IEA publishes Ammonia Technology Roadmap

By Kevin Rouwenhorst on October 19, 2021

Last week, the International Energy Agency (IEA) published the Ammonia Technology Roadmap, which provides deep technical insight into the nitrogen fertilizer industry’s decarbonization pathway to 2050.

Various scenarios were introduced, including a baseline scenario, a sustainable development scenario (SDS), and a net zero emissions (NZE) scenario with a 2050 horizon. It should be noted that the role of ammonia as fuel and hydrogen carrier is not discussed. You can download a PDF of the Ammonia Technology Roadmap via the IEA website.

Ammonia is the starting point for all mineral nitrogen fertilisers, forming a bridge between the nitrogen in the air and the food we eat. Around 70% of ammonia is used to make fertilisers, with the remainder used for a wide range of industrial applications, such as plastics, explosives and synthetic fibres. Ammonia may also serve as a low-carbon energy vector in the future, but that application is not considered within the core analytical scope of this technology roadmap. Ammonia production accounts for around 2% of total final energy consumption and 1.3% of CO2 emissions from the energy system. An increasingly numerous and affluent global population will lead to growth in ammonia production, during a period in which governments around the world have declared that emissions from the energy system must head towards net zero.

Abstract from the Ammonia Technology Roadmap, IEA, October 2021

Currently, ammonia generates about 450 million tonnes (Mt) of CO2 annually, about 1.3% of global CO2 emissions according to the IEA. This is due to the fossil feedstocks currently used to produce ammonia. About 22% of ammonia production is based on coal, which creates twice as much CO2 as natural gas-based ammonia production.

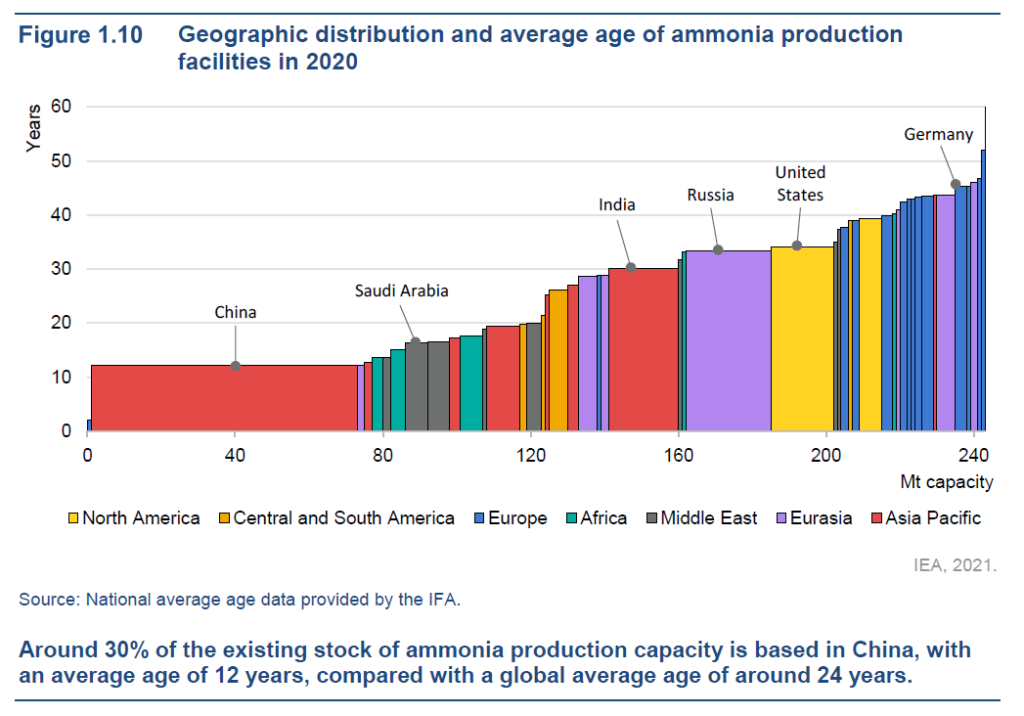

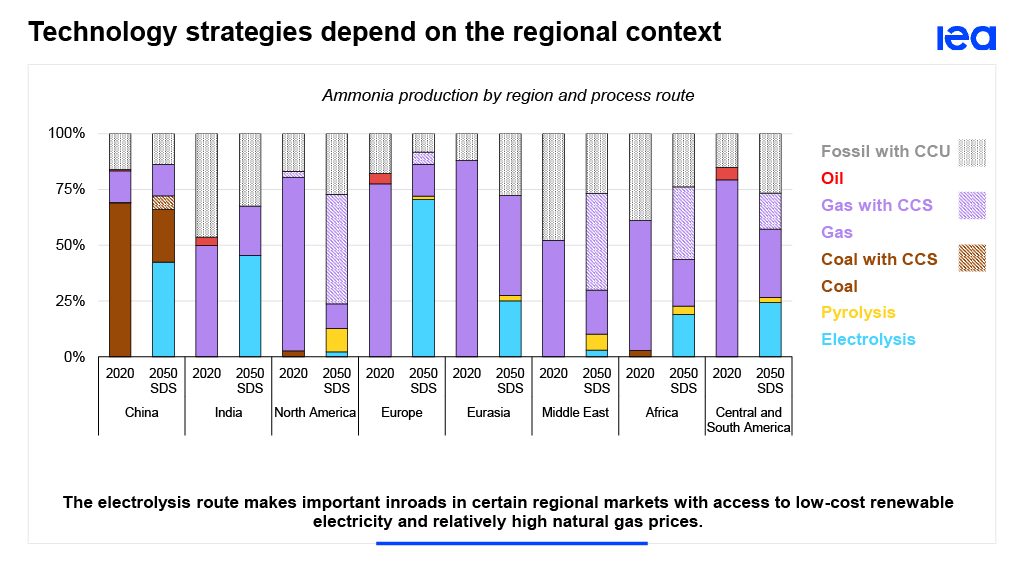

Coal-based ammonia production is mainly located in China, and about 30% of the existing ammonia production capacity worldwide is located in China. In addition, the average age of an ammonia plant in China is only 12 years, while the global average is 24 years. Ammonia plants can typically operate for multiple decades, creating an especially complex situation for decarbonization within China.

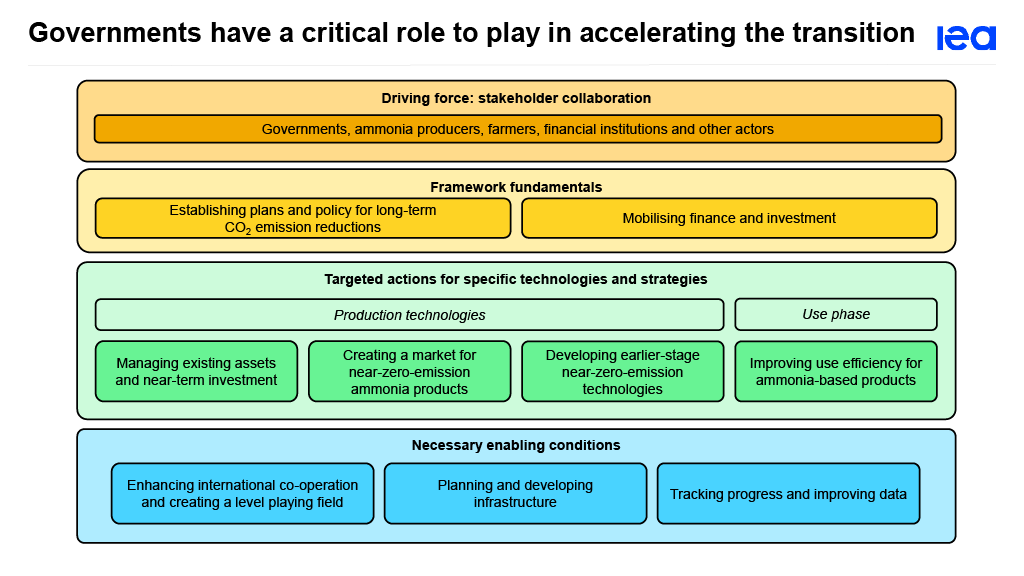

Moving beyond technology pathways, the IEA clearly states that strong policy actions are required to accelerate decarbonization of nitrogen fertilizers by 2050, both within China and worldwide.

Strategies should be backed by mandatory long-term emission reduction policies, with stringency increasing over time in a predictable manner. This may include carbon pricing in the form of carbon taxes or an ETS, or a tradeable emissions performance standard that would require a decreasing average emission intensity of ammonia production.

Ammonia Technology Roadmap, IEA, October 2021

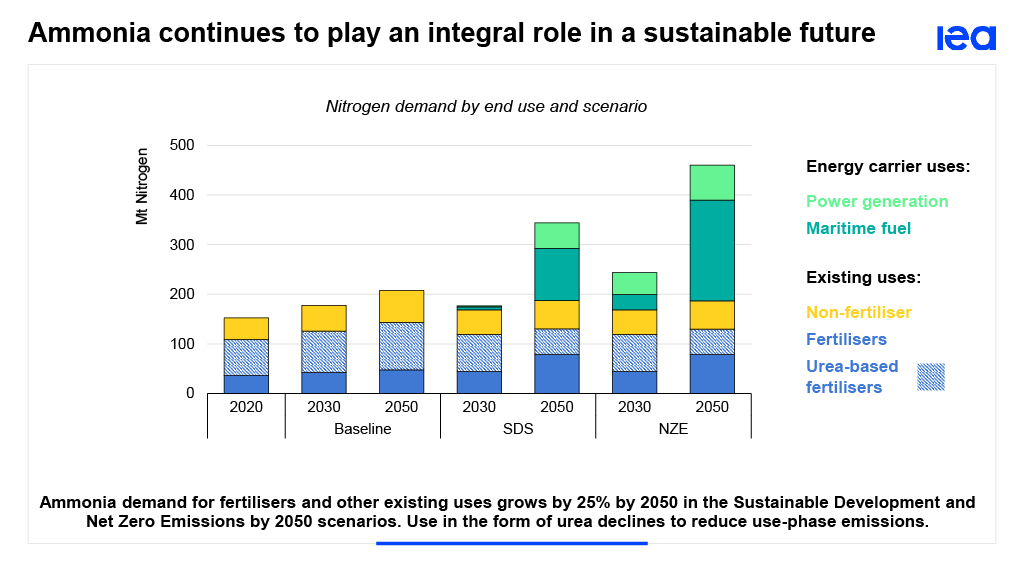

Future ammonia demand

According to IEA’s analysis, the future demand for ammonia is based on one of three scenarios. In case of the “baseline” scenario, growth of ammonia production up to 2050 is due to growth in fertilizer demand and non-fertilizer uses. In case of the “sustainable development” scenario (SDS) and the “net zero emissions” scenario (NZE), the IEA predicts that ammonia will also play a role for power generation and as a maritime fuel. And, in the NZE, the maritime market is estimated to be larger than the current applications combined. As stated above, however, consideration of these future energy markets was not included in the decarbonization roadmap.

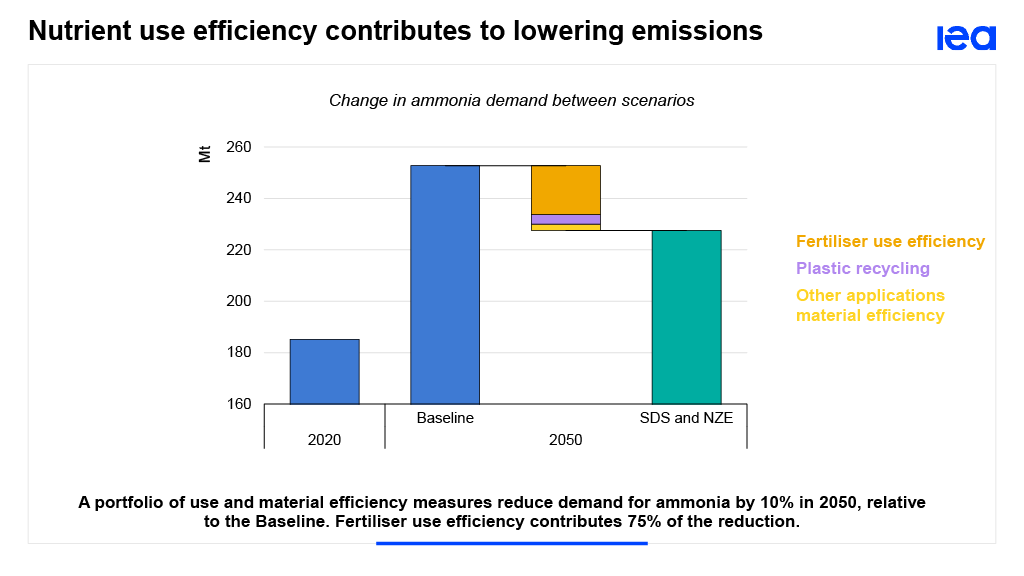

The ammonia demand from current markets, such as fertilizers and plastic manufacturing, also depends on the future scenario. In the baseline scenario, the ammonia demand for current markets amounts to over 250 million tonnes annually by 2050. Upon decarbonization of the global energy system (SDS and NZE), efficient resource utilization becomes increasingly important and demand from current markets grows less significantly to below 230 million tonnes. Examples include more efficient fertilizer application and plastic recycling.

Decarbonization: cheaper than business as usual

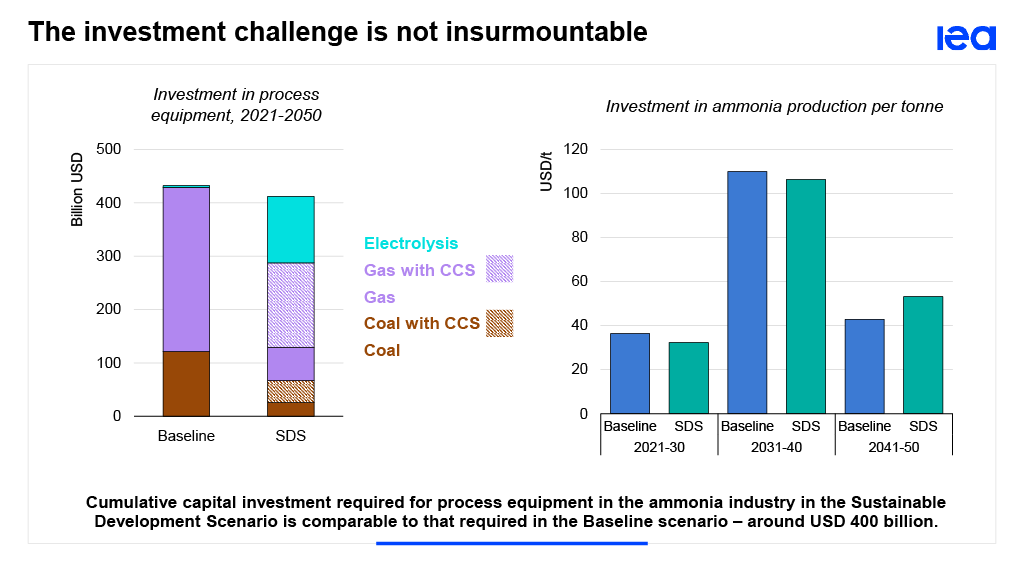

Over the past decades, the conventional wisdom was that decarbonization is more expensive current fossil technology. However, the IEA report indicates that the cumulative capital investment required by the ammonia industry for the baseline scenario and the SDS are about equal, at around USD 400 billion through 2050.

The role of renewable ammonia

The IEA estimates a prominent role for decarbonization via CCS and CCUS for the fertilizer sector, both from natural gas and from coal feedstocks, while the role of renewable ammonia remains limited.

It should be noted that the International Energy Agency has historically underestimated the annual added solar capacity in its World Energy Outlook. As increased installations lead to a decrease in costs (“Swanson’s Law“), an underestimation of the deployment of solar inevitably leads to an overestimation for the cost of solar. This might lead to an overestimate of the cost for renewable ammonia from solar (and wind), which can in part explain the relatively low share of renewable ammonia in IEA’s Ammonia Technology Roadmap, even in the NZE scenario.

In this light, and especially following recent discussions regarding the footprint of blue hydrogen and recent announcements of 17 million tonnes of renewable ammonia per year by 2030, the IEA’s estimate regarding renewable ammonia production may prove to be on the low side. But the IEA will be updating its assumptions every year: only four years ago, when the IEA first looked at the decarbonization of ammonia, it estimated that renewable ammonia would only take off after 2050.

Methane pyrolysis

Interestingly, methane pyrolysis is highlighted as a decarbonization pathway in the SDS and NZE scenarios for locations with low cost abundant natural gas, such as North America and the Middle East. Methane pyrolysis is the process where natural gas is converted to solid carbon black and hydrogen gas. Although methane pyrolysis is currently an experimental technology, Monolith Materials has already announced a 270,000 ton per year ammonia plant in Nebraska based on the process.