IEA: ammonia key to decarbonising shipping by 2050

By Julian Atchison on October 03, 2023

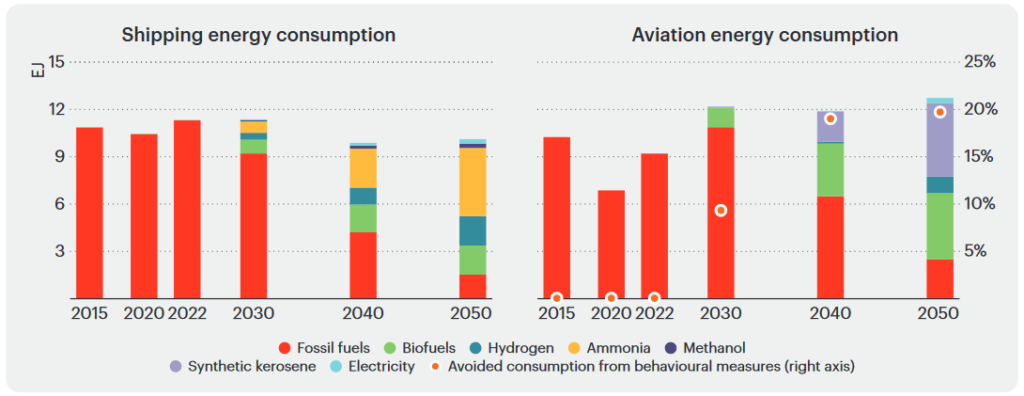

The latest edition of the IEA’s Net Zero Roadmap forecasts a key role for ammonia fuel in decarbonising the global shipping sector. With international shipping activity to more than double by 2050, ammonia’s share of final energy consumption will rise from 0% last year to 44% in 2050, with a suite of other low-carbon fuels to play a role (biofuels and hydrogen 19% each, methanol 3%). 15% of shipping activity will still be fossil-powered, but the sector will have drastically reduced its carbon emissions by this time, with further reductions to occur.

The report authors note significant progress has been made since the last edition, particularly around commercialisation of ammonia-powered two-stroke engines. Ammonia-ready vessel orders will also continue to increase in the coming years:

While today there are no commercial ships operating on ammonia, engine manufacturers have successfully tested the technology, and around 150 ammonia-ready vessels were on order at the end of 2022. These ships present an opportunity to rapidly develop the associated safety protocols. In the NZE Scenario, orders of ammonia-ready vessels increase from the 2022 level on average by about 20% per year to 2030, representing about 15% of typical annual vessel orders.

From Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach (IEA, 2023).

On the power generation front, the report forecasts ammonia co-firing will play a minor role in abated fossil fuel power generation in 2050. With unabated fossil plants set to all but disappear by 2050, CCUS, hydrogen co-firing (gas turbines), ammonia co-firing (coal generating units) and biomethane will all contribute. Hydrogen & ammonia co-firing will contribute 1,161 TWh of electricity generation, based on 427 GW of installed capacity.

Other key players line up behind ammonia maritime fuel

In its recent report The Future of Maritime Fuels, Lloyd’s Register has also forecast a key role for ammonia in decarbonising shipping. Together, “blue and e-ammonia” will capture between 20-60% of the shipping fuel market by 2050, with an average of 46% across the scenarios (a similar figure to the IEA report). The most promising – and highly adopted – alternative maritime fuel in 2050 will be e-ammonia, or ammonia from electrolytic hydrogen feedstock. Hydrogen required to supply ammonia for the shipping industry could represent up to 8.3 -17.5 % of global hydrogen demand in 2050. Lloyd’s Register also notes that the shipping industry will need to “drive most of the development for the supply infrastructure and show leadership in securing the adequate scaling of the supply” to realise this outcome.

In an interview with Motorship Magazine, OCI HyFuels Business Development Director (Marine) Barend van Schalkwyk explained what the future fuel mix for shipping would look like in 2050. With low-carbon alternative fuels set to “enter the arena” later this decade, “Green methanol will grow from now to 2030 and then likely continue to supply a consistent proportion. E-ammonia will become more significant from 2030 onwards and is likely to become the most significant fuel in the sector by 2050, due to its zero emission credentials”. Strong regulations – including but not limited to carbon levies, legislated targets and industry-wide definitions for “low emissions fuels” – are still required to ensure the uptake of alternative maritime fuels like ammonia.