H2Global: a clean ammonia market maker

By Trevor BrownJulian Atchison on November 28, 2024

Timo Bollerhey outlines strategy, results and future plans in keynote to AEA’s 21st Annual Conference

To open the AEA’s 2024 annual conference in New Orleans, H2Global Managing Director Timo Bollerhey presented updates from the “green market maker”. How does H2Global see its role in developing early markets and pushing us closer to industry tipping points? What were some of the findings from its first ammonia auction? And on what global locations and markets will future ammonia auctions focus?

H2Global’s role in the early years of market creation

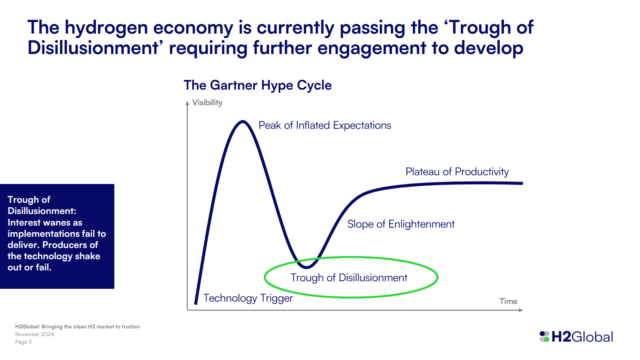

Click to expand. The Gartner Hype Cycle, including the “Trough of Disillusionment” (where the nascent hydrogen industry currently sits). From Timo Bollerhey, Shaping the Global Energy Transition (Nov 2024).

As Bollerhey explains in his presentation, current clean commodity markets lack many of the key features of mature, functioning markets. To meet our global climate targets, we need to accelerate both creation and maturation of these new markets. It’s a fair to observe that the nascent low-emission hydrogen industry is currently passing a “Trough of Disillusionment” (a step in the Gartner Hype Cycle, see right) – but we should keep this trough in context. We need to push through this phase, and move steadily up the “Slope of Enlightenment” to ultimately reach the “Plateau of Productivity”.

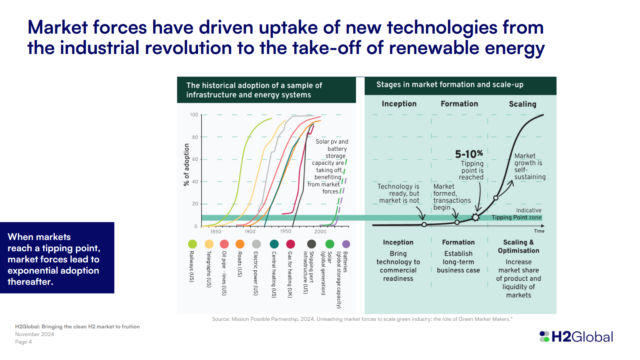

Click to expand. Historical adoption patterns of new markets after they reach a 5-10% tipping point. From Timo Bollerhey, Shaping the Global Energy Transition (Nov 2024).

Although the current phase of market development may appear gloomy, it is important to remember that markets typically reach a tipping point at about 5-10% adoption, after which exponential growth can occur. Today, the nascent low-emission hydrogen (and ammonia) market sits before this point, as the first structures begin to be put in place and the first transactions made. A collection of critical industries – railways, roads, electric power, gas for heating, ports, solar PV – have followed this historical adoption pattern of exponential growth once the tipping point is reached (see left).

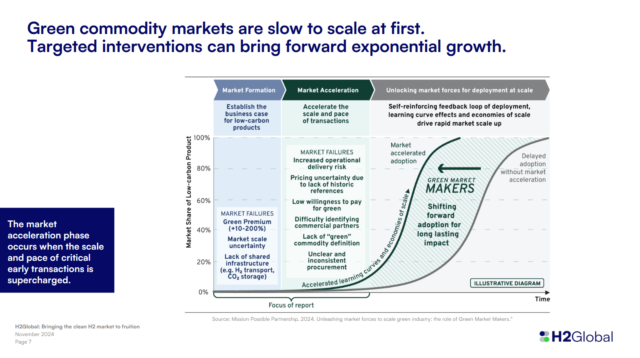

Click to expand. The ability of Green Market Makers to supercharge market development and growth. From Timo Bollerhey, Shaping the Global Energy Transition (Nov 2024).

So, our transition to clean commodities is underway, but investment remains slow. To increase the pace of development, there is a range of options available, and this is where the “green market makers” (GMMs) come into play, with targeted, precise interventions that push the adoption timeline forward. There is a well-established toolbox of public policy and private sector instruments that GMMs can use, simultaneously forming and accelerating markets, bridging the green premium gap, and facilitating early transactions. Currently there is a rich – but fragmented – landscape of market acceleration instruments. Careful coordination across geographies is needed to avoid diluting impact.

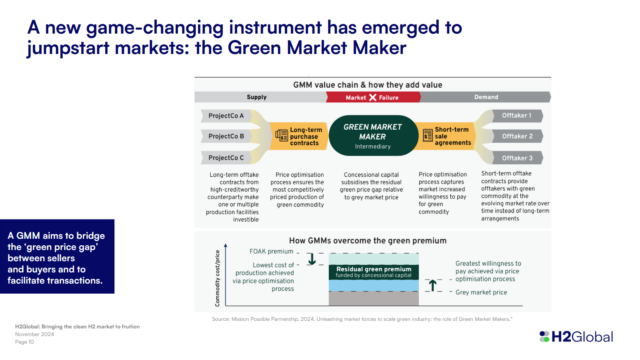

Click to expand. H2Global as a green market maker, acting as an intermediary between supply and demand for clean commodities. From Timo Bollerhey, Shaping the Global Energy Transition (Nov 2024).

H2Global aims to bridge the green premium gap between sellers and buyers, and to facilitate transactions for clean commodities. Concessional capital funds the gap between best-in-class production costs for the clean commodity, and the greatest willingness to pay a green premium. This gap is funded over long-term offtake contracts by an intermediary company (HINT.CO, funded directly by governments and climate/development capital), creating business cases and leading to investment security for both supplier and customer. A unique “double-auction” sequence on both the supply and demand sides minimizes the price gap. For more information on the H2Global market mechanism itself and its evolution over time, check out our AEA website archives.

Recent ammonia auction: lessons to carry forward

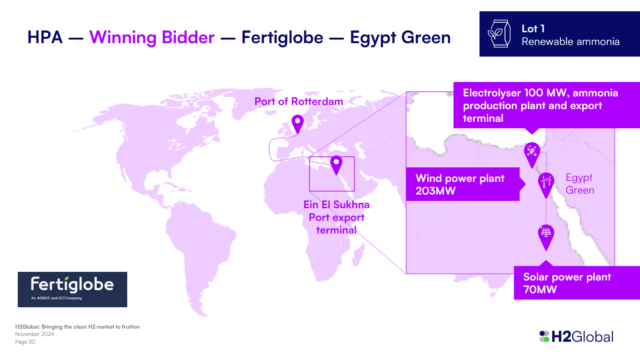

Click to expand. The winning bidder of H2Global’s first ammonia auction, Fertiglobe’s Egypt Green project. From Timo Bollerhey, Shaping the Global Energy Transition (Nov 2024).

To date, €5.83bn billion has been committed or earmarked for H2Global to carry out its role (primarily by the German government). Around €397 million of this has just been committed to the winning bidders of H2Global’s first-ever ammonia auction, launched in 2022 and awarded in July this year. From twenty-two preliminary bidders and five finalists, one contract was awarded that allowed the winning project to reach FID. At its Egypt Green project in Ain Sokhna, Fertiglobe will use renewable electricity, hydrogen and nitrogen feedstocks to produce renewable ammonia, which will be shipped to Europe between 2027 and 2033. A minimum 40,000 tons per year will be delivered across six years (2028-2033), with the first delivery from Egypt to Europe in 2027.

Click to expand. Fixed price details for Fertiglobe’s successful H2Global bid. From Timo Bollerhey, Shaping the Global Energy Transition (Nov 2024).

The renewable ammonia from Egypt has a fixed delivery price per ton – 1,000 € – including net product price, transport and logistic charges, import and export duties. Fertiglobe’s bid included a production cost of 811 € per ton.

Bollerhey shared a few lessons learned from this first ammonia auction:

- The overall ammonia “lot sizes” and length of contract term are actually at the lower end of the scale in the current market environment. With bidders focused on realizing economies of scale, substantially larger lot sizes will feature in the next ammonia auctions.

- The lack of practical experience in the interpretation of new EU regulations and the import of derivatives into Europe is difficult for bidders. This in turn hinders project investment.

- Access to necessary port infrastructure is a challenge for many bidders. HINT.CO will attempt to ease this bottleneck in future auctions.

Positively, H2Global also reports that all bidders involved were committed, constructive and have already provided feedback on targeted advice and assistance that can be provided in future auctions.

Future auction locations

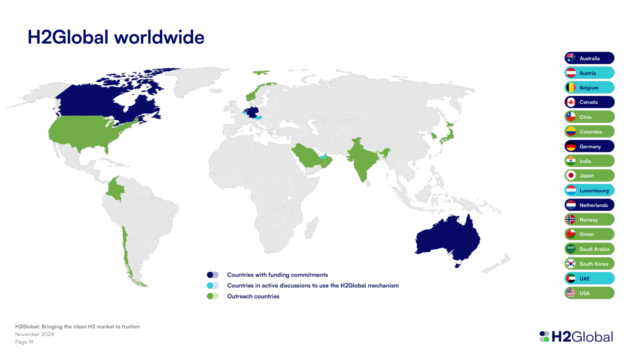

Click to expand. Countries and their various funding commitments to H2Global. From Timo Bollerhey, Shaping the Global Energy Transition (Nov 2024).

So where to next? H2Global has active discussions and outreach with a wide range of countries for funding hydrogen imports into Europe. Australia, the Netherlands, Germany and Canada have already committed funds. Discussions are advanced with other European destinations (including Austria, Belgium and Luxembourg), and also with the UAE.

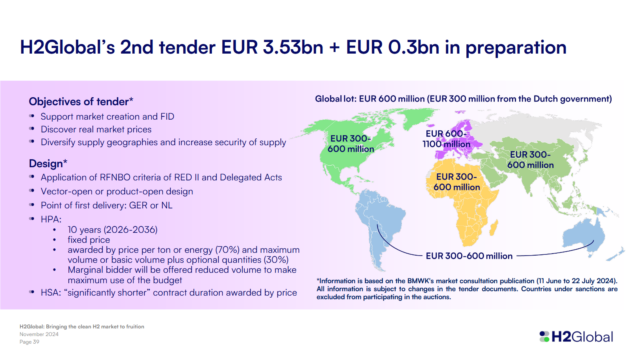

Click to expand. H2Global’s second auction, which will be approximately four times the size of the first ammonia auction, as well as featuring multiple production locations. From Timo Bollerhey, Shaping the Global Energy Transition (Nov 2024).

A second auction is currently in the planning stages, with a truly global design. It will be larger than the first ammonia auction (€3.83 billion versus €1 billion), include a fixed price contract for a 10 year period (2026-2036), feature Germany or the Netherlands as the first point of delivery into Europe, and feature multiple supplier-customer agreements (potentially with multiple different hydrogen vectors). Different € amounts are being committed to various production geographies (see left), diversifying supply.

A maritime mechanism?

Finally, there is also the potential for H2Global to enter the maritime fuel space. Actions are already underway to scale the supply of alternative maritime fuels (e.g. the ZEMBA coalition and green shipping corridors), and H2Global is considering a special auction design for maritime fuels. Considerations include different funding allocations, shorter-term contracts, and the inclusion of other environmental and social sustainability criteria other than EU regulations and carbon intensity. Work continues, with more to be announced in 2025.