Green Ammonia Volume Analysis – A Roadmap Towards 2030

By Sofia Furstenberg Stott on May 18, 2022

The correct policies are now necessary to ‘put Norway on the map as the frontrunner in the green maritime shift’.

Yara Clean Ammonia, together with NCE Maritime CleanTech and with analysis support from DNV, have delivered a volume analysis and roadmap for the use of renewable ammonia in the Norwegian domestic shipping sector. The findings of the report were presented last month at a launch event in Oslo, and also featured during Nor-Shipping 2022.

Yara & NCE Maritime Cleantech

In 2019, Yara announced the scope of their Clean Ammonia Transition, highlighting a need for common standards for low-carbon or zero-carbon ammonia, and for early support mechanisms like “contracts for difference”. Fast forward a few years to now, and Yara have already announced their move into owning and operating the first ammonia maritime fuel terminals, to be deployed across Scandinavia. But while deployment plans accelerate, the development of common frameworks and standards remains slow.

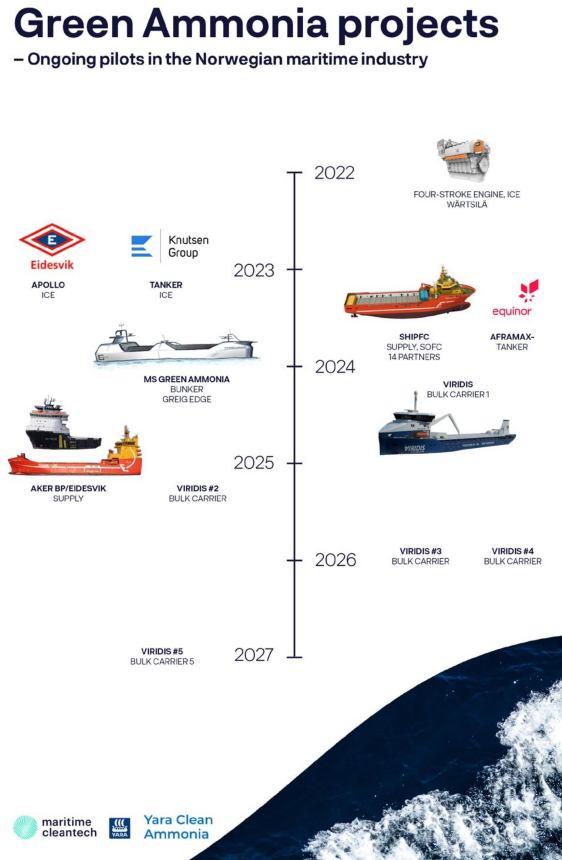

NCE Maritime Cleantech is no stranger to the maritime ammonia space either. The technology cluster is closely involved with the ShipFC project, and has a good representation of maritime ammonia pioneers through its partners and associated projects (e.g. the Knutsen OAS engine trials at the Sustainable Energy Catapult Centre with Wärtsilä, and the Amazon-backed startup Amogy).

Green ammonia required for Norway to meet emissions reduction targets for domestic shipping

The report Green Ammonia volume analysis – a roadmap towards 2030 is firm in its statement that:

Norway is not able to meet the national target of a 50 percent reduction in Greenhouse Gas emissions from domestic shipping by 2030, with the currently committed CO2-tax and emission reduction requirements for defined segment [and that] Norway needs to enforce defined requirements for emission reductions, and an incremental increase of CO2 tax up to 2000 NOK/ton in 2030. A more rapid reduction of CO2 emissions is achievable by adding investment support for shipowners making use of green ammonia.

Main findings, Green Ammonia volume analysis – a roadmap towards 2030 (Apr 2022)

Overcoming barriers to 2030

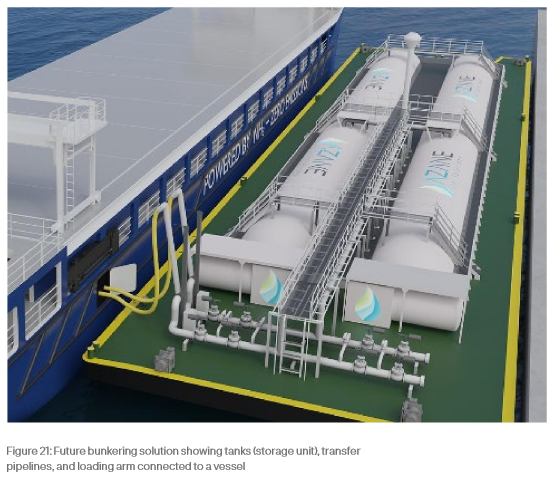

The report expands on how to approach existing barriers for widespread technology adoption. In particular the authors focus on two challenges: i) how a lack of networks for bunkering hubs results in high distribution costs and weak supply security, and ii) how a lack of mature technical solutions, scalability, and operating procedures for ammonia fuel bunkering is holding back uptake.

It highlights the range of different bunkering solutions under development, namely onshore direct ship bunkering alongside a quay, and floating bunkering solutions being either fixed, self-propelled, or moved by tugs. The authors also suggest that offshore supply vessels – which successfully piloted battery hybrids in Norway – could be a likely target group for implementing and scaling the use of renewable ammonia as maritime fuel.

69% emissions reduction of domestic shipping fleet to 2030

Working with different scenarios and using AIS data to simulate potential ammonia uptake (all which anticipate that there is full availability of all fuel types and the needed technology), the resulting emission reductions in this report vary from 15% to 69% of Norway’s domestic shipping fleet by 2030. The assumptions used have been validated by an industry reference group.

Including electrolysis, methane pyrolysis and CCS, the report refers to existing and announced capacities totaling almost 8 million tonnes per year of low carbon ammonia to come online by 2030, and about 400,000 tonnes per year of renewable ammonia coming on stream from Yara’s Porsgrunn plant by 2026. This however is dependent on “access to clean energy and sufficient grid capacity”. This caution underlines the need for cohesive action; clean ammonia production must coordinate with national developments of renewable energy infrastructure. The authors are not voicing any concern over fuel access, however.

Certification via a “clean fuel certificate”

The report details different potential approaches for the certification of ammonia, as part of a so-called “clean fuel certificate”:

1. Environmental attributes of the product, such as:

– Product carbon footprint (x tCO2/tNH3)

– Production technology utilized (e.g., electrolysis with renewable electricity) o Geographical origin of the energy and the raw materials

2. How the product attributes have been preserved throughout each step in the supply chain:

– Details on how traceability is ensured through the chain of custody

3. How the information is verified and how the certification system complies with specific standards:

– Details on how the scheme is operated, audited, and reported

– What standards and methods were followed to collect, calculate, and report the information

What information needs to be certified? Green Ammonia volume analysis – a roadmap towards 2030 (Apr 2022)

Challenges of co-processing

The authors suggest that a combination of mass balance and book & claim chain of custody would be the most beneficial approach. This is because of a common fuel supplier supply chain challenge that will undoubtedly be present during the transition to low and zero-carbon fuels: co-processing (“the simultaneous, common processing of clean and fossil inputs” as described by the authors). In the case of ammonia, it is warned this could result in duplicating most of the supply chain infrastructure and logistics to create physically separated streams, which obviously would have high impact on fuel cost.

Available funding

Acknowledging that financial support may be necessary to bring all maritime actors along the zero-carbon transformation, the report makes an effort to present a very comprehensive overview of Norwegian and Nordic/European potential funding schemes. For readers outside the Norwegian context this chapter is still very much worth a read.

By familiarizing with the ambitions and applications of the variety of funding schemes, one is provided with an important insight: that high levels of innovation are needed to attract public funding, and that pilot developments need to have a visible path towards scaling and global export. It also shows that different support schemes can support different parts of a project, and that cross-collaborative approaches are therefore much needed to reach effective progress.

To conclude, this report suggests that renewable ammonia can meet and reach beyond the 2030 decarbonisation targets for the Norwegian domestic fleet, including the offshore supply and fish farming fleet, with the introduction of an incremental carbon tax of 2,000 NOK per tonne CO2 by 2030 (roughly US$200 per tonne). This needs to be supported by ammonia fuel certification and a clean fuel certificate has therefore been proposed. Offshore supply vessels are suggested attractive targets for pilot cases to accelerate the development and create a market for renewable ammonia production, bunkering infrastructure, and distribution technologies.