Key shipping stakeholders see a multi-fuel future: new survey results

By Julian Atchison on May 08, 2023

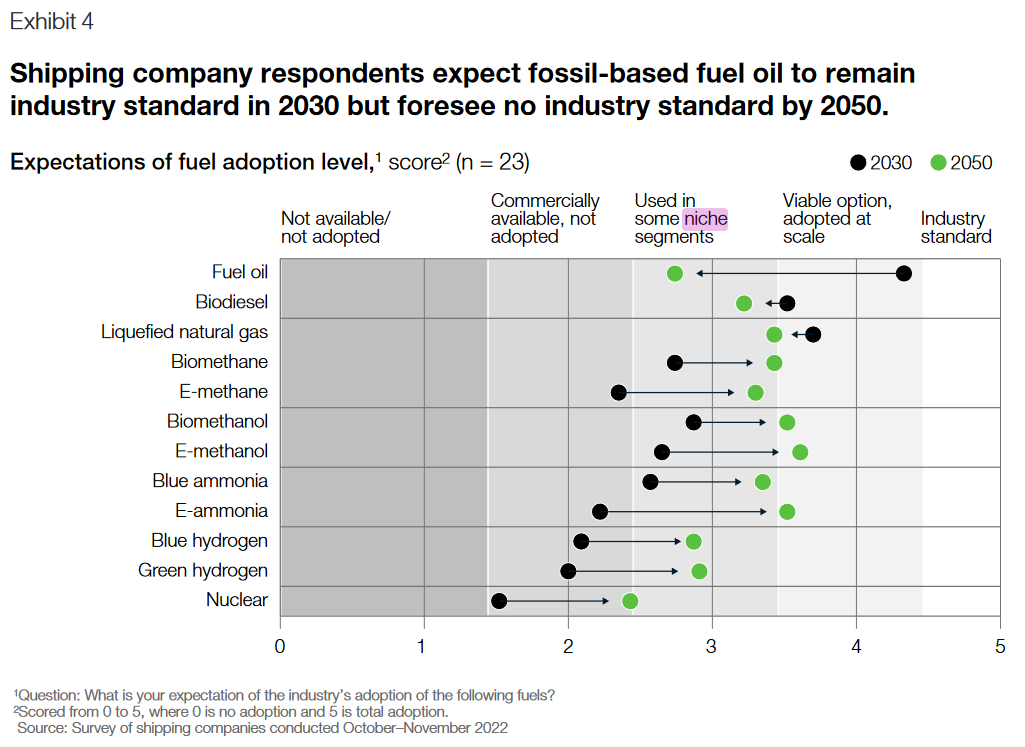

A survey of shipping industry leaders representing 20% of the world’s current fleet capacity was recently conducted by the Global Maritime Forum, the Global Centre for Maritime Decarbonisation, and the Mærsk Mc Kinney Møller Center for Zero Carbon Shipping. The results reveal how industry insiders see the ongoing maritime fuel transition. With conventional ship engines set to remain the preferred technology until at least 2050, almost all the survey respondents saw their fleets running on a mix of fuels by that date – a “step-change in fuel diversity”. 45% of survey respondents saw their fleets running on one particular mix of fuels by that date: fuel oil/biodiesel, methane, methanol, and ammonia, with no one fuel dominating.

When asked whether a particular fuel would only be used in niche segments or adopted or scale by 2050, both methanol and (renewable) ammonia were seen as viable for adoption at scale. But the results were grouped quite closely, with no fuel seen as becoming an industry-wide standard (or even getting close on the scale to the current perception of fuel oil). As expected, fuel availability, fuel cost, the willingness of industry customers to pay a green premium and regulatory change were all identified as the key external factors affecting the adoption of new maritime fuels.

The industry will need to think strategically about how to operate multi-fuel fleets and green fuels must be introduced in a safe and cost-efficient manner to make them the preferred alternative to current petroleum products.

Bo Cerup-Simonsen, CEO of the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping, in GMF’s official press release, 20 Apr 2023

Implications, recommendations

In terms of implications for various stakeholder groups, the survey authors had some interesting suggestions. Shipping companies themselves can continue to develop green maritime corridors, sign multi-year offtake agreements for new fuels (such as a series of contracts signed by Maersk for methanol supply in March last year), adopt other energy efficiency measures like wind sails, and continue to be involved in partnerships and consortia.

The task is trickier for fuel producers, who must push to drive down fuel costs and develop supply at large-scale. The authors suggest that open dialogues with shipping companies would help (recall that uncertainty over the availability of new fuels was clearly the biggest concern to survey respondents), and that fuel producers and bunkering providers have an excellent opportunity to collaborate and demonstrate clear timelines for new fuel availability at specific ports. Such a partnership was announced between bunker provider Monjasa and ammonia producer HØST PtX Esbjerg in February this year.

On the regulatory side, decisions that close the cost gap and create a level playing field for all shipping companies are recommended. The adoption of a Well-to-Wake approach for emissions accounting is also suggested, as are clearer safety, handling, and operating guidelines for ammonia fuel.