Industry report sees multi-billion ton market for green ammonia

By Trevor Brown on June 04, 2020

This week, Argus Media published a white paper on green ammonia. This includes an overview of potential new markets and market volumes, a round-up of green ammonia projects around the world, and an assessment of production technologies and their impact on the ammonia cost curve. Argus estimates that, by 2040, green ammonia could cost just $250 per ton.

Argus is an industrial analysis and consulting firm with long experience in the ammonia market, which, traditionally, centers on the fertilizer sector. This white paper therefore provides a welcome commercial perspective on the outlook for ammonia energy.

Volumes: green ammonia market will be larger than fossil ammonia market

In the title of its white paper, Argus asks whether the “green shift,” or the trend towards sustainable, low-carbon ammonia production, can create a billion ton per year market — five times the size of today’s ammonia market. The new applications for ammonia that lead to a market of this size are generally not relevant to conventional ammonia, which is constrained by its large carbon footprint.

Whereas one tonne of conventional, or “brown” ammonia emits two tonnes of CO2, production of green ammonia would see it produced from renewable energy sources, emitting zero carbon.

Global ammonia production at present stands at 180mn t/yr, but its potential use as an energy source and energy carrier could see demand for it rise to a multi-billion tonne market for use in a range of applications. Ammonia is now one of the main fuels being considered by the maritime sector to enable the shipping industry to meet new CO2 reduction targets proposed by 2030 and 2050. Ammonia is also being seriously considered as a means to store renewable energy for delayed use, and as a carrier for hydrogen transportation.

Argus Media article, Green ammonia: Opportunity knocks, May 28, 2020

I wrote last week about Monash University’s Roadmap to an Ammonia Economy, which provides another assessment of green ammonia’s market potential. The Monash publication described a pathway, driven by new technology innovation, that unlocked exponential growth leading to a green ammonia market fully one hundred times larger than today’s.

Solving for cost: regulations, incentives, or markets

One of the most interesting sections concerns the cost of green ammonia. This includes analysis of ammonia plant capital costs, including for small scale plants, and of operating costs — “the biggest hurdle.”

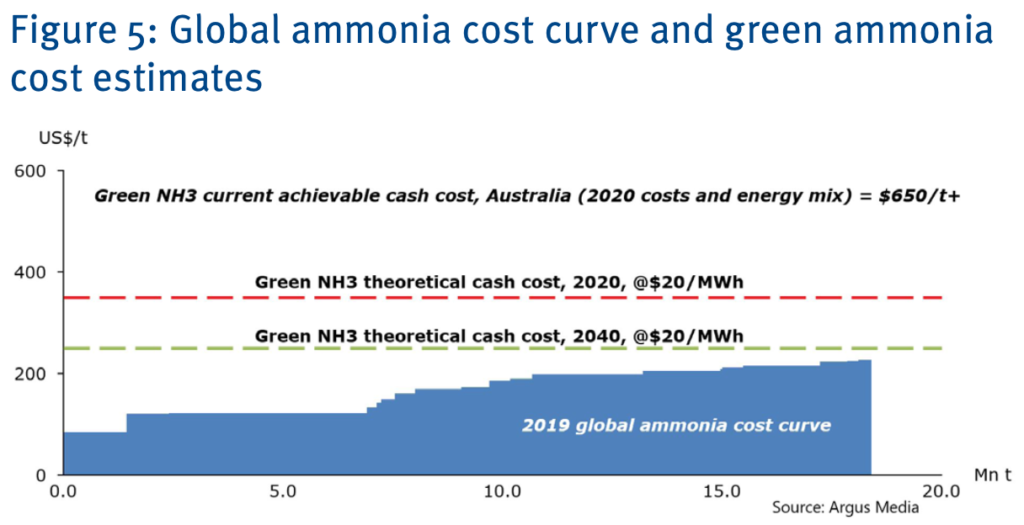

Argus estimates that the production cost of green ammonia today would be more than $650 per ton (using Australia as an example and “assuming 2020 costs, technology, energy mix and an average electricity cost of $50/ MWh”). This is roughly twice the market price of conventional ammonia.

Things would get more interesting if electricity prices dropped below $20/MWh, a price at which the levelized cost of hydrogen would drop to $2.30/kg, and result in a cash cost of ammonia of around $335-340/t. Taking into account reasonable assumptions for long-term efficiency gains, we are assuming that a levelized cost of hydrogen could drop below $1.50/kg by 2040, which in turn would allow ammonia cash costs in the $245-250/t region (roughly the cash cost of production of a plant supplied with $6/mmBtu gas).

Argus Media white paper, Green shift to create 1 billion tonne ‘green ammonia’ market?, June 2020

The question then becomes: how to move this market forwards using either incentives (like a carbon tax) or regulation (like the IMO is developing to support its emission reduction targets). A third mechanism would be a market-based solution that rewards green ammonia with a premium price (“a two-tier pricing system”). These are all complementary measures, most effective in combination.

A key component of the commercial adoption of green ammonia in the future will be the level of incentives provided or regulation enforcing its use. The most likely incentive could come in the form of CO2 taxation and credits … We assume that based on the lowest green ammonia cash costs achievable today (i.e. above $300/t), CO2 prices would have to climb at least above $50/t to level the playing field for green vs. brown ammonia.

Regulations could play a pivotal role for the adoption of green ammonia, similarly to how they incentivised investments in renewables. For instance, legislation from the IMO could enforce absorbing the higher cost of ammonia in marine application. In addition, the implementation of a two-tier pricing system for ammonia (for any application), similar to power markets, would also provide additional support to green ammonia.

Argus Media white paper, Green shift to create 1 billion tonne ‘green ammonia’ market?, June 2020

The transition will be gradual

The white paper concludes with a dose of reality, namely that the shift to green ammonia will not manifest as a sudden shock to the industry, either for producers or for consumers, but as a “gradual transition.”

For producers, this transition can be achieved through incremental additions of “green hydrogen as a feedstock mixed with hydrogen produced from steam reforming.” As electrolyzers are installed on existing production sites, and then expanded over time until they ultimately replace the steam reforming unit completely, the carbon intensity of the product is driven down to near zero.

For the future green ammonia consumer, the white paper looks at the example of maritime fuel. It points out that the maritime sector is interested in ammonia for two reasons: “primarily due to its zero-carbon emissions, and also due to its zero-sulphur content, which … ensures compliance with IMO 2020 and IMO 2050.”

The paper argues that ammonia — of any color — provides compliance with the existing low-sulphur regulations (IMO 2020). But using conventional ammonia in the near-term would involve the same technologies and infrastructure that would be required in the longer-term to comply with low-GHG regulations (IMO 2050). In theory, therefore, ship owners and operators could switch to brown (fossil-based) ammonia fuel in the near-term, in advance of the necessary global scale-up of green (renewable) ammonia production.

The interest in ammonia as a marine fuel is not limited to green ammonia, but it is also involving brown ammonia, purely on the basis of its zero-carbon/sulphur properties, even though on a net basis there would not be any CO2 emissions advantages from switching from conventional marine fuels to brown ammonia. Nevertheless, the use of brown ammonia as a marine fuel could facilitate the transition towards increased usage of blue and green ammonia in the longer term.

Argus Media white paper, Green shift to create 1 billion tonne ‘green ammonia’ market?, June 2020