Green ammonia at oil and gas scale: the 15 GW Asian Renewable Energy Hub

By Trevor Brown on August 06, 2020

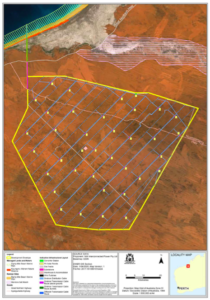

The Asian Renewable Energy Hub will be a 6,500 square kilometer wind and solar farm in Australia’s Pilbara desert, producing green ammonia for export beginning in 2027/28. This was recently reported as an investment of AU$ 22 billion (US$ 16 billion). As it says on its website, this is “renewable energy at oil and gas scale.”

Details recently entered the public domain regarding the project’s upstream segment (power generation). Now, its downstream segment (green ammonia production) is coming into focus as well. InterContinental Energy, one of the project backers, represents the Asian Renewable Energy Hub as just one project within its $100+ billion, 50 million ton per year, green ammonia and green methanol production portfolio: “the largest and most advanced portfolio of green hydrogen projects worldwide.”

Asian Renewable Energy Hub

The Asian Renewable Energy Hub made headlines in May 2020, when Western Australia’s Environmental Protection Authority (EPA) published its environmental impact assessment approving the project.

A massive $22 billion-plus wind and solar farm in the Pilbara and 3000 construction jobs moved closer to reality today with the approval by the Environmental Protection Authority of the Asian Renewable Energy Hub.

Eventually, the Hub will consist of up to 1743 wind turbines and 2000 megawatts of solar panels ...

The project would be built by about 3000 workers in stages over 10 years, according to the EPA report. It could then operate for more than 50 years employing about 400 workers.

BoilingCold, $22B Pilbara wind and solar farm gets environmental tick, May 4, 2020

The combination of wind and solar is crucial because the production profile of each variable input is complementary with the other: nighttime wind balances daytime solar. By combining both wind and solar on a very large site, intermittency is reduced, and this increases the capacity factor (and therefore profitability) of the electrolyzers producing hydrogen and the Haber-Bosch plant producing ammonia.

We’ve been writing on this topic for some years, including analysis of the economic impact of this strategy by Cédric Philibert and his team within the IEA, and, most recently, the NEOM green ammonia plant announced in Saudi Arabia, which has a very similar strategy.

While 3 GW of the power will serve local industry, the remaining 12+ GW will be used in “large scale production of green hydrogen products for domestic and export markets.”

The project will generate very large volumes of cheap, clean renewable energy, which is ideal for the large scale production of green hydrogen, which will find markets both in Australia and overseas. Japan and Korea in particular …

The scale of the project could enable the creation of new supply chain facilities for the manufacturing and assembly of equipment for wind and solar generation and for hydrogen production, which would create new, local, high value jobs.

Asian Renewable Energy Hub website, accessed August 2020

The Asian Renewable Energy Hub is being developed by a consortium that includes Danish wind turbine manufacturer Vestas, renewable energy developer CWP Energy Asia, and private investment companies Pathway Investments and InterContinental Energy.

InterContinental Energy

According to the InterContinental Energy website, the Asian Renewable Energy Hub is its “most advanced project, and the only one in the public domain.” But all of its projects share the same concept: to develop vast amounts of renewable energy in order to export green hydrogen-based fuels — ammonia or methanol — from “coastal deserts,” where high quality wind and solar resources combine with a large amount of available land and port access for ease of export.

InterContinental Energy’s unique coastal desert sites are both very sunny during the day, and very windy at night. This means low cost clean energy 24/7, allowing the projects to run processing equipment day and night, maximizing their usage. The large size of our projects provides economies of scale and lower variability of power, further reducing the cost of green hydrogen for customers …

Using green hydrogen as a base, we can develop sustainable new supply chains for clean fuels and products. Hydrogen is difficult to transport, but is readily converted into green ammonia and green methanol, which are easier to ship and useful in their own right.

InterContinental Energy website, Green Fuels Production and Markets, accessed August 2020

And while the Asian Renewable Energy Hub is the most advanced of the projects in InterContinental Energy’s portfolio, it may also be one of the smallest. The portfolio represents “over US$100 billion of investment,” with potential to produce more than 50 million tons per year of green ammonia and/or green methanol.

As the largest green fuels developer globally, InterContinental Energy is committed to driving the renewable energy revolution beyond green electricity to green fuels. Using only wind, sun, and water, our portfolio will produce clean fuels at a scale and cost historically only possible with oil and gas …

Making ammonia or methanol from renewable sources will offset approximately two tons of CO2 per ton of green product. As such, the current portfolio will offset over 100 million tons of CO2 per year.

InterContinental Energy website, accessed August 2020

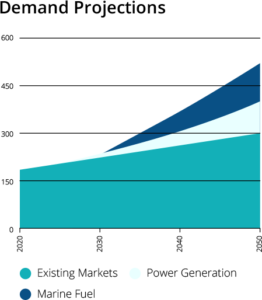

InterContinental Energy illustrates the commercial opportunity by measuring three of the potential markets for green ammonia: the existing ammonia market (primarily fertilizer), power generation (coal power stations and combined cycle gas turbines), and maritime fuel.

By 2050, these three markets could represent annual demand for more than 500 million tons of green ammonia.

InterContinental Energy sees fertilizer consumption increasing from 185 to 305 million tons per year between 2020 and 2050 (based on McKinsey data). It sees ammonia combustion for power generation, a new market, reaching 93 million tons per year by 2050 (based on analysis by the Institute of Energy Economics in Japan). And it measures the maritime fuel opportunity as another 121 million tons per year by 2050 (based on numbers from DNV GL).

For each of these markets, InterContinental Energy sees a “Long price target $350-400/ton.”

Another market for green ammonia, not included in these numbers, is as a hydrogen carrier, where ammonia can be imported, then cracked and purified on-site to supply hydrogen to fuel cell vehicles. This was the market explicitly addressed by the 4 GW / $5 billion NEOM green ammonia plant in Saudi Arabia, with Air Products investing an additional $2 billion in necessary infrastructure to export and distribute that green ammonia-based hydrogen to market. That project expects to export 1.2 million tons per year of green ammonia starting in 2025.

2025 is the anticipated date of the “Financial Investment Decision” for the first phase of the Asian Renewable Energy Hub, which then expects to produce its “First exports” by 2027/28.

With a production capacity (as yet unannounced) likely to be multiple million tons per year of green ammonia, available this decade, the Asian Renewable Energy Hub plants a large-scale flag in the energy landscape: signaling the supply-side readiness to serve these new markets.