HyEx: ammonia from the Chilean desert

By Kevin Rouwenhorst on March 08, 2023

In our January episode of Ammonia Project Features, Asunción Borras (Engie) and Pablo Wallach (Enaex) presented on the HyEx project for renewable ammonia production in Chile. The recording is available via the AEA’s Vimeo channel, and you can also download the speaker presentations.

In the 19th century, Chile was one of the very first countries to export nitrogen fertilizers on an industrial scale. Chile had some of the largest deposits of Guano (fecal excrement from marine birds containing nitrogen and phosphate) and Chile Saltpeter (sodium nitrate). One of the main causes of the closure of this industry in Chile was the invention of synthetic nitrogen fertilizer production methods at the turn of the 20th century.

Big renewable potential

Currently, Chile is a major importer of ammonia. According to the World Bank, Chile imported about 347,000 tonnes of ammonia in 2019, at a cost of 91 million USD. The bulk of this comes from Trinidad & Tobago and the United States. Following the supply chain disruptions throughout 2021, the cost of ammonia imports more than doubled, resulting in a total cost of 215 million USD.

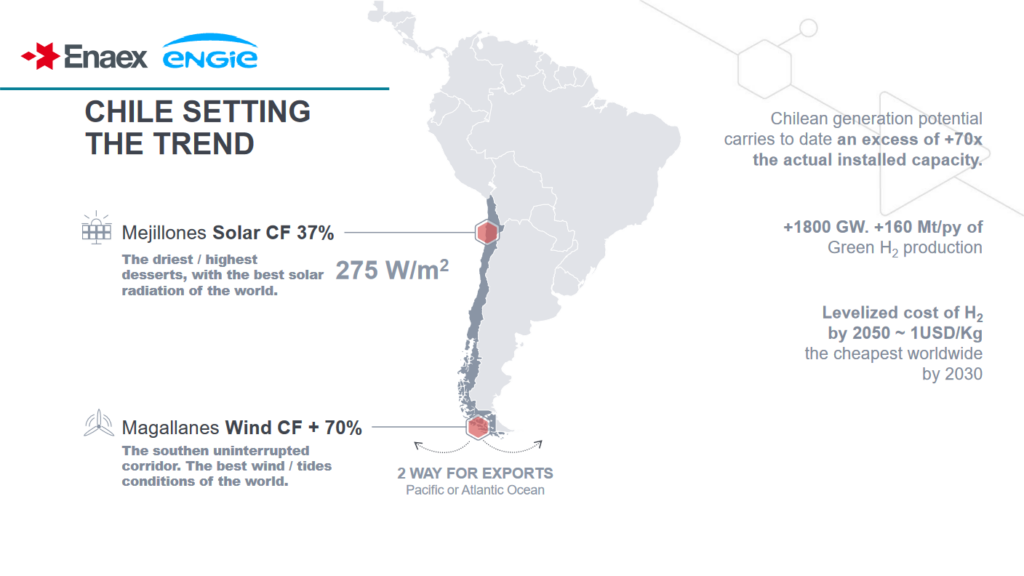

This sets the stage for Chile to produce its own ammonia from renewable energy. Chile has some of the best solar potential globally. The Atacama desert in Chile’s north boasts a solar capacity factor of 37% and solar irradiation of 275 W/m2. Where wind power is concerned, the Magallanes area in southern Chile boasts wind capacity factors in excess of 70%.

According to Fasihi and colleagues, Chile is among the lowest cost locations for renewable ammonia production from solar PV and wind by 2030. The cost of ammonia was estimated at around 400 EUR per tonne in the best locations in Chile. Similarly, Armijo and Philibert found that renewable ammonia can be produced at a cost below 500 EUR per tonne in the Atacama desert in the near future. This can make locally produced renewable ammonia competitive with imported fossil ammonia.

In order to accommodate the development of renewable hydrogen and its derivatives, Chile has issued a National Green Hydrogen Strategy. The aim is to have at least 5 GW electrolyzers by 2025, and to have the lowest cost renewable hydrogen production globally by 2030. By 2040, Chile aims to be among the top 3 exporters of hydrogen and its derivatives.

Decarbonizing mining in Chile

The north of Chile is also the location for most of the country’s mining activity. According to the US International Trade Administration, Chile accounts for 29% of global copper production, and 22% of global lithium production, two relevant metals for the energy transition. Mining implies a need for blasting agents such as ammonium nitrate.

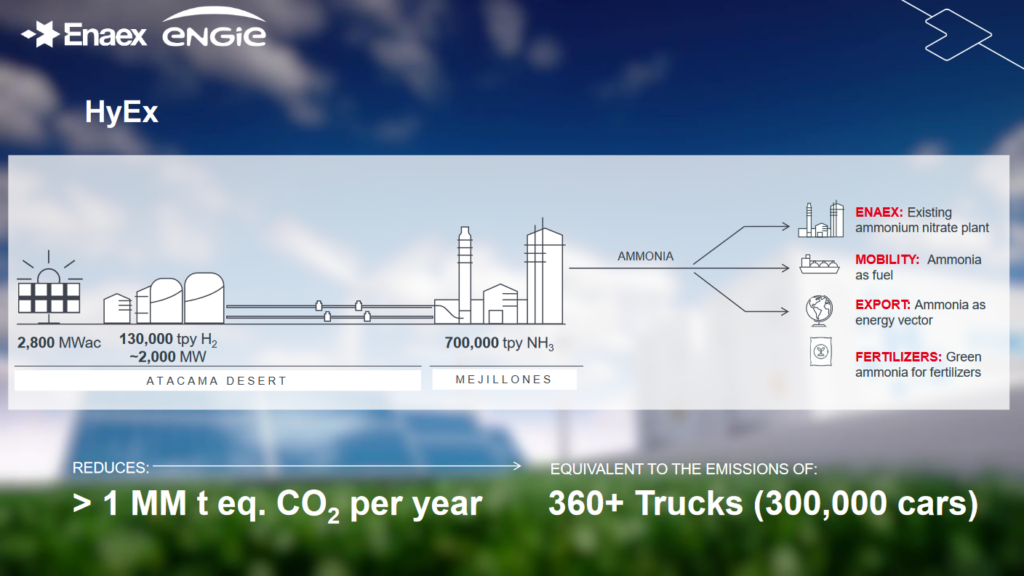

The company Enaex imports approximately 350,000 tonnes of ammonia per year for conversion to ammonium nitrate blasting agents at its Prillex plant in Mejillones. Enaex estimates Scope 3 emissions of 750,000 tonnes CO2 equivalent annually from ammonia imports to its terminal in Mejillones. The company aims to decarbonize its value chain, while providing blasting services for material extraction required during the energy transition. A step towards decarbonization is the import of ammonia with a reduced carbon footprint. The aim is to transition to fossil-based ammonia with CCS (‘blue ammonia’) as it becomes available.

Furthermore, Enaex operates the last “classical” renewable ammonia production plant with electrolysis-based hydrogen production in Cachimayo near Cuzco in Peru. The plant has 18 MW of alkaline electrolysis and an estimated annual capacity of 15,000 ammonia per year. The plant has been operated since the 1960s. Recently, Engie and Enaex agreed to a new PPA (power purchase agreement), wherein ENGIE will supply certified renewable electricity (mainly hydropower, some peakshaving) to fully power operations at Enaex’s plant in Cachimayo. The aim is to certify this renewable ammonia and nitrate derivatives by the end of 2023. Furthermore, additional DeNOx facilities will be installed for the nitric acid production plant in Cachimayo, further reducing emissions of NOx and N2O from the facility.

The Cachimayo plant not only allows for the production of renewable ammonia and derivatives. In fact, it is the largest ammonia plant in the world solely fed with electrolysis-based hydrogen. This allows Enaex to gain valuable experience and to test the flexibility of the hydrogen production and the ammonia plant. For example, Enaex has developed a method to operate the ammonia plant in standby mode for several hours, ie. during hours with high electricity cost. The air separation unit (ASU) for nitrogen generation, however, operates continuously.

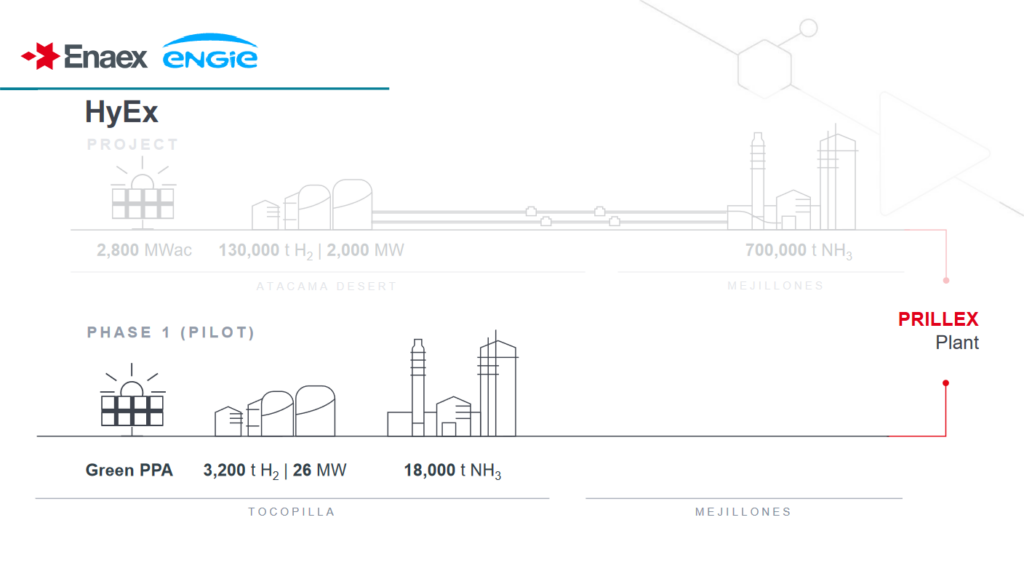

HyEx: pilot

In the future, large-scale renewable ammonia production from solar PV and wind in Chile can be produced at a relatively low cost. However, the integrated solution is currently not proven at a relevant scale. A “de-risking” approach has been chosen for the HyEx project, wherein a pilot plant for 18,000 tonnes of ammonia production per year will be deployed in 2025 (pending FID by the end of this year), before scaling up to 700,000-plus tonnes of ammonia production per year. Engie is responsible for the renewables and hydrogen production, whereas Enaex will operate the ammonia plant. KBR has been selected as licensor of the ammonia synthesis technology.

A drawback of small-scale ammonia production is the higher cost of the end product, implying the competitiveness with fossil-based ammonia production is currently limited. However, such pilot plants will be required to de-risk larger, more economically-viable renewable ammonia plants. Therefore, the HyEx project has received substantial funding from the Chilean and foreign governments for the pilot phase.

The pilot plant will be powered by existing solar PV capacity via a PPA, coupled with 26 MW electrolysis capacity to produce 18,000 tonnes of ammonia per year. The electrolyzers and ammonia plant will be located in Tocopilla. The produced renewable ammonia will be transported by truck over about 132 kilometers to Enaex’s existing Prillex plant in Mejillones. So far, alkaline electrolyzers have been included in the environmental permits. However, a final choice for the electrolysis technology (alkaline or PEM) has not been made yet. Water for the electrolysis units will be provided by an existing water desalination plant with spare capacity due the closure of coal-fired thermal power plants.

Renewable electricity will be available for 20 hours per day, based on solar PV combined with battery storage. About 1 tonne of hydrogen storage will be installed for the 4 hours without renewable power. The ammonia plant will operate at 40% load during these 4 hours. The FEED for the pilot plant started at the end of 2022, and is expected to be done by September 2023. FID is expected by the end of 2023, for production to start in 2025.

Engie is also active in other renewable ammonia projects globally to achieve operational experience with electrolysis-based hydrogen, including the YURI project in the Pilbara, northern Australia. The first phase of the project consists of 18 MW solar PV capacity coupled with 10 MW electrolysis capacity for renewable hydrogen production to be fed to an existing fossil-based ammonia plant of Yara in 2024.

HyEx: full-scale

At full-scale, the HyEx is estimated to be based on 2.6 GW of newbuild solar PV capacity to power 2.0 GW of electrolyzer capacity in the Atacama desert. The ammonia plant is located downstream in Mejillones, producing 700,000-plus tonnes of ammonia per year. The hydrogen plant and ammonia plant will be connected via pipeline, which also serves as a buffer for intermittency in hydrogen supply. This allows the ammonia plant to operate based on a stable hydrogen supply. Pending FID, construction is expected to start in 2027 for production to start in 2030.

About half of the 700,000-plus tonnes per year capacity will be used to cover Enaex’s existing requirements for ammonia, while the other half may serve ammonia energy uses such as mobility or export to global markets. This allows the ammonia import hub of Mejillones to potentially become an ammonia export hub in the future.

The HyEx project can serve as a flagship project for decarbonizing Chile’s mining industry, while also opening up a new ammonia energy export market in the north of the country. It is important to note that such a project takes time, as the market still needs to develop. The environmental permits are also key, and a good relation with authorities, local communities, and other stakeholders is required for a social license to operate. Furthermore, the integrated technology needs to be demonstrated in a pilot phase, before operation at large scale is deemed feasible. The HyEx pilot plant is one such demonstration – a key stepping stone on the path forward.