DECHEMA and Fertilizers Europe: decarbonizing ammonia production up to 2030

By Kevin Rouwenhorst on May 12, 2022

Recently, DECHEMA and Fertilizers Europe published a report: Technology options for CO2-emission reduction of hydrogen feedstock in ammonia production (click to download pdf). The report details how & where the European fertilizer industry can decarbonize leading up to 2030, with a brief outlook to 2050.

Various technology pathways are discussed: primarily fossil-based feedstock with improved energy efficiency and carbon mitigation, or renewable hydrogen production. The study highlights that carbon mitigation pathways are not the same for all parts of Europe. The authors argue that – in order to capitalize on the significant emissions reduction potential on offer for the sector – any future policies must be technology agnostic and highly-sensitive to local resource availability.

The study clearly demonstrated that there is no universal path to decarbonize the fertilizer sector across Europe…The policy makers must ensure that legislative framework recognizes regional differences and does not discriminate technologies that offer the biggest abatement potential in the interim transition phase.

Fertilizers Europe Director General Jacob Hansen in his organisation’s press release (download pdf), 23 Feb 2022

Currently, Europe has about 19 million tonnes of ammonia annual production capacity. Assuming average process emissions of 1.9 tonnes of CO2 per tonne ammonia, this results in about 36 million tonnes of CO2 produced from the ammonia production process, if all capacity is utilized. This new report proposes a scenario for eliminating as much as 19% of those carbon emissions by 2030, with decarbonization of electricity grids throughout the EU (and further technology developments) to almost fully decarbonize the sector by 2050.

Carbon mitigation through energy efficiency & CCS

The first method to minimize fossil-based feedstock and CO2 emissions is utilizing best available technology (BAT). According to the authors, this can reduce up to 8% energy consumption versus an ‘average European ammonia plant’ and decrease CO2 emissions by up to 20% at a given facility. However, the authors caution that a BAT approach is insufficient, and process emissions must be eliminated in order to meet 2030 targets.

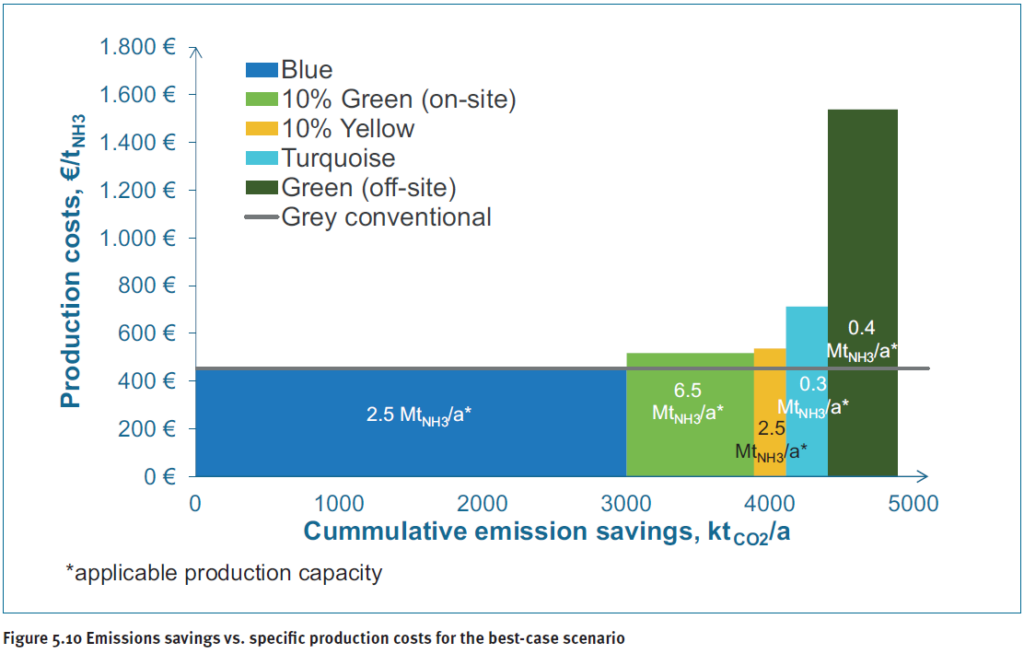

The report suggests that the major source of emissions reduction to 2030 will come from capturing CO2. In the best case scenario, the report expects about 3 million tonnes of CO2 reduction from capturing process CO2 emissions across the sector.

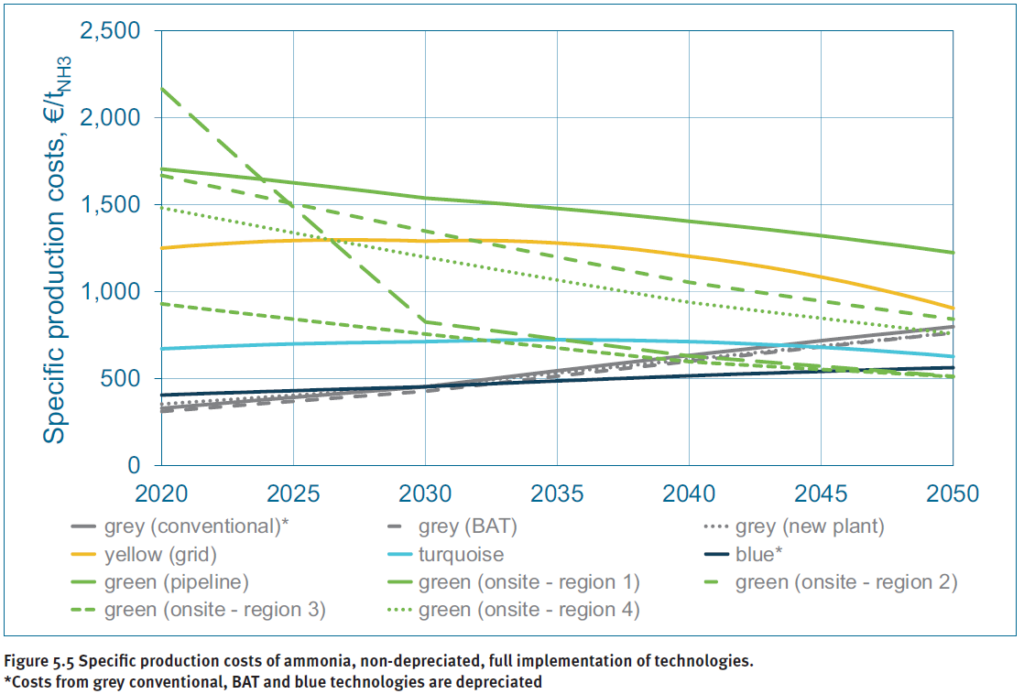

In their analysis, the authors found that ammonia with CO2 capture and storage will be cost competitive with conventional ammonia, (ie. without carbon emission mitigation) by 2030 due to rising carbon prices. Indeed, the only reason it is currently more expensive (though not significantly so) is the added cost of CO2 transport and storage. Other technologies, such as electrolysis-based hydrogen from renewable electricity or from a low carbon grid, and methane pyrolysis-based hydrogen account for the remainder of carbon mitigation.

It should be noted that the report describes ‘blue hydrogen’ as natural gas-based hydrogen production in a steam methane reformer (SMR) with carbon capture and storage for the process CO2 emissions (about two third of CO2 emissions from an SMR). However, capturing the other third of the CO2 emissions, the flue gas, is not considered by the authors. (We have previously written on this topic, and Haldor Topsøe’s AmmonFuel report suggests that capture and storage of the flue gas CO2 costs about 50-65 USD per tonne ammonia).

The role of renewable ammonia

The report considers electrolysis-based hydrogen with electricity obtained either from renewables or from a low carbon grid. While the report does consider offsite hydrogen production, delivered to ammonia plants by pipeline, the authors predict only a single ammonia plant could meet 100% of its hydrogen demand this way in 2030 due to constraining factors. Rather, onsite production and consumption of up to 10% of the hydrogen feedstock was considered the optimal technology pathway for decarbonizing existing EU plants. The report assumes an either / or approach to decarbonization via renewables (100% vs. 10%), whereas technology developers and plant owners are developing more flexible hybrid and stepwise approaches to decarbonization.

Different regions, different electrolysis potential

The authors point out that changing the granularity of analysis (ie. whole-EU vs. smaller regions) improves the case for electrolytic hydrogen produced from both renewable energy and grid electricity. At a whole EU-level, the emissions intensity from grid-powered electrolysis is currently higher than conventional hydrogen production. The trajectory of grid decarbonization on the continent means these lines cross in 2037. But there are already areas with low carbon-intensity electricity generation (eg. France) where those lines have already crossed, making grid-powered electrolysis a distinct possibility for decarbonizing ammonia production near-term – in some places at least.

Similarly, onsite renewable hydrogen production shows huge potential in two smaller regions of the EU: southern Europe (Italy, Spain and France), and Norway. Here, the authors predict that renewable ammonia becomes cost-competitive with conventional ammonia by 2037 at the latest, albeit with significant electricity infrastructure still required to be built.

This potential has already driven some ammonia plants to make plans to introduce green hydrogen at rates above 10%. Fertiberia plans to fully decarbonize its plants in Puertollano and Palos de la Frontera by 2025 and 2027, respectively, using solar PV electricity. Yara has announced plans to fully decarbonize its plant in Porsgrunn with low-carbon grid electricity by 2026.

Ongoing high gas prices

Recent developments have resulted in high gas prices within Europe, causing most European ammonia plant operators to curtail production, or even shut down entirely. Relatively expensive LNG is considered as an alternative to provide natural gas to European ammonia plants. This will increase the cost of fossil-based ammonia production, with or without carbon mitigation, as compared to standard cost levels.

The analysis performed in the report of DECHEMA and Fertilizers Europe was performed before the high gas prices ensued. Should the high natural gas prices in Europe persist, it is entirely possible that electrolysis-based hydrogen production becomes increasingly competitive, and that the role of renewable ammonia (or even partial decarbonization) grows faster than the authors anticipate.

Looking ahead

In their late-2018 report Feeding Life 2030, Fertilizers Europe speculated on the decarbonization of the EU ammonia industry, suggesting that perhaps 10% of hydrogen for ammonia production in 2030 would come from renewable resources. This new analysis takes further steps by introducing technology pathways, benchmarks, and a region-by-region breakdown to drive steady decarbonization of the sector in the near-term (and possibly eliminate emissions altogether by 2050). The technology is available, the pace can be quickened and the drive to decarbonize is real: all that’s needed is the right support.

Our industry has an ambition to advance even faster in the green transition. But to enable higher pace of investments, the fertilizer sector calls for a regulatory framework that supports investments in clean technologies, improves access to abundant and affordable renewable energy and provides financial support. All these elements are a prerequisite for the industry to deliver on the objectives of the green transformation in Europe.

Fertilizers Europe Director General Jacob Hansen in his organisation’s press release (download pdf), 23 Feb 2022