Maritime decarbonization is a trillion dollar opportunity

By Trevor Brown on February 06, 2020

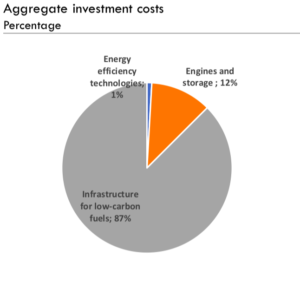

In January 2020, the Global Maritime Forum published new analysis that calculates “the capital investment needed to achieve decarbonization” in line with the International Maritime Organization’s Initial GHG Strategy. The result of this analysis, which assumes that ammonia will be “the primary zero carbon fuel choice adopted by the shipping industry,” is an aggregate investment of between $1 trillion and $1.4 trillion dollars, from 2030 to 2050, or roughly $50 to $70 billion per year across two decades.

Ship-side costs are only 13% of this number. The bulk of the investment will be directed towards green ammonia plants for maritime fuel synthesis. By 2050, this global fuel demand is estimated to be more than 900 million tons per year of green ammonia, more than five time today’s total global output of conventional ammonia.

One Trillion Dollars (not a very big number)

To contextualize these seemingly huge amounts, the Global Maritime Forum’s Insight Brief points out that a $1 trillion total, spread over 20 years, is not an unrealistic number: we spend more than that in energy investments every year ($1.85 trillion in 2018, according to the IEA).

Last year, the Environmental Defense Fund (EDF) published the report Sailing on Solar, which demonstrated the economic opportunities to be gained by implementing “zero-carbon fuels such as green ammonia and hydrogen.” To help the industry see this latest analysis in proper context, EDF wrote an editorial article that was published this week:

Shipping’s green $1trn is a profitable investment, not a cost … We need this crucial investment to build renewable plants and other infrastructure …

The entire financial sector is looking for green investments more than ever, as governments, asset managers, and the public pile on the pressure over climate change. Demand for green bonds currently far exceeds supply. Smart companies in the maritime sector will position themselves to benefit from the growing tidal wave of green cash. However the benefits brought by the clean shipping transition go far beyond the shipping sector. These include new job opportunities and increasing demand for higher-skilled jobs, such as engineers, that will help transform labour markets. The expansion of renewable electricity will push prices of clean electricity down and drive down the cost of decarbonisation in other sectors …

A trillion dollars is a large sum, but shouldn’t be seen as intimidating. To put it into context, in 2018, global fossil fuel consumption subsidies were over $400bn. That equates to almost eight times the annual estimate needed for decarbonising shipping. In this comparison, the investment needed for shipping is really just a drop in the ocean.

Splash 247, Shipping’s green $1trn is a profitable investment, not a cost, January 30, 2020

Allocation of costs, on-ship and on-land

Until this analysis came out, most of the discussion of the cost of decarbonizing shipping has focused on the ship: new technologies for engines and fuel tanks, and for energy efficiency; and the embedded cost of designing, engineering, and regulating these changes.

What this report makes quite clear is that ship-based investments are a small part of the program — 13% to be precise.

The vast majority of the investment is in fuel production and distribution.

The biggest share of investments is needed in the land-based infrastructure and production facilities for low carbon fuels … Hydrogen production make up around half of the total land-based investments needed, while ammonia synthesis and storage and bunkering infrastructure make up the other half.

Global Maritime Forum, The scale of investment needed to decarbonize international shipping, January 2020

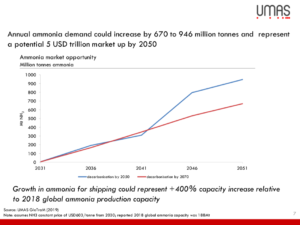

Global green ammonia production capacity

The report quantifies the alternative fuel demand that maritime decarbonization would create, and translates this into global green ammonia production capacity.

Today, we produce about 180 million tons of conventional ammonia globally, each year. By 2050, the additional green ammonia production capacity required to meet fuel demand from the maritime sector could be five times this much. The estimate ranges from 670 to 946 million tons per year. This would represent “a potential 5 USD trillion market.”

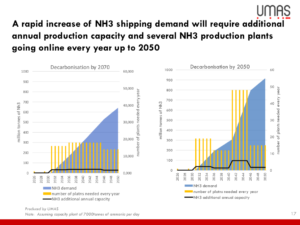

The analysts also quantified the build-out required to deliver this production capacity expansion, estimating the number of green ammonia plants that would need to begin operating each year between today and 2050 in order to meet this new demand.

The model assumes a cost-efficient ‘mega-ammonia’ plant size, with capacity of around 7,000 tons per day or 2 million tons per year. Significant maritime fuel demand for green ammonia is projected to begin soon after 2030, by which time, to ramp up green ammonia production fast enough, around 10 to 20 of these plants would need to begin operating every year.

Cost reduction pathways: volume and collaboration

The authors are aware that such a massive expansion of green ammonia would have a profound impact on technology costs, most importantly reducing the capital costs of electrolyzers, both through scaling up unit capacity and scaling up manufacturing volumes.

The opportunity to reduce the overall costs of decarbonization is greatest in the upstream production of fuels. This emphasizes the need to involve stakeholders across the full fuel value chain to make the transition possible in the most economically efficient manner.

Global Maritime Forum, The scale of investment needed to decarbonize international shipping, January 2020

Finally, the analysts make the case for another cost-reduction route: sector coupling. This would see disparate stakeholders come together in coalitions to enable better distribution of risk across the value chain, and to exploit the potential of ammonia and hydrogen as market flexible commodities.

Investments in hydrogen and ammonia production can serve other purposes than supplying fuels for shipping, which can create synergies and reduce the investment risk, especially in the early phase of the transition.

Global Maritime Forum, The scale of investment needed to decarbonize international shipping, January 2020