “supply infrastructure” investment makes up the vast bulk of the USD 1 trillion needed to meet the industry’s decarbonisation goals (see right).

Managing negative impacts

While the report outlines economic incentives like a MBM to be more cost-effective than direct regulatory approaches, such as a fuel mandate, it suggests that direct regulatory approaches might be more politically palatable. It warns, however, that climate regulations which do not generate revenues, including a fuel mandate, can create disproportionate negative impacts for LDCs (least-developed countries) and SIDS (small-island developing states), which may create an overall lower environmental effectiveness of the measure; “This could result in a situation where States are being serviced by exempted ships that are increasingly more inefficient and older, whilst others benefit from newer vessels and innovation though compliance with the measure”.1

Way forward

The Closing the Gap report is providing a wealth of detailed thought work to progress the maritime energy transition, fairly and equitably. It outlines different possible regulatory and voluntary routes, and discusses their different potential, their opportunities, and challenges for impact. The maritime energy shift can be a catalyst for the wider scaling of zero carbon energy infrastructure across the world. Therefore, the ammonia energy stakeholder environment should be encouraged to involve in this thought work, as it progresses towards further maturity and realisation.

1. Solomon Islands & Tonga (2020) A proposal to addressing impact assessment uncertainties when considering proposed measures to reduce GHG emissions from ships. Submitted to IMO as ISWG-GHG 7/2/11.