How to build a green shipping corridor

By Sofia Furstenberg Stott on December 18, 2022

Key takeaways from a pioneering workshop at the AEA annual conference in Phoenix

The AEA annual conference coincided this year with COP27. This made for almost live updates transmitting from COP27 into the AEA conference proceedings, which created a great sense of relevance and urgency to the audience in the room. In relation to maritime green corridors, and with the conference as usual hosted in the US, it was encouraging to learn about US specific initiatives being announced, such as the “US National Plan for Maritime Decarbonization”, and its efforts to develop tools and resources through a maritime corridor hub and bilateral collaborations on maritime green corridors.

Earlier this year, the Maersk McKinney Møller Centre for Zero Carbon Shipping, together with McKinsey & Company, launched a Feasibility Phase Blueprint for the advancement of green shipping corridors. This blueprint meticulously takes you through seven phases of feasibility assessment: i) corridor baseline assessment, ii) alternative fuels supply chain, iii) port and bunkering infrastructure, iv) vessel decarbonisation pathway, v) cargo demand analytics, vi) summary and vii) roadmaps forward. In a pioneering workshop, we gathered around 60 members of the Ammonia Energy Association together to explore how the ammonia sector can engage to support the advancement of green shipping corridors, using this new blueprint as a basis.

Focusing on select, targeted questions from the blueprint, we asked how ammonia stakeholders could &/or should support development in the seven feasibility criteria.

Setting a baseline

When evaluating the viability of a port and trade route as a potential target for a green corridor, establishing a baseline is a first priority. We asked the group how can/should ammonia stakeholders:

- Help answer questions related to decarbonization potential and timeline for a specific green ammonia corridor? What conversations need to happen and how do we need to share information?

- Assist in identifying market and commercial enablers?

- Help identify trade flow synergies along an ammonia green corridor?

The answers included the opportunity for ammonia stakeholders (e.g. ammonia producers, traders, carriers, shipowners, OEMs, etc.) to “provide visibility” into all existing and planned green corridor initiatives, including key contacts and how to engage. This fits very well with the newly established Mission Innovation Green Shipping Corridors site, with its route tracker and match-making platform. Answers also included the providing of “easy access” to shipping traffic data and providing of data on the market structure of shipping services and trade on the suggested corridor. From fragmented or concentrated traffic patterns, top cargo owners/traders and top ship operators could then more easily be identified.

Visibility of future production volumes

The next segment assessed was the future fuels supply chain. Here, we asked how we could or should:

- Support with information about existing and planned production volumes of ammonia, and engage in exploration of future capacity development dedicated for shipping fuel?

- Assist with estimating future fuel demand?

- Assist with establishing an overview of required fuel production investment and financing?

Providing visibility was again a key answer in the discussions that followed. It was suggested that the ammonia production sector could enhance visibility to production capacity projects and what phase of maturity they are in, including low-carbon ammonia volumes to be produced, and if any of this will be earmarked for maritime use. In this regard, it would be helpful for a green corridor assessment initiative to receive insight into whether producers are looking to lock in offtake, and under what conditions.

Ammonia stakeholders could – where possible – also provide visibility to the shipping order book of ammonia-ready vessels, types and sizes, delivery dates and likely trade routes.

Infrastructure, infrastructure, infrastructure

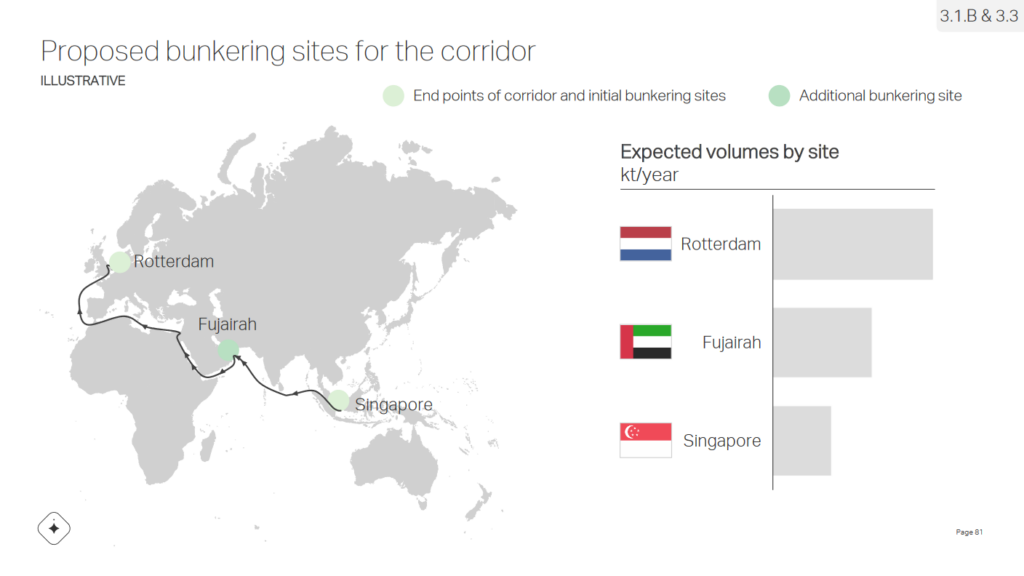

Next, participants discussed issues surrounding the port development. Questions asked included how ammonia stakeholders could or should:

- Assist with insights related to planned and existing ammonia (port, bunkering and storage) infrastructure, and any retrofitting of these?

- Assist with developing insights related to bunkering capacity requirements?

It was suggested that details of existing ammonia infrastructure in the targeted port as well as in the immediate hinterland could be very useful for the corridor feasibility study (eg. storage facilities, terminals, pipelines, rails, and ammonia plants). That would include assessing the availability of physical space for potential new infrastructure. Certainly it would be important to have information of the amounts of ammonia currently being either imported or exported from the port, and if there is a growth potential for low-carbon ammonia import/export for other industries than maritime?

The regulatory envelope was also touched upon. It would be useful to have better access to relevant port, state and local authorities. National regulations can be difficult to navigate, and it is always helpful to know who to contact and for what.

Relating to bunkering capacity requirements, the group discussed the need for making basic ship and voyage details more readily available to corridor assessment initiatives, including bunkering behavior of ships calling on the port. Price guidance on cost basis would be useful to enable attractiveness of location compared to adjacent regions.

Discussions also ventured into the question of shipowners’ decarbonisation agendas and willingness to bunker ammonia as part of their development goals. Providing an overview of shipowners’ targets and clear ambitions would certainly be helpful for assessing the relevance of a green shipping corridor of low-carbon ammonia.

Cargo Demand Analysis

The last discussion related to cargo demand, and how the ammonia sector can get involved. We reflected on how ammonia stakeholders could or should:

- Assist with cargo demand analysis? Are there synergies to be explored with the ammonia transport sector?

- Help identify mechanisms to support demand for decarbonized trade?

Here, the conversations centered around the ship operator, who were suggested to provide more visibility as to cargo owners’ level of interest for low carbon transport. This could be done through adoption of technologies or practices allowing cargo owners to know the footprint of delivering their cargo.

Wrapping up

At the end of the session, the whole group was asked whether they had identified any issues that were omitted from the blueprint, which were particularly important for the ammonia sector. It was noted that while safety standards and policies are mentioned numerous times in the blueprint, there is very little detail that touches upon the implications of these, such as safety zones and limitations to access. There is also no mention of the public perception of safety, and how such issues need to be addressed.

Further, while environmental policies and regulations are included in the blueprint, there is no mention of the environmental impact and costs of developing green corridors, not least with regards to infrastructure land use and the impact this can have on e.g. coastal living communities and biodiversity. From an ammonia perspective, any environmental risk derived from an increased use of ammonia at sea needs to be well understood and acknowledged when assessing the opportunities of green ammonia shipping corridors.

Note: huge thanks to Ralph Matlack for assisting with the in-session note-taking.