Hydrogen Stands Out in BP’s New Strategy

By Stephen H. Crolius on August 13, 2020

Last week oil major BP released its second quarter financial results – and used the occasion to share the company’s new strategy. “We aim to be a very different kind of energy company by 2030,” the company said, “as we scale up investment in low-carbon, focus our oil and gas production and make headway on reducing emissions.” “Investment in low-carbon” turns out to involve full embrace of the hydrogen paradigm circa 2020: power-to-gas; carbon capture, utilization, and storage; and the possibility of a “hydrogen export” business based on ammonia.

According to Oil & Gas IQ (“the world’s largest community of oil and gas professionals”), BP is, with revenues of USD $304 billion, the world’s fifth largest petroleum company. In a February 2020 announcement previewing its IEC strategy, BP spoke about its greenhouse gas footprint: it has global emissions from operations “of around 55 million tonnes of CO2 equivalent (MteCO2e)” and carbon in the oil and gas it produces that is “equivalent currently to around 360 MteCO2e emissions a year,” for an annual total of 415 MteCO2e. Global carbon emissions in 2019 were approximately 43 billion tonnes, which means BP is acknowledging ownership of a full one percent of the problem.

According to its August 4 investor presentation, BP’s strategy embodies three major thrusts: “scale-up our low-carbon electricity and energy businesses significantly; transform our convenience and mobility offer; and focus our valuable oil, gas and refining portfolio, and make it more resilient.”

Included within the low-carbon thrust are renewable electricity, bioenergy, and hydrogen. Critically, BP is looking at these pursuits as synergistic parts of a whole: “The three low carbon energy businesses, complemented by integrated gas, will all be needed to transition. Moreover, they are complementary to deliver low carbon systems and solutions.”

The presentation contains one more level of detail: “We believe in a role for both blue and green hydrogen and will focus on both, in North America and Europe, targeting industrial and heavy-duty transport; as well as the Australian export market for green hydrogen.” Specific reference is made to an Australian “Hydrogen Export Project.” This was the subject of an Ammonia Energy article (“Project GERI: BP’s green ammonia feasibility study”) in May 2020. “While this project begins small,” the article says, “with a pilot-scale 20,000 ton per year green ammonia plant selling into domestic markets, it could lead to a 1,000,000 ton per year (1.5 GW capacity), export-oriented green ammonia plant.” According to the announcement from the Australian Renewable Energy Agency, Project GERI “will generate findings to better understand the technical and financial implications of a fully integrated renewable hydrogen supply chain.” The AUD $4.4 million (USD $2.8 million) effort is slated for completion in February 2021.

results and strategy presentation,” August 4, 2020.

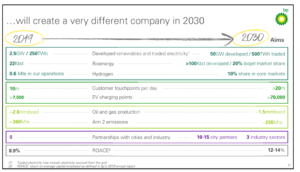

BP’s low-carbon energy thrust embodies quantitative 2030 goals in each of its focus areas: renewable electricity generation capacity is to increase from 2.5 GW to 50 GW; bioenergy production from 22,000 barrels per day to more than 100,000; and annual production of hydrogen from 600,000 tonnes to a ten percent share of “core markets.” (“Core markets” presumably include the aforementioned industrial uses, heavy-duty transport, and tradable energy.)

The framing of the latter goal in terms of market share is a significant gesture. On the one hand, it represents something like a 20-fold increase in BP’s hydrogen output. On the other hand, the global oil and gas industry generates annual revenues in the ballpark of USD $5 trillion, giving BP a market share of approximately six percent. A goal of ten percent thus signals the company’s intention to occupy a larger position in the sustainable energy economy of the future than it occupies in the unsustainable one of today. With the spate of recent news about other heavyweights entering the green ammonia arena (“Saudi Arabia to export renewable energy using green ammonia,” “Solar ammonia, available in Spain from 2021,” “Green ammonia at oil and gas scale: the 15 GW Asian Renewable Energy Hub”), an interesting – and beneficial – race appears to be shaping up.